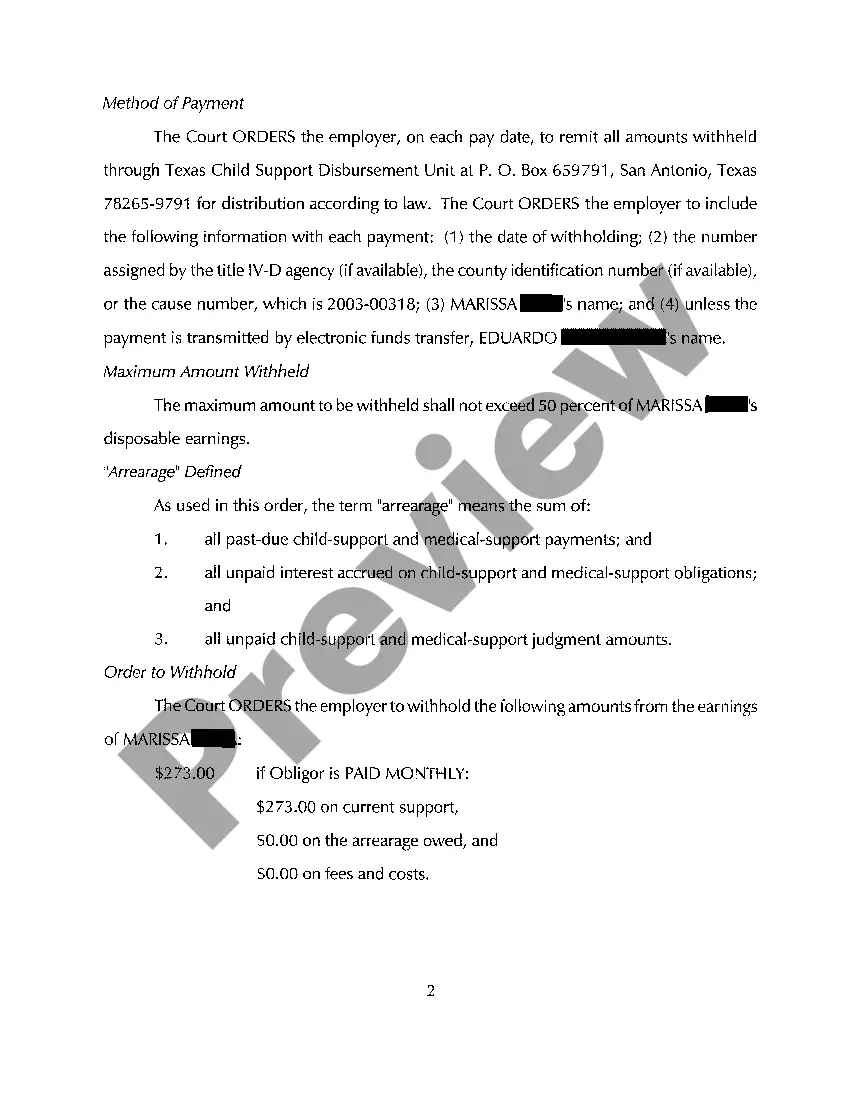

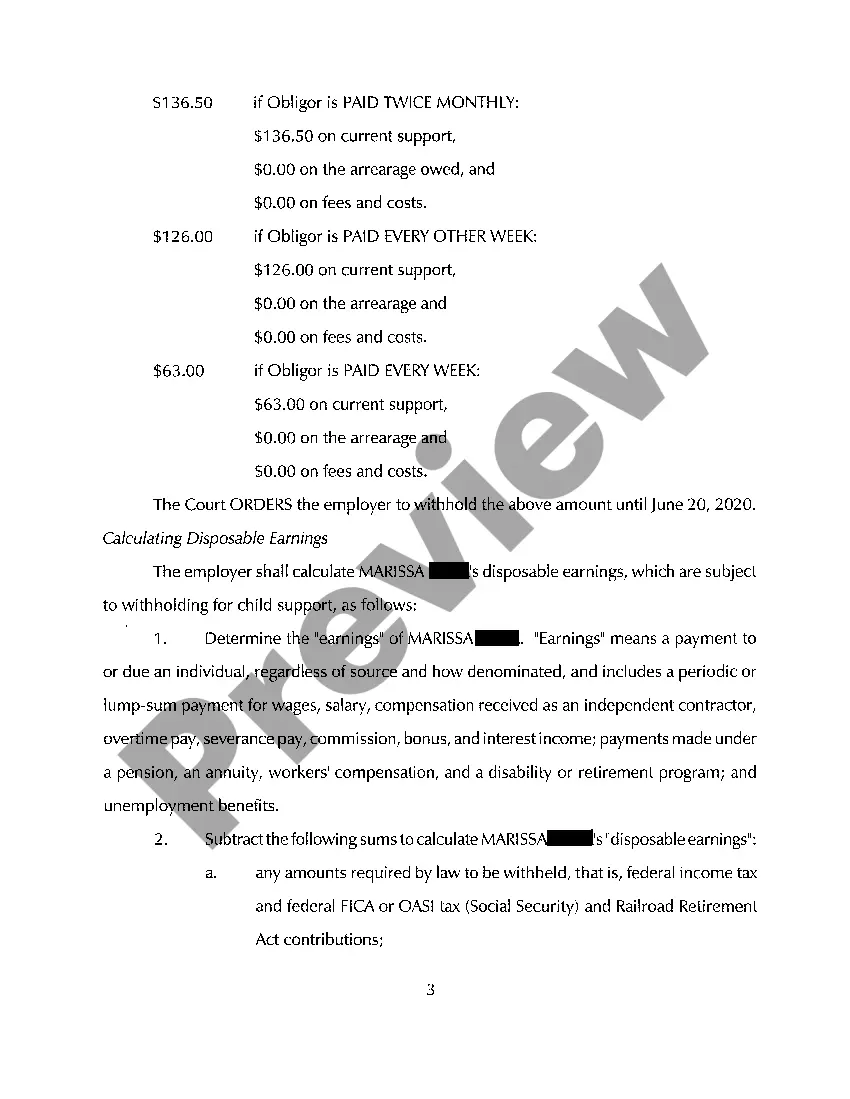

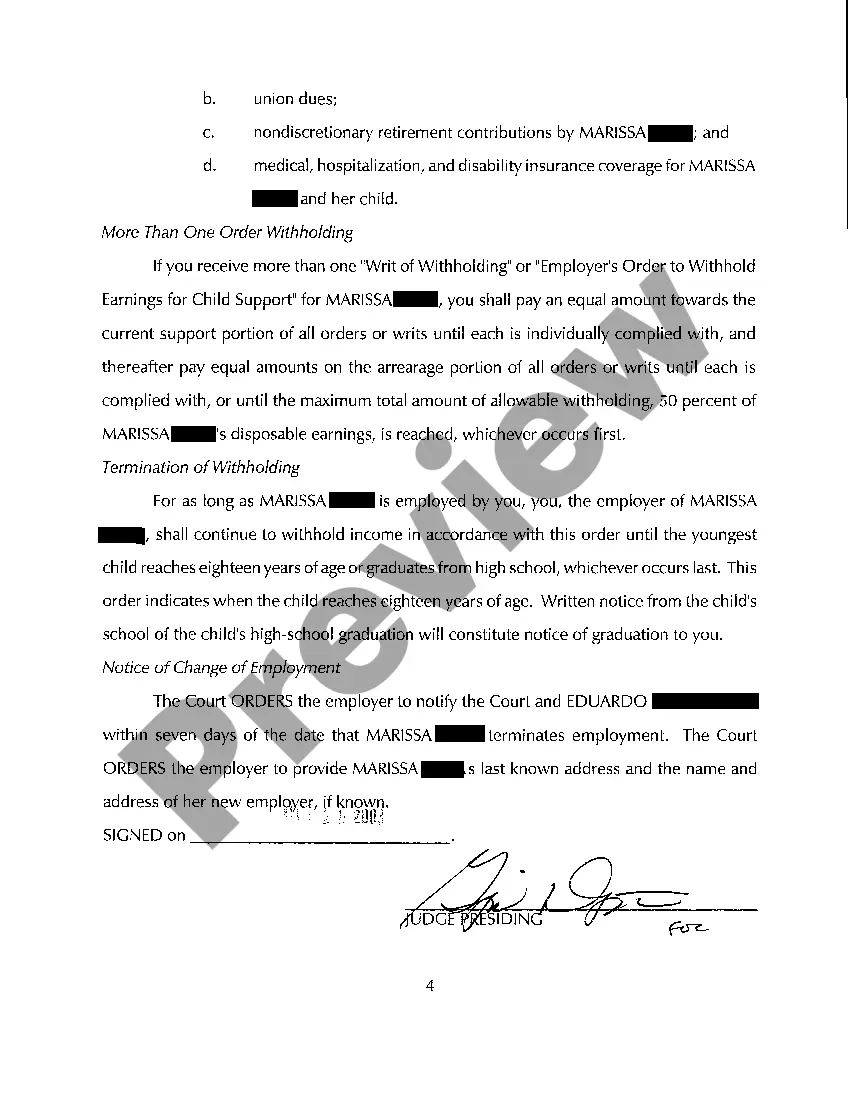

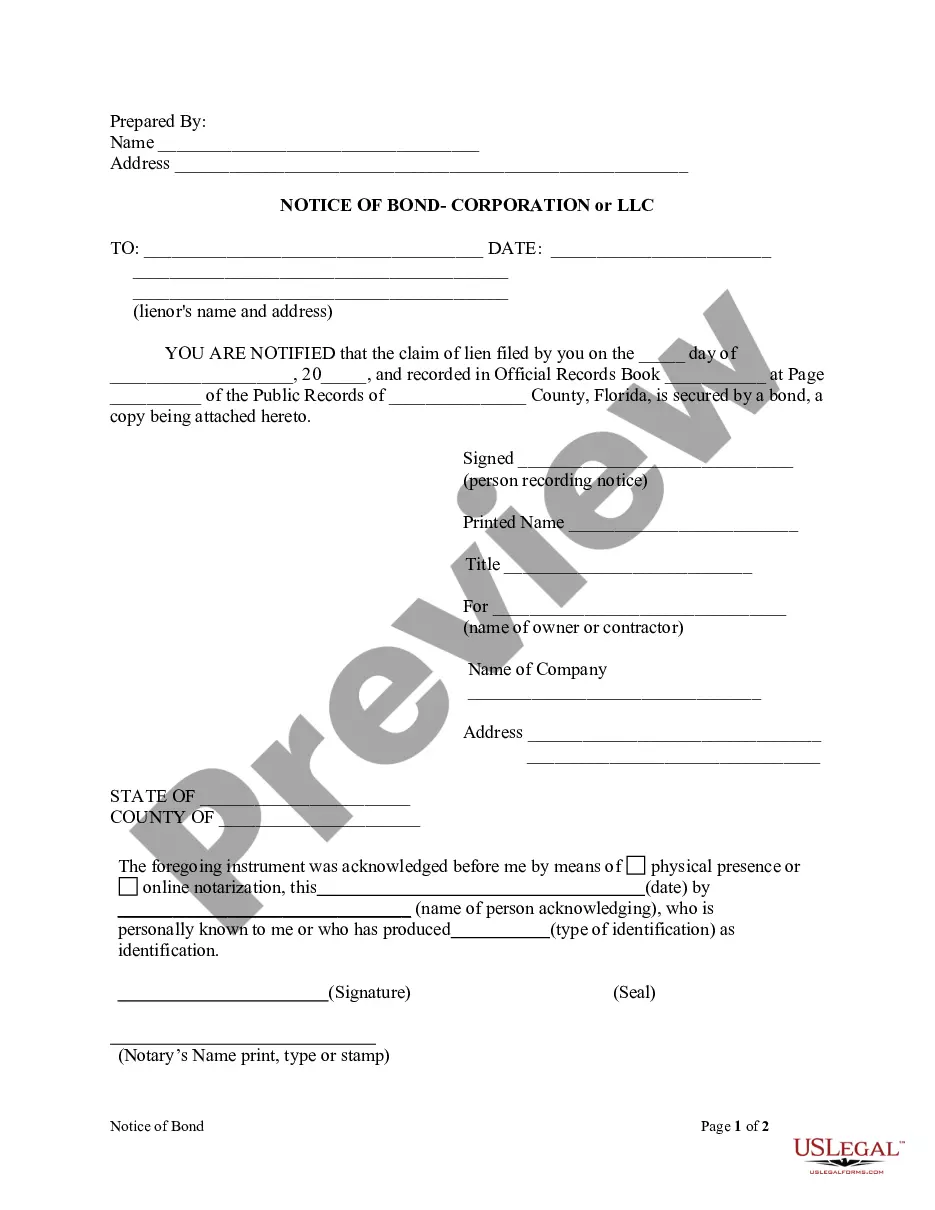

Keywords: Pasadena Texas, Order to Withhold From Earnings, Child Support Description: A Pasadena Texas Order to Withhold From Earnings Child Support is a legal document issued by a court to enforce child support payments. When a non-custodial parent fails to meet their financial obligations towards their child, this order allows the withholding of a portion of their earnings to ensure regular support for the child. The order is served to the employer of the non-custodial parent, who is then responsible for deducting the specified amount from their paycheck and forwarding it to the appropriate agency or individual designated to receive the child support. There are different types of Pasadena Texas Orders withholding From Earnings Child Support depending on the circumstances of the case: 1. Initial Order: This type of order is typically issued when child support is initially established or modified. It sets out the details of the child support obligation, including the amount to be withheld from the parent's earnings and the frequency of payments. 2. Voluntary Withholding Order: A voluntary withholding order is put in place when the non-custodial parent agrees to have child support payments automatically deducted from their paycheck. This type of order is beneficial as it ensures consistent and timely payments without the need for court intervention. 3. Default Order: If the non-custodial parent disregards their child support obligations and fails to make payments, a default order can be issued. It authorizes the automatic withholding of earnings without the parent's consent. This type of order is typically sought when there is a history of non-compliance or repeated late payments. 4. Income Withholding Order: This type of order is specifically designed to enforce child support obligations when a non-custodial parent has fallen behind on their payments. It allows for the withholding of a higher percentage of their income to catch up on arrears. It is important for employers to comply with a Pasadena Texas Order to Withhold From Earnings Child Support as failing to do so can lead to legal action and penalties. Employers must accurately calculate and deduct the specified amount from the paycheck and forward it to the appropriate child support agency or recipient as per the court's instructions. Regular reporting of earnings and remittance of child support payments is essential for both parties involved and ensures the child's financial well-being.

Pasadena Texas Order to Withhold From Earnings Child Support

Description

How to fill out Pasadena Texas Order To Withhold From Earnings Child Support?

Make use of the US Legal Forms and have instant access to any form you want. Our helpful platform with thousands of templates simplifies the way to find and get virtually any document sample you want. You can download, fill, and sign the Pasadena Texas Order to Withhold From Earnings Child Support in a couple of minutes instead of browsing the web for many hours seeking the right template.

Utilizing our catalog is a great way to improve the safety of your document filing. Our experienced legal professionals on a regular basis review all the documents to ensure that the templates are relevant for a particular region and compliant with new acts and regulations.

How do you obtain the Pasadena Texas Order to Withhold From Earnings Child Support? If you have a subscription, just log in to the account. The Download option will appear on all the samples you look at. Additionally, you can get all the previously saved records in the My Forms menu.

If you don’t have an account yet, follow the tips below:

- Open the page with the template you require. Make certain that it is the template you were looking for: check its name and description, and take take advantage of the Preview feature if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Download the document. Choose the format to get the Pasadena Texas Order to Withhold From Earnings Child Support and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy template libraries on the internet. We are always happy to help you in virtually any legal procedure, even if it is just downloading the Pasadena Texas Order to Withhold From Earnings Child Support.

Feel free to take advantage of our service and make your document experience as straightforward as possible!