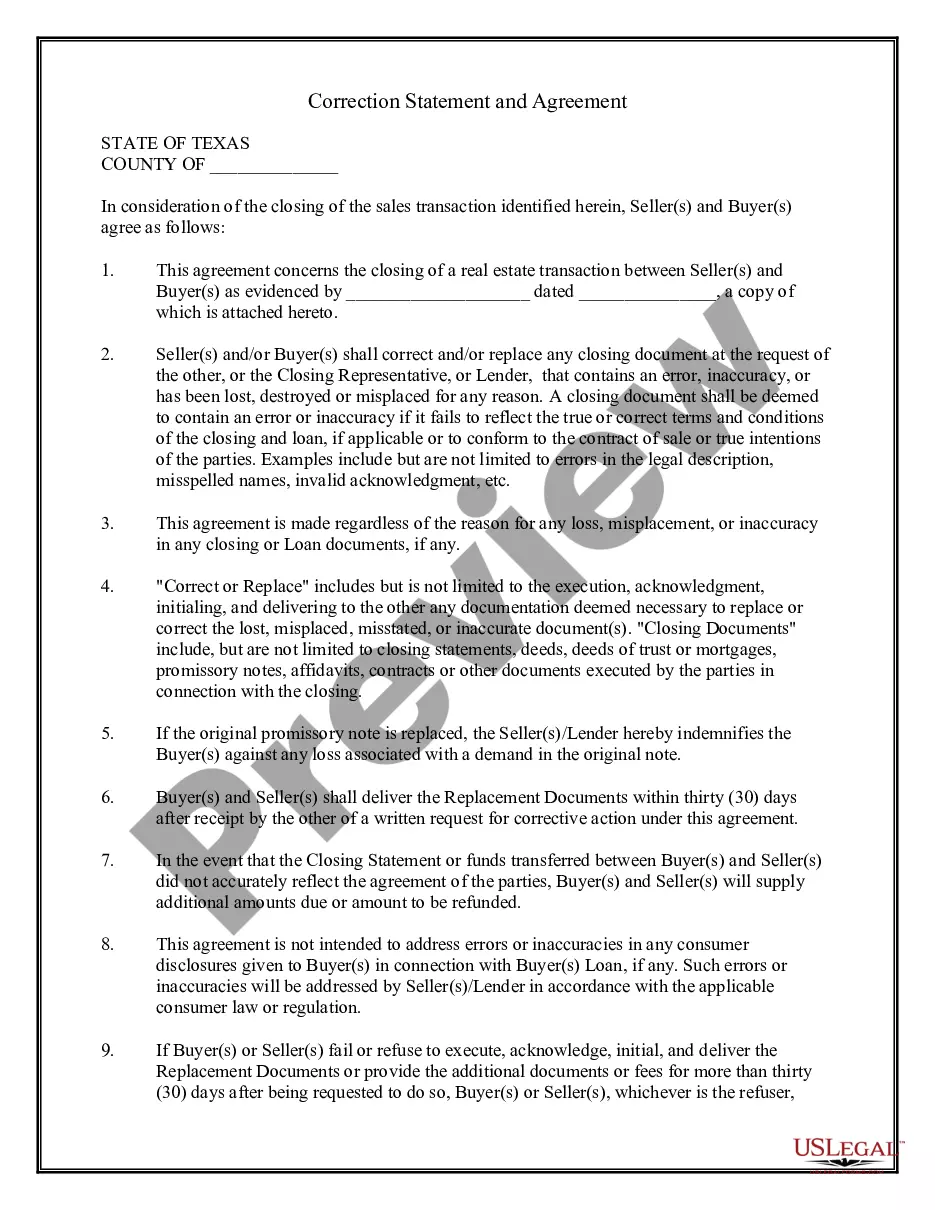

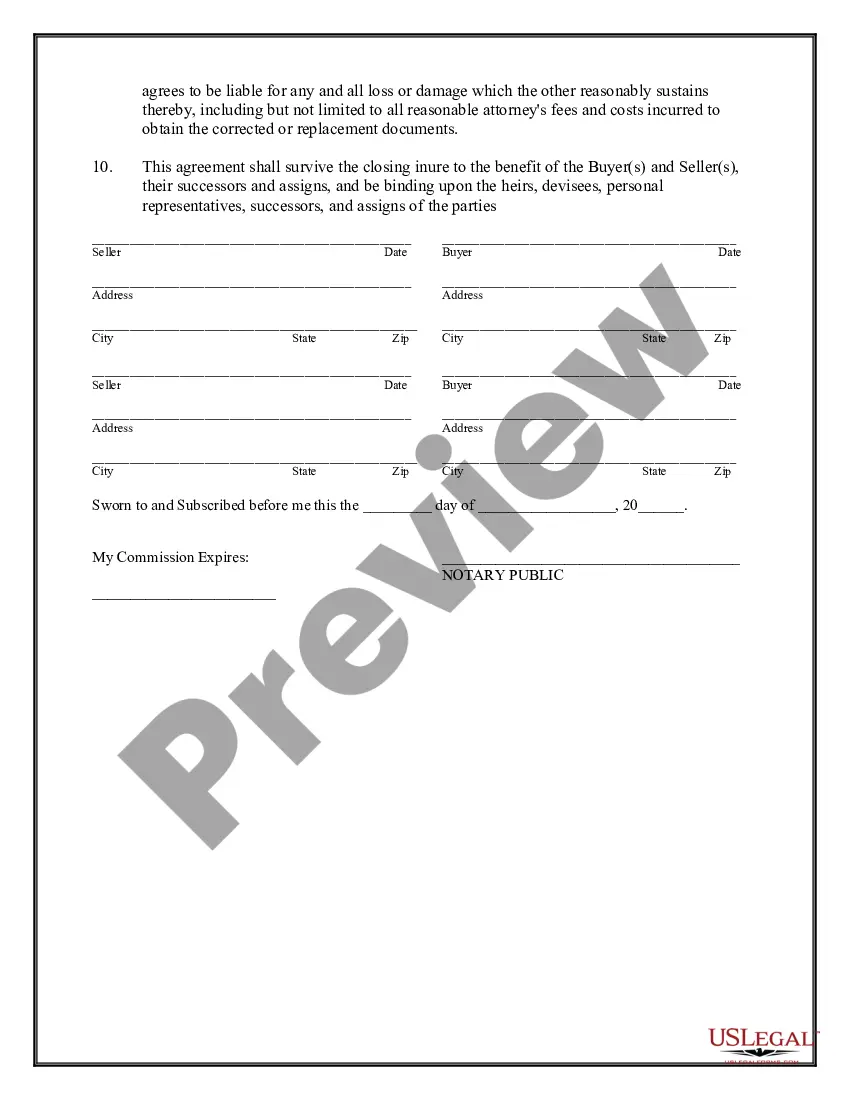

This Correction Statement and Agreement form is for a buyer and seller to sign at the closing for a loan or purchase of real property agreeing to execute corrected documents in the event of certain errors. It also is used to provide replacement documents in the event any documents are lost or misplaced.

The Houston Texas Correction Statement and Agreement is a legally binding document that is used to correct erroneous or inaccurate information within specific records or documents related to an individual or a business entity. This statement acts as a correction notice, ensuring that any incorrect information is rectified promptly and in compliance with the applicable regulations and guidelines. The purpose of the Houston Texas Correction Statement and Agreement is to provide a formal mechanism for individuals or business entities to rectify any mistakes or discrepancies in their records or documents. These errors may include incorrect personal information, addresses, financial details, or any other relevant information that needs to be updated or corrected. The agreement requires the individual or business entity to provide detailed information about the incorrect information, along with the accurate and updated details that need to be substituted. It is essential to include specific keywords within the agreement, such as "correction," "amendment," "update," or "rectification," to ensure clarity and specificity. Different types of Houston Texas Correction Statement and Agreement may exist based on the nature of the document or record being corrected. Some common types include: 1. Correction Statement for Personal Records: This type of agreement is typically used when correcting personal information such as name, date of birth, social security number, or contact details of an individual. 2. Correction Statement for Business Records: Business entities may use this agreement to correct any inaccuracies related to their company name, business address, tax identification number, or other pertinent information. 3. Correction Statement for Financial Records: This type of agreement is primarily used to correct errors in financial documents such as bank statements, tax returns, or credit reports. It may involve rectifying incorrect financial figures, account balances, or other financial details. 4. Correction Statement for Legal Documents: In case of any errors or inaccuracies in legal documents like contracts, agreements, or court filings, this agreement provides a formal path for the necessary corrections to be made. The Houston Texas Correction Statement and Agreement must be signed by the individual or an authorized representative of the business entity seeking the correction. It is advisable to consult a legal professional or seek guidance from the relevant authorities to ensure compliance with applicable regulations and to properly draft the agreement.The Houston Texas Correction Statement and Agreement is a legally binding document that is used to correct erroneous or inaccurate information within specific records or documents related to an individual or a business entity. This statement acts as a correction notice, ensuring that any incorrect information is rectified promptly and in compliance with the applicable regulations and guidelines. The purpose of the Houston Texas Correction Statement and Agreement is to provide a formal mechanism for individuals or business entities to rectify any mistakes or discrepancies in their records or documents. These errors may include incorrect personal information, addresses, financial details, or any other relevant information that needs to be updated or corrected. The agreement requires the individual or business entity to provide detailed information about the incorrect information, along with the accurate and updated details that need to be substituted. It is essential to include specific keywords within the agreement, such as "correction," "amendment," "update," or "rectification," to ensure clarity and specificity. Different types of Houston Texas Correction Statement and Agreement may exist based on the nature of the document or record being corrected. Some common types include: 1. Correction Statement for Personal Records: This type of agreement is typically used when correcting personal information such as name, date of birth, social security number, or contact details of an individual. 2. Correction Statement for Business Records: Business entities may use this agreement to correct any inaccuracies related to their company name, business address, tax identification number, or other pertinent information. 3. Correction Statement for Financial Records: This type of agreement is primarily used to correct errors in financial documents such as bank statements, tax returns, or credit reports. It may involve rectifying incorrect financial figures, account balances, or other financial details. 4. Correction Statement for Legal Documents: In case of any errors or inaccuracies in legal documents like contracts, agreements, or court filings, this agreement provides a formal path for the necessary corrections to be made. The Houston Texas Correction Statement and Agreement must be signed by the individual or an authorized representative of the business entity seeking the correction. It is advisable to consult a legal professional or seek guidance from the relevant authorities to ensure compliance with applicable regulations and to properly draft the agreement.