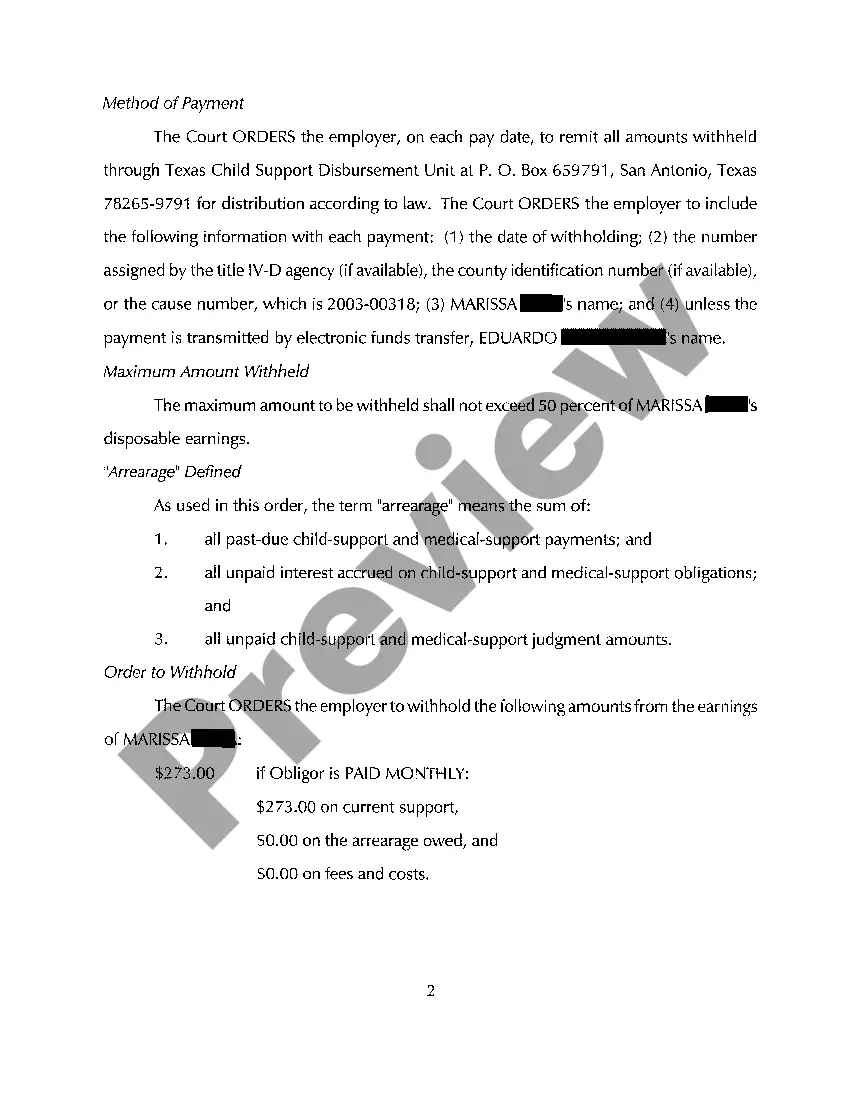

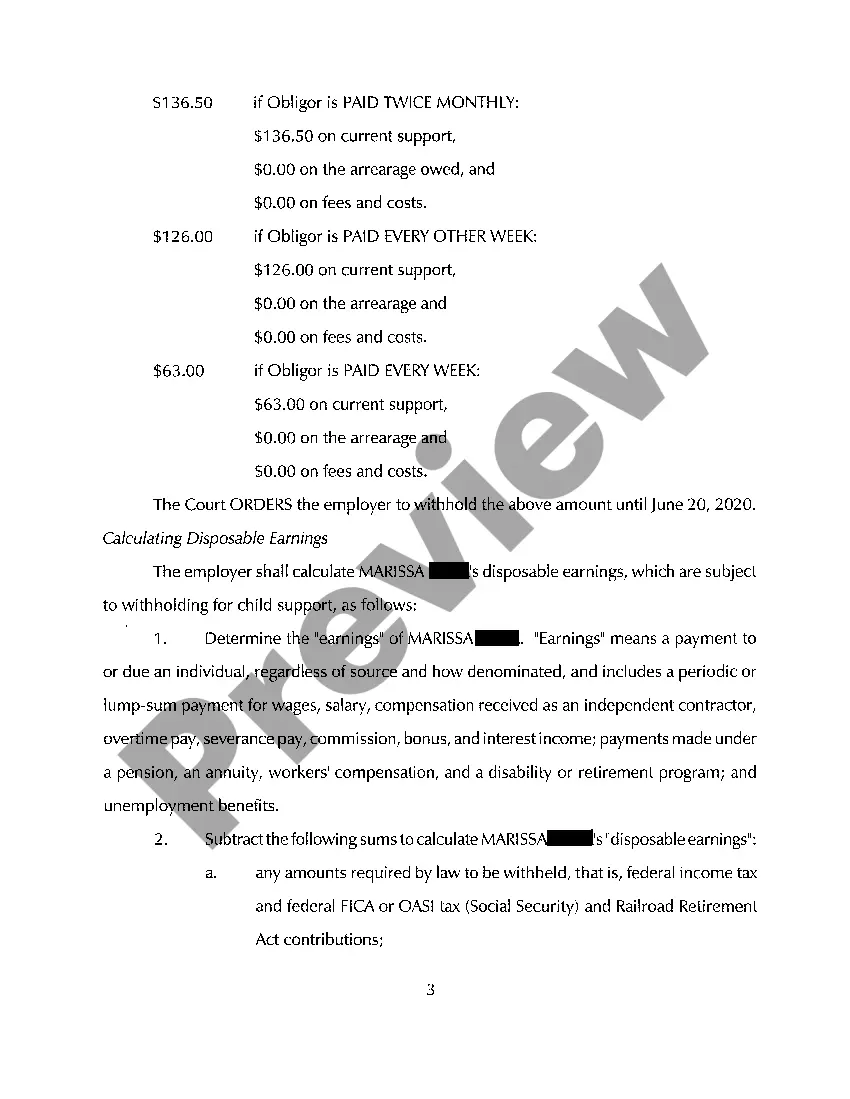

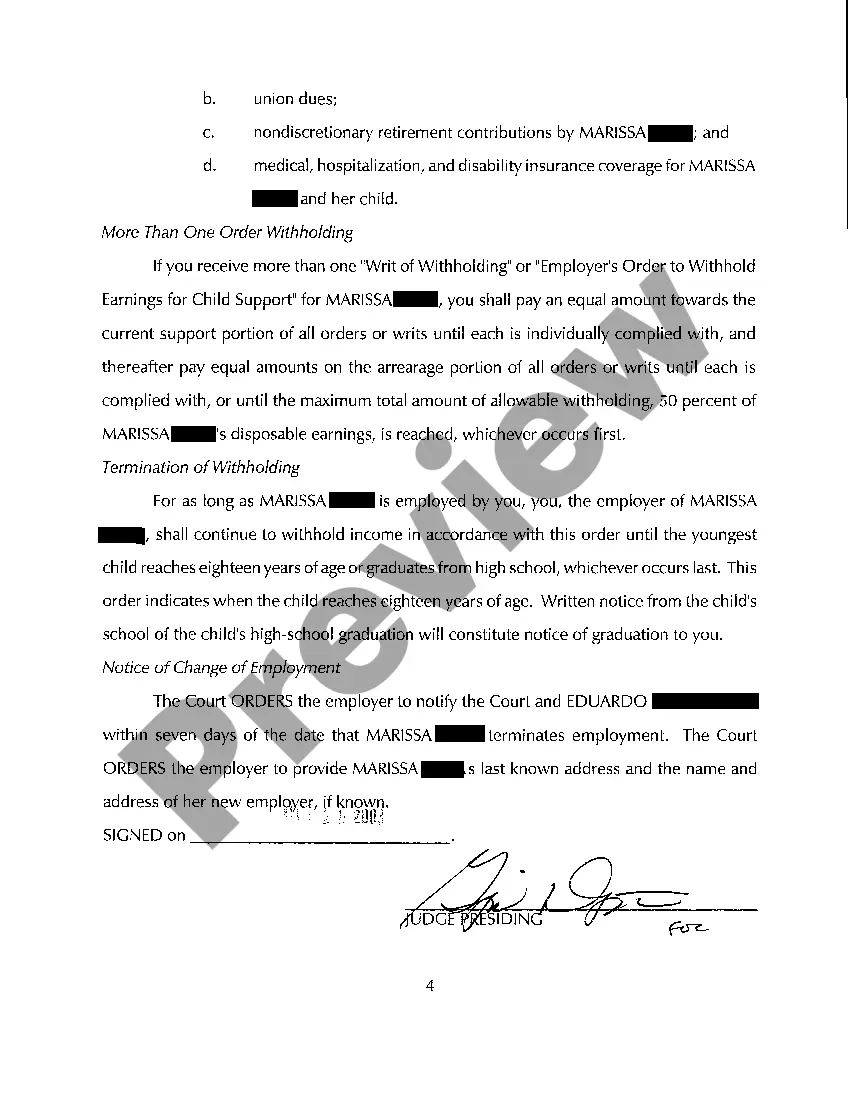

Abilene Texas Order to Withhold From Earnings Child Support is a legal mechanism aimed at ensuring the timely payment of child support by noncustodial parents in Abilene, Texas. This court-issued order allows for automatic deductions from the paying parent's income, directly allocating funds towards child support obligations. The purpose of such an order is to streamline the payment process and reduce the chances of default or non-payment. Here are a few types of Abilene Texas Order to Withhold From Earnings Child Support: 1. Original Order: This is the initial court order issued when child support is established or modified. It mandates the noncustodial parent to make regular payments for the financial support of their child(men). The order may include provisions for automatic wage withholding. 2. Income Withholding Order: Commonly referred to as an TWO, this type of order specifically deals with wage garnishment. It requires the withholding of child support payments from the noncustodial parent's income. The order is sent to the employer, who deducts the specified amount and remits it to the appropriate child support agency. 3. Voluntary Withholding Order: This order comes into effect when the noncustodial parent voluntarily agrees to have child support payments deducted from their earnings. It is often utilized as a proactive approach to ensuring the timely payment of child support. 4. Administrative Withholding Order: This order is typically used when child support payments fall behind, and attempts to collect payment through voluntary withholding have been unsuccessful. It may be issued by the child support agency, directing the employer to withhold a specific amount from the noncustodial parent's income until arbitrages are cleared. 5. Medical Support Withholding Order: In cases where the court has ordered the noncustodial parent to provide health insurance for their child(men), this order applies. It directs the employer to deduct the necessary health insurance premiums from the parent's income to ensure medical coverage for the child. 6. Lump-Sum Payment Withholding Order: This type of order authorizes the withholding of child support from a lump-sum payment, such as a tax refund or a bonus. It enables the capture of outstanding child support arbitrages or ensures the payment of current child support obligations. 7. Termination of Withholding Order: This order is issued when child support obligations are fulfilled or terminated, terminating the wage withholding process. It is crucial for both custodial and noncustodial parents to be aware of the various types of Abilene Texas Order to Withhold From Earnings Child Support, as well as their implications. Seeking legal advice and understanding the specific rules and procedures involved can help ensure compliance with the law and the best interests of the children involved.

Abilene Texas Order to Withhold From Earnings Child Support is a legal mechanism aimed at ensuring the timely payment of child support by noncustodial parents in Abilene, Texas. This court-issued order allows for automatic deductions from the paying parent's income, directly allocating funds towards child support obligations. The purpose of such an order is to streamline the payment process and reduce the chances of default or non-payment. Here are a few types of Abilene Texas Order to Withhold From Earnings Child Support: 1. Original Order: This is the initial court order issued when child support is established or modified. It mandates the noncustodial parent to make regular payments for the financial support of their child(men). The order may include provisions for automatic wage withholding. 2. Income Withholding Order: Commonly referred to as an TWO, this type of order specifically deals with wage garnishment. It requires the withholding of child support payments from the noncustodial parent's income. The order is sent to the employer, who deducts the specified amount and remits it to the appropriate child support agency. 3. Voluntary Withholding Order: This order comes into effect when the noncustodial parent voluntarily agrees to have child support payments deducted from their earnings. It is often utilized as a proactive approach to ensuring the timely payment of child support. 4. Administrative Withholding Order: This order is typically used when child support payments fall behind, and attempts to collect payment through voluntary withholding have been unsuccessful. It may be issued by the child support agency, directing the employer to withhold a specific amount from the noncustodial parent's income until arbitrages are cleared. 5. Medical Support Withholding Order: In cases where the court has ordered the noncustodial parent to provide health insurance for their child(men), this order applies. It directs the employer to deduct the necessary health insurance premiums from the parent's income to ensure medical coverage for the child. 6. Lump-Sum Payment Withholding Order: This type of order authorizes the withholding of child support from a lump-sum payment, such as a tax refund or a bonus. It enables the capture of outstanding child support arbitrages or ensures the payment of current child support obligations. 7. Termination of Withholding Order: This order is issued when child support obligations are fulfilled or terminated, terminating the wage withholding process. It is crucial for both custodial and noncustodial parents to be aware of the various types of Abilene Texas Order to Withhold From Earnings Child Support, as well as their implications. Seeking legal advice and understanding the specific rules and procedures involved can help ensure compliance with the law and the best interests of the children involved.