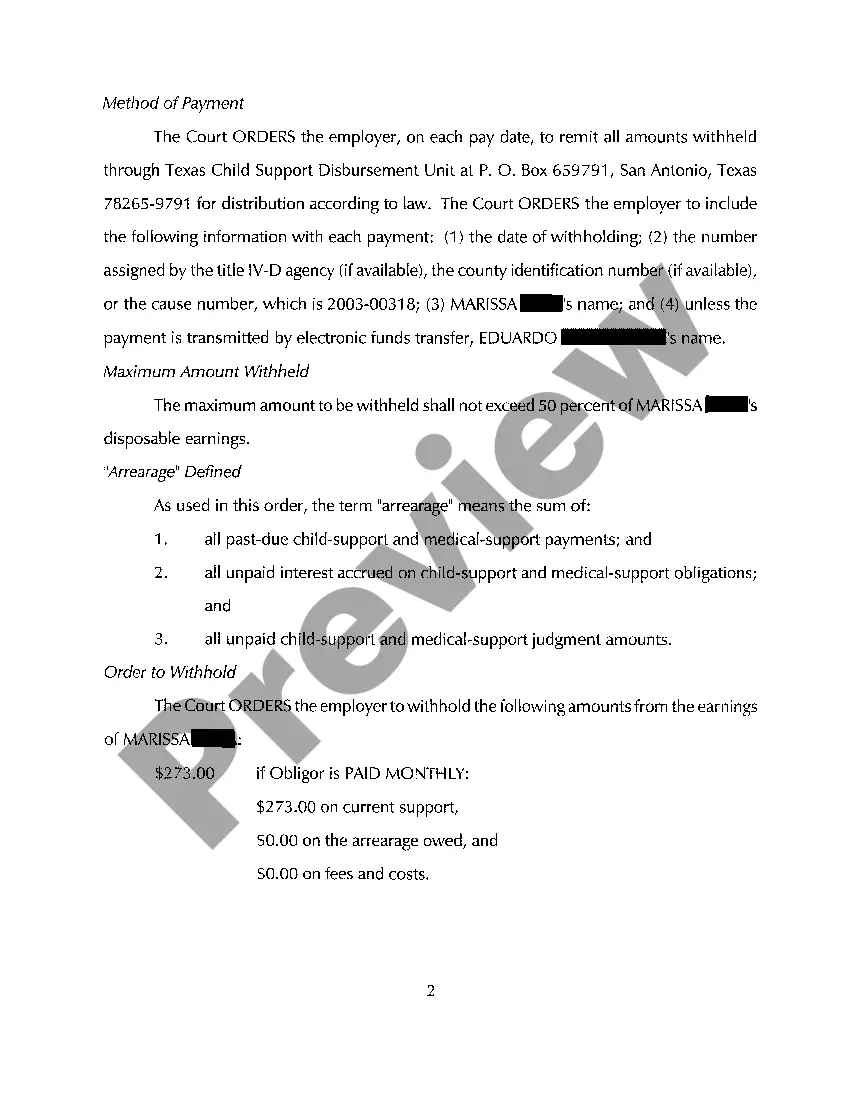

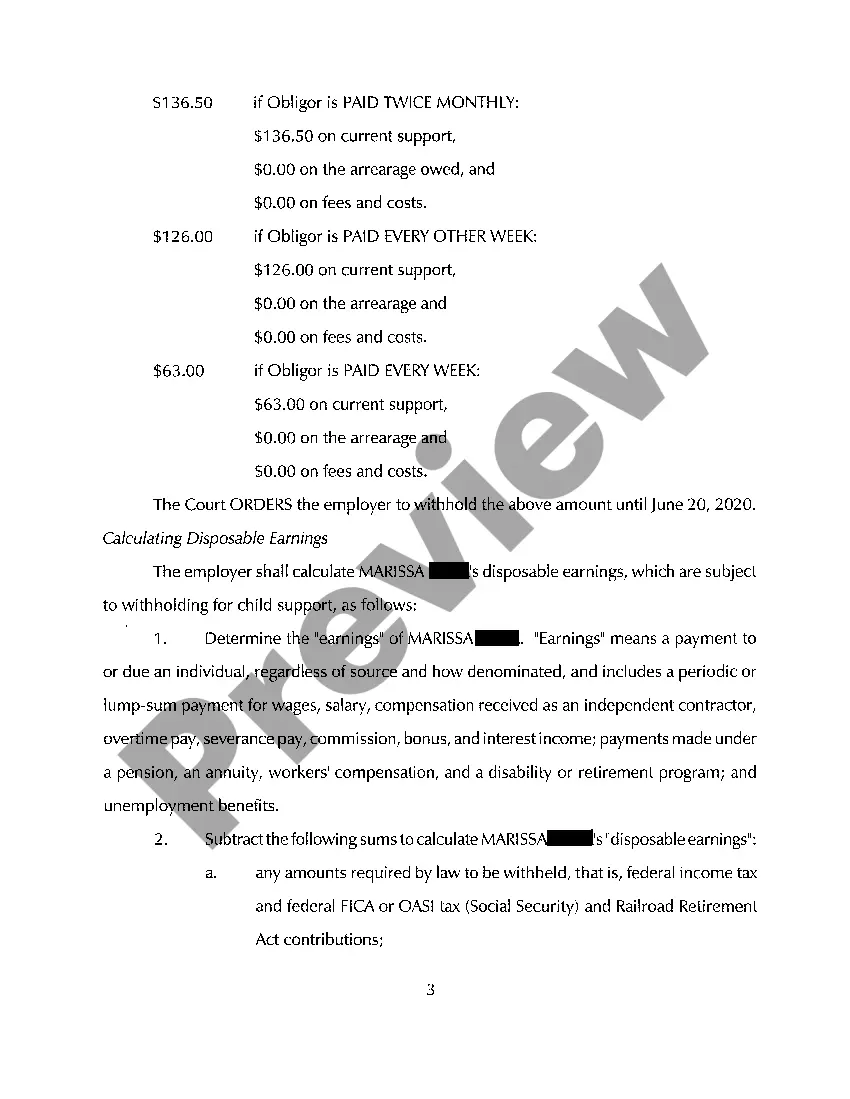

Grand Prairie, Texas Order to Withhold From Earnings Child Support: A Detailed Description When it comes to the enforcement of child support obligations in Grand Prairie, Texas, the judicial system utilizes various methods to ensure timely payments. One such method is the Order to Withhold From Earnings, a powerful tool that authorities can employ to secure child support payments directly from the noncustodial parent's income. In this article, we will delve into the specifics of the Grand Prairie, Texas Order to Withhold From Earnings Child Support, highlighting its purpose, process, and different types. The Order to Withhold From Earnings is an administrative procedure that allows the Texas Child Support Division (CSD) to automatically deduct child support payments from the noncustodial parent's wages or other sources of income. This order serves as a legal obligation, binding the employer to directly withhold the designated amount from the employee's earnings and remit it to the appropriate authorities. It ensures consistent and regular payments, helping custodial parents meet their children's financial needs. To initiate the process of obtaining an Order to Withhold From Earnings in Grand Prairie, Texas, the custodial parent or the CSD must file a request with the Office of the Attorney General (TAG). The TAG will review the case and, if determined eligible, take necessary legal action to secure the order from a judge. Once the order is issued, it will be sent to both the employer and the noncustodial parent, outlining explicit instructions regarding the amount to be withheld and the payment frequency. In Grand Prairie, Texas, there are two primary types of Orders withholding From Earnings Child Support: 1. Ongoing Wage Withholding: This type of order is applicable when child support arrears exist or when future child support payments need to be enforced. Ongoing wage withholding ensures consistent deductions from the noncustodial parent's earnings until the child support obligation is paid in full or until further modifications are made through the court. 2. Lump-Sum Payment Withholding: In situations where the noncustodial parent owes significant arrears or a lump-sum payment arises due to a tax refund, lottery winnings, or a substantial financial gain, the court may issue a lump-sum payment withholding order. This approach allows for a one-time deduction from the noncustodial parent's income source to offset the past due child support. It is essential to note that the Grand Prairie, Texas Order to Withhold From Earnings Child Support is designed to benefit the children and custodial parents by providing a reliable and efficient mechanism to ensure child support payments are made in a timely manner. It not only relieves the custodial parent from the burden of constantly requesting payments but also facilitates a smoother enforcement process. In conclusion, the Grand Prairie, Texas Order to Withhold From Earnings Child Support is a powerful instrument deployed to enforce child support obligations. By utilizing this method, the Texas Child Support Division aims to guarantee the financial stability and well-being of children, providing them with the necessary resources for a healthy upbringing. Whether securing ongoing wage withholding or implementing lump-sum payment withholding, this order serves as an essential mechanism in the realm of child support enforcement, ensuring the financial responsibilities of noncustodial parents are met.

Child Support Minimum Texas

Description

How to fill out Grand Prairie Texas Order To Withhold From Earnings Child Support?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney solutions that, usually, are extremely costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Grand Prairie Texas Order to Withhold From Earnings Child Support or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Grand Prairie Texas Order to Withhold From Earnings Child Support complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Grand Prairie Texas Order to Withhold From Earnings Child Support is suitable for you, you can choose the subscription plan and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!