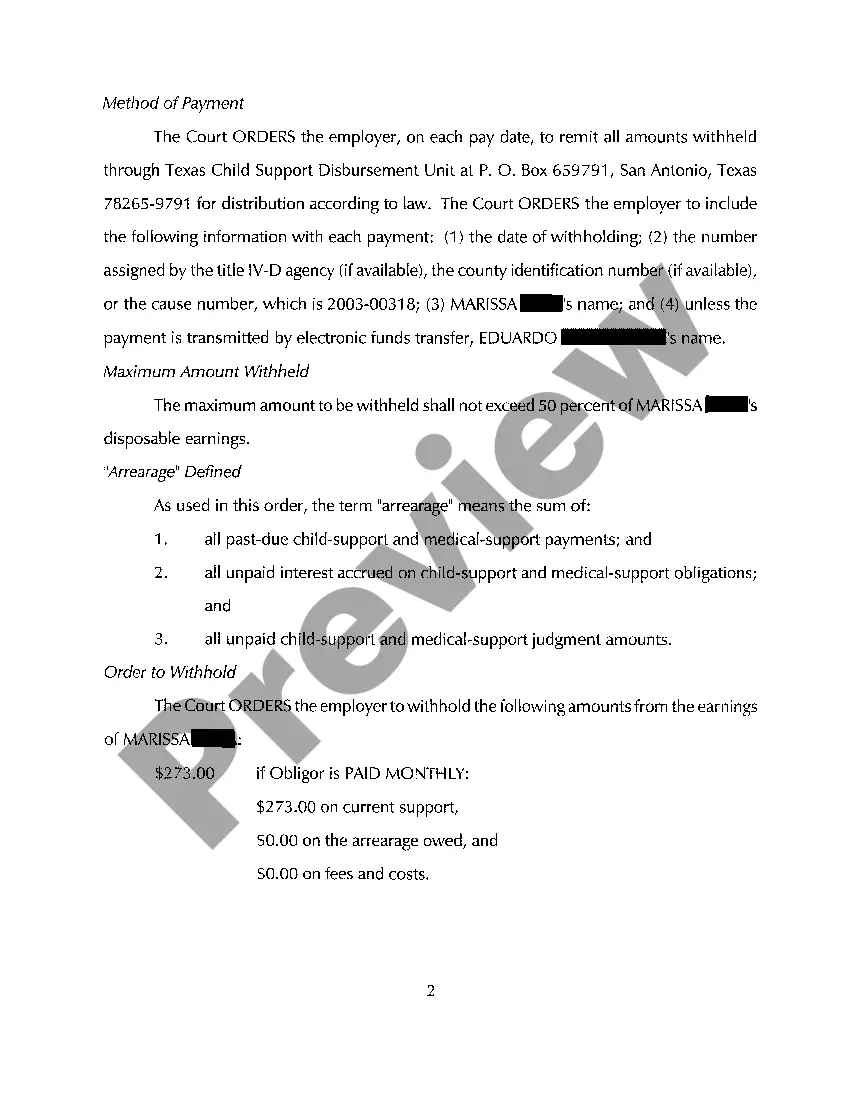

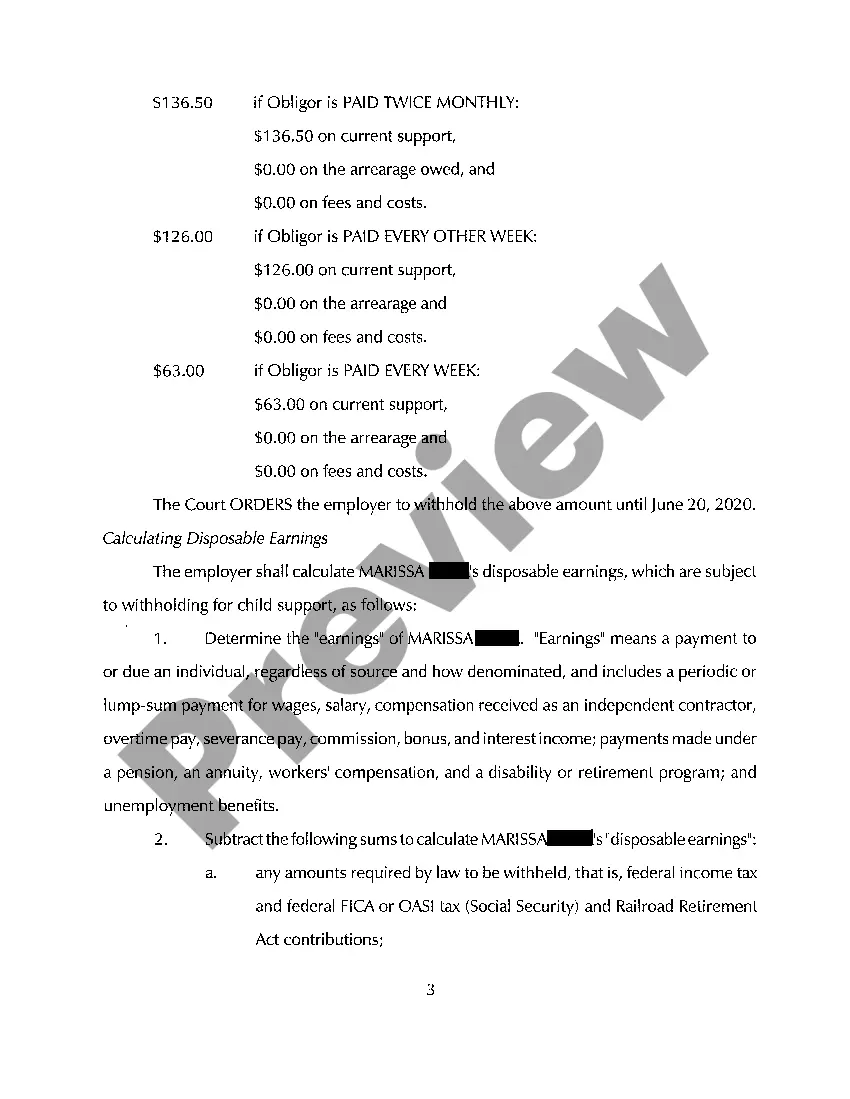

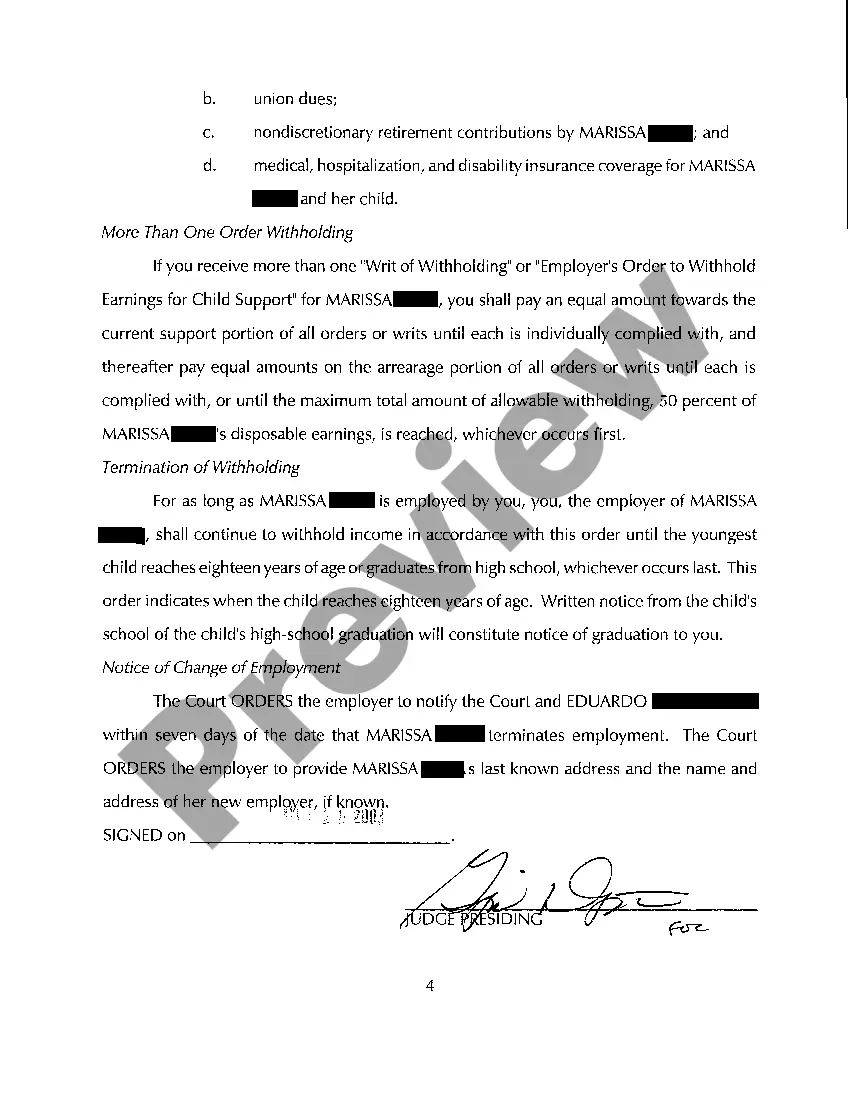

Sugar Land, Texas Order to Withhold From Earnings Child Support: A Detailed Description An Order to Withhold From Earnings (OWE) Child Support in Sugar Land, Texas is a legal directive issued by a court that requires an employer or income provider to deduct child support payments directly from a noncustodial parent's wages. This measure ensures that financial support for the child(men) is consistently met, providing stability and care for their needs. In Sugar Land, Texas, there are two main types of OWE Child Support: 1. Income Withholding Order (TWO): The most common type of OWE Child Support in Sugar Land, the Income Withholding Order mandates employers to withhold the determined child support amount from the noncustodial parent's wages. This is typically achieved through payroll deductions, wherein a specific percentage or fixed amount is deducted and forwarded to the Texas Child Support Disbursement Unit. 2. Voluntary Wage Assignment (VIA): Unlike an TWO, a Voluntary Wage Assignment is a popular alternative agreed upon by both parents involved. In this scenario, the noncustodial parent voluntarily consents to have child support payments deducted directly from their wages. This arrangement offers a convenient and reliable method for child support collection, minimizing conflicts and ensuring regular financial contributions. The Sugar Land, Texas Order to Withhold From Earnings Child Support process initiates when a custodial parent files a child support case with the Texas Attorney General's Child Support Division. The court then reviews the case and determines the appropriate child support obligations based on Texas child support guidelines, considering factors such as the noncustodial parent's income, number of children, and other relevant circumstances. Once the court order is established, the OWE Child Support is typically enforced through the employer of the noncustodial parent. The employer is directed to withhold the designated amount from each paycheck and remit it to the designated disbursement unit within the Texas Office of the Attorney General. It is crucial to understand that failure to comply with a Sugar Land, Texas Order to Withhold From Earnings Child Support can lead to severe consequences. Nonpayment or consistent late payment may result in additional penalties, including wage garnishment, suspension of driver's license, interception of tax refunds, or even the initiation of contempt-of-court proceedings. To ensure smooth and efficient enforcement of an Order to Withhold From Earnings Child Support in Sugar Land, Texas, it is essential for all parties involved to communicate and abide by the court order. Custodial and noncustodial parents should promptly update any changes in employment, income, or personal circumstances to ensure the accuracy and appropriateness of child support calculations. In conclusion, a Sugar Land, Texas Order to Withhold From Earnings Child Support is a legal instrument designed to guarantee financial security for children. It provides a structured approach to collecting child support payments, ensuring that the noncustodial parent meets their obligations. Understanding the different types of OWE and complying with court orders is vital to safeguard the best interests of the child(men) involved and maintain a harmonious co-parenting relationship.

Sugar Land Texas Order to Withhold From Earnings Child Support

Description

How to fill out Sugar Land Texas Order To Withhold From Earnings Child Support?

Do you need a trustworthy and inexpensive legal forms provider to buy the Sugar Land Texas Order to Withhold From Earnings Child Support? US Legal Forms is your go-to solution.

No matter if you require a basic agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of separate state and area.

To download the form, you need to log in account, locate the needed form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Sugar Land Texas Order to Withhold From Earnings Child Support conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is good for.

- Restart the search in case the form isn’t suitable for your legal situation.

Now you can create your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Sugar Land Texas Order to Withhold From Earnings Child Support in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal paperwork online once and for all.