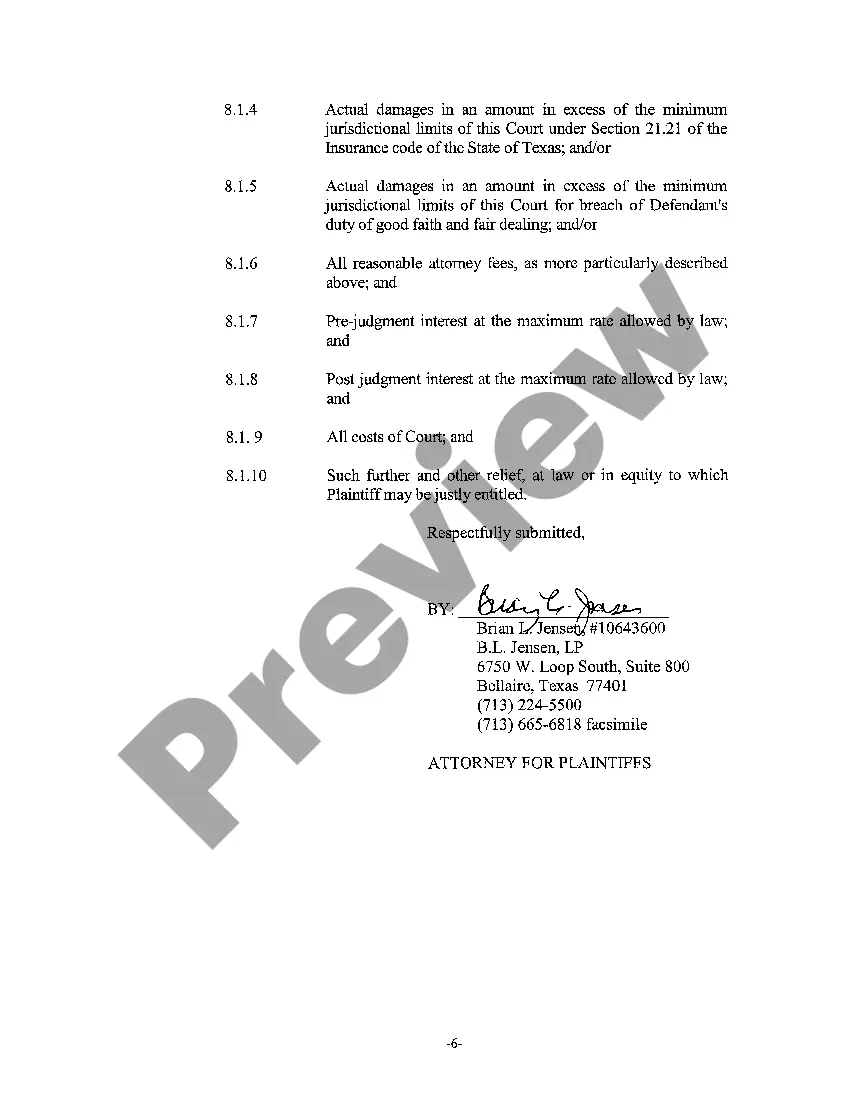

Title: Understanding College Station Texas Plaintiff's Original Petition for Breach of Insurance Policy: Types and Detailed Description Introduction: College Station, Texas, is home to many individuals and businesses who rely on insurance policies to protect their interests and assets. However, there are instances when insurers fail to honor their contractual obligations, resulting in a breach of insurance policy. To address such breaches, plaintiffs in College Station may file an original petition for breach of insurance policy. This article provides a detailed description of this legal document and explores potential types that may exist. Detailed Description of College Station Texas Plaintiff's Original Petition for Breach of Insurance Policy: 1. Definition: A plaintiff's original petition for breach of an insurance policy serves as the initial step in a legal action against an insurance company. It outlines the claims made by the plaintiff (i.e., the individual or entity adversely affected) against the insurer for failing to fulfill their contractual obligations. 2. Purpose: The primary purpose of the plaintiff's original petition is to seek compensation for damages suffered due to the insurer's breach of the insurance policy. The petitioner outlines the specific reasons for the alleged breach and requests appropriate relief, which may include monetary compensation, policy reformation, or specific performance of the policy terms. 3. Key Elements and Contents: i. Identification: The plaintiff identifies themselves and their attorney, along with the defendant (the insurance company), ensuring all parties are properly represented. ii. Jurisdiction and Venue: The petitioner establishes the appropriate jurisdiction (College Station, Texas) and venue (the local court) for the lawsuit. iii. Statement of Facts: This section provides a comprehensive account of the events leading to the alleged breach. It includes details about the insurance policy, the nature of the defendant's obligation, and how the breach occurred. iv. Breach Allegation: The plaintiff clearly states the acts or omissions by the insurance company that constitute the breach of the insurance policy. These allegations should be specific, supported by evidence, and connect directly to the insurer's contractual obligations. v. Damages Sought: The petition details the damages suffered by the plaintiff as a direct result of the breach. This may include financial losses, emotional distress, or any other harm endured. vi. Request for Relief: The plaintiff specifies the relief sought, such as the desired compensation, policy reformation, or adherence to the terms of the policy. vii. Prayer for Relief: The plaintiff concludes the petition by formally requesting the court to grant the requested relief. Types of College Station Texas Plaintiff's Original Petition for Breach of Insurance Policy: 1. Personal Injury Insurance Policy Breach: Pertains to situations where the defendant failed to cover medical expenses or compensate for personal injuries suffered by the policyholder. 2. Property Insurance Policy Breach: Focuses on situations where the insurer failed to reimburse the policyholder for property damages caused by covered perils such as fire, theft, or natural disasters. 3. Liability Insurance Policy Breach: Occurs when the insurance company refuses to defend or indemnify the policyholder in a liability claim made by a third party. 4. Health Insurance Policy Breach: Involves instances where the insurer fails to provide the coverage or reimburses medical expenses improperly, causing harm to the policyholder. Conclusion: When an insurance company fails to uphold its obligations, plaintiffs in College Station, Texas, have the option to file a plaintiff's original petition for breach of insurance policy. This legal document serves as a comprehensive account of the alleged breach, outlines the damages suffered, and requests appropriate relief. Understanding the various types of breaches, such as personal injury, property, liability, and health insurance policy breaches, can help individuals and businesses protect their rights and pursue proper compensation.

College Station Texas Plaintiff's Original Petition for Breach of Insurance Policy

Description

How to fill out College Station Texas Plaintiff's Original Petition For Breach Of Insurance Policy?

Make use of the US Legal Forms and obtain immediate access to any form you need. Our beneficial website with thousands of templates makes it easy to find and get almost any document sample you want. You are able to save, complete, and sign the College Station Texas Plaintiff's Original Petition for Breach of Insurance Policy in just a few minutes instead of browsing the web for hours attempting to find an appropriate template.

Using our catalog is a great strategy to improve the safety of your record submissions. Our experienced attorneys regularly check all the documents to ensure that the forms are relevant for a particular region and compliant with new acts and regulations.

How can you get the College Station Texas Plaintiff's Original Petition for Breach of Insurance Policy? If you have a profile, just log in to the account. The Download option will appear on all the samples you look at. Moreover, you can find all the earlier saved records in the My Forms menu.

If you don’t have an account yet, stick to the instruction listed below:

- Find the form you need. Make certain that it is the form you were looking for: check its headline and description, and utilize the Preview feature when it is available. Otherwise, use the Search field to look for the appropriate one.

- Start the saving procedure. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Select the format to obtain the College Station Texas Plaintiff's Original Petition for Breach of Insurance Policy and modify and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy form libraries on the internet. We are always happy to help you in any legal process, even if it is just downloading the College Station Texas Plaintiff's Original Petition for Breach of Insurance Policy.

Feel free to take full advantage of our service and make your document experience as efficient as possible!