The Texas Family Code addresses various aspects of family law, including child custody, visitation, support, and the division of marital property during a divorce. In such cases, Waco Information Required by the Texas Family Code refers to specific details and documentation that must be provided to the court or opposing party to ensure fair resolution and protection of all parties involved. There are several types of Waco Information Required by the Texas Family Code, each serving a different purpose within the legal process. These types include: 1. Financial Information: The Texas Family Code requires individuals involved in family law cases to disclose their financial circumstances. This includes providing details about income, assets, debts, expenses, and financial obligations. Parties may need to submit documents such as tax returns, bank statements, pay stubs, property deeds, and credit card statements. 2. Child-Related Information: In cases involving child custody, visitation, or support, the Family Code mandates the submission of Waco Information specific to the children involved. This may include details on the child's medical history, education, extracurricular activities, and any special needs they may have. Relevant documents could include school records, medical reports, and any custody or visitation agreements in place. 3. Employment and Income Information: When determining child support or spousal support payments, the Family Code requires individuals to provide employment and income details. This may involve providing paycheck stubs, employment contracts, proof of bonuses or commissions, and other income-related documents. The court may use this information to calculate fair support payments based on the Texas Child Support Guidelines. 4. Property and Asset Information: In cases involving the division of marital property, the Family Code mandates the disclosure of property and asset information. This includes details about real estate holdings, vehicles, investments, retirement accounts, and any other assets acquired during the marriage. Parties need to provide relevant financial statements, property appraisals, and relevant ownership documents. 5. Debts and Liabilities: The Family Code also requires individuals to disclose any outstanding debts, loans, or liabilities. This includes credit card debts, mortgages, student loans, and any other financial obligations. Providing accurate information about debts ensures an equitable division of both assets and liabilities during divorce proceedings. It is important to note that Waco Information Required by Texas Family Code may vary depending on the specific circumstances of the case. The court may also have additional requirements or request further documentation throughout the legal process. As family law cases can be complex, it is advisable to consult with an experienced attorney to ensure compliance with all information requirements under the Texas Family Code.

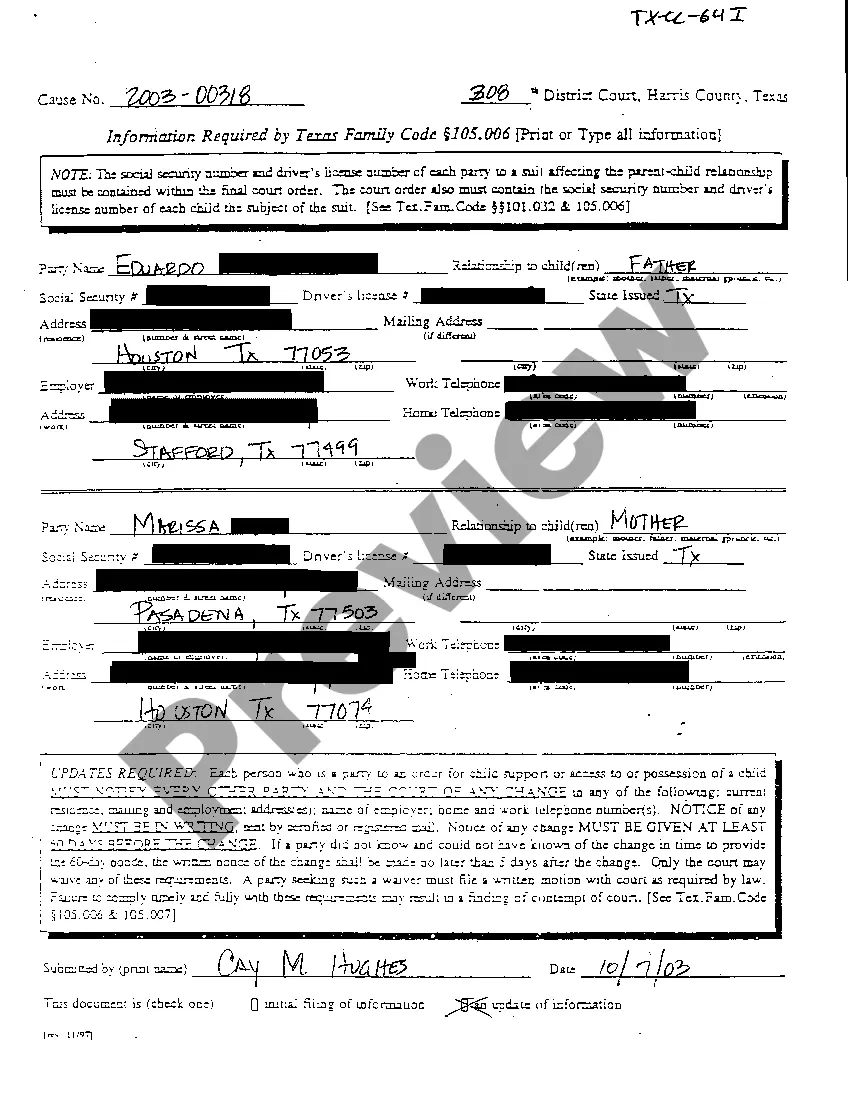

Waco Information Required by Texas Family Code

Description

How to fill out Waco Information Required By Texas Family Code?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for attorney services that, usually, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Waco Information Required by Texas Family Code or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally easy if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Waco Information Required by Texas Family Code complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Waco Information Required by Texas Family Code is proper for your case, you can select the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!