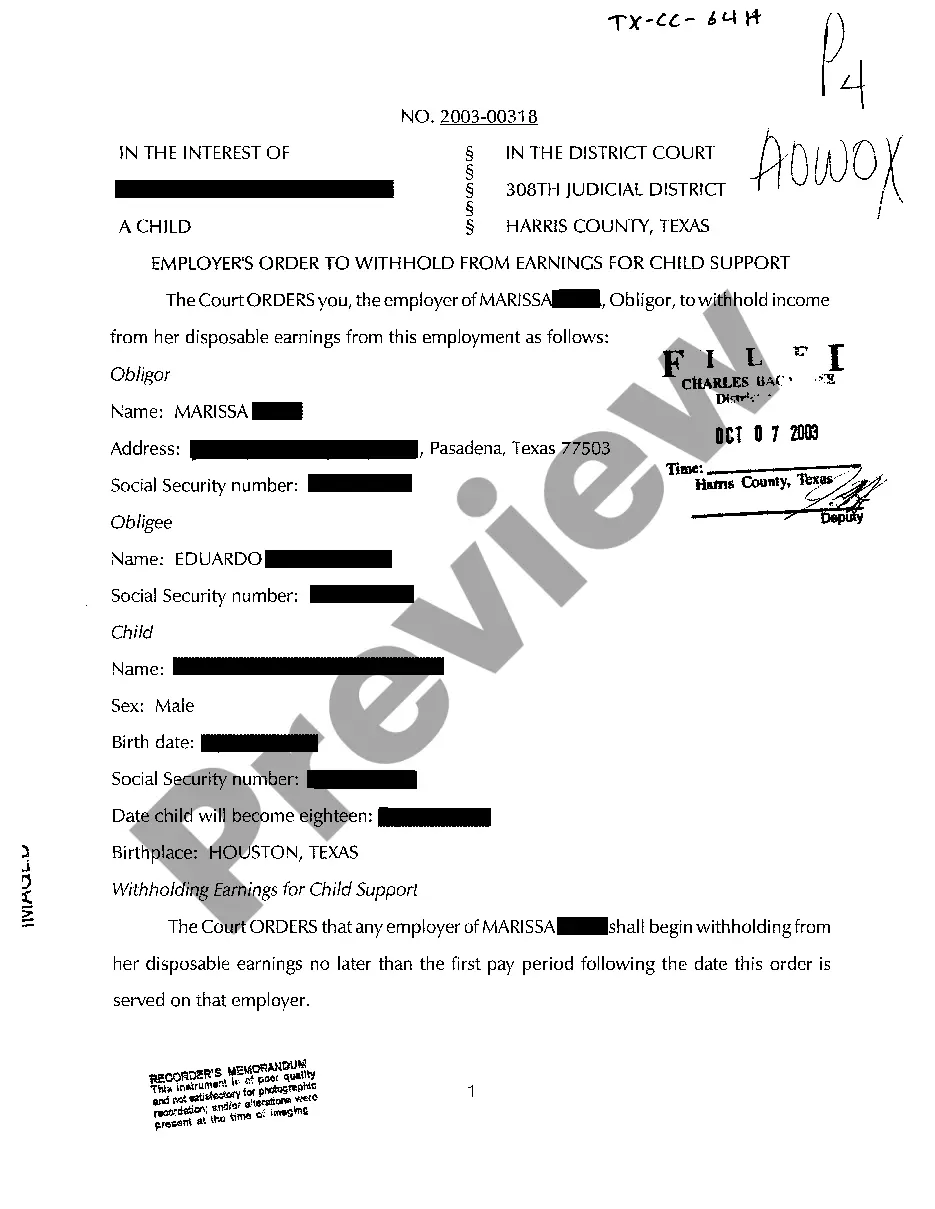

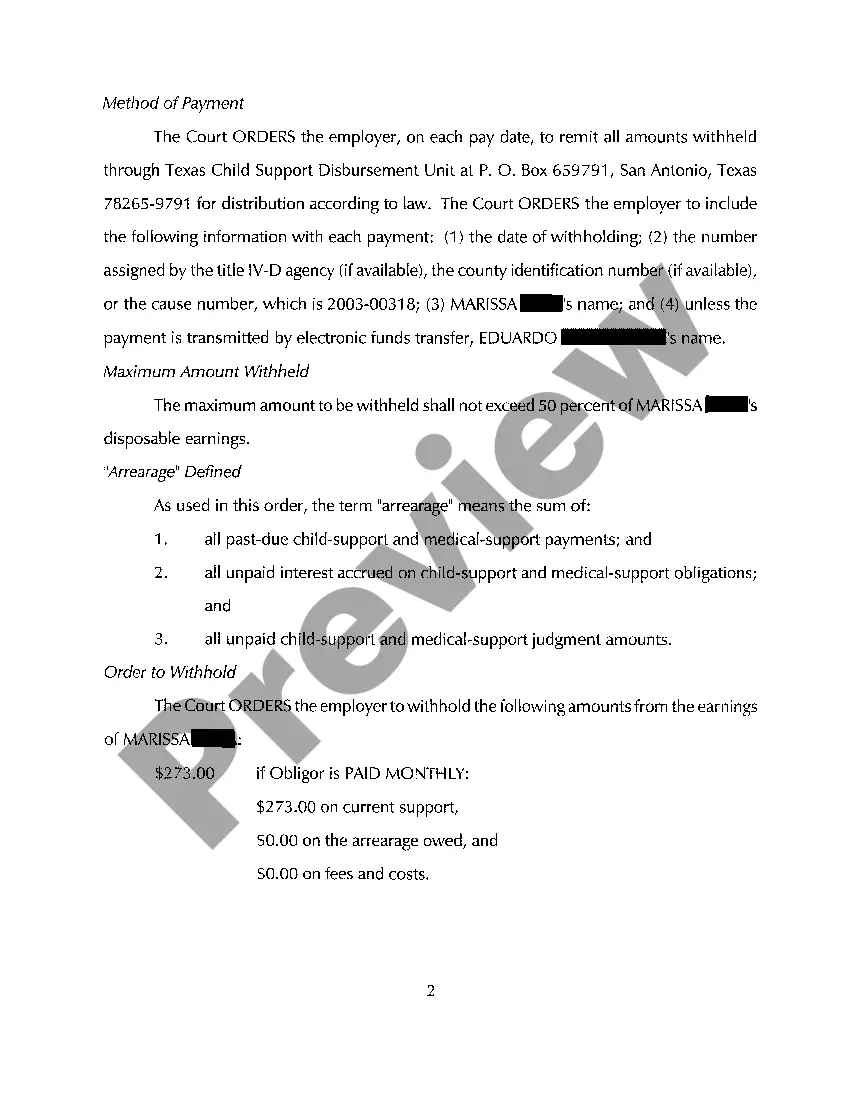

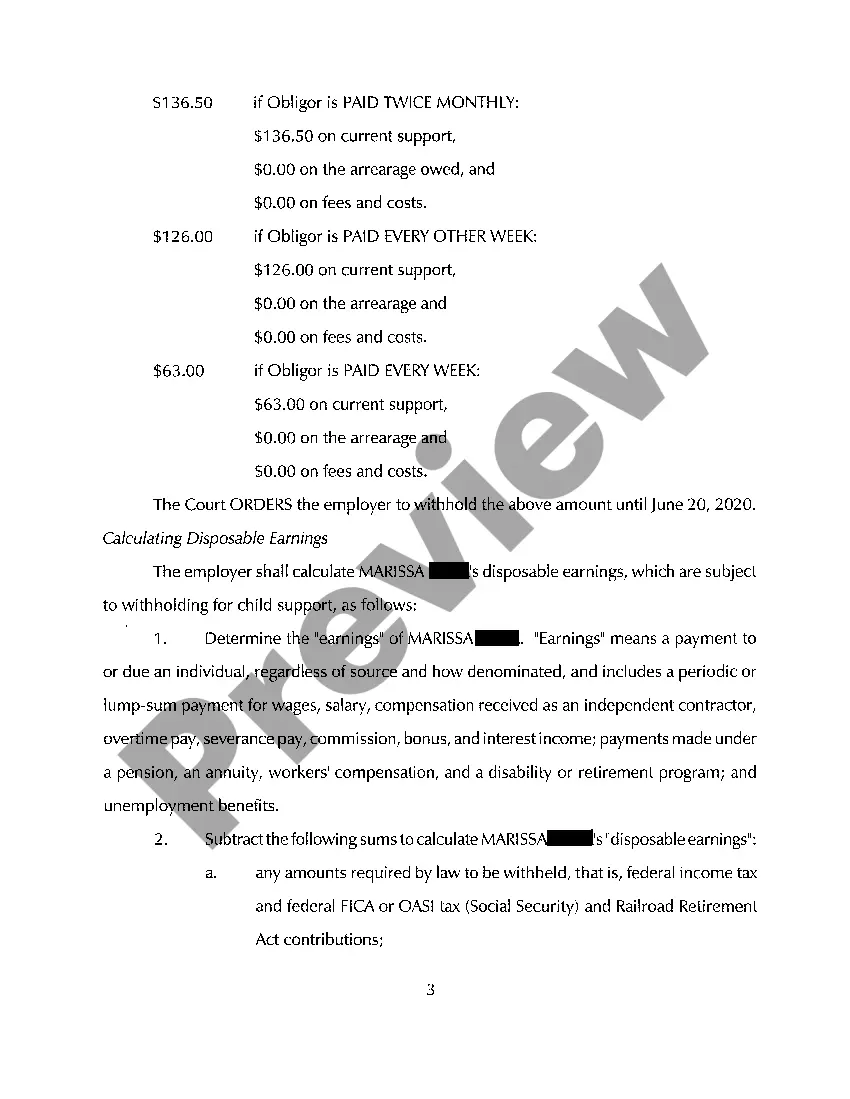

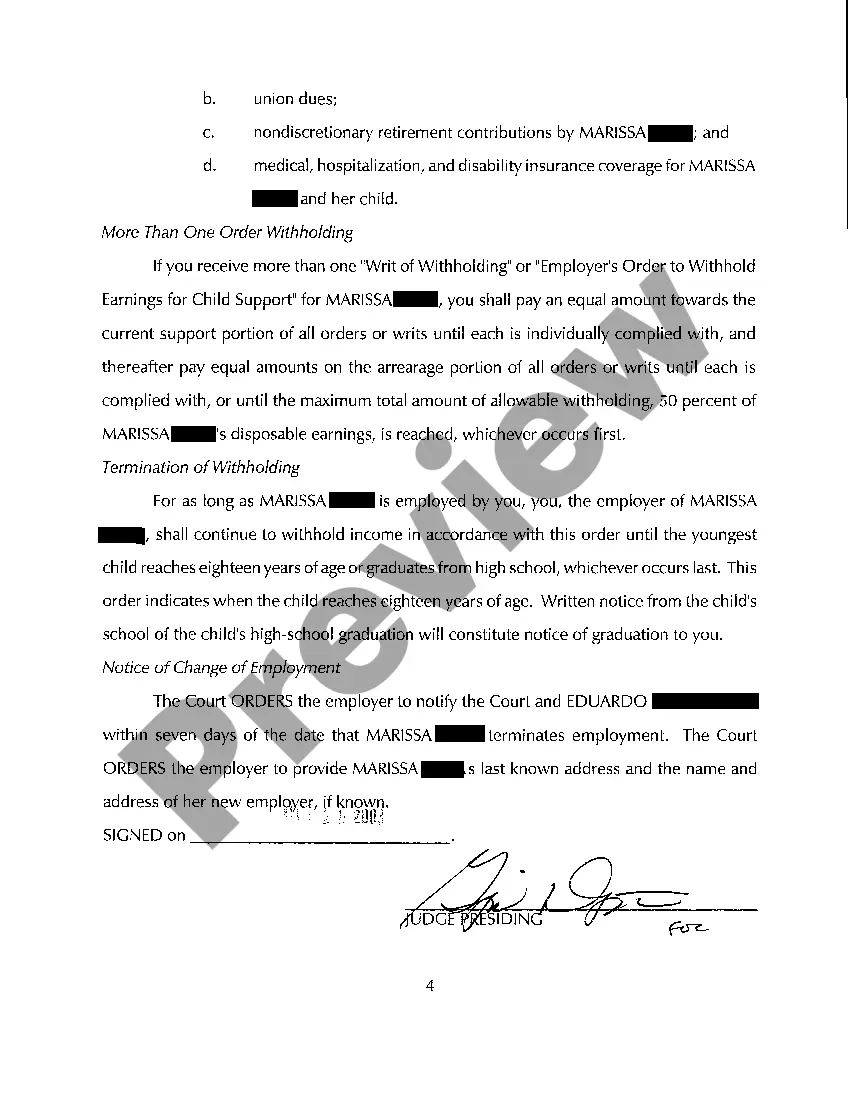

Carrollton Texas Order to Withhold From Earnings Child Support: A Detailed Description Child support is a crucial aspect of ensuring the well-being of children whose parents are no longer together. The Carrollton Texas Order to Withhold From Earnings Child Support is designed to enforce the financial responsibilities of non-custodial parents by deducting child support payments directly from their earnings. This article will delve into the details of this order and explain its various types. In Carrollton, Texas, the Order to Withhold From Earnings Child Support is issued by the court when child support payments are not being made consistently or in the correct amount. This order provides a mechanism for the automatic deduction of such payments from the non-custodial parent's wages or income sources. By implementing this order, the State of Texas ensures that child support obligations are met promptly and consistently, prioritizing the best interests of the child. There are several types of Carrollton Texas Orders withholding From Earnings Child Support, which may vary depending on the circumstances and requirements of each case. Some notable types include: 1. Administrative Orders: These orders are issued by the Texas Attorney General's Office (TAG) when the custodial parent receives public assistance benefits, such as Temporary Assistance for Needy Families (TANK). The TAG works closely with the employer to deduct child support payments directly from the non-custodial parent's wages. 2. Private Orders: In cases where the custodial parent does not receive public assistance, a private order may be issued by the court. Both parties can agree to this order voluntarily, or it may be established after a court hearing. Private orders also involve the employer deducting child support payments from the non-custodial parent's earnings. 3. Medical Support Orders: In addition to child support, medical support is often required to ensure the child's healthcare needs are adequately met. A medical support order may be incorporated into the Carrollton Texas Order to Withhold From Earnings Child Support, requiring the non-custodial parent to provide medical insurance coverage or pay for medical expenses directly. It is important to note that these orders must comply with the Texas Family Code and federal laws, such as the Consumer Credit Protection Act (CCPA). The CCPA limits the amount that can be withheld from an employee's earnings, ensuring that they have sufficient income to cover necessary living expenses. When the Carrollton Texas Order to Withhold From Earnings Child Support is in effect, the employer becomes responsible for deducting the specified child support amount from the non-custodial parent's paycheck. These deductions are then sent to the Child Support Division of the Office of the Attorney General, who further disburses the funds to the custodial parent or their designated state agency. In conclusion, the Carrollton Texas Order to Withhold From Earnings Child Support is a legal mechanism to enforce timely and consistent child support payments. By offering different types of orders, tailored to the specific circumstances of each case, the court ensures that children receive the necessary financial support from their non-custodial parents. These orders play a vital role in promoting the child's welfare and easing the financial burden on custodial parents.

Carrollton Texas Order to Withhold From Earnings Child Support

State:

Texas

City:

Carrollton

Control #:

TX-CC-64-08

Format:

PDF

Instant download

This form is available by subscription

Description

A08 Order to Withhold From Earnings Child Support

Carrollton Texas Order to Withhold From Earnings Child Support: A Detailed Description Child support is a crucial aspect of ensuring the well-being of children whose parents are no longer together. The Carrollton Texas Order to Withhold From Earnings Child Support is designed to enforce the financial responsibilities of non-custodial parents by deducting child support payments directly from their earnings. This article will delve into the details of this order and explain its various types. In Carrollton, Texas, the Order to Withhold From Earnings Child Support is issued by the court when child support payments are not being made consistently or in the correct amount. This order provides a mechanism for the automatic deduction of such payments from the non-custodial parent's wages or income sources. By implementing this order, the State of Texas ensures that child support obligations are met promptly and consistently, prioritizing the best interests of the child. There are several types of Carrollton Texas Orders withholding From Earnings Child Support, which may vary depending on the circumstances and requirements of each case. Some notable types include: 1. Administrative Orders: These orders are issued by the Texas Attorney General's Office (TAG) when the custodial parent receives public assistance benefits, such as Temporary Assistance for Needy Families (TANK). The TAG works closely with the employer to deduct child support payments directly from the non-custodial parent's wages. 2. Private Orders: In cases where the custodial parent does not receive public assistance, a private order may be issued by the court. Both parties can agree to this order voluntarily, or it may be established after a court hearing. Private orders also involve the employer deducting child support payments from the non-custodial parent's earnings. 3. Medical Support Orders: In addition to child support, medical support is often required to ensure the child's healthcare needs are adequately met. A medical support order may be incorporated into the Carrollton Texas Order to Withhold From Earnings Child Support, requiring the non-custodial parent to provide medical insurance coverage or pay for medical expenses directly. It is important to note that these orders must comply with the Texas Family Code and federal laws, such as the Consumer Credit Protection Act (CCPA). The CCPA limits the amount that can be withheld from an employee's earnings, ensuring that they have sufficient income to cover necessary living expenses. When the Carrollton Texas Order to Withhold From Earnings Child Support is in effect, the employer becomes responsible for deducting the specified child support amount from the non-custodial parent's paycheck. These deductions are then sent to the Child Support Division of the Office of the Attorney General, who further disburses the funds to the custodial parent or their designated state agency. In conclusion, the Carrollton Texas Order to Withhold From Earnings Child Support is a legal mechanism to enforce timely and consistent child support payments. By offering different types of orders, tailored to the specific circumstances of each case, the court ensures that children receive the necessary financial support from their non-custodial parents. These orders play a vital role in promoting the child's welfare and easing the financial burden on custodial parents.

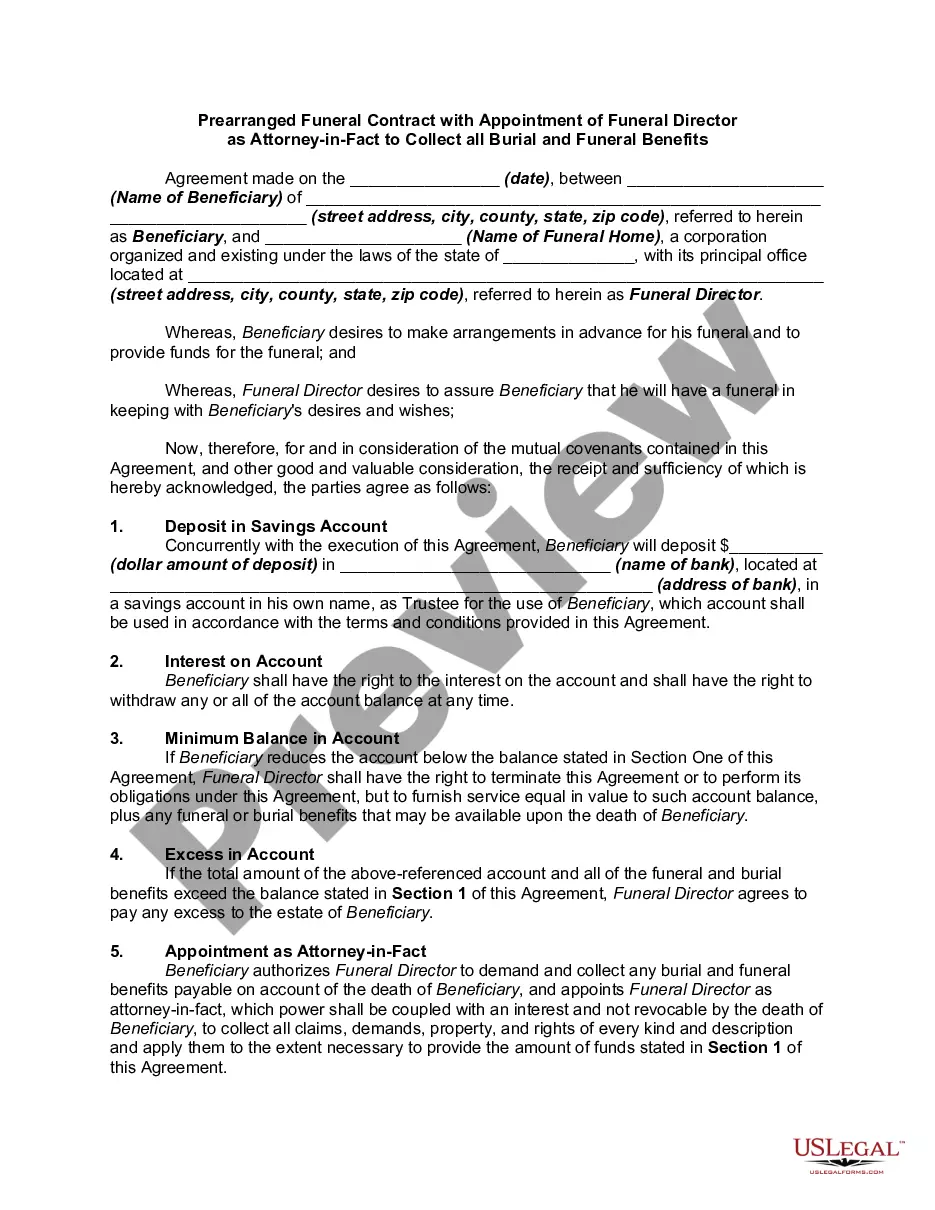

Free preview

How to fill out Carrollton Texas Order To Withhold From Earnings Child Support?

If you’ve already used our service before, log in to your account and download the Carrollton Texas Order to Withhold From Earnings Child Support on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Carrollton Texas Order to Withhold From Earnings Child Support. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!