The Irving Texas Non-Foreign Affidavit Under IRC 1445 is an important legal document used in real estate transactions to certify the non-foreign status of the seller in order to comply with the requirements of the Internal Revenue Code (IRC) Section 1445. This affidavit is specifically applicable to properties located in Irving, Texas. The purpose of the Irving Texas Non-Foreign Affidavit Under IRC 1445 is to ensure that the buyer, typically a United States (U.S.) citizen or resident alien, withholds and remits the appropriate amount of tax on the sale of real property by a foreign seller. The affidavit contains detailed information about the seller, such as their name, address, and taxpayer identification number. The seller must declare under penalties of perjury that they are not a foreign person or entity, as defined by the IRC, for tax purposes. This affidavit helps the buyer and the Internal Revenue Service (IRS) verify the non-foreign status of the seller and facilitates the proper withholding of taxes. It is crucial to note that failing to comply with the requirements of IRC Section 1445 can have serious consequences, including penalties and fines for both the buyer and seller. Therefore, it is essential for all parties involved in the real estate transaction to fully understand and adhere to the rules and regulations surrounding non-foreign affidavits. While there may not be different types of Irving Texas Non-Foreign Affidavit Under IRC 1445, variations in the format or specific language may exist depending on the preferences of different real estate professionals or organizations involved. It is crucial to consult with a qualified real estate attorney or professional to ensure the accurate completion and submission of the affidavit for each transaction. Additionally, the IRS provides guidance and resources regarding the requirements and procedures for complying with IRC Section 1445. Keywords: Irving Texas, Non-Foreign Affidavit, IRC 1445, real estate transactions, Internal Revenue Code, seller, buyer, non-foreign status, taxation, penalties, compliance.

Irving Texas Non-Foreign Affidavit Under IRC 1445

Description

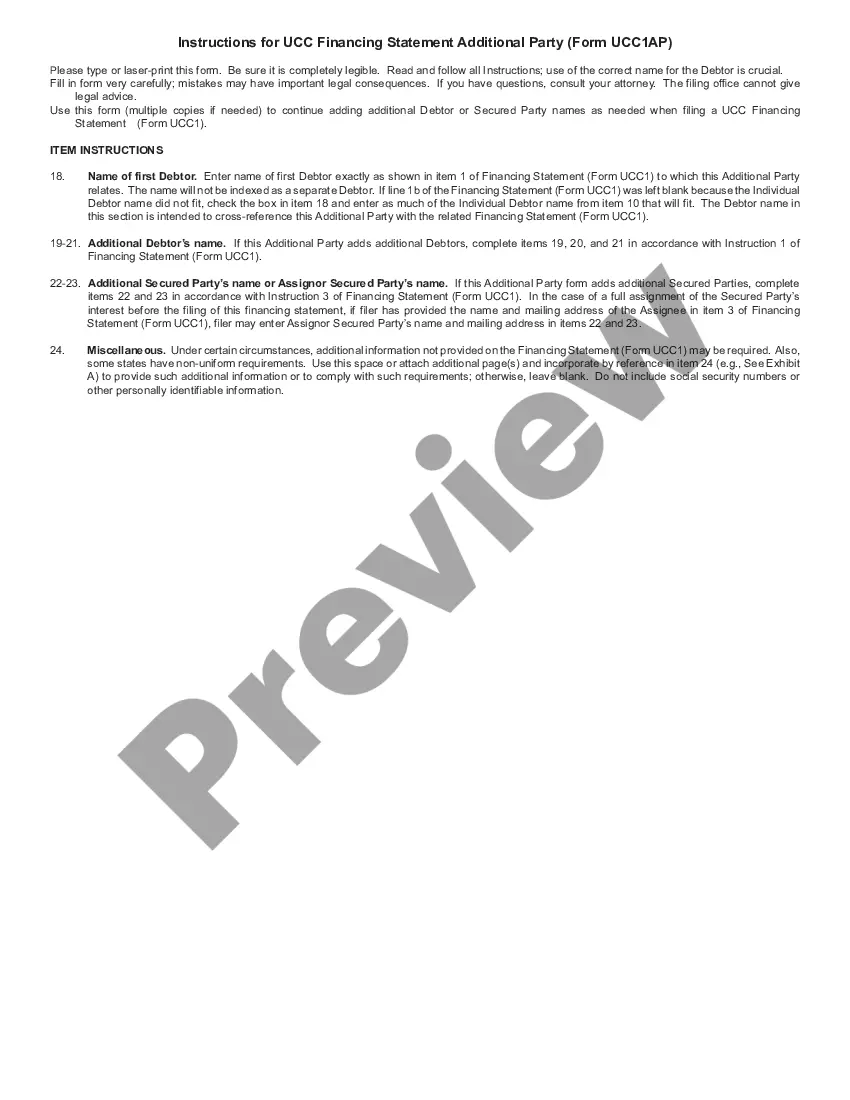

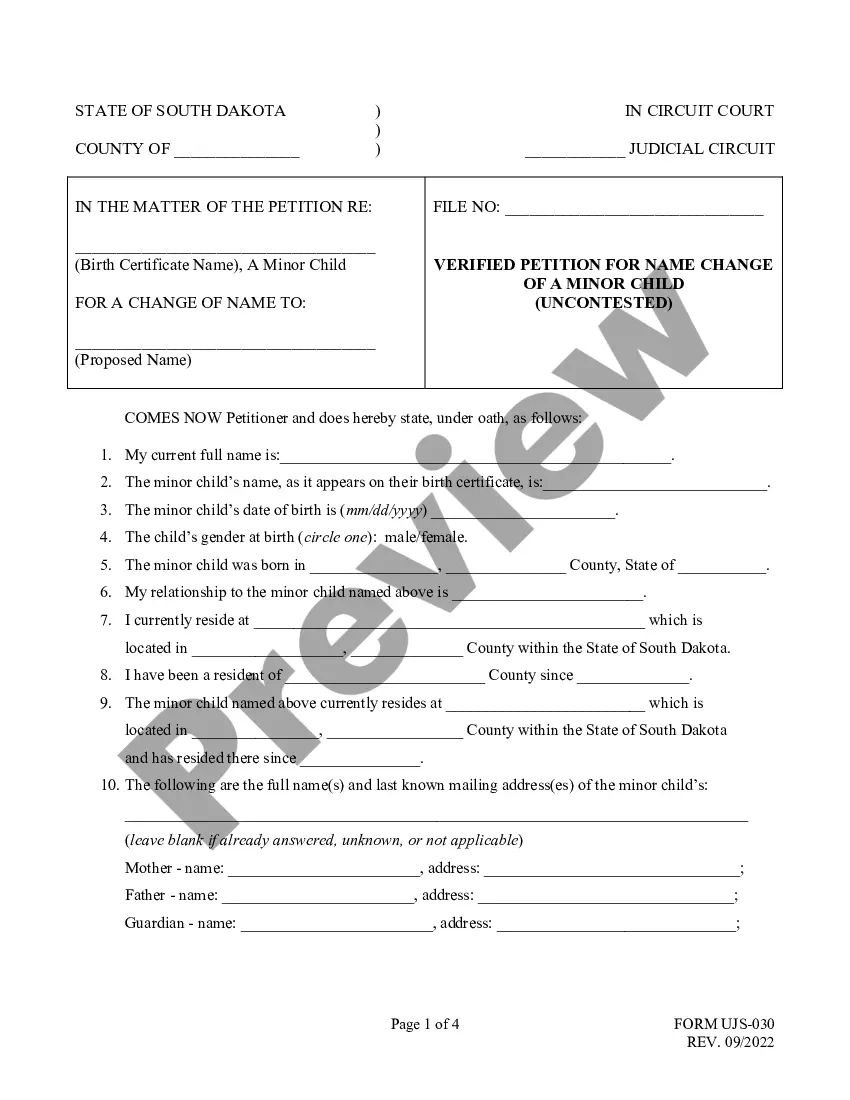

How to fill out Irving Texas Non-Foreign Affidavit Under IRC 1445?

If you are looking for a pertinent document, it’s incredibly challenging to find a superior source than the US Legal Forms website – arguably the most extensive online collections.

With this collection, you can locate thousands of document samples for commercial and personal purposes by categories and states, or keywords.

Utilizing our sophisticated search feature, acquiring the latest Irving Texas Non-Foreign Affidavit Under IRC 1445 is as simple as 1-2-3.

Complete the payment process. Employ your credit card or PayPal account to finalize the registration.

Receive the document. Choose the format and save it on your device. Edit the document. Fill out, modify, print, and sign the obtained Irving Texas Non-Foreign Affidavit Under IRC 1445.

- Additionally, the relevance of each document is confirmed by a team of experienced attorneys who regularly assess the templates on our platform and update them per the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to obtain the Irving Texas Non-Foreign Affidavit Under IRC 1445 is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions outlined below.

- Ensure you have accessed the sample you need. Review its description and use the Preview feature (if available) to inspect its content. If it does not fulfill your needs, use the Search field at the top of the page to find the appropriate document.

- Confirm your choice. Select the Buy now button. After that, pick your desired subscription plan and enter your details to set up an account.

Form popularity

FAQ

To navigate FIRPTA, one effective approach is to utilize an Irving Texas Non-Foreign Affidavit Under IRC 1445. This affidavit can help clarify the seller's non-foreign status, thus eliminating the need for withholding taxes during the real estate sale. Additionally, consulting a knowledgeable tax professional can provide valuable insights into specific exemptions and compliance requirements. By understanding and using the right documents, you can streamline the transaction process.

foreign status affidavit is a document that certifies an individual or entity is not a foreign person under U.S. tax laws. In the context of the Irving Texas NonForeign Affidavit Under IRC 1445, this affidavit allows buyers and sellers to confirm the nonforeign status of the seller. By providing this affidavit, parties involved in a real estate transaction can avoid withholding taxes that would usually apply to foreign sellers. It serves as a crucial tool for facilitating smooth property transfers.

The withholding rate on the proceeds from the sale of a US real property interest typically stands at 15%. This rate applies when the seller is a foreign person, ensuring that the IRS collects necessary taxes. However, by filing an Irving Texas Non-Foreign Affidavit Under IRC 1445, sellers can claim exemption from this withholding rate if they can prove they are not foreign. This can help maximize the seller's profit and simplify the sale process.

When foreigners sell US property, they may be subject to the Foreign Investment in Real Property Tax Act (FIRPTA). This law mandates that buyers withhold tax on the gross proceeds of the sale to address potential tax liabilities for foreign sellers. By submitting the Irving Texas Non-Foreign Affidavit Under IRC 1445, sellers can often avoid FIRPTA withholding, making the transaction smoother for both parties involved.

US real property interest includes interest in land, improvements to land, and certain rights or benefits associated with real estate. This can encompass residential homes, commercial buildings, and even leasehold interests. Understanding the scope of US real property interest is essential, especially for foreign investors engaging in transactions. Utilizing resources like the Irving Texas Non-Foreign Affidavit Under IRC 1445 can help clarify eligibility and obligations.

The seller's affidavit of non-foreign status is a declaration that the seller is not a foreign individual or entity according to IRS guidelines. This affidavit eliminates the need for the buyer to withhold taxes from the sale proceeds. By utilizing the Irving Texas Non-Foreign Affidavit Under IRC 1445, sellers can assure buyers and avoid unnecessary tax implications. Uslegalforms simplifies the creation of this essential document.

To mail a FIRPTA certificate, you typically send it to the Internal Revenue Service (IRS) at the address specified on the form. It's important to send it promptly to avoid any delays in the transaction. If you need guidance on where to send your Irving Texas Non-Foreign Affidavit Under IRC 1445, uslegalforms offers resources that provide clear instructions for compliance. Ensuring you send it to the correct address helps streamline the process.

Typically, the seller provides the FIRPTA affidavit to the buyer as part of the closing process. This is usually handled by a real estate attorney or a title company assisting in the transaction. By securing an Irving Texas Non-Foreign Affidavit Under IRC 1445, sellers take an essential step in ensuring compliance with IRS regulations and facilitating a smoother closing. Platforms like uslegalforms can help you navigate this process.

A Section 1445 affidavit is a document that certifies a seller's non-foreign status under the Foreign Investment in Real Property Tax Act (FIRPTA). This affidavit is crucial for buyers as it helps clarify tax obligations during the sale of U.S. real estate. By obtaining an Irving Texas Non-Foreign Affidavit Under IRC 1445, sellers can avoid withholding taxes that are typically applied to foreign sellers. You can easily obtain this affidavit through platforms like uslegalforms.