Harris Texas Plaintiff's Original Petition for Breach of Insurance Policy is a legal document filed by plaintiffs in Harris County, Texas, seeking remedies for an alleged breach of an insurance policy. This petition serves as the initial step in a lawsuit against an insurance company or any party failing to fulfill their obligations under an insurance policy. The defendant in this petition is typically the insurance company or the responsible party against whom the breach claim is being made. The plaintiffs, who are the policyholders or beneficiaries, submit this document to assert their rights and seek compensation for damages, losses, or injuries covered by the insurance policy. Keywords: Harris Texas, plaintiff's original petition, breach of insurance policy, legal document, lawsuit, insurance company, obligations, policyholders, beneficiaries, compensation, damages, losses, injuries. Different types of Harris Texas Plaintiff's Original Petition for Breach of Insurance Policy may include specific variations depending on the type of insurance policy involved. Some common types include: 1. Auto Insurance Policy Breach: This petition is filed when an insurance company fails to comply with the terms and conditions of an auto insurance policy, such as denying valid claims, delaying payments, or acting in bad faith. 2. Homeowners Insurance Policy Breach: This type of petition is initiated when an insurance company breaches its obligations under a homeowners' insurance policy, such as denying coverage for a valid claim or underpaying for damages caused by covered perils like fire, theft, or natural disasters. 3. Health Insurance Policy Breach: Plaintiffs file this petition when an insurance company violates the terms of a health insurance policy, such as denying coverage for necessary medical treatments, wrongfully canceling a policy, or engaging in unfair claims practices. 4. Business Insurance Policy Breach: This petition is utilized when an insurance company fails to fulfill its obligations under a business insurance policy, such as refusing to provide coverage for a legitimate claim or undervaluing the business's losses resulting from covered events like property damage, liability claims, or business interruption. 5. Disability Insurance Policy Breach: This type of petition is filed when an insurance company breaches its obligations under a disability insurance policy, such as denying valid disability claims, terminating benefits prematurely, or engaging in unfair claim handling practices. It's crucial to note that the exact terminology and specifications may vary, and it is recommended to consult with a legal professional or refer to the specific jurisdiction's laws and regulations when drafting or interpreting a Harris Texas Plaintiff's Original Petition for Breach of Insurance Policy.

Harris Texas Plaintiff's Original Petition for Breach of Insurance Policy

State:

Texas

County:

Harris

Control #:

TX-CC-59-01

Format:

PDF

Instant download

This form is available by subscription

Description

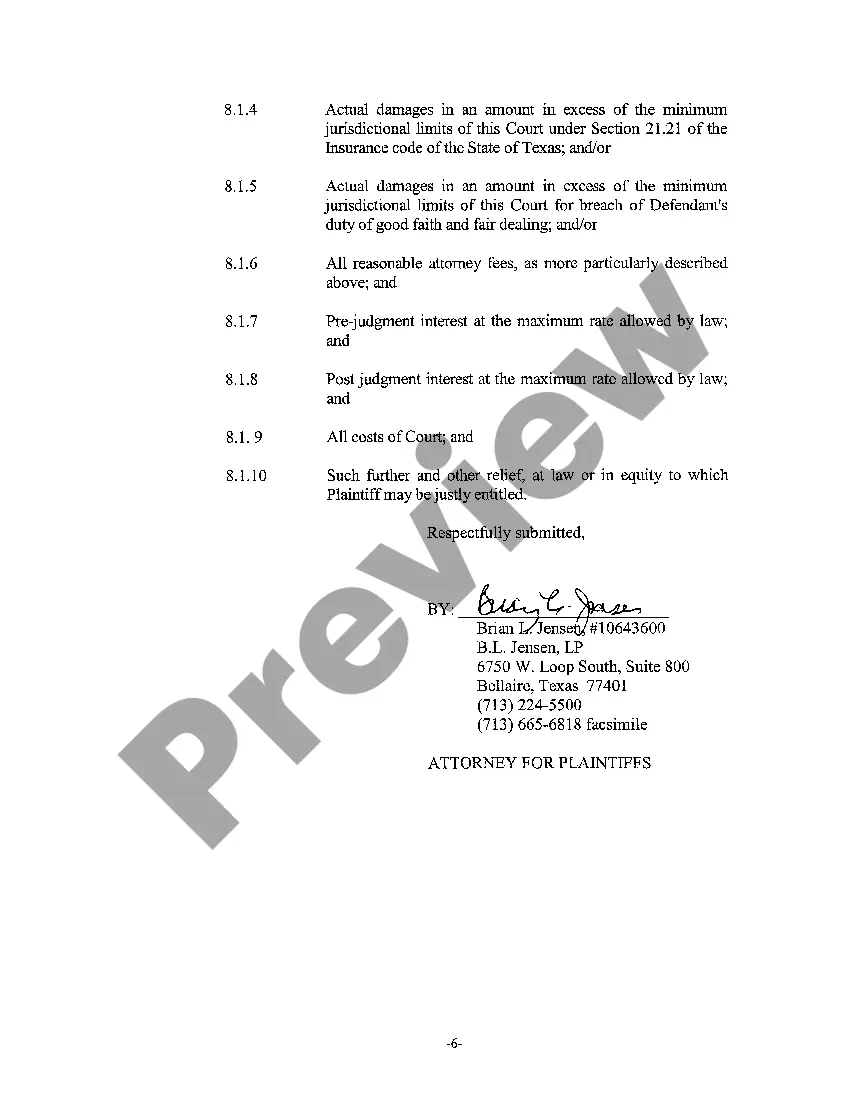

A01 Plaintiff's Original Petition for Breach of Insurance Policy

Harris Texas Plaintiff's Original Petition for Breach of Insurance Policy is a legal document filed by plaintiffs in Harris County, Texas, seeking remedies for an alleged breach of an insurance policy. This petition serves as the initial step in a lawsuit against an insurance company or any party failing to fulfill their obligations under an insurance policy. The defendant in this petition is typically the insurance company or the responsible party against whom the breach claim is being made. The plaintiffs, who are the policyholders or beneficiaries, submit this document to assert their rights and seek compensation for damages, losses, or injuries covered by the insurance policy. Keywords: Harris Texas, plaintiff's original petition, breach of insurance policy, legal document, lawsuit, insurance company, obligations, policyholders, beneficiaries, compensation, damages, losses, injuries. Different types of Harris Texas Plaintiff's Original Petition for Breach of Insurance Policy may include specific variations depending on the type of insurance policy involved. Some common types include: 1. Auto Insurance Policy Breach: This petition is filed when an insurance company fails to comply with the terms and conditions of an auto insurance policy, such as denying valid claims, delaying payments, or acting in bad faith. 2. Homeowners Insurance Policy Breach: This type of petition is initiated when an insurance company breaches its obligations under a homeowners' insurance policy, such as denying coverage for a valid claim or underpaying for damages caused by covered perils like fire, theft, or natural disasters. 3. Health Insurance Policy Breach: Plaintiffs file this petition when an insurance company violates the terms of a health insurance policy, such as denying coverage for necessary medical treatments, wrongfully canceling a policy, or engaging in unfair claims practices. 4. Business Insurance Policy Breach: This petition is utilized when an insurance company fails to fulfill its obligations under a business insurance policy, such as refusing to provide coverage for a legitimate claim or undervaluing the business's losses resulting from covered events like property damage, liability claims, or business interruption. 5. Disability Insurance Policy Breach: This type of petition is filed when an insurance company breaches its obligations under a disability insurance policy, such as denying valid disability claims, terminating benefits prematurely, or engaging in unfair claim handling practices. It's crucial to note that the exact terminology and specifications may vary, and it is recommended to consult with a legal professional or refer to the specific jurisdiction's laws and regulations when drafting or interpreting a Harris Texas Plaintiff's Original Petition for Breach of Insurance Policy.

Free preview

How to fill out Harris Texas Plaintiff's Original Petition For Breach Of Insurance Policy?

If you’ve already used our service before, log in to your account and download the Harris Texas Plaintiff's Original Petition for Breach of Insurance Policy on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Harris Texas Plaintiff's Original Petition for Breach of Insurance Policy. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!