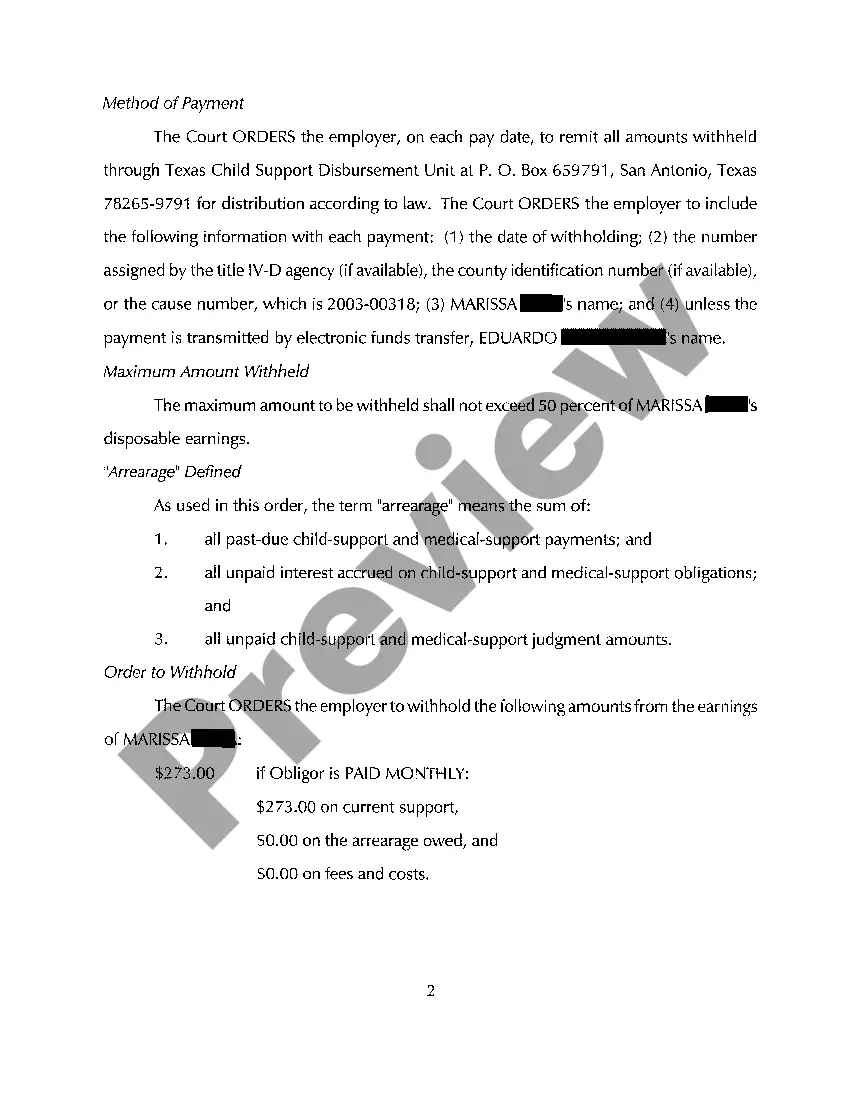

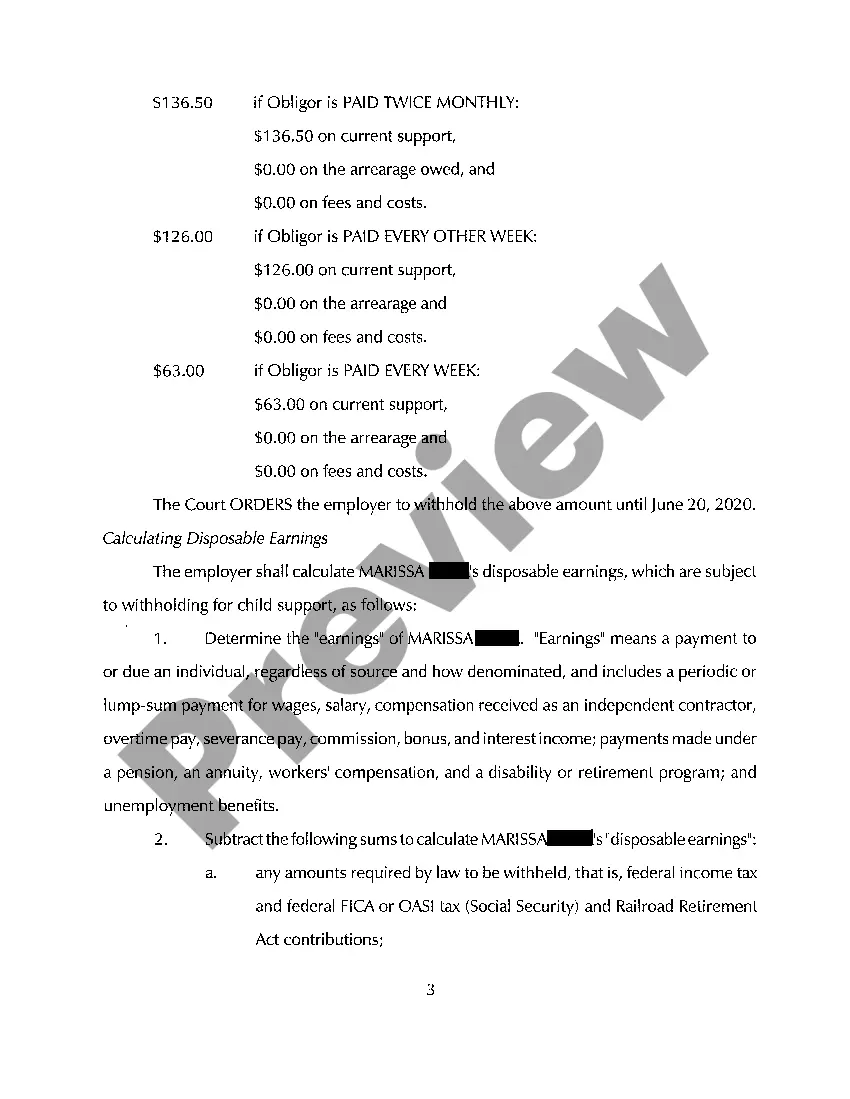

A Beaumont Texas Order to Withhold From Earnings Child Support is a legal document that mandates an employer to deduct child support payments directly from an employee's wages before the employee receives their paycheck. This type of order ensures that child support payments are consistently paid and enables the custodial parent to receive timely financial support to meet their child's needs. Beaumont, Texas, provides various types of Orders withholding From Earnings Child Support, addressing different circumstances and requirements. Below are some common types: 1. Initial Order to Withhold: When a child support order is first established or modified, this order sets out the terms for withholding child support from an employee's earnings. It specifies the frequency and amount to be withheld, as determined by the court or the Office of the Attorney General. 2. Wage Withholding Order: This type of order is issued when a noncustodial parent fails to make child support payments on time or consistently. It authorizes the employer to withhold a specific amount from the employee's wages and remit it directly to the child support agency or the custodial parent until the arrears are satisfied. 3. Lump Sum Withholding Order: In cases where a noncustodial parent becomes entitled to a significant lump sum payment, such as a tax refund, lottery winnings, or an inheritance, this order is used to intercept the funds and allocate them towards the payment of child support. 4. Medical Support Withholding Order: A court may issue this order to enforce the noncustodial parent's obligation to provide medical support for their child. It directs the employer to deduct any healthcare premiums or medical expenses from the employee's wages and send the amount to the appropriate party or agency. 5. Interstate Income Withholding Order: When either the custodial or noncustodial parent resides in a different state, and income withholding is necessary, an Interstate Income Withholding Order may be utilized. It ensures that child support payments are properly withheld and transmitted across state lines, in compliance with the Uniform Interstate Family Support Act (IFSA). In conclusion, a Beaumont Texas Order to Withhold From Earnings Child Support is a fundamental legal tool used to enforce the timely and consistent payment of child support. Various types of orders cater to different circumstances, including initial orders, wage withholding, lump sum withholding, medical support withholding, and interstate income withholding. These orders play a crucial role in safeguarding the financial welfare of children and ensuring they receive the support they deserve.

Beaumont Texas Order to Withhold From Earnings Child Support

Description

How to fill out Beaumont Texas Order To Withhold From Earnings Child Support?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Beaumont Texas Order to Withhold From Earnings Child Support gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Beaumont Texas Order to Withhold From Earnings Child Support takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Beaumont Texas Order to Withhold From Earnings Child Support. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

Income withholdings refer to the practice of deducting a specific amount from an individual's paycheck to cover obligations like child support. In Beaumont, Texas, the Order to Withhold From Earnings Child Support establishes this process, ensuring that payments are made directly from wages. This method provides a straightforward solution for managing child support, alleviating concerns for custodial parents about missed payments. By implementing income withholdings, you secure consistent financial assistance for your children.

An earning withholding order is a legal directive that instructs an employer to deduct a fixed amount from an employee's earnings to cover child support obligations. In Beaumont, Texas, this procedure helps maintain consistent payments, which is vital for child welfare. An Order to Withhold From Earnings Child Support protects the financial interests of children and ensures they receive the necessary support. Understanding how these orders work empowers custodial parents to enforce their rights effectively.

An earnings order is a legal document that directs an employer to withhold a portion of an employee's earnings for child support payments. In Beaumont, Texas, an Order to Withhold From Earnings Child Support ensures that payments are made regularly and consistently. This type of order is especially beneficial for custodial parents, as it provides a reliable method for collecting financial support. By establishing this order, you can help secure the financial well-being of the children involved.

An income withholding order is a specific type of income order that instructs employers to deduct child support payments directly from an employee's paycheck. This tool is essential in ensuring timely payments and reduces the risk of missed child support obligations. With the Beaumont Texas Order to Withhold From Earnings Child Support, such orders help maintain a consistent flow of support, benefiting the child's welfare greatly. Utilizing resources like uslegalforms can assist you in navigating this process effectively.

An order for income deduction is a legal directive that allows child support payments to be automatically deducted from a parent's paycheck. This order ensures timely payments and compliance with child support obligations. The Beaumont Texas Order to Withhold From Earnings Child Support reflects this system, focusing on protecting the child's best interests. Resources like UsLegalForms can provide additional information on how these orders work and support necessary filings.

To stop garnishment from child support, the most effective method is to petition the court for a modification of your child support obligation. You must demonstrate a valid reason, such as job loss or significant financial hardship, to the courts. Proper legal procedures must be followed to ensure your request is considered appropriately. UsLegalForms can help you prepare the required filings and understand the steps involved.

The income withholding for support form is typically filled out by the court or the child support agency. The parent receiving support often must ensure this form is completed correctly and submitted to the paying parent’s employer. This process applies to the Beaumont Texas Order to Withhold From Earnings Child Support, emphasizing its importance. If you need assistance, UsLegalForms can assist in understanding and completing the necessary documentation.

To stop wage garnishment for child support in Texas, you'll need to address the underlying child support order with the court. This might involve filing a motion for modification or termination based on current circumstances. Engaging with legal resources can clarify options and strategies. Using UsLegalForms can streamline this process by offering templates and guidance.

A father can stop paying child support in Texas by obtaining a court order that modifies or ends the child support obligation. This typically requires showing a significant change in circumstances, such as loss of employment or changed financial status. It is vital to navigate this process legally to avoid complications. UsLegalForms provides tools to help you file the needed forms effectively.

To stop child support garnishment in Texas, you must file a motion with the court that issued the original child support order. This motion can request a modification or termination of child support based on changes in your financial situation. If you provide sufficient evidence, the court may consider your request, highlighting the importance of following the legal process. Utilizing resources like UsLegalForms can guide you through these necessary steps.