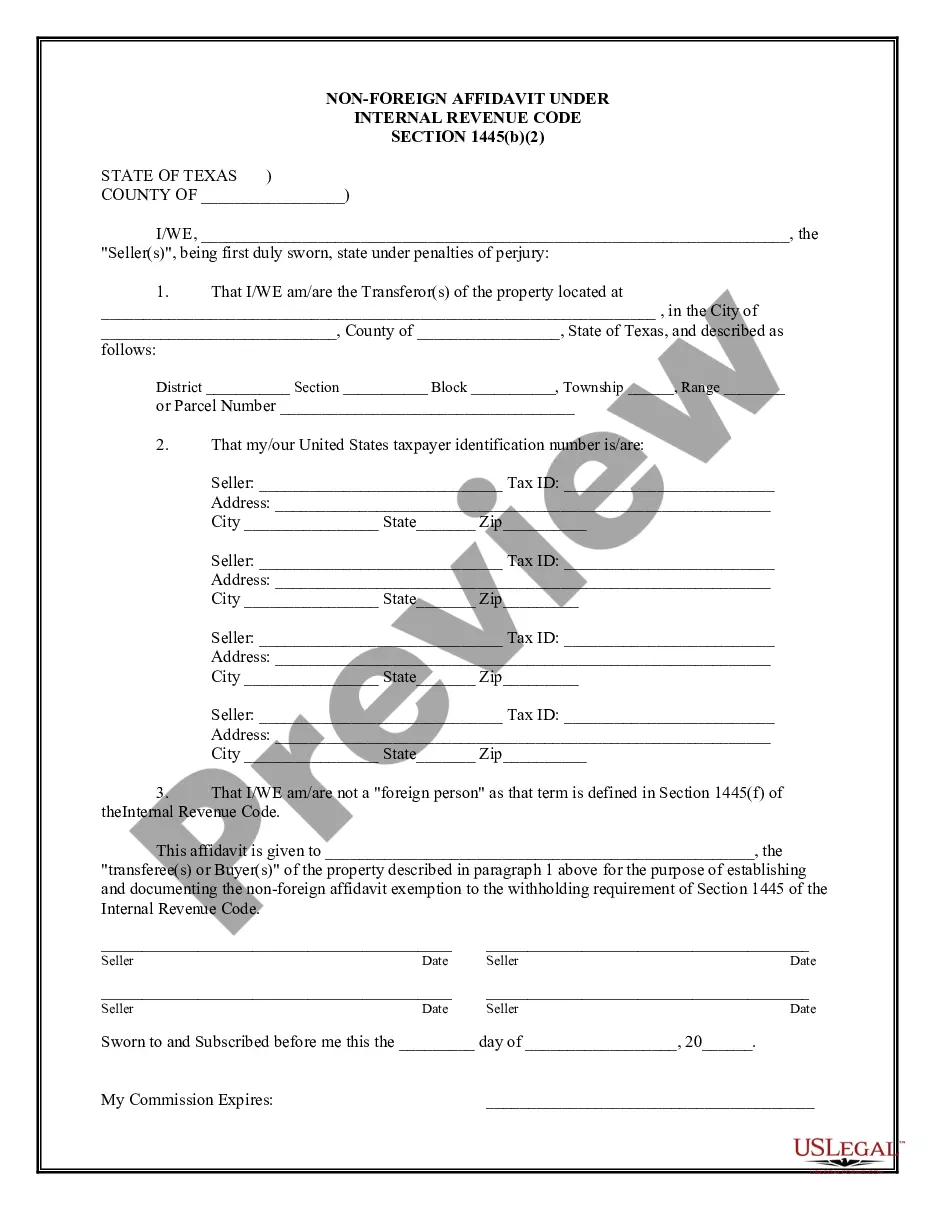

Odessa Texas Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Texas Non-Foreign Affidavit Under IRC 1445?

If you have previously utilized our service, Log In to your account and download the Odessa Texas Non-Foreign Affidavit Under IRC 1445 to your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment schedule.

If this is your initial encounter with our service, adhere to these straightforward steps to obtain your document.

You have continuous access to each document you have purchased: you can find it in your profile within the My documents menu whenever you require it again. Take advantage of the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Ensure you’ve identified the correct document. Browse through the description and utilize the Preview option, if available, to verify if it suits your needs. If it doesn’t, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and complete a payment. Provide your credit card information or choose the PayPal option to finalize the transaction.

- Receive your Odessa Texas Non-Foreign Affidavit Under IRC 1445. Choose the file format for your document and save it to your device.

- Complete your template. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A certificate of foreign status is a document that confirms that a seller is indeed a foreign person under U.S. tax law. This certificate is vital for buyers to ensure compliance with FIRPTA regulations. However, utilizing an Odessa Texas Non-Foreign Affidavit Under IRC 1445 can negate the necessity of this certificate by proving non-foreign status, making the sales process more straightforward for everyone involved.

A nonresident certificate is a form that verifies a seller's status as a nonresident for tax purposes. It is essential for sellers who need to prove their residency status under the rules of FIRPTA and helps in avoiding unnecessary tax withholdings. Utilizing an Odessa Texas Non-Foreign Affidavit Under IRC 1445 serves as a reliable method for sellers to secure this certification, ensuring smooth transactions and compliance.

A seller's certification of non-foreign status is a document that confirms a seller is not a foreign person, allowing the sale of real estate without FIRPTA withholding. By using an Odessa Texas Non-Foreign Affidavit Under IRC 1445, sellers can complete this certification effectively. This makes it easier for buyers and sellers to navigate property transactions without tax liabilities, enhancing the efficiency of the sale.

To navigate FIRPTA requirements, you can utilize an Odessa Texas Non-Foreign Affidavit Under IRC 1445. This affidavit allows the seller to certify that they are not classified as a foreign person, thus avoiding the withholding tax imposed by FIRPTA. Engaging with a qualified professional or a service like USLegalForms can simplify the process, ensuring compliance while protecting your interests.

Section 1445 of the IRS Code establishes the requirements for withholding taxes on the sale of U.S. real property interests by foreign persons. This section allows the IRS to assess tax on gains realized from property sales, protecting tax revenue. To navigate these requirements, especially in Odessa, utilizing the Odessa Texas Non-Foreign Affidavit Under IRC 1445 is crucial. This affidavit can exempt you from withholding, easing the financial burden during your property transactions.

The purpose of a FIRPTA certificate is to certify a seller's foreign status, determining the appropriate withholding tax from the sale proceeds of U.S. real property. This certificate plays a significant role in ensuring compliance with federal tax regulations. If you are involved in a real estate transaction in Odessa, using the Odessa Texas Non-Foreign Affidavit Under IRC 1445 can facilitate the certification process. This tool not only simplifies transactions but also alleviates concerns about excessive tax withholding.

IRS Notice 1445 is a communication regarding the requirements of FIRPTA and the withholding necessary when a foreign person disposes of U.S. real property. This notice reminds sellers and buyers alike about tax obligations that apply under the Internal Revenue Code. Understanding this notice is vital for ensuring compliance, and the Odessa Texas Non-Foreign Affidavit Under IRC 1445 plays a key role in clarifying your tax responsibilities. It helps protect you from unexpected withholding taxes.

A 1445 form refers to IRS Form 8288-B, also known as the Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests. This form is used to apply for a reduction or elimination of FIRPTA withholding. By utilizing the Odessa Texas Non-Foreign Affidavit Under IRC 1445, you can clarify your non-foreign status, making it essential in this process. Having the proper documentation can expedite your transactions.

To file FIRPTA withholding, you need to complete IRS Form 8288 and submit it along with the necessary payment to the IRS. It’s crucial to ensure that you’re following all regulations to avoid any penalties. In Odessa Texas, this process is simplified through the use of the Odessa Texas Non-Foreign Affidavit Under IRC 1445, which certifies your foreign status. By completing this affidavit, you can prevent unnecessary withholding on proceeds from the sale of your property.

Yes, a FIRPTA affidavit typically requires notarization to ensure its authenticity and to comply with legal standards. This notarization is crucial, as it provides an official verification of the seller's identity and claims about foreign status. When using the Odessa Texas Non-Foreign Affidavit Under IRC 1445, make sure to have it properly notarized to avoid complications.