Title: Understanding Plano Texas Plaintiff's Original Petition for Breach of Insurance Policy Keywords: Plano Texas, plaintiff's original petition, breach of insurance policy, types Introduction: Plano Texas plaintiff's original petition for breach of insurance policy is a legal document filed by an individual or entity (the plaintiff) against an insurance company (the defendant) in the Plano Texas area. This petition serves as the initial step in initiating a lawsuit for compensation due to an alleged breach of an insurance policy. Types of Plano Texas Plaintiff's Original Petition for Breach of Insurance Policy: 1. Personal Property Insurance Policy: This type of plaintiff's original petition in Plano Texas entails a claim against an insurance company for breaching their obligations regarding personal property insurance policies. It may involve disputes related to damaged or stolen personal belongings, delayed or denied claims, or inadequate compensation in regard to a policyholder's assets. 2. Auto Insurance Policy: Plaintiffs may file this specific petition against an auto insurance provider in Plano Texas due to issues such as denial of coverage, failed compensation for vehicle damages, unjust premium increases, or any other violation of the policy terms and conditions concerning automobile insurance. 3. Homeowners Insurance Policy: Homeowners in Plano Texas may submit a plaintiff's original petition against their insurance company for breaches related to homeowners insurance policies. This petition could involve disputes over a denied or delayed claim for property damage caused by natural disasters, thefts, accidents, or negligence in coverage and compensation. 4. Health Insurance Policy: In cases where an individual is dissatisfied with their health insurance company's actions, they may file a plaintiff's original petition for breach of insurance policy in Plano Texas. This could involve disputes over claim denial or delay, inadequate coverage for necessary medical treatments, or any other violation of the health insurance agreement. 5. Business Insurance Policy: If a business in Plano Texas experiences a breach by their insurance provider or is denied proper compensation, a plaintiff's original petition may be filed. This type of petition typically addresses issues related to commercial property damage, liability claims, business interruption, or any other discrepancies in the policy terms within the business insurance coverage. Conclusion: When facing a breach of insurance policy situation in Plano Texas, plaintiffs can resort to filing a plaintiff's original petition to seek legal remedies. Whether it involves personal property, auto, homeowners, health, or business insurance, understanding the specific type of breach is crucial for building a strong case against the defendant insurance company. Seeking the assistance of an experienced attorney specializing in insurance disputes is advisable to navigate the legal complexities effectively and increase the chances of a successful outcome.

Plano Texas Plaintiff's Original Petition for Breach of Insurance Policy

State:

Texas

City:

Plano

Control #:

TX-CC-59-01

Format:

PDF

Instant download

This form is available by subscription

Description

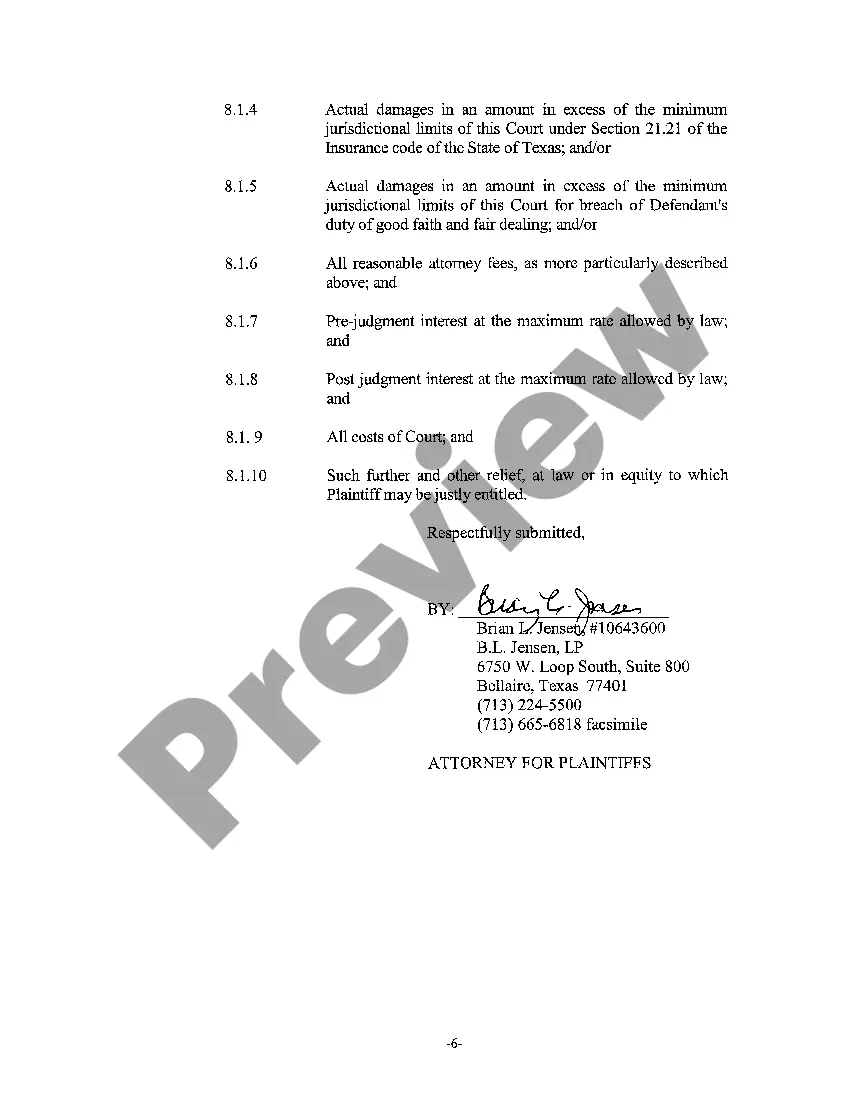

A01 Plaintiff's Original Petition for Breach of Insurance Policy

Title: Understanding Plano Texas Plaintiff's Original Petition for Breach of Insurance Policy Keywords: Plano Texas, plaintiff's original petition, breach of insurance policy, types Introduction: Plano Texas plaintiff's original petition for breach of insurance policy is a legal document filed by an individual or entity (the plaintiff) against an insurance company (the defendant) in the Plano Texas area. This petition serves as the initial step in initiating a lawsuit for compensation due to an alleged breach of an insurance policy. Types of Plano Texas Plaintiff's Original Petition for Breach of Insurance Policy: 1. Personal Property Insurance Policy: This type of plaintiff's original petition in Plano Texas entails a claim against an insurance company for breaching their obligations regarding personal property insurance policies. It may involve disputes related to damaged or stolen personal belongings, delayed or denied claims, or inadequate compensation in regard to a policyholder's assets. 2. Auto Insurance Policy: Plaintiffs may file this specific petition against an auto insurance provider in Plano Texas due to issues such as denial of coverage, failed compensation for vehicle damages, unjust premium increases, or any other violation of the policy terms and conditions concerning automobile insurance. 3. Homeowners Insurance Policy: Homeowners in Plano Texas may submit a plaintiff's original petition against their insurance company for breaches related to homeowners insurance policies. This petition could involve disputes over a denied or delayed claim for property damage caused by natural disasters, thefts, accidents, or negligence in coverage and compensation. 4. Health Insurance Policy: In cases where an individual is dissatisfied with their health insurance company's actions, they may file a plaintiff's original petition for breach of insurance policy in Plano Texas. This could involve disputes over claim denial or delay, inadequate coverage for necessary medical treatments, or any other violation of the health insurance agreement. 5. Business Insurance Policy: If a business in Plano Texas experiences a breach by their insurance provider or is denied proper compensation, a plaintiff's original petition may be filed. This type of petition typically addresses issues related to commercial property damage, liability claims, business interruption, or any other discrepancies in the policy terms within the business insurance coverage. Conclusion: When facing a breach of insurance policy situation in Plano Texas, plaintiffs can resort to filing a plaintiff's original petition to seek legal remedies. Whether it involves personal property, auto, homeowners, health, or business insurance, understanding the specific type of breach is crucial for building a strong case against the defendant insurance company. Seeking the assistance of an experienced attorney specializing in insurance disputes is advisable to navigate the legal complexities effectively and increase the chances of a successful outcome.

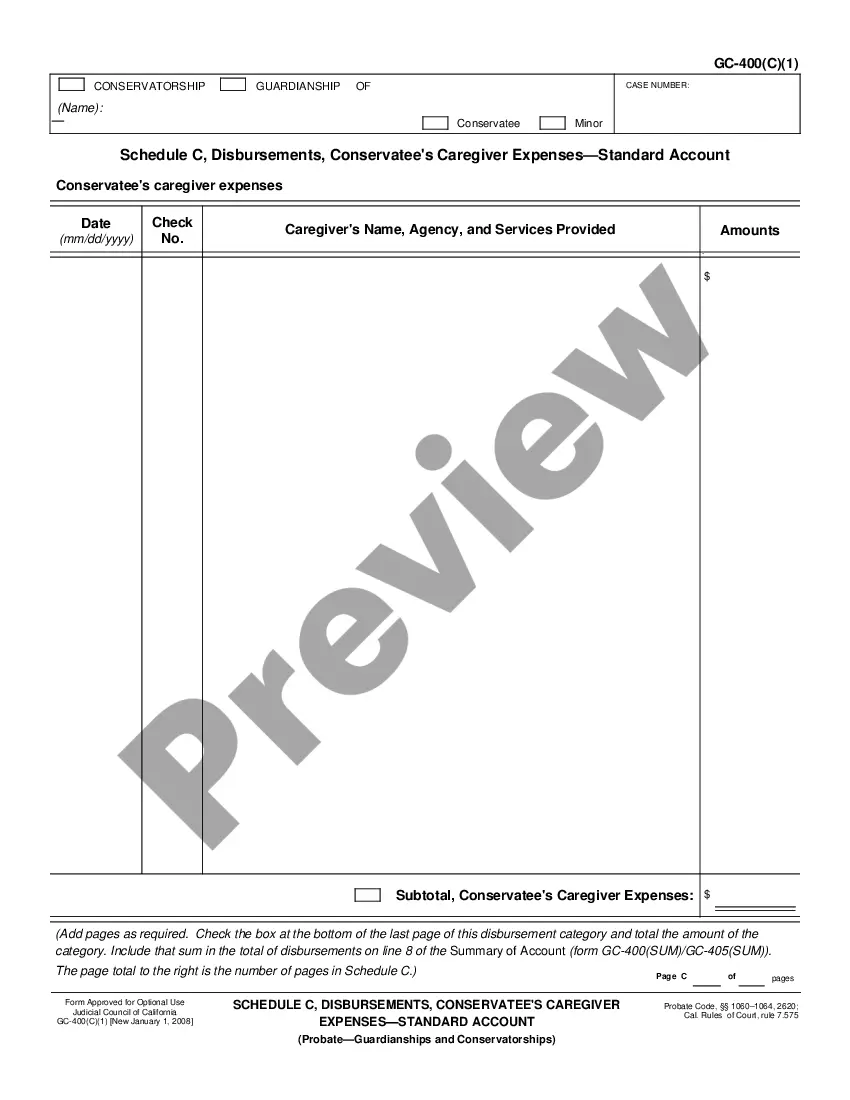

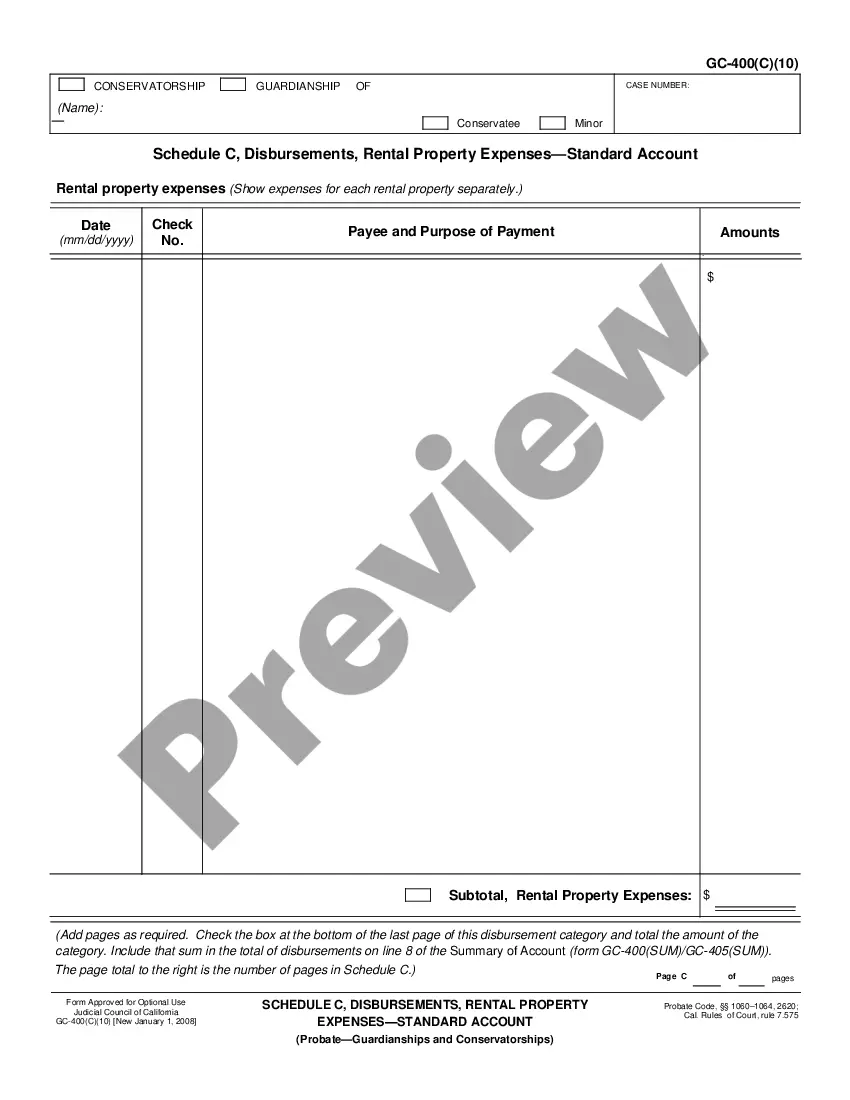

Free preview

How to fill out Plano Texas Plaintiff's Original Petition For Breach Of Insurance Policy?

If you’ve already utilized our service before, log in to your account and save the Plano Texas Plaintiff's Original Petition for Breach of Insurance Policy on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Plano Texas Plaintiff's Original Petition for Breach of Insurance Policy. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!