Title: Understanding Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy Description: In Lewisville, Texas, the Plaintiff's Original Petition for Breach of Insurance Policy serves as a legal document initiated by an individual (the plaintiff) against an insurance company due to an alleged violation of the terms and conditions of an insurance policy. This detailed description aims to shed light on this legal process, outlining its purpose, elements, and potential variations. Keywords: Lewisville Texas, Plaintiff's Original Petition, Breach of Insurance Policy, legal document, insurance company, terms and conditions, legal process, variations. 1. Purpose of Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy: The Plaintiff's Original Petition for Breach of Insurance Policy in Lewisville, Texas, is a formal legal document filed in a civil court to seek monetary compensation or other remedies for damages resulting from an insurance company's failure to fulfill its obligations as stated in an insurance policy. It aims to provide the plaintiff with a legal recourse to address the insurance company's breach of contract. 2. Elements of Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy: a) Identification: The petitioner (plaintiff) must properly identify themselves and indicate that they have suffered harm or loss due to the insurance company's actions or omissions. b) Insurance Policy Information: Detailed information regarding the insurance policy in question should be provided, such as the policy number, coverage type, effective dates, and any applicable endorsements. c) Breach of Insurance Policy: The petitioner must clearly outline how the insurance company has violated the terms and conditions of the insurance policy, including specific provisions that were not honored. d) Damages: The plaintiff needs to specify the amount of financial loss, physical harm, or emotional distress they have suffered as a direct result of the insurance company's breach. 3. Types of Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy: a) Personal Injury: This type of petition is filed when an individual has been injured or harmed due to the insurance company's failure to cover medical expenses or compensate for lost income as specified in the insurance policy. b) Property Damage: When an insurance company refuses to provide sufficient compensation for property damage, the plaintiff can file this petition to seek reimbursement for repair or replacement costs. c) Bad Faith: In cases where an insurance company has acted in bad faith, denying legitimate claims without proper investigation or significant delay, the plaintiff can file a petition alleging the insurer's violation of their duty to act in good faith. d) Denied Claims: If an insurance company wrongfully denies a valid claim without valid grounds or an adequate explanation, the petitioner can file this type of petition to dispute the denial and seek just compensation. By initiating a Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy, the petitioner aims to ensure that their rights are protected, seeking justice and fair compensation for the damages they have incurred due to the insurance company's failure to uphold the terms and conditions of the insurance contract.

Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy

State:

Texas

City:

Lewisville

Control #:

TX-CC-59-01

Format:

PDF

Instant download

This form is available by subscription

Description

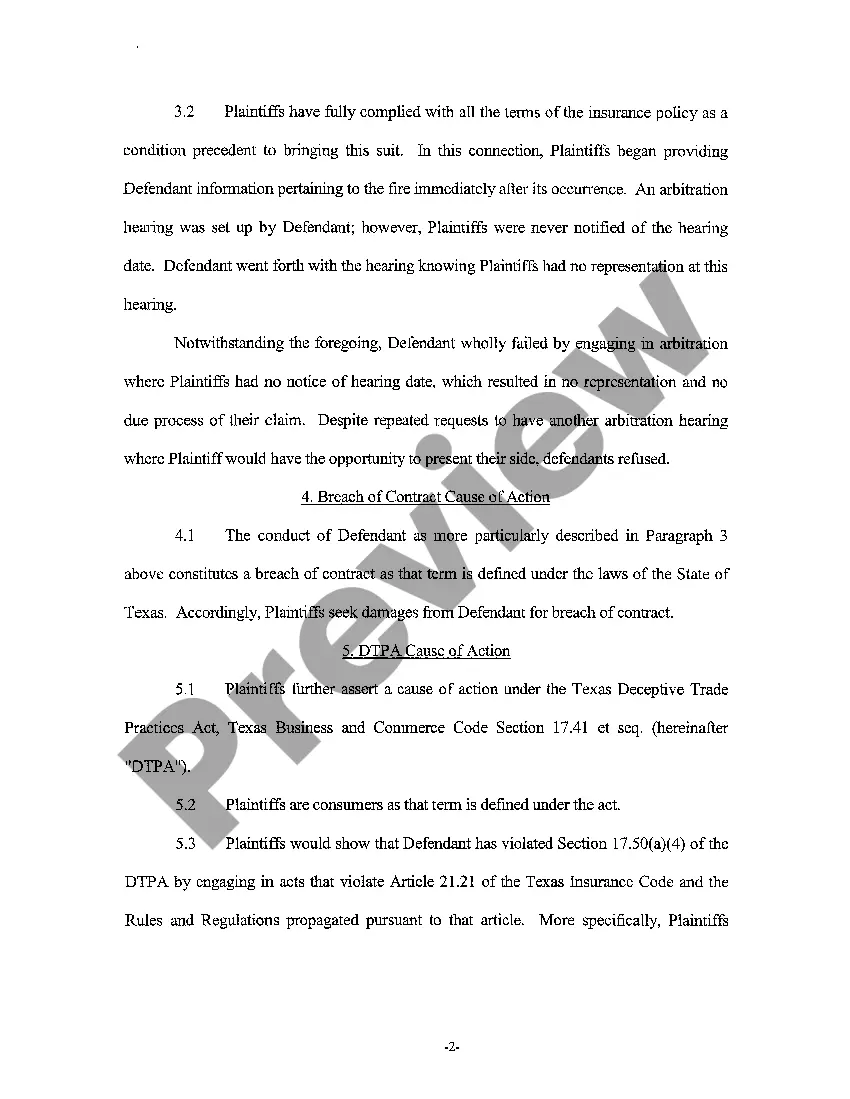

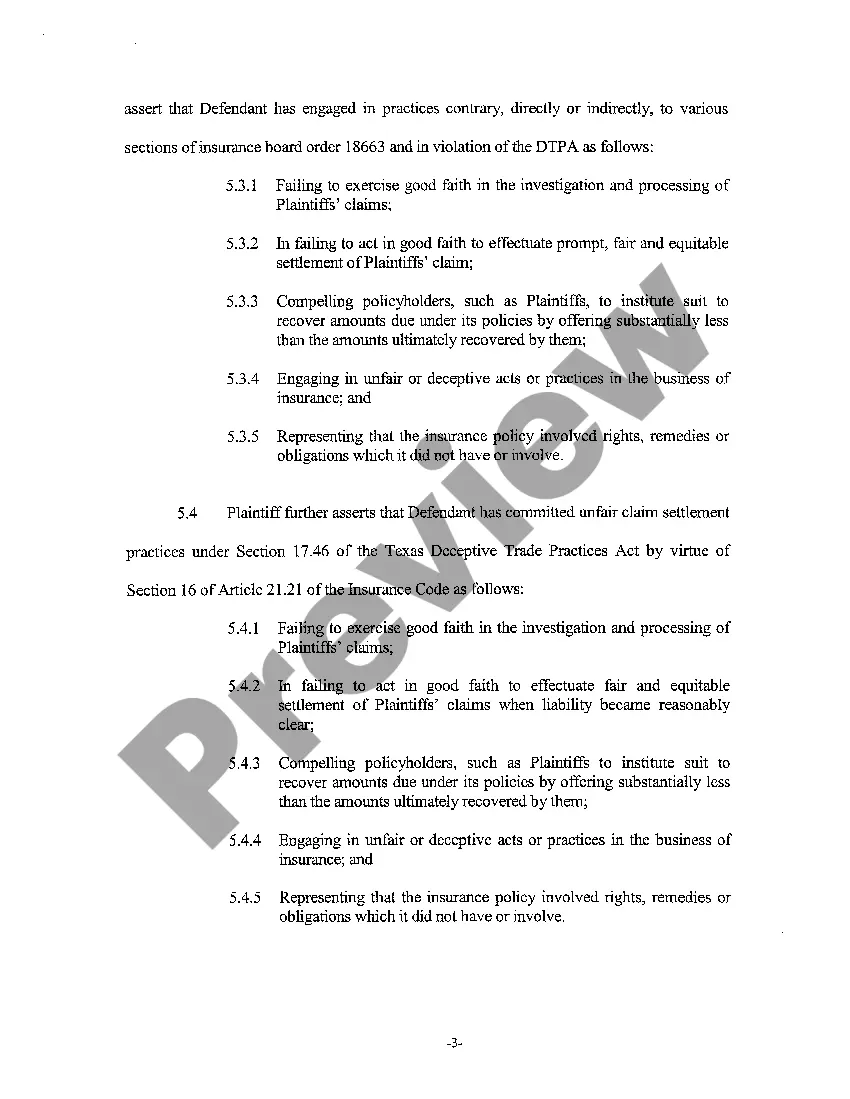

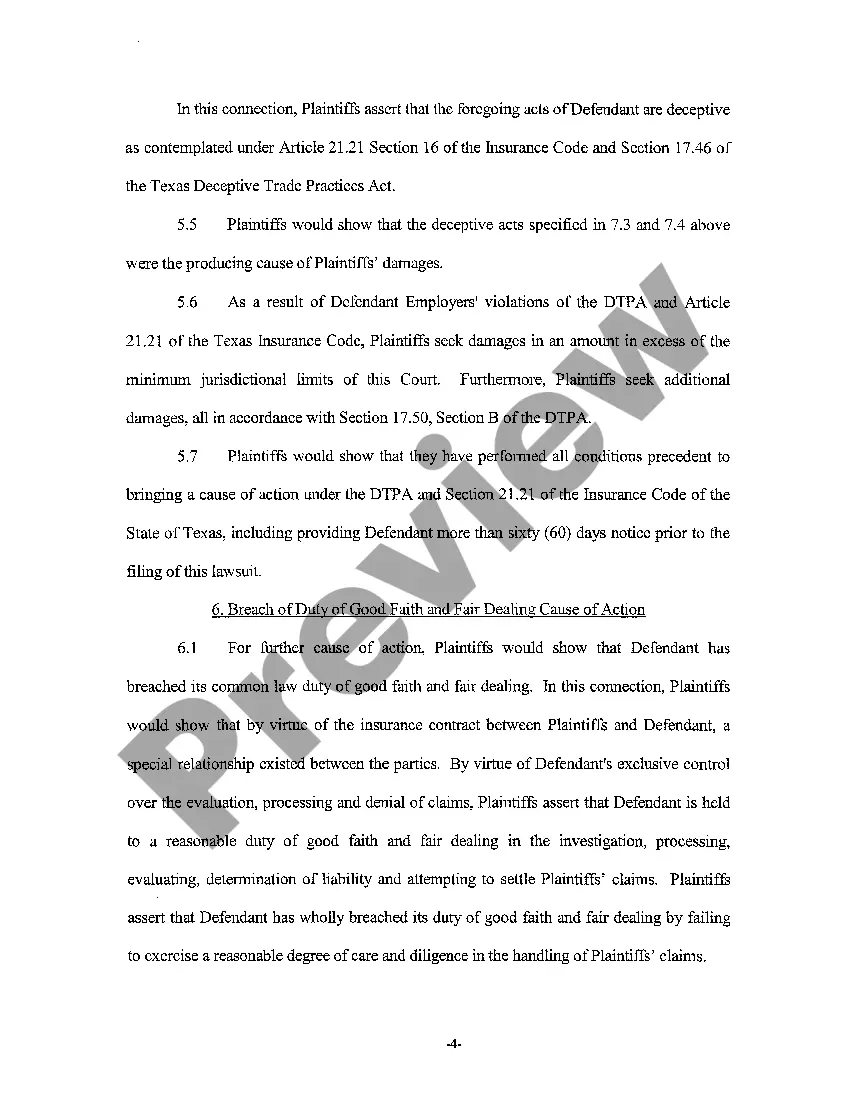

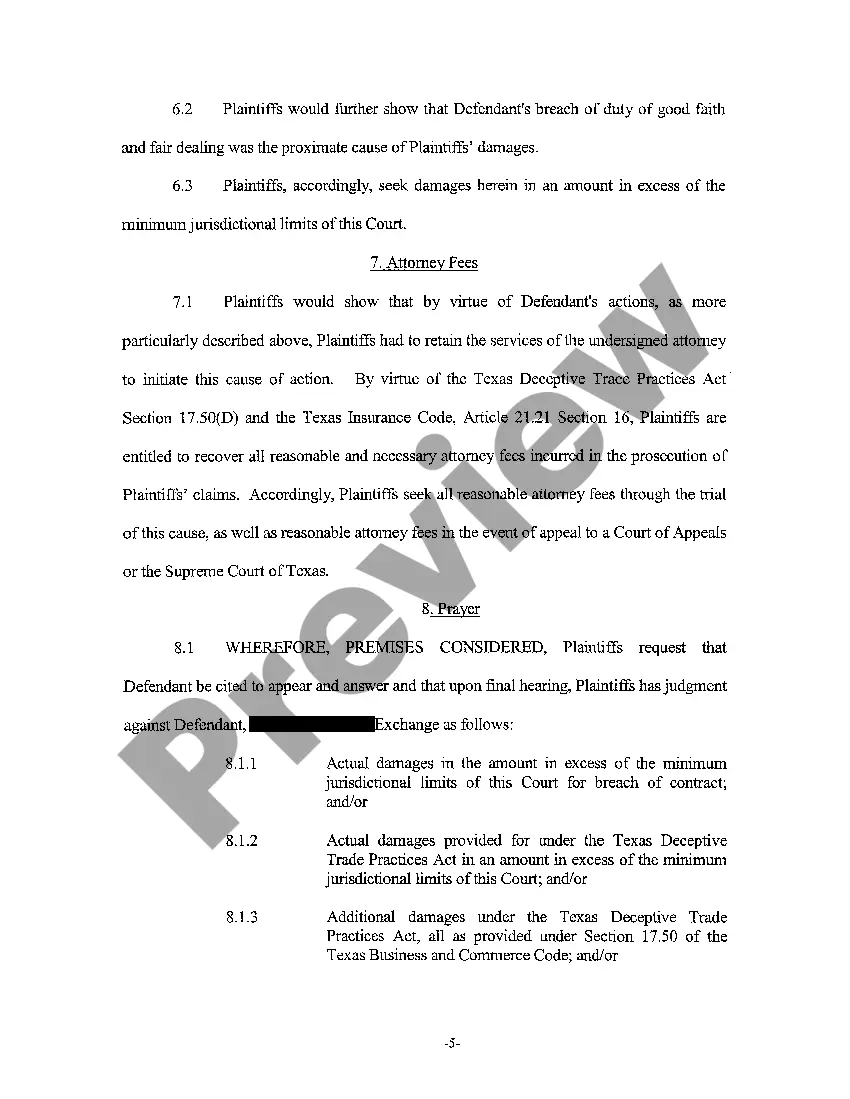

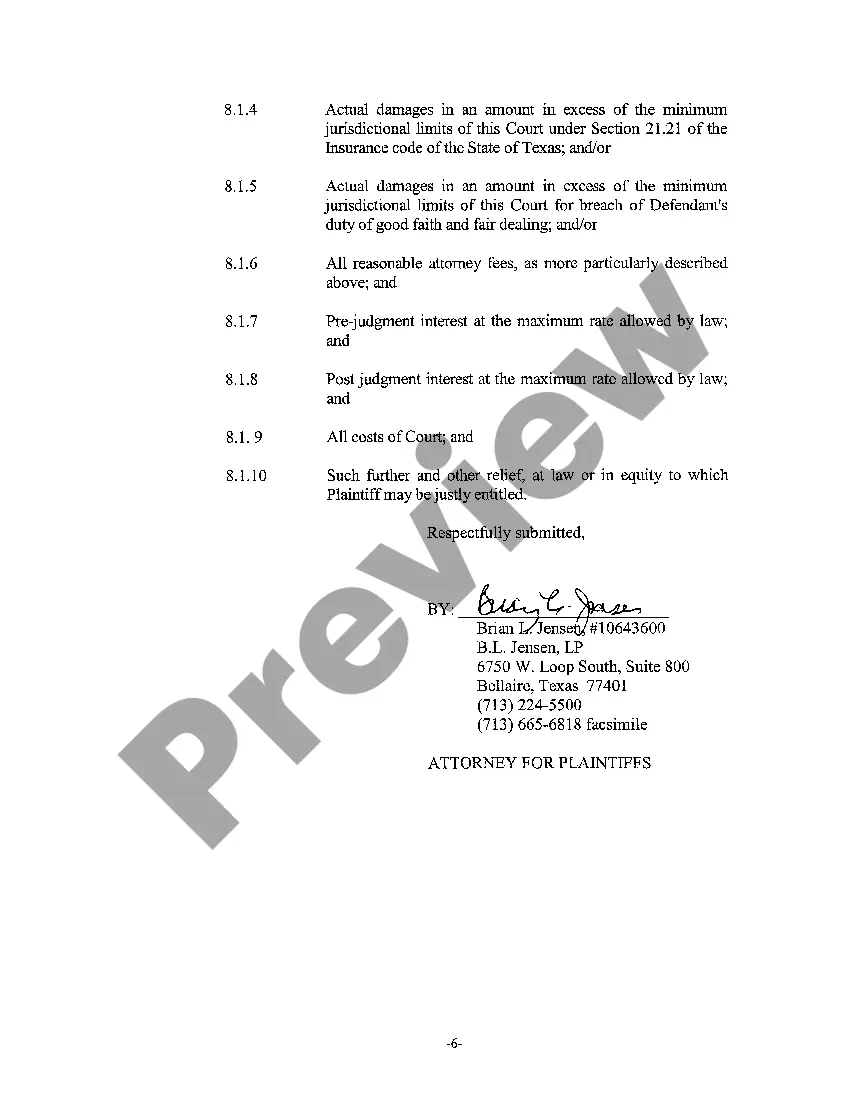

A01 Plaintiff's Original Petition for Breach of Insurance Policy

Title: Understanding Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy Description: In Lewisville, Texas, the Plaintiff's Original Petition for Breach of Insurance Policy serves as a legal document initiated by an individual (the plaintiff) against an insurance company due to an alleged violation of the terms and conditions of an insurance policy. This detailed description aims to shed light on this legal process, outlining its purpose, elements, and potential variations. Keywords: Lewisville Texas, Plaintiff's Original Petition, Breach of Insurance Policy, legal document, insurance company, terms and conditions, legal process, variations. 1. Purpose of Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy: The Plaintiff's Original Petition for Breach of Insurance Policy in Lewisville, Texas, is a formal legal document filed in a civil court to seek monetary compensation or other remedies for damages resulting from an insurance company's failure to fulfill its obligations as stated in an insurance policy. It aims to provide the plaintiff with a legal recourse to address the insurance company's breach of contract. 2. Elements of Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy: a) Identification: The petitioner (plaintiff) must properly identify themselves and indicate that they have suffered harm or loss due to the insurance company's actions or omissions. b) Insurance Policy Information: Detailed information regarding the insurance policy in question should be provided, such as the policy number, coverage type, effective dates, and any applicable endorsements. c) Breach of Insurance Policy: The petitioner must clearly outline how the insurance company has violated the terms and conditions of the insurance policy, including specific provisions that were not honored. d) Damages: The plaintiff needs to specify the amount of financial loss, physical harm, or emotional distress they have suffered as a direct result of the insurance company's breach. 3. Types of Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy: a) Personal Injury: This type of petition is filed when an individual has been injured or harmed due to the insurance company's failure to cover medical expenses or compensate for lost income as specified in the insurance policy. b) Property Damage: When an insurance company refuses to provide sufficient compensation for property damage, the plaintiff can file this petition to seek reimbursement for repair or replacement costs. c) Bad Faith: In cases where an insurance company has acted in bad faith, denying legitimate claims without proper investigation or significant delay, the plaintiff can file a petition alleging the insurer's violation of their duty to act in good faith. d) Denied Claims: If an insurance company wrongfully denies a valid claim without valid grounds or an adequate explanation, the petitioner can file this type of petition to dispute the denial and seek just compensation. By initiating a Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy, the petitioner aims to ensure that their rights are protected, seeking justice and fair compensation for the damages they have incurred due to the insurance company's failure to uphold the terms and conditions of the insurance contract.

Free preview

How to fill out Lewisville Texas Plaintiff's Original Petition For Breach Of Insurance Policy?

If you’ve already used our service before, log in to your account and save the Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Lewisville Texas Plaintiff's Original Petition for Breach of Insurance Policy. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!