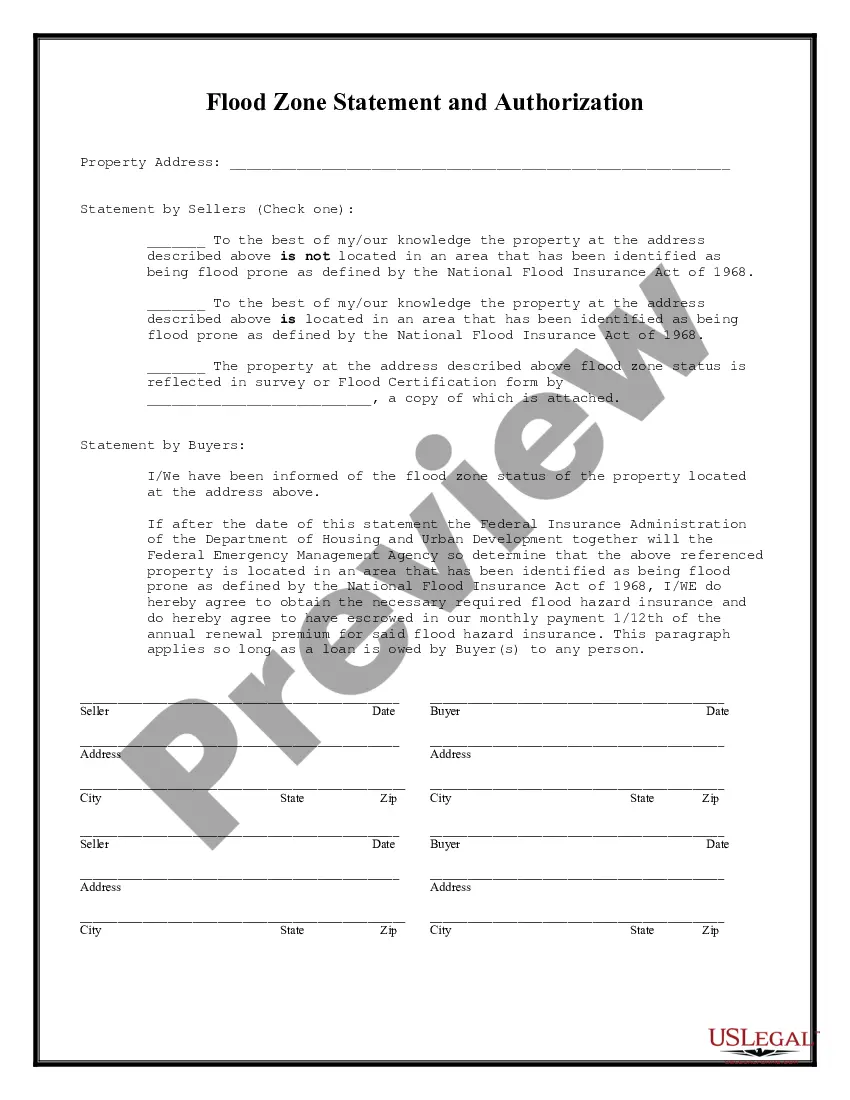

League City, Texas Flood Zone Statement and Authorization plays a crucial role in assessing and managing flood risk within the city. This detailed description will outline the purpose and significance of this statement and authorization, highlighting the various types it encompasses. League City, located in Galveston County, Texas, experiences frequent and heavy rainfall, making it prone to flooding. To mitigate potential damages and ensure public safety, the city requires property owners, potential buyers, and insurance companies to provide a comprehensive Flood Zone Statement and Authorization. The Flood Zone Statement and Authorization is a formal document that verifies a particular property's flood zone status according to the Federal Emergency Management Agency (FEMA) flood maps. It assists in determining if a property falls within a designated Special Flood Hazard Area (FHA) or a flood risk zone. This information is crucial for establishing the property's flood insurance requirements, building restrictions, and community planning. There are several types of League City, Texas Flood Zone Statement and Authorization, tailored to different situations and stakeholders. Let's explore the most common types: 1. Property Owner Flood Zone Statement and Authorization: — This type is typically required from property owners wishing to assess their flood risk or obtain flood insurance. — It involves providing details about the property, including the address, legal description, and potentially a survey or elevation certificate. — The statement authorizes designated entities to access the property for flood-related assessment and documentation purposes. 2. Real Estate Transaction Flood Zone Statement and Authorization: — When buying or selling a property within League City, this type of statement and authorization is necessary to ensure all parties are aware of the flood risk associated with the property. — It includes disclosure of the property's flood zone location and any previous flood damage history, if applicable. — Both the buyer and seller must acknowledge and authorize the disclosure and verification process. 3. Insurance Related Flood Zone Statement and Authorization: — Insurance companies often require policyholders or potential policyholders to submit this type of statement and authorization. — It provides crucial flood zone information necessary for determining insurance rates and coverage limits. — Property owners authorize the insurance company to verify their property's flood risk, potentially leading to updated coverage or premium adjustments. In conclusion, League City, Texas Flood Zone Statement and Authorization is a critical tool to mitigate flood-related risks and ensure the safety of inhabitants and property within the area. Whether it's property owners, buyers, sellers, or insurance companies, complying with the appropriate flood zone statement and authorization requirements is crucial for informed decision-making, community planning, and adequate insurance coverage.

League City Texas Flood Zone Statement and Authorization

Description

How to fill out League City Texas Flood Zone Statement And Authorization?

If you are searching for a relevant form, it’s extremely hard to find a more convenient platform than the US Legal Forms website – probably the most considerable online libraries. With this library, you can get a large number of document samples for company and personal purposes by types and states, or key phrases. With our advanced search feature, discovering the latest League City Texas Flood Zone Statement and Authorization is as easy as 1-2-3. In addition, the relevance of each document is confirmed by a group of expert lawyers that on a regular basis review the templates on our website and revise them based on the latest state and county demands.

If you already know about our system and have a registered account, all you need to receive the League City Texas Flood Zone Statement and Authorization is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have opened the form you require. Read its description and make use of the Preview option (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to discover the needed record.

- Affirm your selection. Choose the Buy now option. Following that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Select the format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the acquired League City Texas Flood Zone Statement and Authorization.

Every single template you add to your profile has no expiry date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you want to have an extra version for editing or creating a hard copy, you can return and save it once more at any moment.

Take advantage of the US Legal Forms professional catalogue to gain access to the League City Texas Flood Zone Statement and Authorization you were looking for and a large number of other professional and state-specific samples on a single platform!