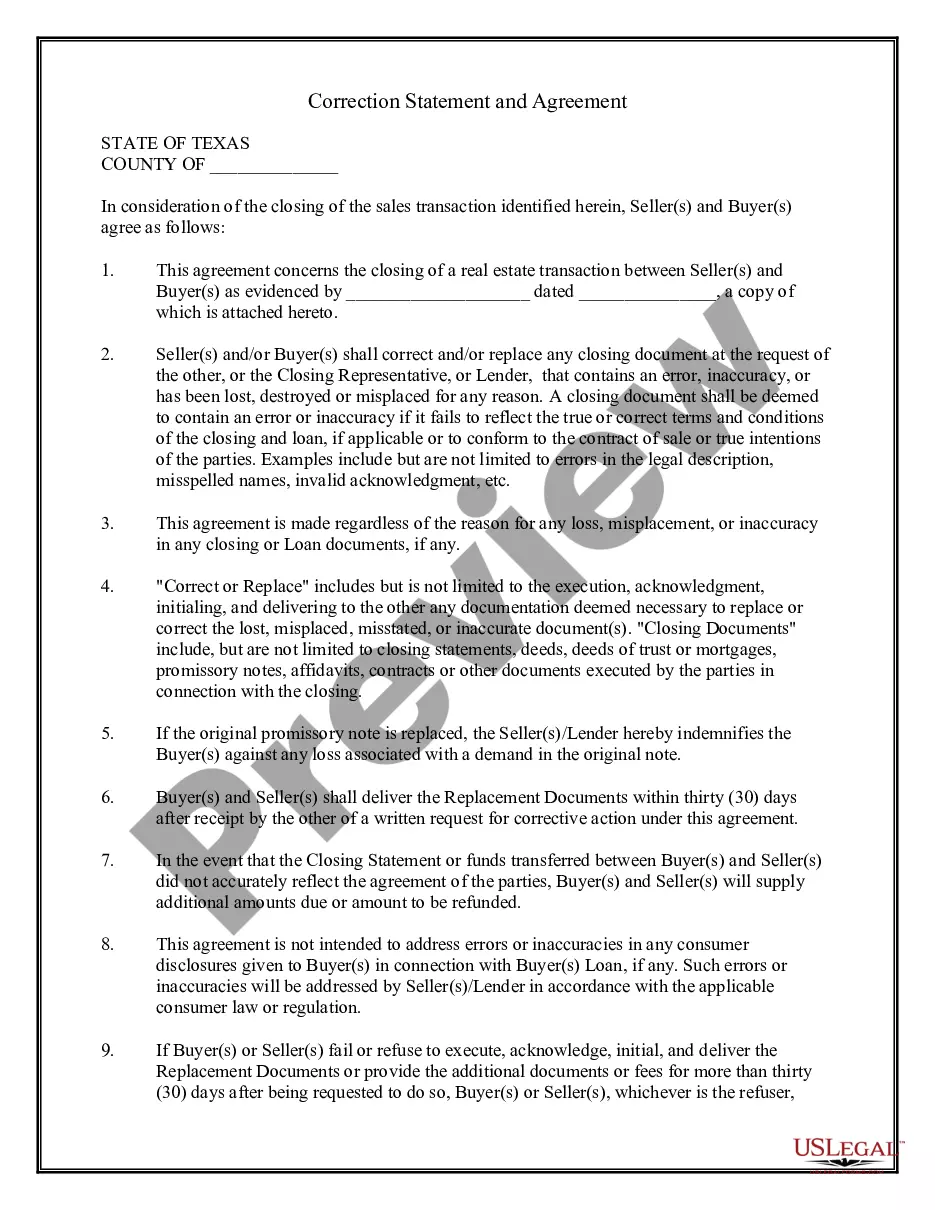

This Correction Statement and Agreement form is for a buyer and seller to sign at the closing for a loan or purchase of real property agreeing to execute corrected documents in the event of certain errors. It also is used to provide replacement documents in the event any documents are lost or misplaced.

The Harris Texas Correction Statement and Agreement is a legal document used to correct or amend inaccurate or incomplete information in previous documents or records. It is primarily designed to rectify errors made in official records maintained by the Harris County, Texas authorities. The Harris Texas Correction Statement and Agreement serves as a legally binding contract between the individual seeking corrections and the county authorities responsible for maintaining accurate records. By signing this agreement, both parties are acknowledging the need for corrections and agree to the terms and conditions outlined within the document. This document is crucial for individuals who have identified incorrect information in their Harris County records, such as personal information, property records, court documents, or tax records. It is important to note that submitting a correction statement does not guarantee automatic changes, but it does initiate the process of rectifying the identified errors. There are various types of Harris Texas Correction Statement and Agreements, each addressing specific record categories or departments. Some common types include: 1. Personal Information Correction Statement: This form allows individuals to correct errors related to their personal details, such as name, address, date of birth, social security number, or other identifying information. 2. Property Records Correction Statement: This statement is utilized when individuals identify discrepancies in property-related records, such as incorrect tax assessments, property ownership, or boundary information. 3. Court Records Correction Statement: Court records are frequently updated using this agreement when errors are found in legal documents, including judgments, sentences, or case information. 4. Tax Records Correction Statement: This type of correction statement enables individuals to rectify inaccuracies in their tax records, including assessments, exemptions, or other tax-related data. 5. Vital Records Correction Statement: This document is essential for correcting errors in vital records such as birth certificates, death certificates, marriage licenses, or divorce decrees. It is crucial to consult the specific Harris County department relevant to your record type in order to obtain the correct form for your situation. The Correction Statement and Agreement must be completed accurately, providing necessary supporting documents and evidence to attest to the errors, ensuring a swift and smooth correction process. By utilizing the Harris Texas Correction Statement and Agreement, individuals can take proactive steps to ensure accurate record keeping, promoting fairness and transparency within the system.The Harris Texas Correction Statement and Agreement is a legal document used to correct or amend inaccurate or incomplete information in previous documents or records. It is primarily designed to rectify errors made in official records maintained by the Harris County, Texas authorities. The Harris Texas Correction Statement and Agreement serves as a legally binding contract between the individual seeking corrections and the county authorities responsible for maintaining accurate records. By signing this agreement, both parties are acknowledging the need for corrections and agree to the terms and conditions outlined within the document. This document is crucial for individuals who have identified incorrect information in their Harris County records, such as personal information, property records, court documents, or tax records. It is important to note that submitting a correction statement does not guarantee automatic changes, but it does initiate the process of rectifying the identified errors. There are various types of Harris Texas Correction Statement and Agreements, each addressing specific record categories or departments. Some common types include: 1. Personal Information Correction Statement: This form allows individuals to correct errors related to their personal details, such as name, address, date of birth, social security number, or other identifying information. 2. Property Records Correction Statement: This statement is utilized when individuals identify discrepancies in property-related records, such as incorrect tax assessments, property ownership, or boundary information. 3. Court Records Correction Statement: Court records are frequently updated using this agreement when errors are found in legal documents, including judgments, sentences, or case information. 4. Tax Records Correction Statement: This type of correction statement enables individuals to rectify inaccuracies in their tax records, including assessments, exemptions, or other tax-related data. 5. Vital Records Correction Statement: This document is essential for correcting errors in vital records such as birth certificates, death certificates, marriage licenses, or divorce decrees. It is crucial to consult the specific Harris County department relevant to your record type in order to obtain the correct form for your situation. The Correction Statement and Agreement must be completed accurately, providing necessary supporting documents and evidence to attest to the errors, ensuring a swift and smooth correction process. By utilizing the Harris Texas Correction Statement and Agreement, individuals can take proactive steps to ensure accurate record keeping, promoting fairness and transparency within the system.