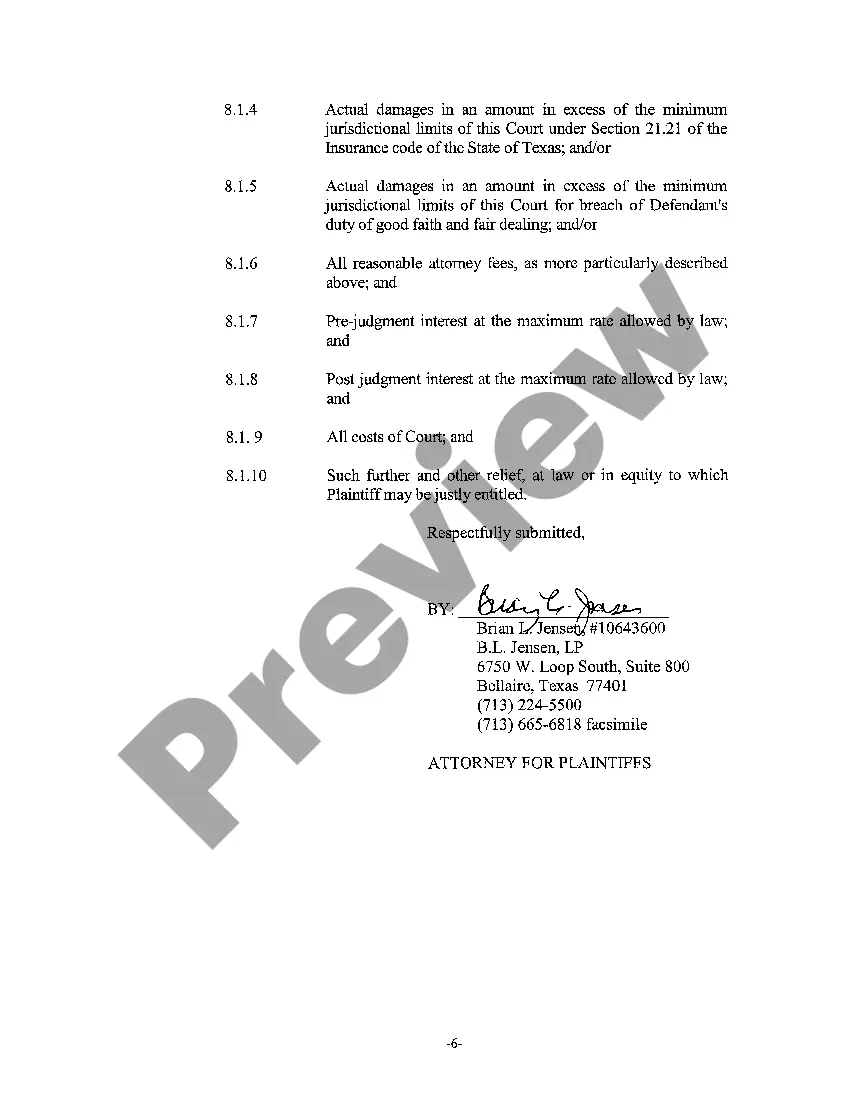

The San Antonio Texas Plaintiff's Original Petition for Breach of Insurance Policy is a legal document filed by a plaintiff (the party claiming harm or damages) against an insurance company for the alleged breach of an insurance policy contract. This petition initiates a lawsuit, seeking compensation or remedies for the damages suffered due to the insurance company's failure to fulfill its obligations as outlined in the policy. Key elements included in the San Antonio Texas Plaintiff's Original Petition for Breach of Insurance Policy typically entail: 1. Parties Involved: This section identifies the plaintiff (the party filing the lawsuit) and the defendant (the insurance company). It provides contact information and background details of both parties involved. 2. Jurisdiction and Venue: The petition specifies that the lawsuit is being filed in San Antonio, Texas, and provides reasoning as to why the local court holds jurisdiction over the matter. 3. Statement of Facts: This section presents a detailed narrative of the events leading to the alleged breach of the insurance policy. It outlines the relevant facts, incidents, and actions taken by both parties, highlighting how the defendant failed to fulfill its contractual obligations. 4. Breach of Contract Allegations: The plaintiff presents a compelling argument to demonstrate how the insurance company violated the terms of the policy. This section may include specific clauses or provisions of the insurance policy that were not honored and how those actions resulted in harm or damages to the plaintiff. 5. Damages Sought: The plaintiff outlines the specific monetary or non-monetary damages suffered as a result of the breach of the insurance policy. This may include economic damages such as medical expenses, property damage, loss of income, or non-economic damages like pain and suffering or emotional distress. The petitioner seeks compensation or other remedies to rectify these damages. 6. Legal Basis for the Lawsuit: The petition cites the applicable laws, statutes, or regulations that support the plaintiff's claims against the defendant. It may reference relevant Texas insurance laws, contract law, or any other legal principles that strengthen the plaintiff's case. 7. Prayer for Relief: This section concludes the petition by stating the desired relief or remedies sought by the plaintiff. This could include monetary compensation, policy-specific benefits, punitive damages, attorney's fees and costs, or any other suitable relief under the law. Different types of San Antonio Texas Plaintiff's Original Petition for Breach of Insurance Policy may exist based on the specific insurance policy in question. Some common variations include Plaintiff's Original Petition for Breach of Auto Insurance Policy, Plaintiff's Original Petition for Breach of Homeowners Insurance Policy, or Plaintiff's Original Petition for Breach of Business Insurance Policy. Each of these variations would outline the details and peculiarities relevant to that particular type of insurance policy and the alleged breach.

San Antonio Texas Plaintiff's Original Petition for Breach of Insurance Policy

State:

Texas

City:

San Antonio

Control #:

TX-CC-59-01

Format:

PDF

Instant download

This form is available by subscription

Description

A01 Plaintiff's Original Petition for Breach of Insurance Policy

The San Antonio Texas Plaintiff's Original Petition for Breach of Insurance Policy is a legal document filed by a plaintiff (the party claiming harm or damages) against an insurance company for the alleged breach of an insurance policy contract. This petition initiates a lawsuit, seeking compensation or remedies for the damages suffered due to the insurance company's failure to fulfill its obligations as outlined in the policy. Key elements included in the San Antonio Texas Plaintiff's Original Petition for Breach of Insurance Policy typically entail: 1. Parties Involved: This section identifies the plaintiff (the party filing the lawsuit) and the defendant (the insurance company). It provides contact information and background details of both parties involved. 2. Jurisdiction and Venue: The petition specifies that the lawsuit is being filed in San Antonio, Texas, and provides reasoning as to why the local court holds jurisdiction over the matter. 3. Statement of Facts: This section presents a detailed narrative of the events leading to the alleged breach of the insurance policy. It outlines the relevant facts, incidents, and actions taken by both parties, highlighting how the defendant failed to fulfill its contractual obligations. 4. Breach of Contract Allegations: The plaintiff presents a compelling argument to demonstrate how the insurance company violated the terms of the policy. This section may include specific clauses or provisions of the insurance policy that were not honored and how those actions resulted in harm or damages to the plaintiff. 5. Damages Sought: The plaintiff outlines the specific monetary or non-monetary damages suffered as a result of the breach of the insurance policy. This may include economic damages such as medical expenses, property damage, loss of income, or non-economic damages like pain and suffering or emotional distress. The petitioner seeks compensation or other remedies to rectify these damages. 6. Legal Basis for the Lawsuit: The petition cites the applicable laws, statutes, or regulations that support the plaintiff's claims against the defendant. It may reference relevant Texas insurance laws, contract law, or any other legal principles that strengthen the plaintiff's case. 7. Prayer for Relief: This section concludes the petition by stating the desired relief or remedies sought by the plaintiff. This could include monetary compensation, policy-specific benefits, punitive damages, attorney's fees and costs, or any other suitable relief under the law. Different types of San Antonio Texas Plaintiff's Original Petition for Breach of Insurance Policy may exist based on the specific insurance policy in question. Some common variations include Plaintiff's Original Petition for Breach of Auto Insurance Policy, Plaintiff's Original Petition for Breach of Homeowners Insurance Policy, or Plaintiff's Original Petition for Breach of Business Insurance Policy. Each of these variations would outline the details and peculiarities relevant to that particular type of insurance policy and the alleged breach.

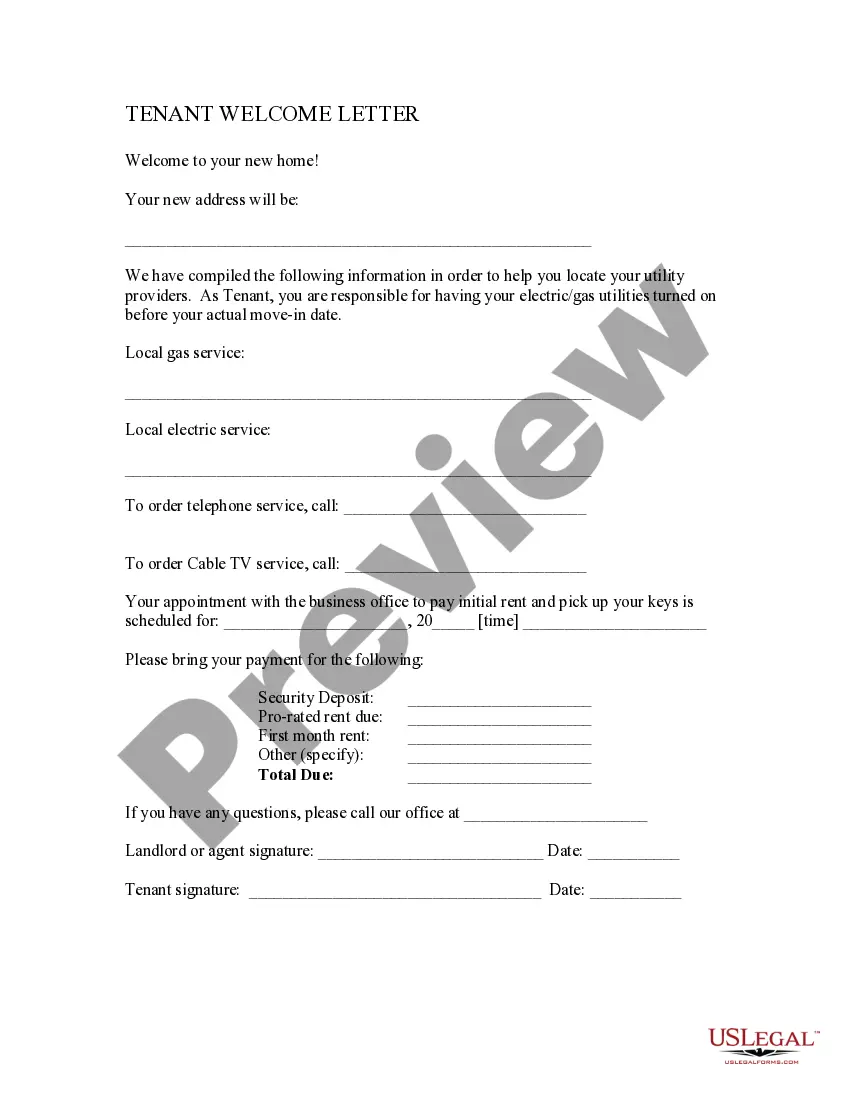

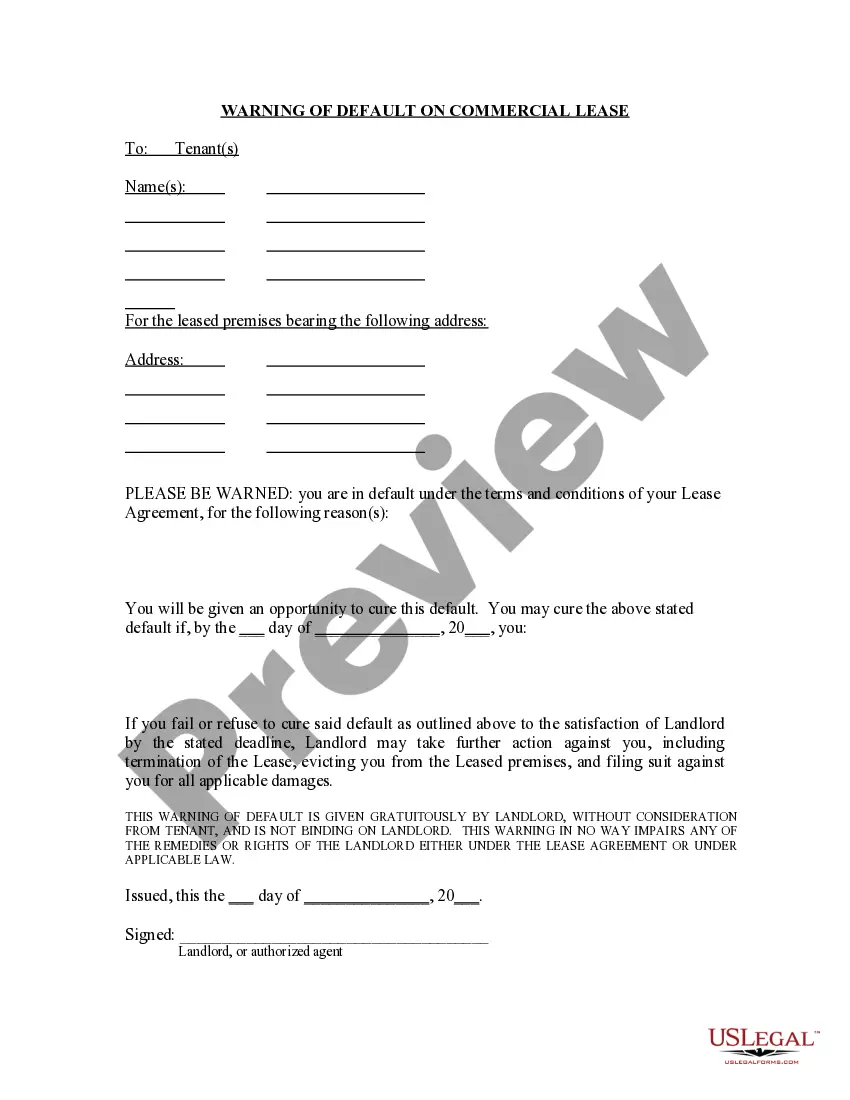

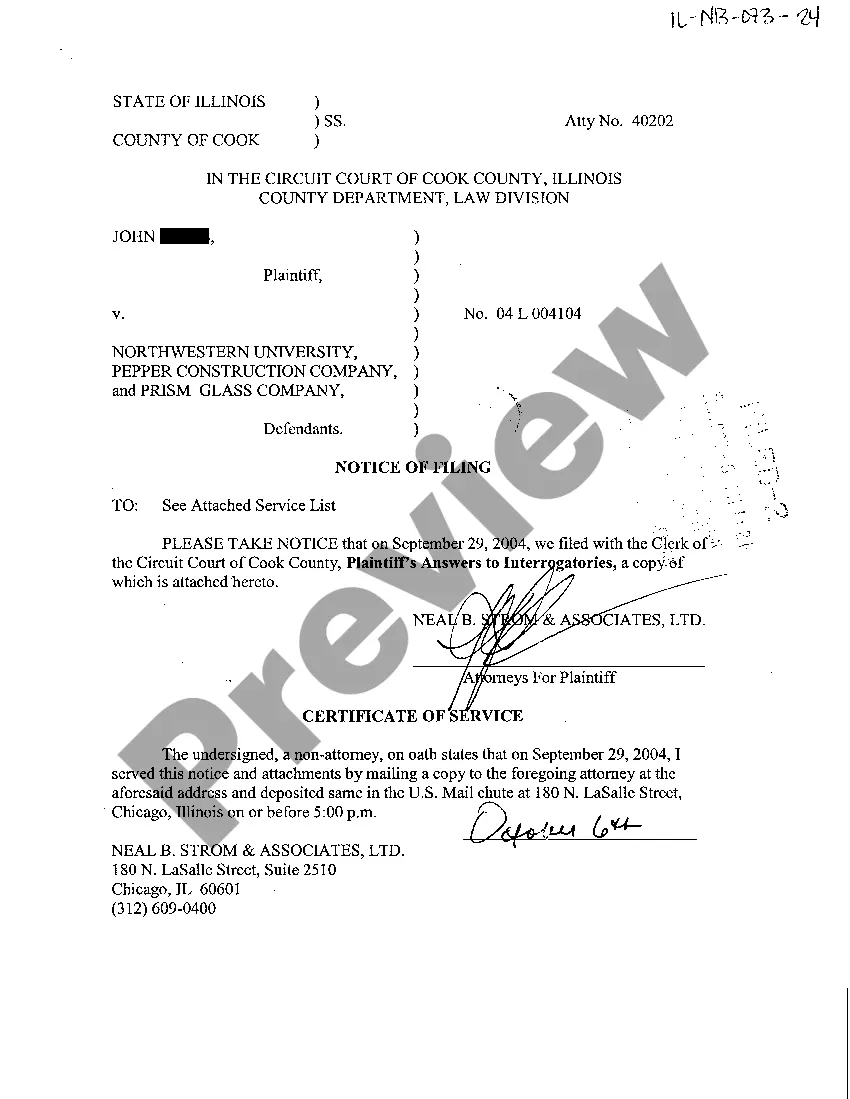

Free preview

How to fill out San Antonio Texas Plaintiff's Original Petition For Breach Of Insurance Policy?

If you’ve already utilized our service before, log in to your account and download the San Antonio Texas Plaintiff's Original Petition for Breach of Insurance Policy on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your San Antonio Texas Plaintiff's Original Petition for Breach of Insurance Policy. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!