Edinburg Texas Official Receipt

Description

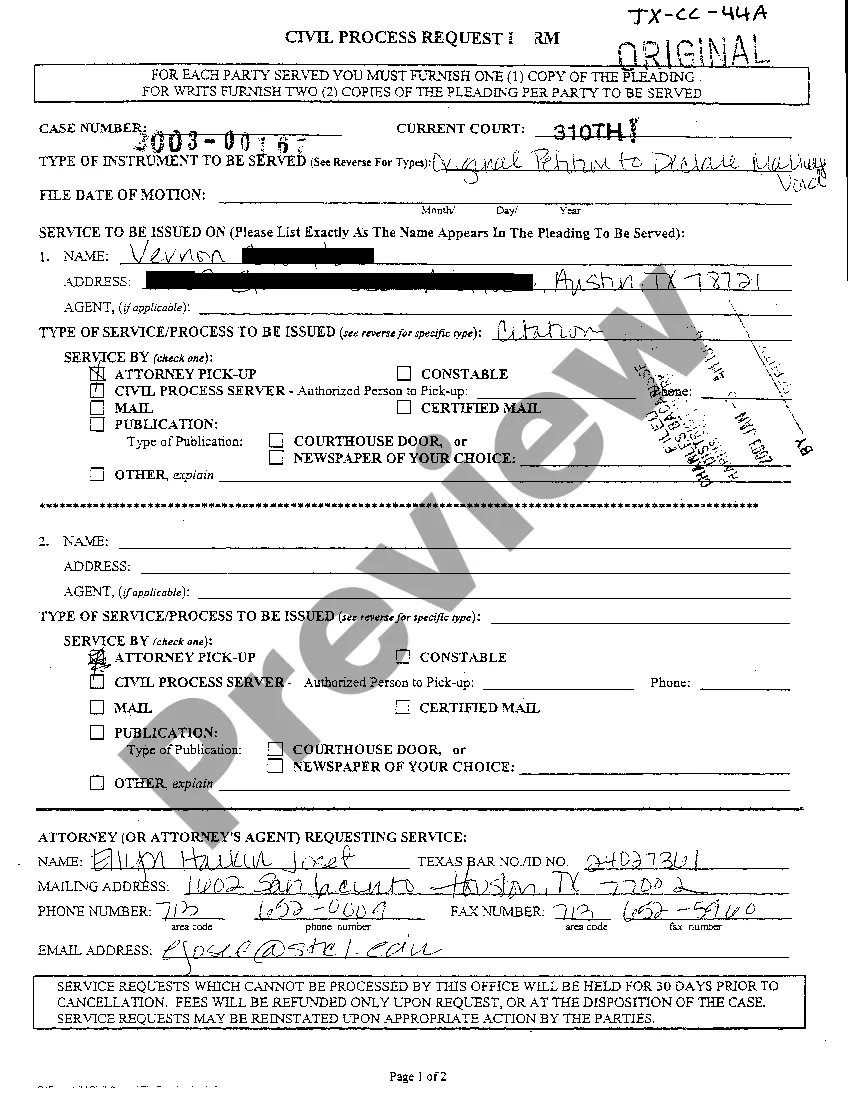

How to fill out Texas Official Receipt?

We consistently strive to lessen or evade legal repercussions when engaging with intricate legal or financial topics.

To achieve this, we seek legal remedies that are often quite expensive.

However, not all legal challenges are equally intricate.

Many of them can be managed independently.

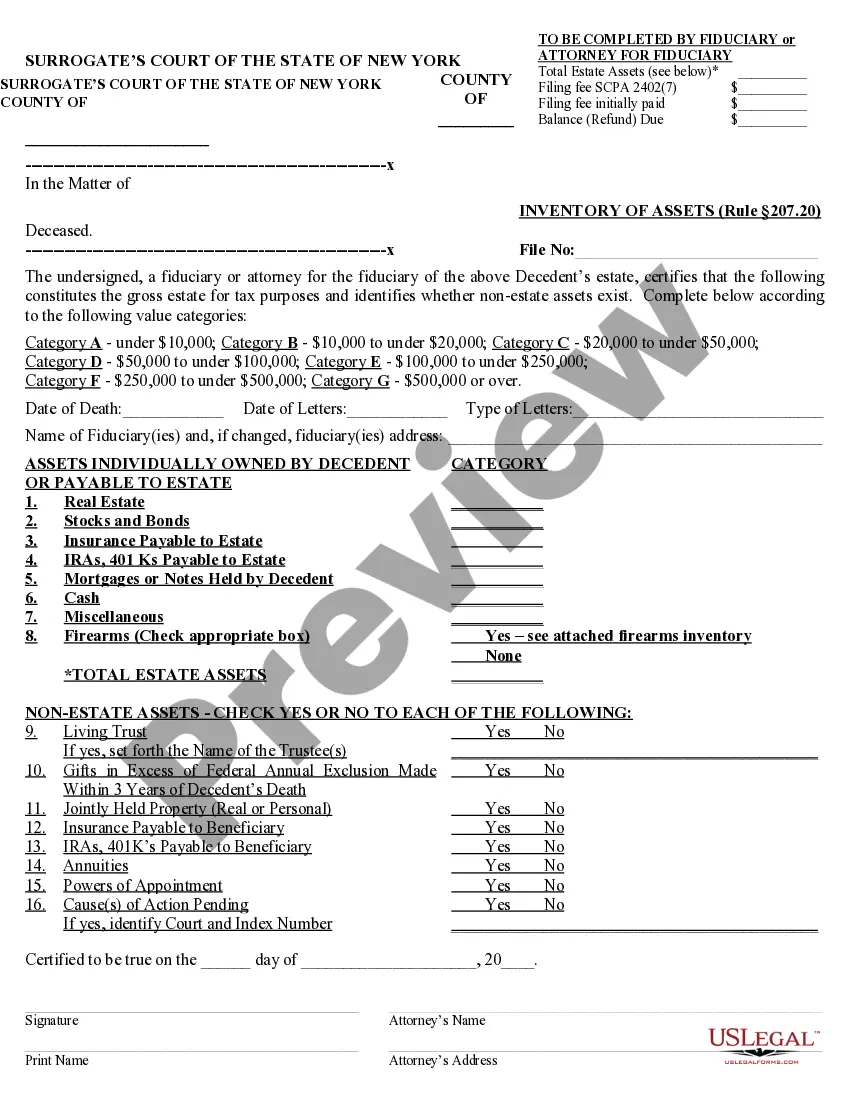

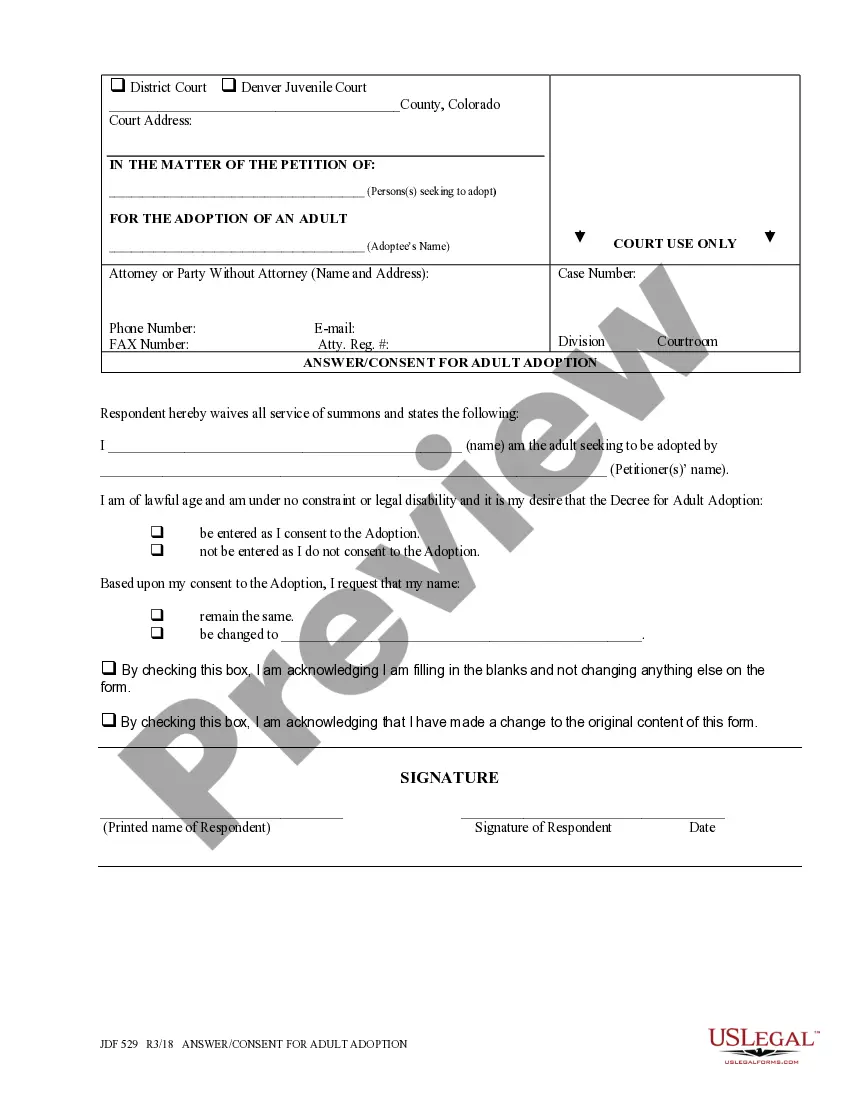

Capitalize on US Legal Forms whenever you need to obtain and download the Edinburg Texas Official Receipt or any other document swiftly and safely.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and power of attorney to articles of incorporation and dissolution petitions.

- Our collection enables you to take charge of your issues without relying on an attorney.

- We offer access to legal templates that aren't always readily available.

- Our templates are specific to states and regions, which greatly streamlines the searching process.

Form popularity

FAQ

To request records from Hidalgo County, Texas, you can submit a request to the appropriate county office via mail, online, or in person. Be sure to include necessary details like the type of record you need, your identification, and any applicable fees. If you're dealing with vital records and need help, consider using US Legal, which provides information on getting your Edinburg Texas Official Receipt easily.

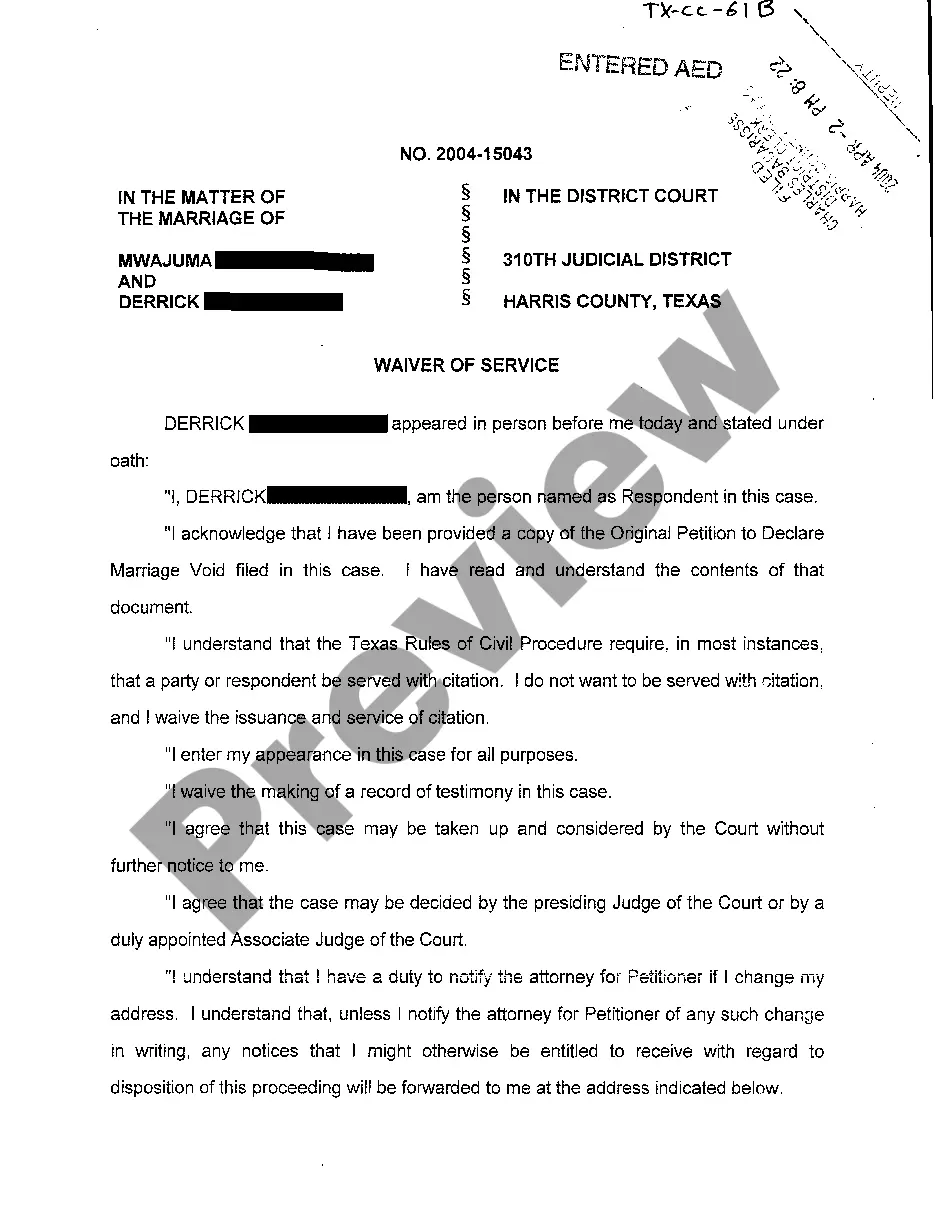

In Texas, obtaining a marriage certificate usually takes about 10 to 14 business days after the marriage license is filed. However, expedited options may be available if you need your certificate sooner. If you want assistance in tracking down an Edinburg Texas Official Receipt or any related documentation, the US Legal platform can help guide you through the necessary steps.

To get a copy of your marriage license in Hidalgo County, Texas, you can visit the Hidalgo County Clerk's office in person or request a copy online. Be prepared to provide your names, date of marriage, and possibly identification. Many find that using the US Legal platform simplifies the steps to obtaining the Edinburg Texas Official Receipt you may need.

Edinburg is located in Hidalgo County, Texas. It serves as the county seat and is a vibrant city within the Rio Grande Valley. If you are in Edinburg, understanding local regulations, such as obtaining an Edinburg Texas Official Receipt, can be essential for many legal processes. Reach out and explore the many resources available to you in Hidalgo County.

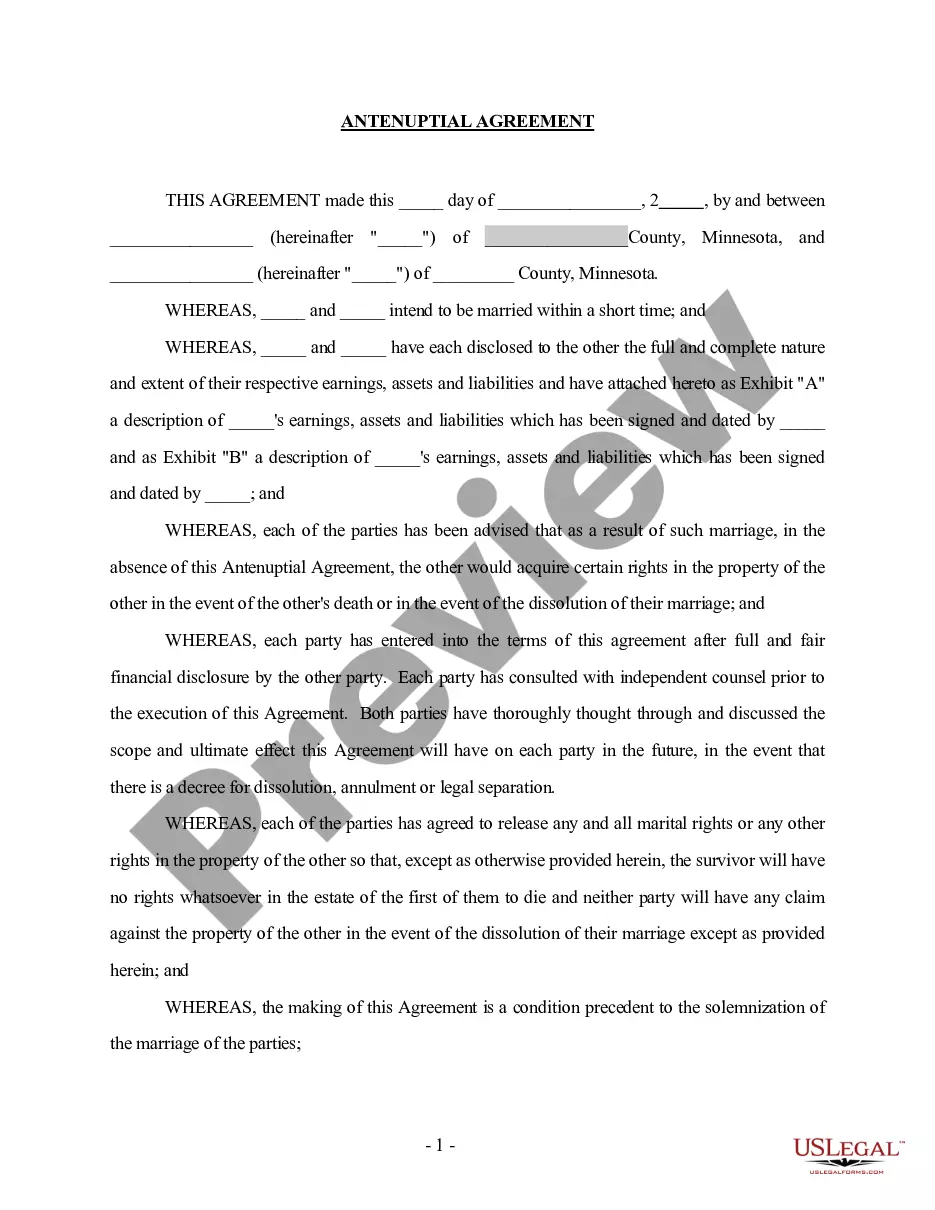

In Texas, a marriage license and a marriage certificate serve different purposes. The marriage license is obtained before the wedding and gives couples legal permission to marry. After the wedding, the officiant files the marriage license, and you can request a marriage certificate, which serves as proof of your marriage. To obtain necessary documents like these, you may find assistance with the US Legal platform to navigate the process smoothly.

Hidalgo County has a predominantly Hispanic population, with approximately 90 percent identifying as Hispanic or Latino in recent estimates. This vibrant demographic plays a pivotal role in shaping the culture, traditions, and community events in the area. The influence of Hispanic heritage is evident in the festivals, food, and community pride. When purchasing local art or goods, keep your Edinburg Texas Official Receipt as a valuable record of your support for local businesses.

Hidalgo County is largely known for its cultural diversity and the annual events that reflect this uniqueness. The county hosts various fairs and festivals throughout the year, emphasizing local art, music, and culinary delights. It serves as a gateway for trade between the U.S. and Mexico, further boosting its economy. Remember, every transaction can be tracked with an Edinburg Texas Official Receipt, which can aid in maintaining records.

Hidalgo is famous for its historical significance and cultural events, particularly the annual celebrations of its heritage. The small community offers a unique glimpse into the traditions of South Texas, drawing visitors to its local festivities. Further, the region is known for its close-knit community and agricultural contributions. When you engage with local businesses, remember to ask for your Edinburg Texas Official Receipt.

McAllen, Texas is well-known for its vibrant cultural scene and diverse population. It's an important commercial hub for the region, often attracting visitors for shopping, dining, and entertainment. Additionally, the city holds various festivals throughout the year, showcasing its rich traditions. Exploring the area can lead to discovering the Edinburg Texas Official Receipt, highlighting the local businesses.

To register a business in Hidalgo County, you will begin by selecting your business structure, such as a sole proprietorship or LLC. Next, you may need to file the necessary paperwork with the county clerk’s office. Be sure to obtain your Edinburg Texas Official Receipt upon completion, as it serves as proof of your business registration. For additional guidance on the process, consider utilizing resources like uslegalforms, which simplify business registration in the area.