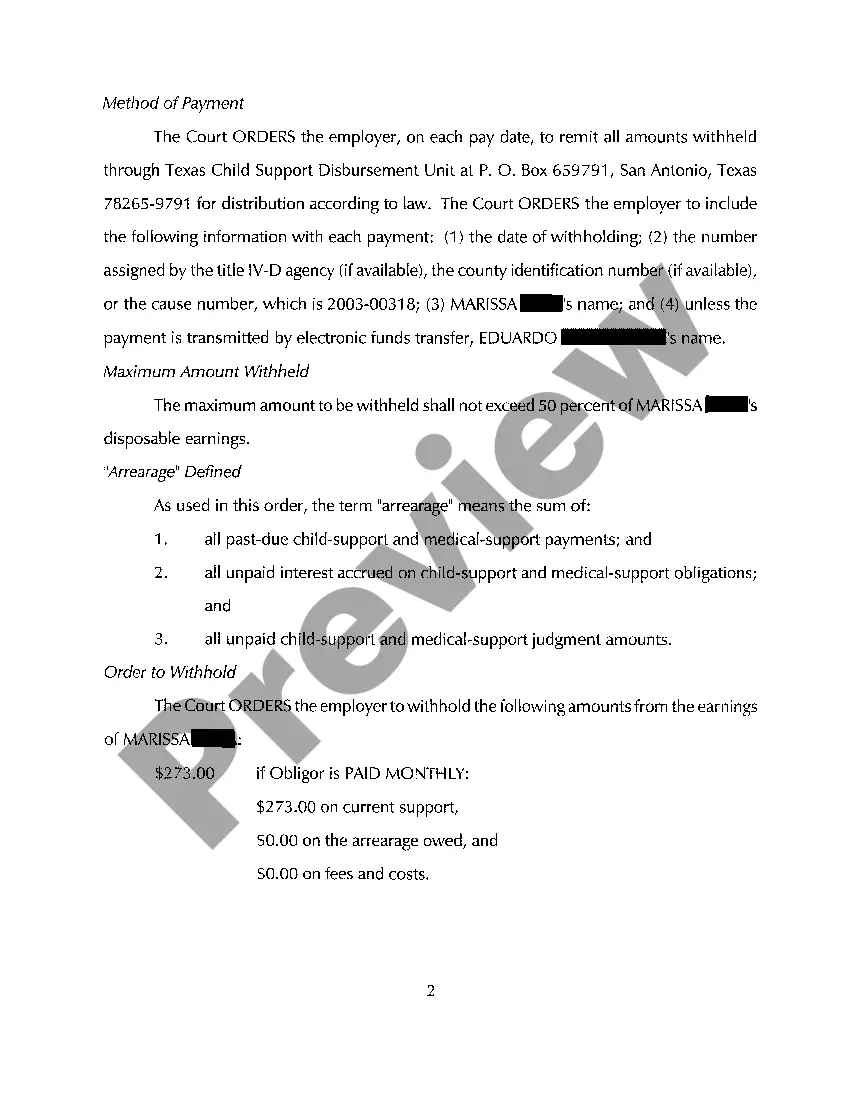

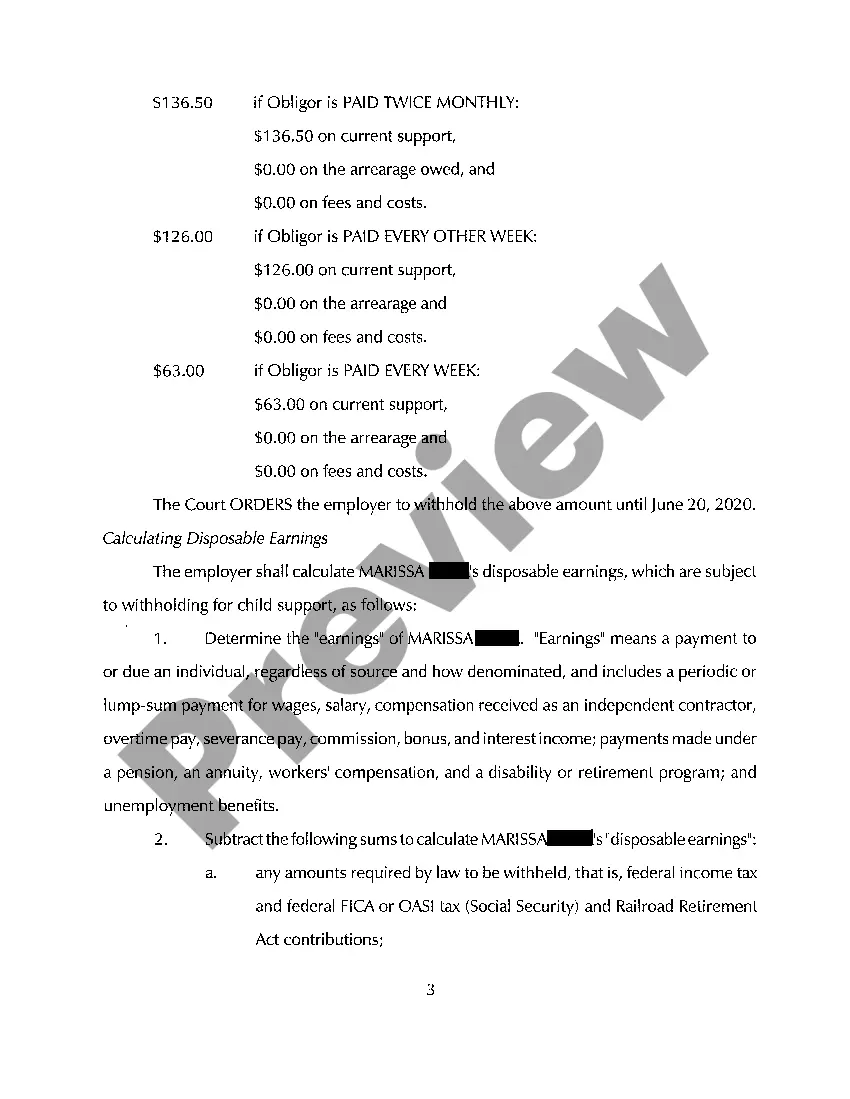

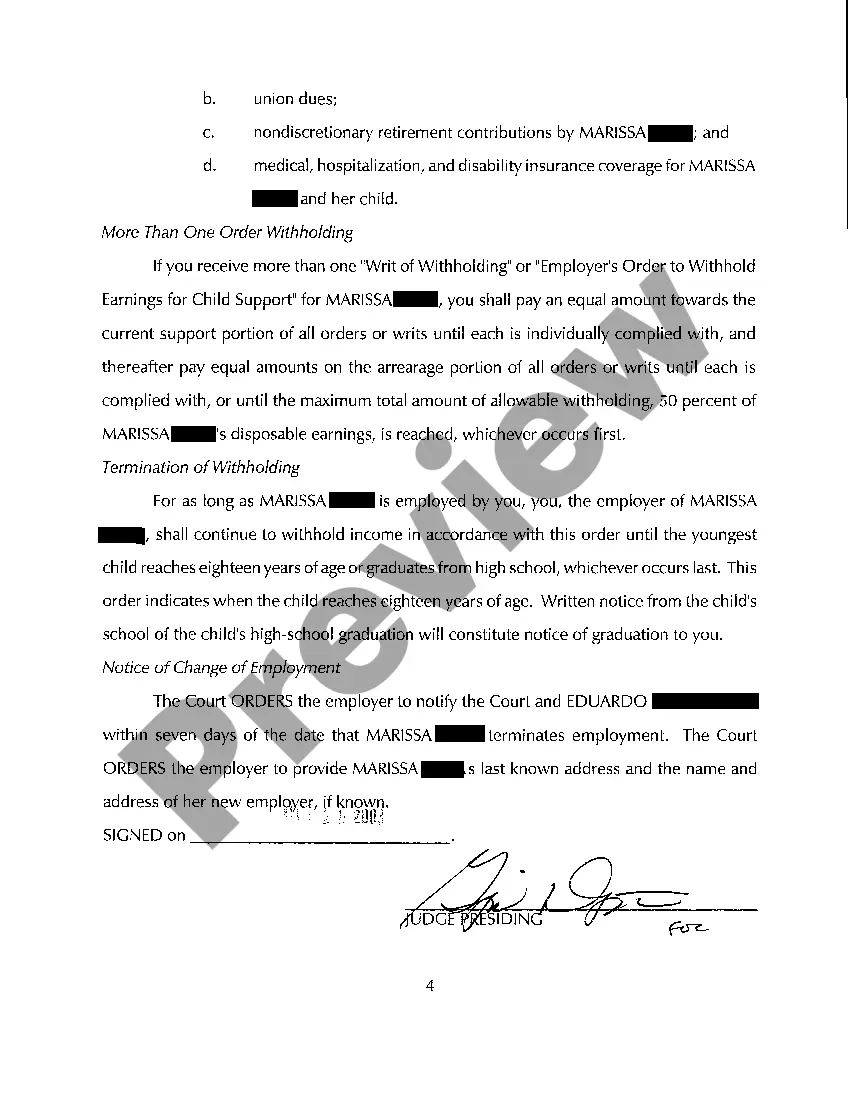

Corpus Christi Texas Order to Withhold From Earnings Child Support is a legal mechanism used to ensure timely and consistent child support payments to custodial parents. When a noncustodial parent fails to meet their child support obligations, the custodial parent can seek a court order to withhold a portion of the noncustodial parent's income. In Corpus Christi, Texas, there are two types of orders withholding from earnings for child support: 1. Income Withholding Order (TWO): This type of order is commonly used in Corpus Christi, Texas, and mandates the noncustodial parent's employer to deduct a specific amount from the parent's paycheck. The deducted amount is then forwarded to the Texas Child Support Disbursement Unit (SDU), which distributes the payments to the custodial parent. 2. Unemployment Compensation Withholding Order (CWO): If the noncustodial parent is receiving unemployment compensation benefits, a CWO may be issued to intercept a portion of these payments. The intercepted amount is directed to the SDU to fulfill the child support obligations. The Corpus Christi Texas Order to Withhold From Earnings Child Support helps ensure that children receive the financial support they need for their well-being and development. It provides an effective means for custodial parents to enforce child support orders and hold noncustodial parents accountable for their responsibilities. To obtain a Corpus Christi Texas Order to Withhold From Earnings Child Support, the custodial parent must follow several steps. Firstly, they need to contact the Office of the Attorney General (TAG) Child Support Division in Corpus Christi to initiate the process. The TAG will collect necessary information related to the child support case, such as the noncustodial parent's employer details and income. Upon gathering the required information, the TAG will file a petition with the court on behalf of the custodial parent, requesting an order to withhold from the noncustodial parent's earnings. The court will then review the case and, if sufficient grounds exist, issue an appropriate order. It is important to note that the court considers various factors, including the noncustodial parent's ability to pay and any extenuating circumstances, before issuing the order. Once the order has been issued, the employer of the noncustodial parent is legally obligated to comply with it. The employer must deduct the specified amount from the parent's paycheck and send it directly to the SDU within the designated timeframe. The SDU will then process and distribute the payments to the custodial parent. In conclusion, Corpus Christi Texas Order to Withhold From Earnings Child Support is a vital tool for enforcing child support obligations. It provides custodial parents in Corpus Christi, Texas, the means to secure consistent financial support for their children. By utilizing either the Income Withholding Order or the Unemployment Compensation Withholding Order, custodial parents can ensure their children's needs are met, contributing to their well-being and stability.

Corpus Christi Texas Order to Withhold From Earnings Child Support

Description

How to fill out Corpus Christi Texas Order To Withhold From Earnings Child Support?

Obtaining verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents suitable for both personal and business requirements, as well as any practical scenarios.

All files are systematically categorized by use and jurisdiction, thus finding the Corpus Christi Texas Order to Withhold From Earnings Child Support becomes as simple and straightforward as 123.

Maintaining clear and law-abiding paperwork is crucial. Utilize the US Legal Forms library to always have vital document templates readily accessible!

- Review the Preview mode and document description.

- Ensure you have selected the appropriate one that fulfills your needs and adequately aligns with your local legal standards.

- Search for another template if necessary.

- If you notice any discrepancies, use the Search tab above to locate the correct one. If it meets your needs, proceed to the next step.

- Complete your purchase.

Form popularity

FAQ

To do this, you or an attorney will need to file a Motion to Terminate Withholding for Child Support in the court that issued the original family court orders. A hearing will be scheduled, where the judge will review the petition and, if everything is in order, will sign an order terminating child support.

Formula for How Child support Is Determined in Texas 1 child ? 20% 2 children ? 25% 3 children ? 30% 4 children ? 35%

The OAG operates a Child Support Evader Program in which officials publish the names and photos of parents who owe more than $5,000 in child support and have a warrant out for their arrest.

What is the maximum amount that may be withheld from a lump sum payment? The maximum amount that may be withheld is 50 percent of the lump sum after taxes or the total amount of arrears, whichever is less. How will the employer be notified to withhold part or all of a lump sum payment?

If both parents agree to end child support, the proper way to end the obligation is by filing a motion with the court to terminate child support. The order MUST BE SIGNED BY A JUDGE to be effective. Ask the OAG is this has been done. If it has not you are still obligated under a court order to pay child support.

§ 1673). In Texas, up to 50% of your disposable earnings may be garnished to pay domestic support obligations such as child support or alimony. (Tex. Fam.

Turn in your completed Petition to Terminate Withholding for Child Support form at the district clerk's office in the county where your current order was made. Get a copy for both you and the other party. The clerk will ?file-stamp? your forms with the date and time and return the copies to you.

Texas also places a cap on net resources, which is adjusted every six years based on inflation. Effective Sept. 1, 2019, Texas raised the child support cap from $8,550 to $9,200.