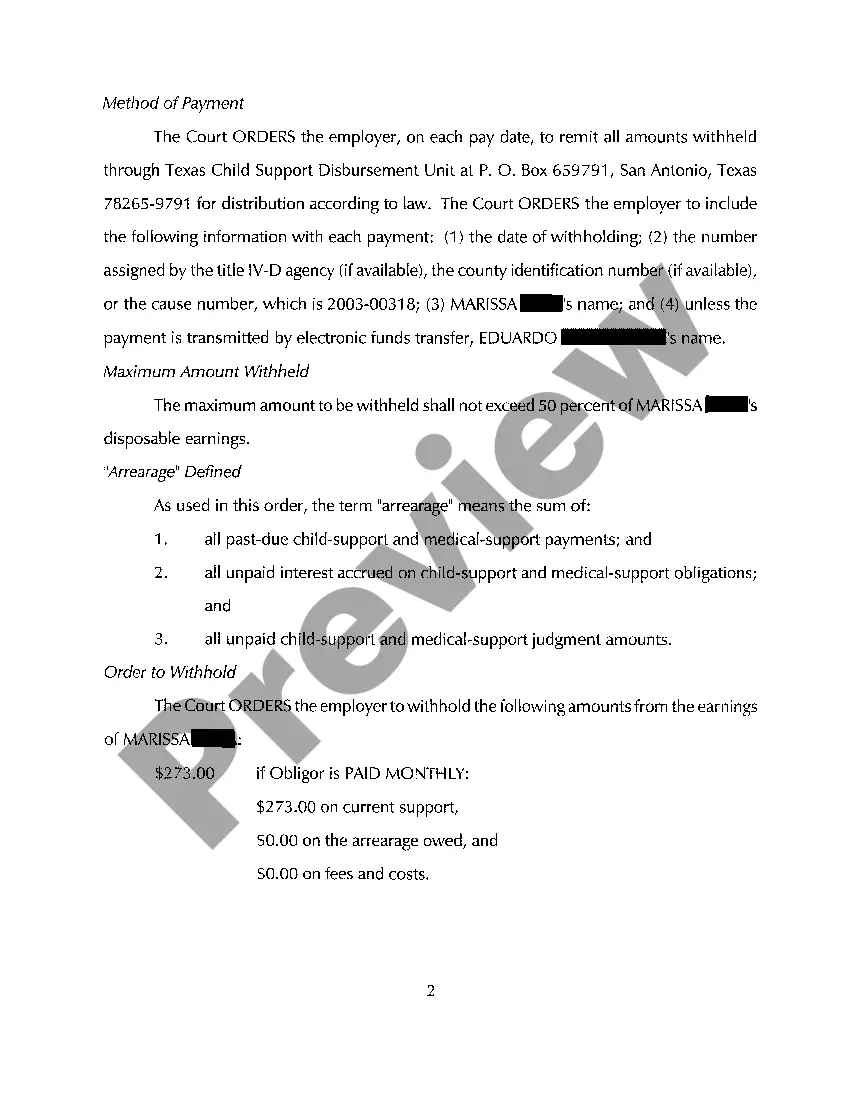

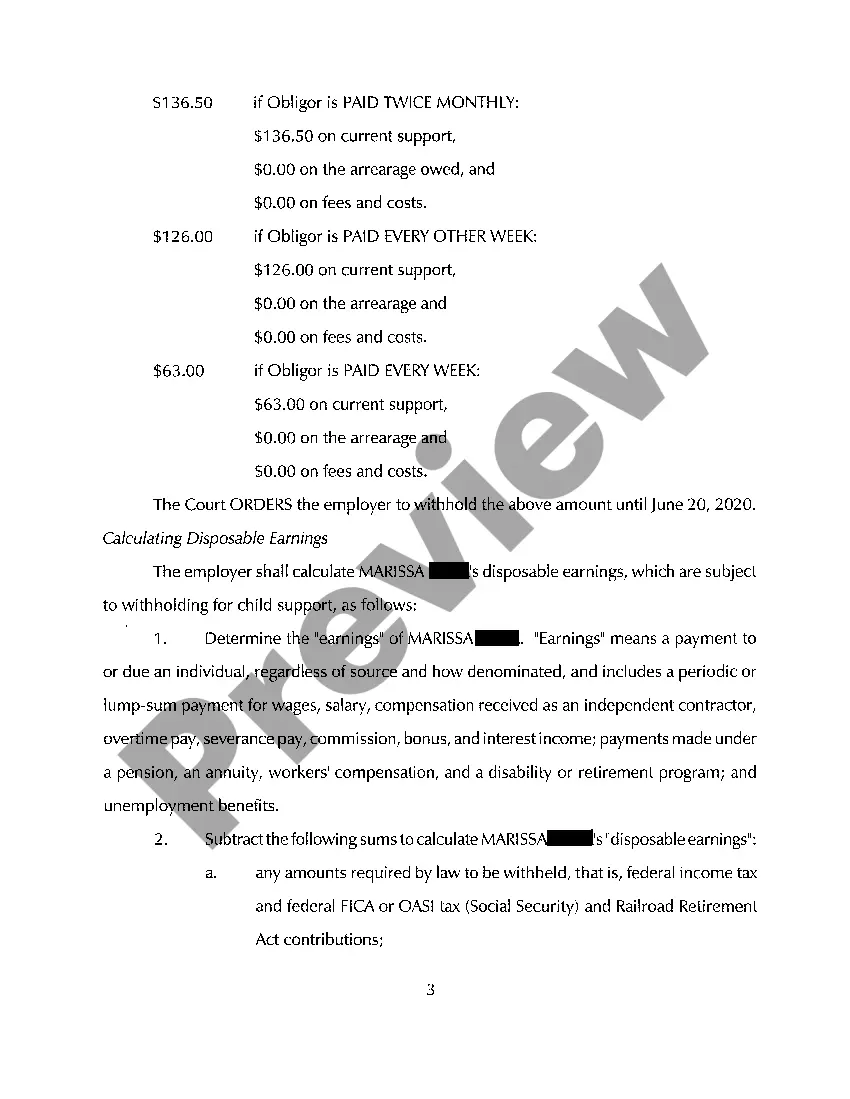

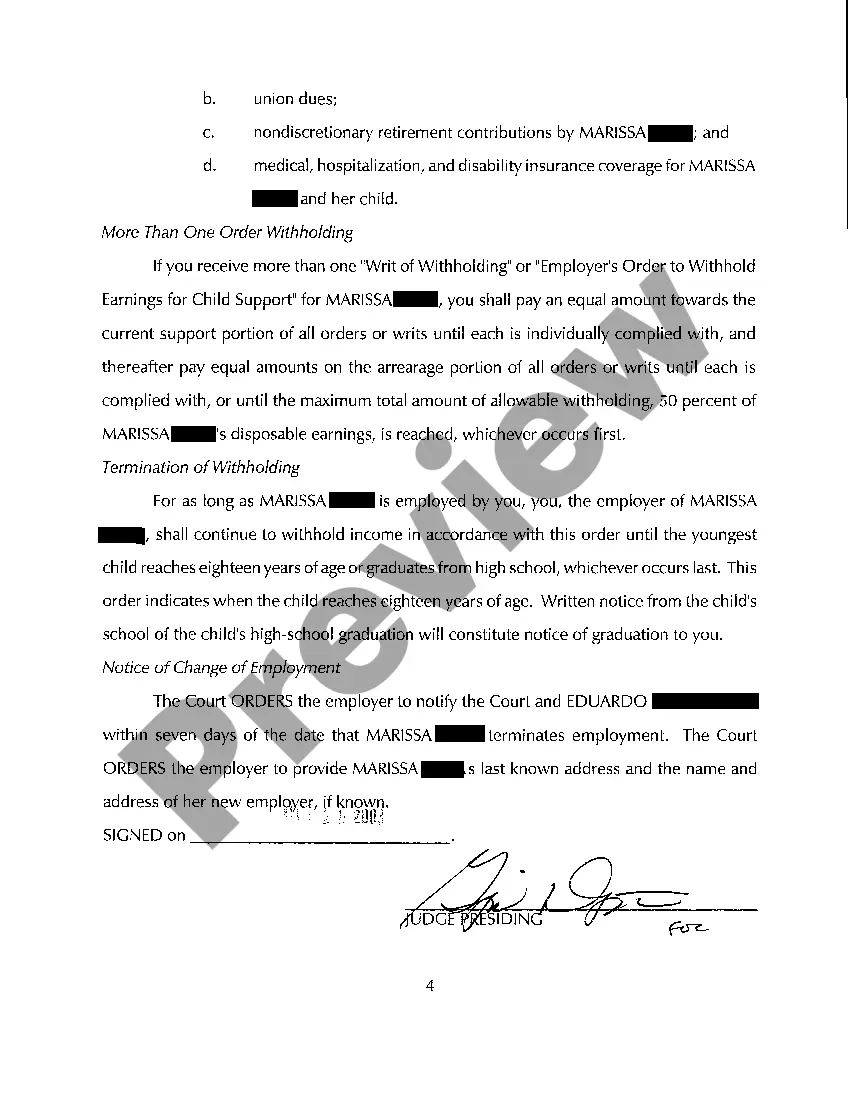

Lewisville, Texas Order to Withhold From Earnings Child Support: A Comprehensive Guide Introduction: Child support is a legal obligation that ensures the financial well-being of a child whose parents are separated or divorced. In Lewisville, Texas, when a parent fails to meet their child support obligations, the court may issue an order to withhold from their earnings. This article provides a detailed description of what Lewisville's Order to Withhold From Earnings Child Support entails, including different types and important considerations. 1. Understanding Order to Withhold From Earnings: An Order to Withhold From Earnings is a legal instrument used by the court to enforce child support payments. This type of order directs the noncustodial parent's employer to deduct child support payments directly from their wages before they receive their paycheck. 2. The Purpose of Order to Withhold From Earnings: The primary purpose of this order is to streamline child support payments, reduce delinquency, and ensure consistent financial support for the child. By requiring the employer to withhold the prescribed amount from the noncustodial parent's earnings, the court aims to enforce timely and regular child support payments. 3. Types of Lewisville Texas Order to Withhold From Earnings Child Support: a) Administrative Wage Withholding: In Lewisville, an administrative wage withholding order may be issued by the Texas Attorney General's Office. This order is issued to employers without the need for a court hearing. It simplifies the process by allowing withholding directly from the obliged's wages. b) Judicial Wage Withholding: In some cases, a judge may issue a judicial wage withholding order. This typically occurs when the noncustodial parent has failed to comply with a previous administrative wage withholding order. A judge can also impose additional penalties or sanctions for non-payment. 4. Important Considerations: a) Employer Obligations: Once an order to withhold from earnings is received, the employer is mandated by law to comply with the order. Failure to comply can lead to legal consequences. Employers must withhold the designated amount and remit it to the appropriate child support agency. b) Calculating the Withholding Amount: The amount to be withheld typically follows state guidelines based on the noncustodial parent's income and the number of dependents. The Texas Family Code specifies the percentage of income that can be withheld unless deviation factors are present. c) Modification or Termination: Order to Withhold From Earnings Child Support can be modified or terminated under certain circumstances, such as changes in employment status, custody arrangements, or when the child reaches adulthood. To modify or terminate the order, the appropriate legal process must be followed. Conclusion: Lewisville, Texas Order to Withhold From Earnings Child Support is an effective tool to ensure the financial stability and well-being of children whose parents are separated or divorced. By mandating employers to deduct child support payments from the noncustodial parent's wages, this order enforces compliance and helps maintain consistent support. Understanding the various types and considerations surrounding such orders is crucial for both parents and employers involved in the child support process.

Lewisville Texas Order to Withhold From Earnings Child Support

State:

Texas

City:

Lewisville

Control #:

TX-CC-64-08

Format:

PDF

Instant download

This form is available by subscription

Description

A08 Order to Withhold From Earnings Child Support

Lewisville, Texas Order to Withhold From Earnings Child Support: A Comprehensive Guide Introduction: Child support is a legal obligation that ensures the financial well-being of a child whose parents are separated or divorced. In Lewisville, Texas, when a parent fails to meet their child support obligations, the court may issue an order to withhold from their earnings. This article provides a detailed description of what Lewisville's Order to Withhold From Earnings Child Support entails, including different types and important considerations. 1. Understanding Order to Withhold From Earnings: An Order to Withhold From Earnings is a legal instrument used by the court to enforce child support payments. This type of order directs the noncustodial parent's employer to deduct child support payments directly from their wages before they receive their paycheck. 2. The Purpose of Order to Withhold From Earnings: The primary purpose of this order is to streamline child support payments, reduce delinquency, and ensure consistent financial support for the child. By requiring the employer to withhold the prescribed amount from the noncustodial parent's earnings, the court aims to enforce timely and regular child support payments. 3. Types of Lewisville Texas Order to Withhold From Earnings Child Support: a) Administrative Wage Withholding: In Lewisville, an administrative wage withholding order may be issued by the Texas Attorney General's Office. This order is issued to employers without the need for a court hearing. It simplifies the process by allowing withholding directly from the obliged's wages. b) Judicial Wage Withholding: In some cases, a judge may issue a judicial wage withholding order. This typically occurs when the noncustodial parent has failed to comply with a previous administrative wage withholding order. A judge can also impose additional penalties or sanctions for non-payment. 4. Important Considerations: a) Employer Obligations: Once an order to withhold from earnings is received, the employer is mandated by law to comply with the order. Failure to comply can lead to legal consequences. Employers must withhold the designated amount and remit it to the appropriate child support agency. b) Calculating the Withholding Amount: The amount to be withheld typically follows state guidelines based on the noncustodial parent's income and the number of dependents. The Texas Family Code specifies the percentage of income that can be withheld unless deviation factors are present. c) Modification or Termination: Order to Withhold From Earnings Child Support can be modified or terminated under certain circumstances, such as changes in employment status, custody arrangements, or when the child reaches adulthood. To modify or terminate the order, the appropriate legal process must be followed. Conclusion: Lewisville, Texas Order to Withhold From Earnings Child Support is an effective tool to ensure the financial stability and well-being of children whose parents are separated or divorced. By mandating employers to deduct child support payments from the noncustodial parent's wages, this order enforces compliance and helps maintain consistent support. Understanding the various types and considerations surrounding such orders is crucial for both parents and employers involved in the child support process.

Free preview

How to fill out Lewisville Texas Order To Withhold From Earnings Child Support?

If you’ve already used our service before, log in to your account and download the Lewisville Texas Order to Withhold From Earnings Child Support on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Lewisville Texas Order to Withhold From Earnings Child Support. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!