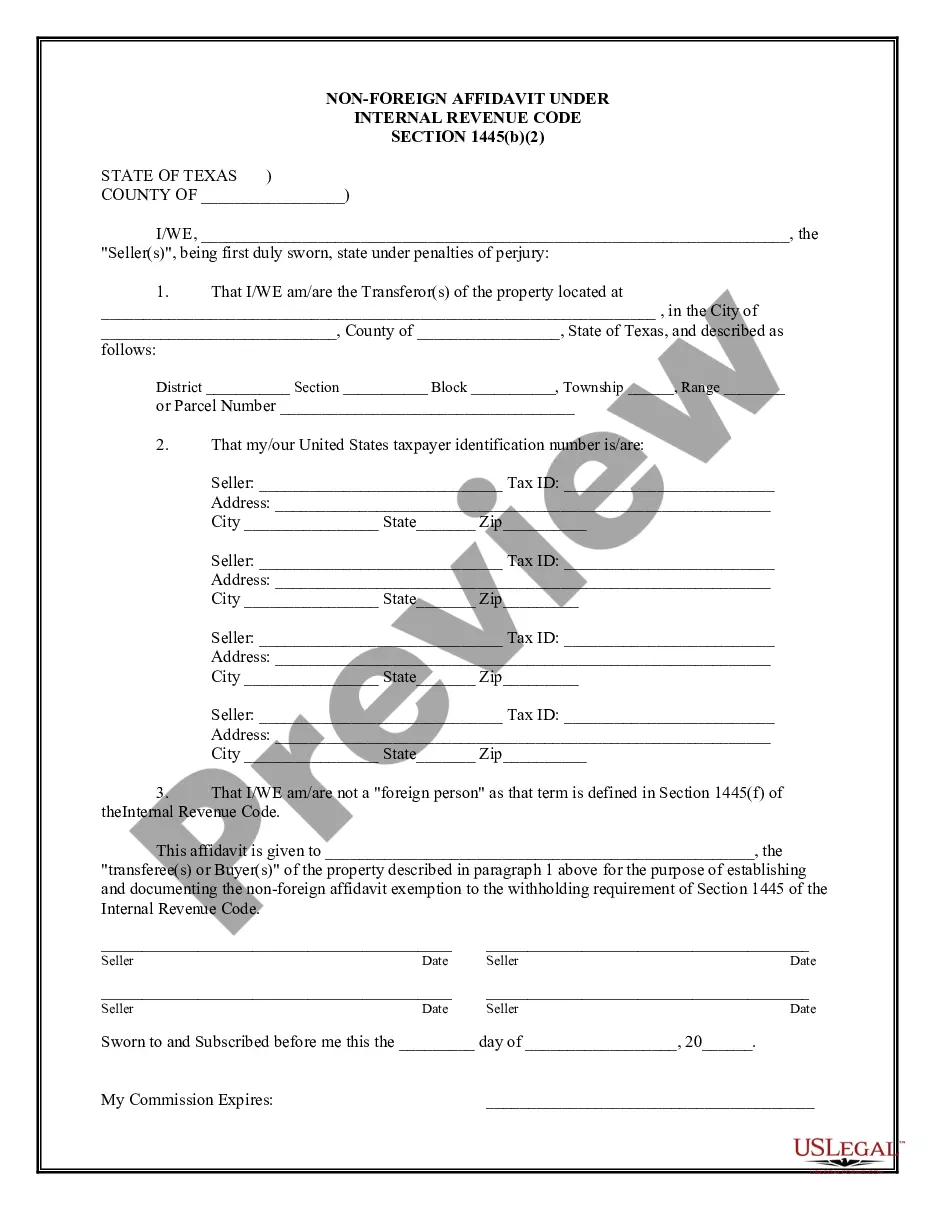

The Pasadena Texas Non-Foreign Affidavit Under IRC 1445 is a legal document used in real estate transactions to confirm the tax status of a seller or transferor, ensuring compliance with the Internal Revenue Code (IRC) section 1445. This affidavit plays a vital role in determining whether the transferor is a U.S. citizen or a foreign person for tax purposes. By providing this document, the transferor affirms their non-foreign status, ensuring that the appropriate tax withholding requirements are met. Pasadena, Texas, being a city in the state of Texas, follows the regulations set forth by the IRC 1445 for real estate transactions involving foreign individuals. While there may not be different types of Pasadena Texas Non-Foreign Affidavit Under IRC 1445, it is necessary to clearly differentiate between the non-foreign affidavit and other types of affidavits used in real estate transactions, such as the foreign affidavit or the non-resident affidavit. The Pasadena Texas Non-Foreign Affidavit Under IRC 1445 typically includes essential details such as the name and address of the transferor, the date of the transfer, a description of the property being transferred, and a confirmation that the transferor is not a foreign person as defined by the IRC regulations. It is crucial to carefully review and accurately complete the affidavit to avoid any tax liability and ensure compliance with both federal and state laws. Furthermore, the affidavit assists title companies, escrow agents, and real estate attorneys in determining whether the transaction falls under the provisions of IRC section 1445, which requires withholding of a portion of the sales proceeds before transferring them to the transferor. This withholding serves as a preemptive measure to ensure that any potential tax obligations of a foreign person are met, reducing the risk of non-compliance. In summary, the Pasadena Texas Non-Foreign Affidavit Under IRC 1445 is a crucial document in real estate transactions within Pasadena, Texas, serving to confirm the tax status of the transferor. By affirming their non-foreign status, the transferor ensures compliance with the provisions of the IRC section 1445, allowing for a smooth and legally compliant transfer of property ownership. Keywords: Pasadena Texas, Non-Foreign Affidavit, IRC 1445, real estate transactions, tax status, compliance, U.S. citizen, foreign person, withholding requirements, title companies, escrow agents, real estate attorneys, sales proceeds, tax liability, preemptive measure, non-compliance.

Pasadena Texas Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Pasadena Texas Non-Foreign Affidavit Under IRC 1445?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Pasadena Texas Non-Foreign Affidavit Under IRC 1445 becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Pasadena Texas Non-Foreign Affidavit Under IRC 1445 takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Pasadena Texas Non-Foreign Affidavit Under IRC 1445. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!