Title: A Comprehensive Overview of Brownsville Texas Plaintiff's Original Petition for Breach of Insurance Policy Keywords: Brownsville Texas, Plaintiff's Original Petition, Breach of Insurance Policy, detailed description, types Introduction: Brownsville, Texas, is a bustling city where individuals and businesses rely on insurance policies to protect their assets, whether it be against property damage, liability claims, or other unforeseen perils. However, occasionally, insurance companies fail to fulfill their contractual obligations, leading to disputes and potential legal action. In such cases, plaintiffs in Brownsville can file a specific type of lawsuit called the "Plaintiff's Original Petition for Breach of Insurance Policy." Overview of Plaintiff's Original Petition: A Plaintiff's Original Petition is a formal, written legal document that initiates a lawsuit in a civil court. This petition serves as the foundation of the plaintiff's case against the insurer who breached their insurance policy. It outlines the facts, allegations, and legal arguments that will be presented during the litigation process. Key Elements of Brownsville Texas Plaintiff's Original Petition for Breach of Insurance Policy: 1. Identification of Parties: The plaintiff's original petition in Brownsville Texas will identify the parties involved in the lawsuit. It typically lists the plaintiff(s) who are seeking compensation for the insurance breach and the defendant(s) who are the insurance company or companies alleged to be in breach. 2. Jurisdiction and Venue: The petition clarifies which court has jurisdiction over the case and why it is the proper venue for litigation. In Brownsville, Texas, this could be the State District Courts, County Courts at Law, or possibly federal courts depending on the circumstances. 3. Statement of Facts: The plaintiff's original petition will include a detailed account of the relevant facts leading to the insurance policy breach. This section might outline specific incidents or scenarios that triggered the coverage, the contractual obligations of the insurer, and any relevant dates or timelines. 4. Breach of Insurance Policy: The heart of the petition is centered around the allegation that the defendant(s) breached their insurance policy. It will outline the specific terms, conditions, or obligations that were allegedly violated by the insurer, such as delayed claim processing, denial of coverage, wrongful termination of policy, or failure to reimburse adequately. 5. Damages: This section articulates the financial, emotional, or other types of damages suffered by the plaintiff due to the breach of the insurance policy. It may include the amount of money sought as compensation, including any additional damages for emotional distress or punitive measures, if applicable. Different Types of Brownsville Texas Plaintiff's Original Petition for Breach of Insurance Policy: While the basic structure of a Plaintiff's Original Petition remains the same, there could be several variations or subtypes depending on the specific context of the insurance breach. Some potential types of Brownsville Texas Plaintiff's Original Petition include: 1. Property Insurance Breach: The plaintiff alleges that the insurer breached the terms and conditions of a property insurance policy, leading to financial losses due to damages sustained. 2. Auto Insurance Breach: The plaintiff claims that the insurance company failed to honor their obligations under an automobile insurance policy, resulting in financial harm related to accidents or damages involving insured vehicles. 3. Liability Insurance Breach: The plaintiff contends that the insurer failed to fulfill their obligations to provide coverage under a liability insurance policy, leading to financial loss due to legal claims or lawsuits brought against the plaintiff. 4. Health Insurance Breach: The plaintiff asserts that the insurer did not meet their obligations outlined in a health insurance policy, resulting in financial harm due to denied claims, insufficient coverage, or delayed reimbursements. Conclusion: In Brownsville, Texas, when an insurance company fails to honor the terms of its policy, plaintiffs can seek recourse through the legal system by filing a Plaintiff's Original Petition for Breach of Insurance Policy. Through this detailed document, plaintiffs outline the facts, allegations, and legal arguments that form the basis of their claim against the insurer. Understanding the different types of breach petitions in Brownsville Texas allows plaintiffs to tailor their arguments based on the specific insurance policy and coverage involved.

Brownsville Texas Plaintiff's Original Petition for Breach of Insurance Policy

State:

Texas

City:

Brownsville

Control #:

TX-CC-59-01

Format:

PDF

Instant download

This form is available by subscription

Description

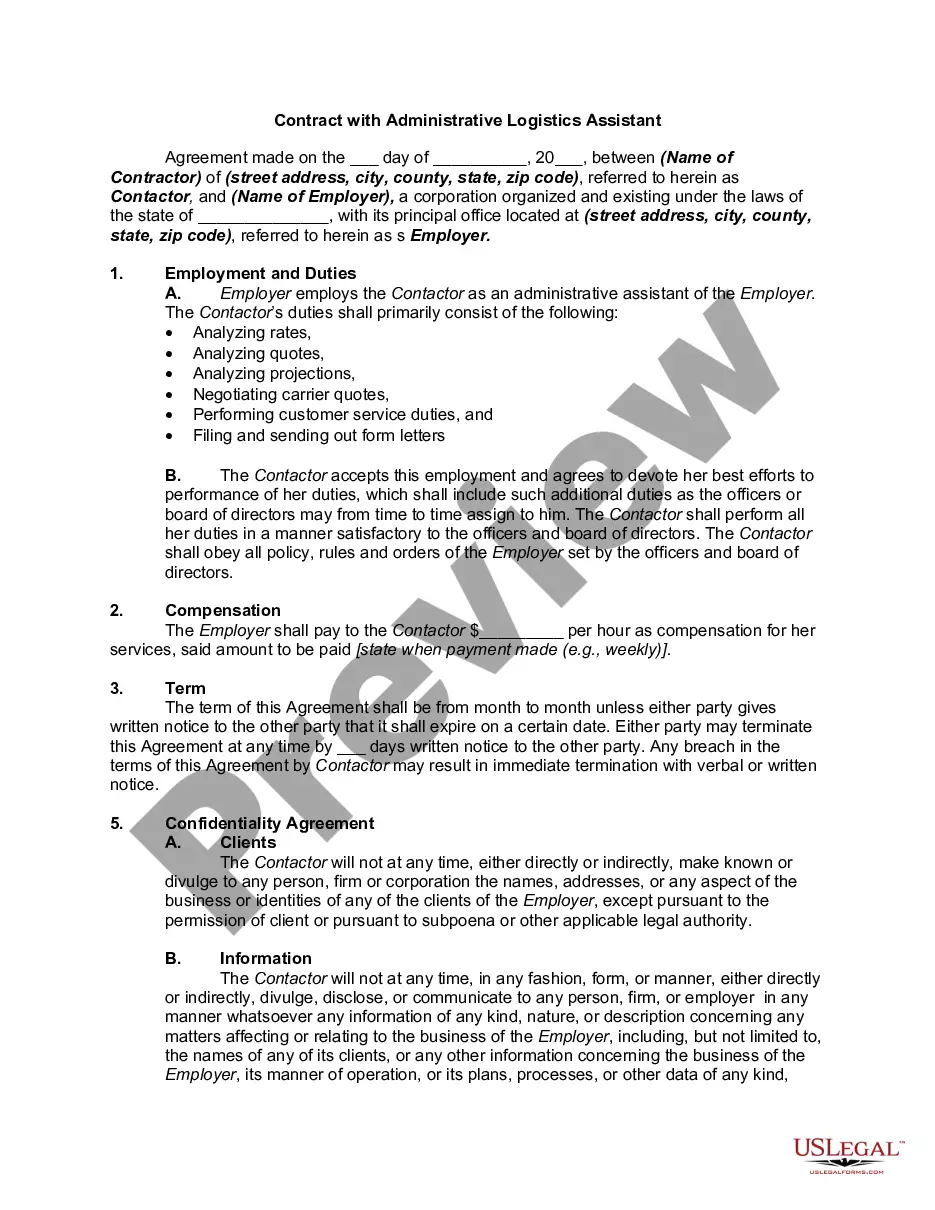

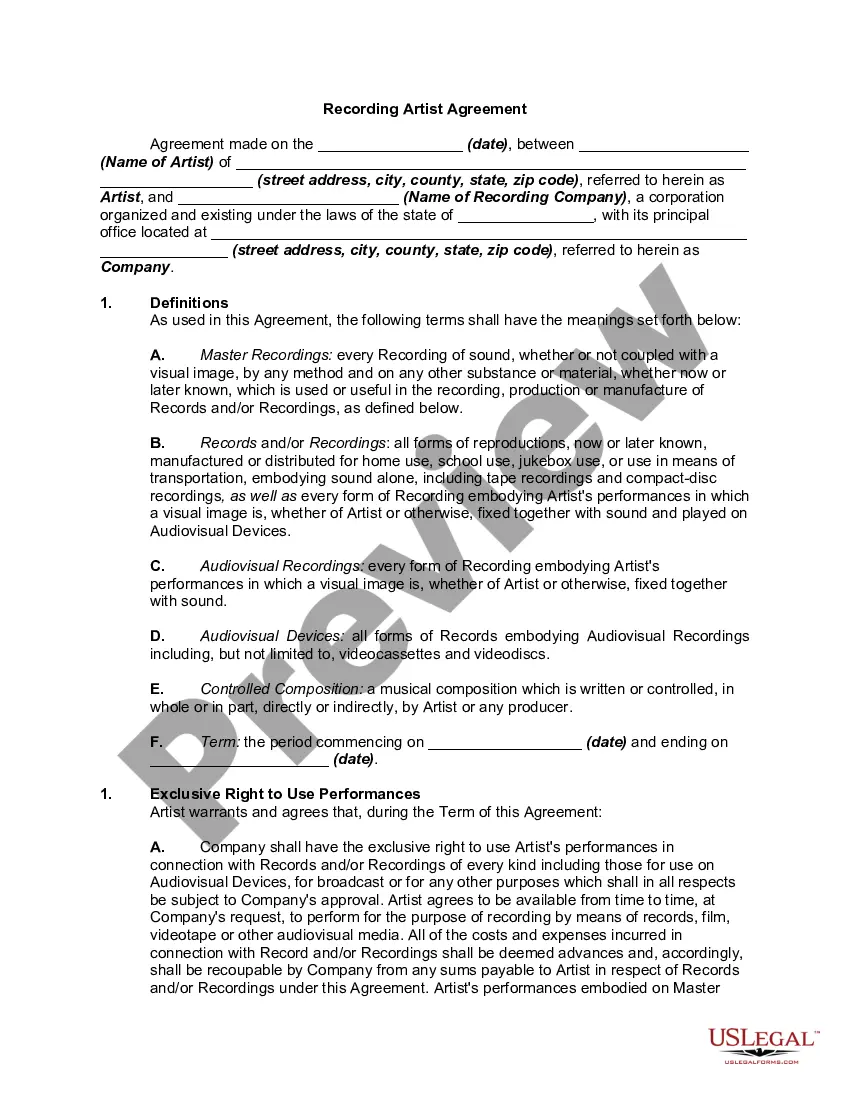

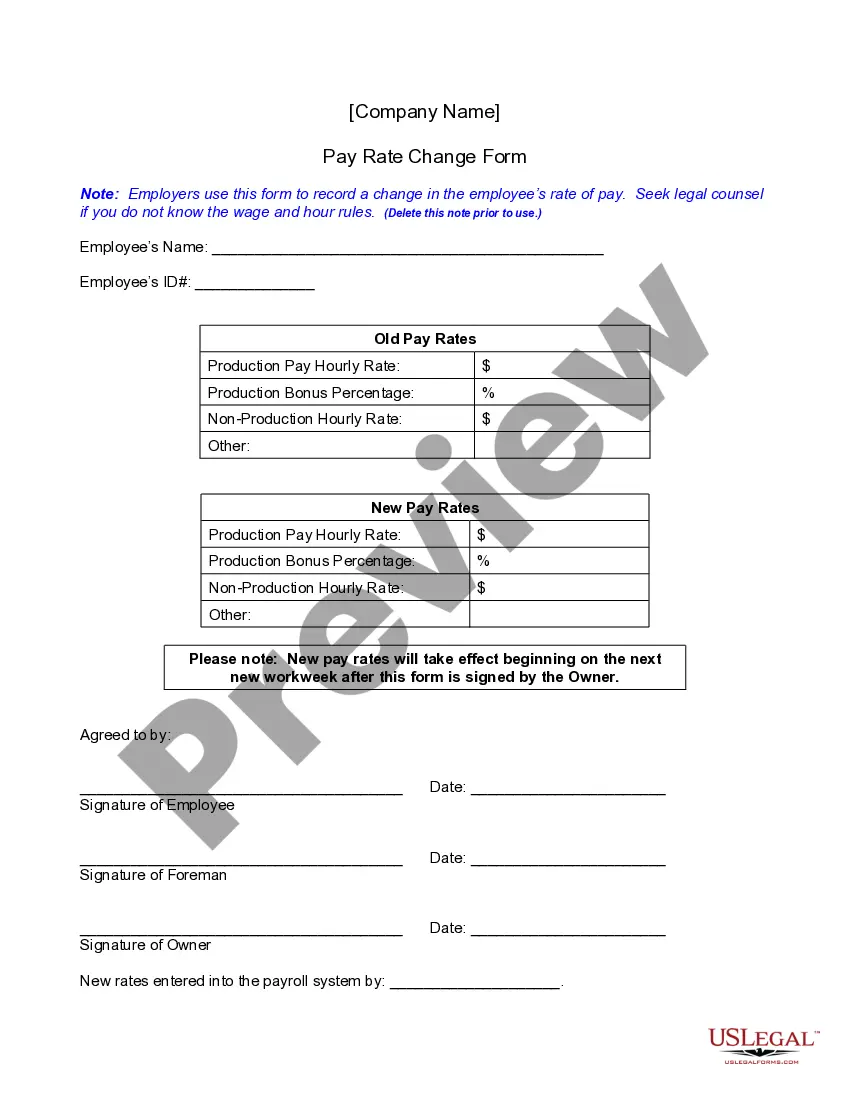

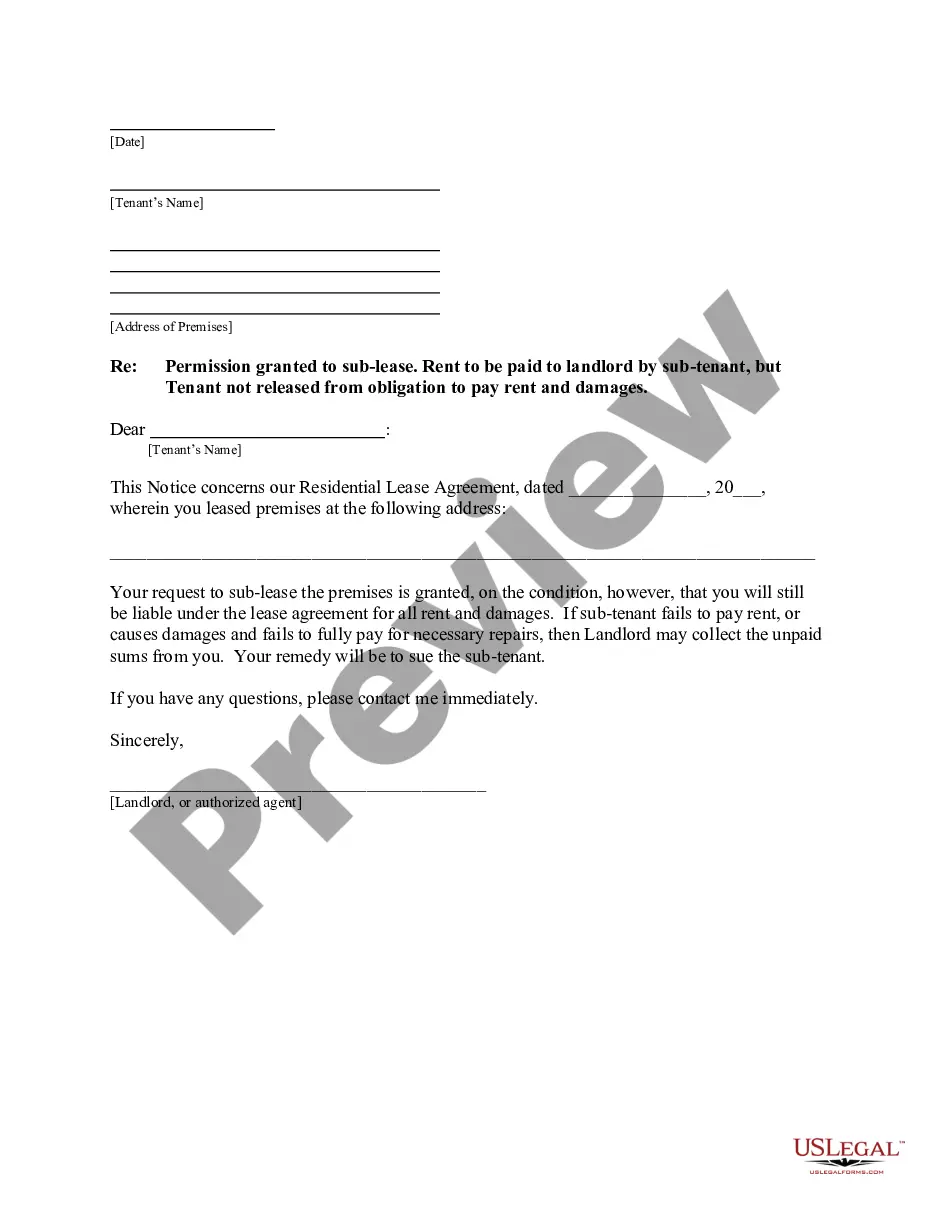

A01 Plaintiff's Original Petition for Breach of Insurance Policy

Free preview

How to fill out Brownsville Texas Plaintiff's Original Petition For Breach Of Insurance Policy?

Acquiring validated templates that align with your regional regulations can be difficult unless you utilize the US Legal Forms repository.

This is an online compilation of over 85,000 legal documents for both individual and business requirements as well as various real-world situations.

All the forms are effectively categorized by application area and jurisdiction, making it as straightforward as pie to find the Brownsville Texas Plaintiff's Original Petition for Breach of Insurance Policy.

Retaining documents organized and compliant with legal standards is of utmost importance. Leverage the US Legal Forms library to consistently have vital document templates readily available for any needs!

- Examine the Preview mode and form details.

- Ensure you've chosen the right option that fulfills your necessities and aligns with your local jurisdiction stipulations.

- Look for another template, if necessary.

- When you notice any discrepancies, utilize the Search tab above to locate the correct form. If it meets your needs, proceed to the next phase.

- Purchase the document.

Form popularity

Interesting Questions

More info

Disappointed or wouldbe beneficiaries and errant fiduciaries fuel the bulk of fiduciary litigation in the probate courts. Thirteenth Court of Appeals at Corpus Christi–Edinburg, Texas.In Texas, personal injury lawsuits can arise in a wide variety of ways. Once the form is printed you will need to fill in these blanks in the form: 1 The first blank at the top of the form is the Case Number. For Insurers and Their Insureds - Texas Insurance Litigation Lawyer. Breach of contract and Texas Insurance Code claims. The law requires only that a guardian ad litem be an attorney licensed to practice law in Texas . 'extraordinary' work in the Brownsville, Texas, case. Retaliation against an employee filing or reporting a complaint about a violation of the law. Original Petition, p. 1. 2.