The McKinney Non-Foreign Affidavit Under IRC 1445 is a legal document that is often required in certain real estate transactions involving foreign sellers or transfers. This affidavit is specific to the city of McKinney, Texas, and is used to comply with the regulations set forth by the Internal Revenue Code (IRC) Section 1445. Under IRC 1445, when a foreign person sells a U.S. real property interest, the buyer is required to withhold a specific amount of the total purchase price as a tax payment to the IRS. However, if the seller provides a valid Non-Foreign Affidavit, the buyer is relieved of this obligation. There are different types of McKinney Texas Non-Foreign Affidavits Under IRC 1445 that may be used depending on the specifics of the transaction. These can include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when the seller is an individual foreign person selling a U.S. real property interest in McKinney, Texas. The individual will need to provide certain information and certifications relevant to their non-foreign status. 2. Corporate Non-Foreign Affidavit: In cases where the seller is a foreign corporation selling a U.S. real property interest in McKinney, Texas, a corporate Non-Foreign Affidavit is required. This affidavit will require the corporation to provide necessary documentation and details about its non-foreign status. 3. Partnership/LLC Non-Foreign Affidavit: If the seller is a foreign partnership or limited liability company (LLC) selling a U.S. real property interest in McKinney, Texas, a partnership or LLC Non-Foreign Affidavit will be necessary. This affidavit will address the non-foreign status of the entity and may involve providing additional partnership or LLC documentation. It is essential to ensure these affidavits are accurately completed with all required information and supporting documentation. Failure to do so may result in the buyer being held liable for the tax withholding requirements under IRC 1445. In conclusion, the McKinney Texas Non-Foreign Affidavit Under IRC 1445 is a critical legal document used to comply with tax regulations when foreign sellers are involved in real estate transactions in McKinney, Texas. Different types of affidavits cater to various seller entities such as individuals, corporations, partnerships, or LCS. Buyers and foreign sellers should consult with legal professionals to ensure compliance with IRC 1445 and to complete the necessary affidavits accurately.

McKinney Texas Non-Foreign Affidavit Under IRC 1445

Category:

State:

Texas

City:

McKinney

Control #:

TX-CLOSE7

Format:

Word;

Rich Text

Instant download

Description

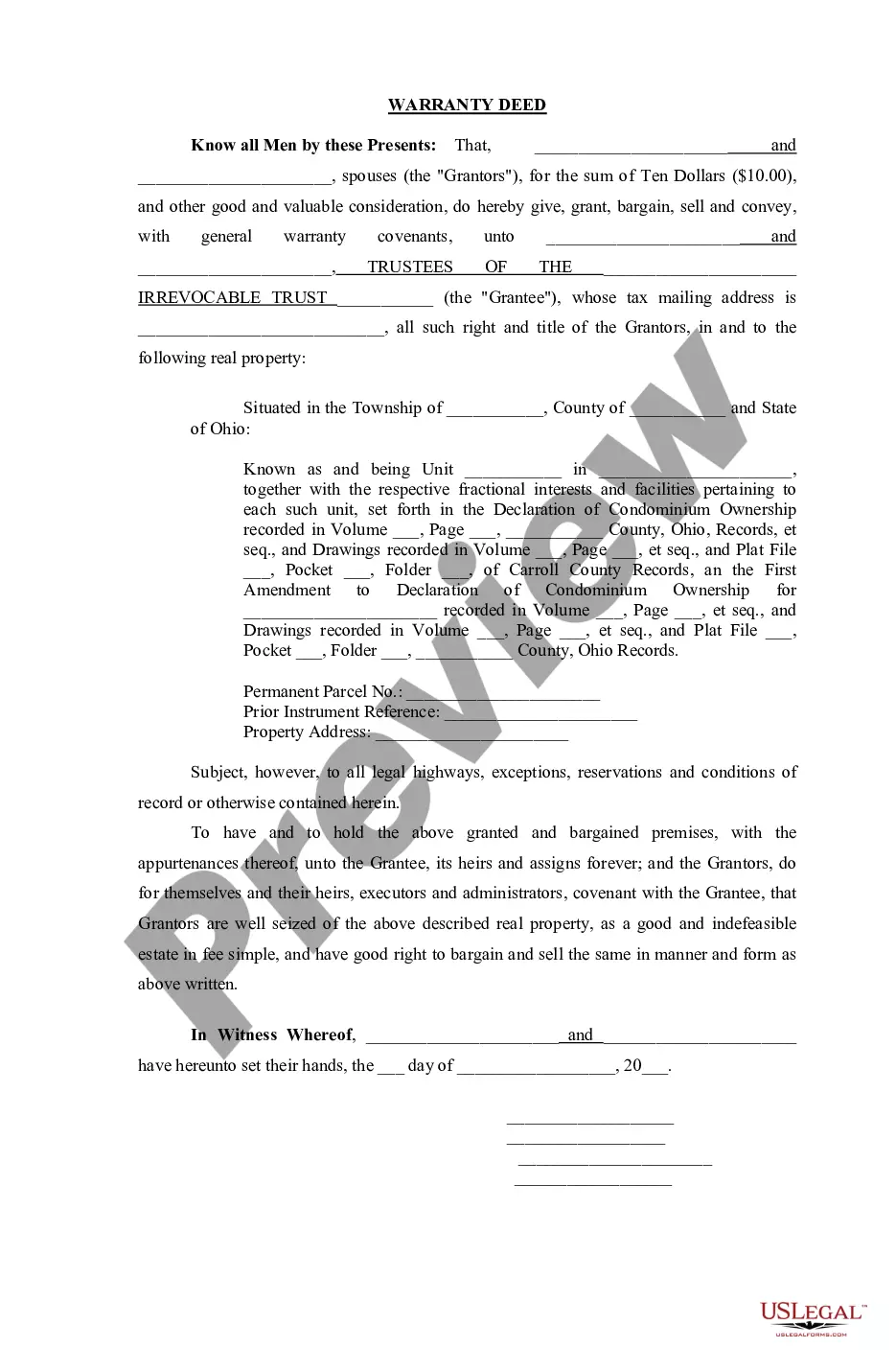

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The McKinney Non-Foreign Affidavit Under IRC 1445 is a legal document that is often required in certain real estate transactions involving foreign sellers or transfers. This affidavit is specific to the city of McKinney, Texas, and is used to comply with the regulations set forth by the Internal Revenue Code (IRC) Section 1445. Under IRC 1445, when a foreign person sells a U.S. real property interest, the buyer is required to withhold a specific amount of the total purchase price as a tax payment to the IRS. However, if the seller provides a valid Non-Foreign Affidavit, the buyer is relieved of this obligation. There are different types of McKinney Texas Non-Foreign Affidavits Under IRC 1445 that may be used depending on the specifics of the transaction. These can include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when the seller is an individual foreign person selling a U.S. real property interest in McKinney, Texas. The individual will need to provide certain information and certifications relevant to their non-foreign status. 2. Corporate Non-Foreign Affidavit: In cases where the seller is a foreign corporation selling a U.S. real property interest in McKinney, Texas, a corporate Non-Foreign Affidavit is required. This affidavit will require the corporation to provide necessary documentation and details about its non-foreign status. 3. Partnership/LLC Non-Foreign Affidavit: If the seller is a foreign partnership or limited liability company (LLC) selling a U.S. real property interest in McKinney, Texas, a partnership or LLC Non-Foreign Affidavit will be necessary. This affidavit will address the non-foreign status of the entity and may involve providing additional partnership or LLC documentation. It is essential to ensure these affidavits are accurately completed with all required information and supporting documentation. Failure to do so may result in the buyer being held liable for the tax withholding requirements under IRC 1445. In conclusion, the McKinney Texas Non-Foreign Affidavit Under IRC 1445 is a critical legal document used to comply with tax regulations when foreign sellers are involved in real estate transactions in McKinney, Texas. Different types of affidavits cater to various seller entities such as individuals, corporations, partnerships, or LCS. Buyers and foreign sellers should consult with legal professionals to ensure compliance with IRC 1445 and to complete the necessary affidavits accurately.

Free preview

How to fill out McKinney Texas Non-Foreign Affidavit Under IRC 1445?

If you’ve already utilized our service before, log in to your account and save the McKinney Texas Non-Foreign Affidavit Under IRC 1445 on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your McKinney Texas Non-Foreign Affidavit Under IRC 1445. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!