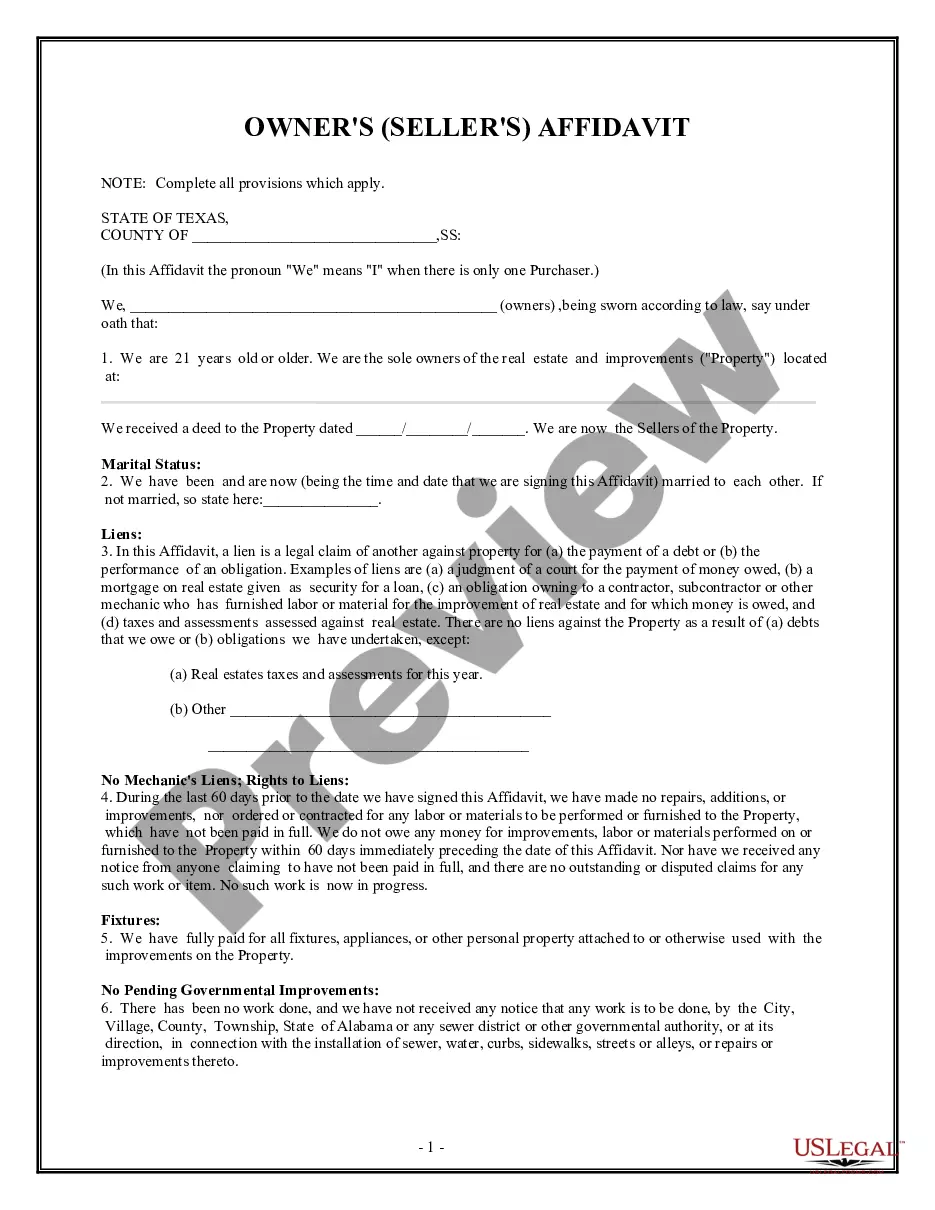

The Houston Texas Owner's or Seller's Affidavit of No Liens is a legal document that serves as proof to the buyer and the title company that the property being sold is free from any liens or encumbrances. This affidavit is typically used during real estate transactions in Houston, Texas. The purpose of the Owner's or Seller's Affidavit of No Liens is to indemnify and protect the buyer from any potential financial or legal claims from third parties who may have an interest in the property. By providing this affidavit, the seller is affirming that they are the rightful owner of the property and that there are no outstanding liens, mortgages, or judgments against it. The affidavit includes important information such as the seller's name, address, and contact details, the legal description of the property, and details about the terms of the sale. It also requires the seller to warrant that they have disclosed any known liens or encumbrances on the property. It should be noted that there are different types of Owner's or Seller's Affidavit of No Liens that may be used in Houston, Texas, depending on the specific circumstances of the transaction. These variations could include: 1. General Owner's Affidavit: This type of affidavit is used when the seller is able to make a general statement affirming that there are no outstanding liens or encumbrances on the property. 2. Partial Lien Release Affidavit: This affidavit is used when there are known liens or encumbrances on the property, but the seller has made arrangements to clear some of them before or at the time of closing. This affidavit would specify the liens that have been addressed and released. 3. Conditional Release Affidavit: In cases where there are outstanding liens or encumbrances on the property, the seller may provide a conditional release, stating that they will clear the liens or encumbrances before the closing date. This allows the sale to proceed, contingent upon the seller fulfilling their obligation to remove the specified liens. Overall, the Houston Texas Owner's or Seller's Affidavit of No Liens is a crucial document in establishing clear title for the buyer and protecting them from any unforeseen financial or legal issues related to the property. It aids in facilitating a smooth and secure real estate transaction in Houston, Texas.

Houston Texas Owner's or Seller's Affidavit of No Liens

Description

How to fill out Houston Texas Owner's Or Seller's Affidavit Of No Liens?

We consistently aim to minimize or evade legal complications when handling intricate legal or financial issues.

To achieve this, we request legal services that, as a general rule, are exceedingly pricey.

Nevertheless, not all legal issues are that complex.

Most of them can be managed by ourselves.

Utilize US Legal Forms whenever you need to obtain and download the Houston Texas Owner's or Seller's Affidavit of No Liens or any other form quickly and securely. Simply Log In to your account and click the Get button next to it. Should you lose the form, you can always re-download it from the My documents tab. The process is just as straightforward if you’re new to the platform! You can establish your account in just a few minutes. Ensure to verify if the Houston Texas Owner's or Seller's Affidavit of No Liens complies with the laws and regulations of your state and locality. Additionally, it is vital that you review the form’s description (if available), and if you notice any inconsistencies with what you initially sought, look for a different form. Once you have confirmed that the Houston Texas Owner's or Seller's Affidavit of No Liens is appropriate for you, you can select a subscription plan and proceed to payment. Then you can download the form in any compatible format. With over 24 years in the market, we’ve assisted millions of individuals by providing ready-to-customize and current legal documents. Take advantage of US Legal Forms now to conserve effort and resources!

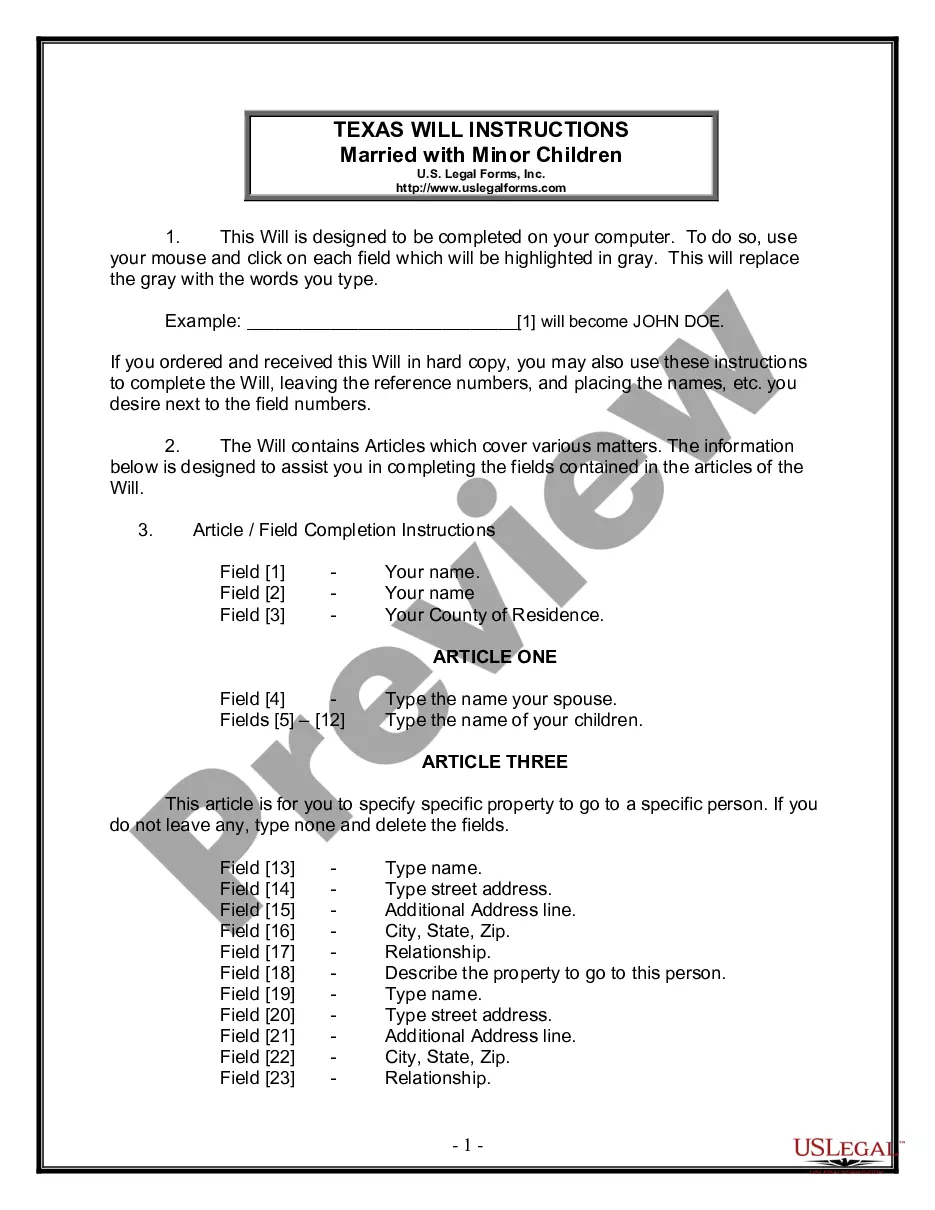

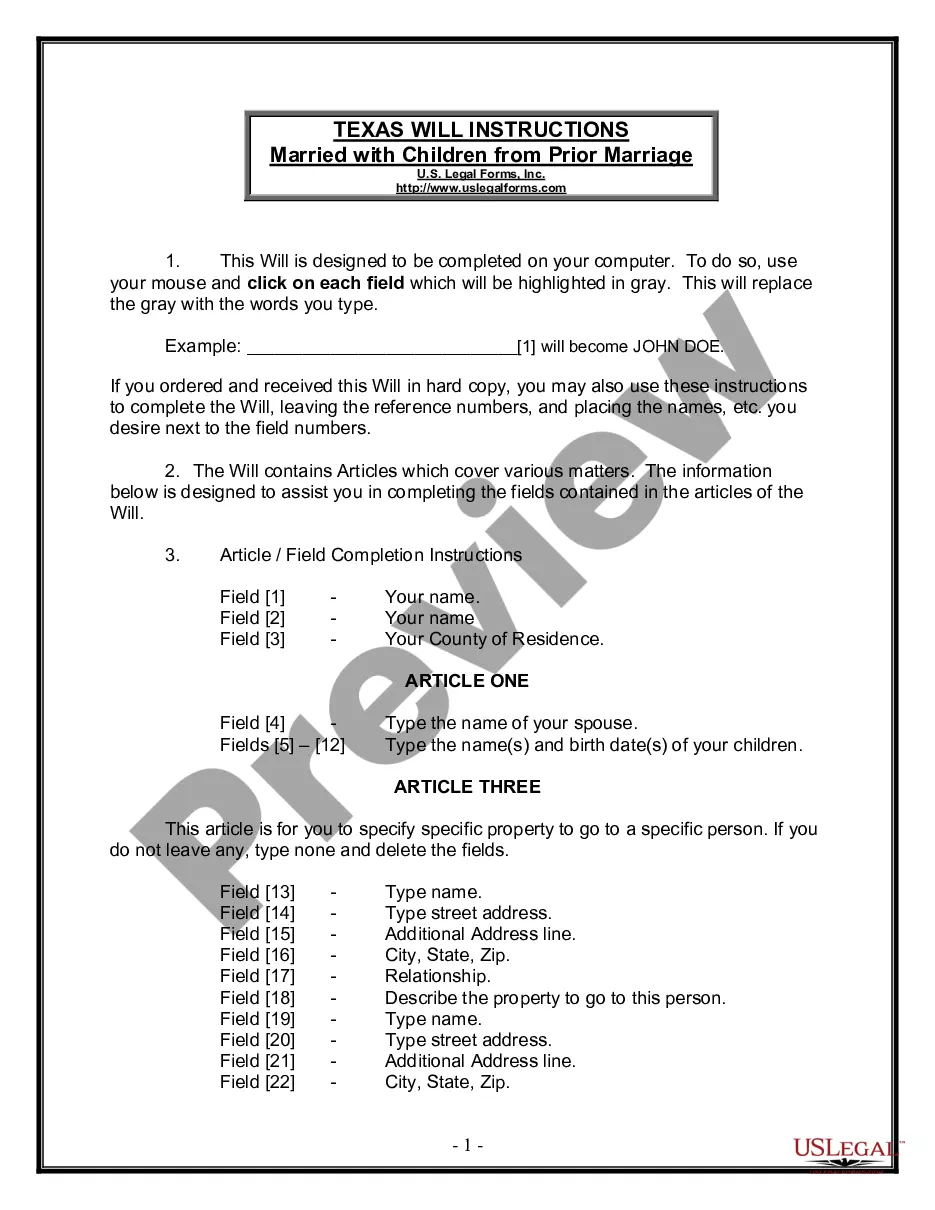

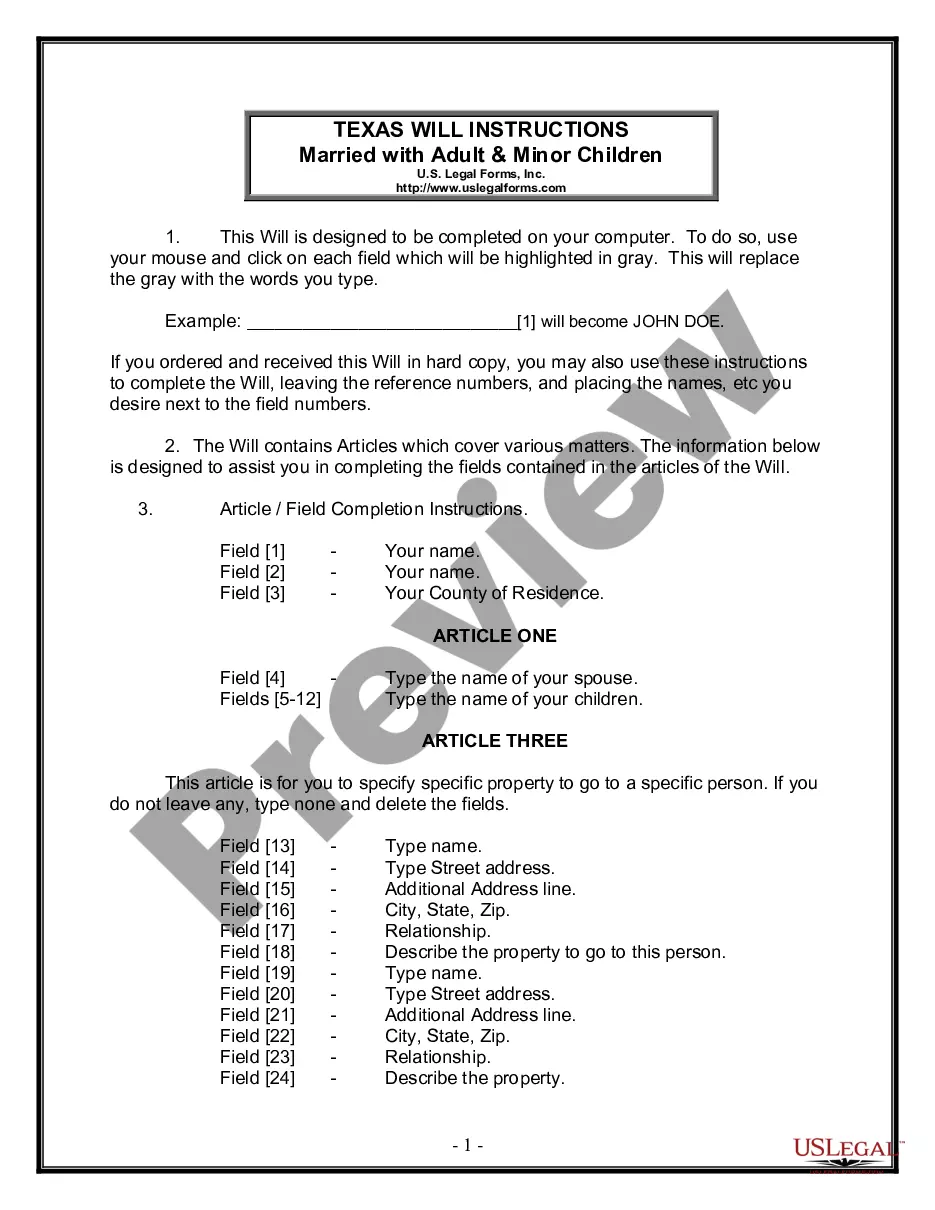

- US Legal Forms is a web-based repository of updated do-it-yourself legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform enables you to take control of your matters without relying on legal counsel.

- We grant access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

According to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.

A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

To show that a lien has officially been removed on a property, you have to file a document called a ?lien release? in the real property records of the county where the property is located. A release of lien simply means removing the lien claim from a specific property.

How Does Someone Put a Judgment Lien on My Texas Home? A creditor can file a lien judgment with the county clerk in whichever Texas county the property is located or the debtor has real estate. A judgment lien will remain on the debtor's property for ten years, even if the property changes ownership.

A judgment lien lasts for ten years. According to Section 52.001 of the Texas Property Code, a judgment lien cannot attach to any real property that is exempt from seizure or forced sale under Chapter 41 of the Texas Property Code.

Add or Remove a Lien on a Vehicle To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

Exempt property includes most of what you need to live: Household items, up to $30,000 for a single person and $60,000 for a family. Vehicles, one for each licensed driver in the house. Your homestead, up to 10 acres urban property (single or family) and up to 100 acres rural (single) and 200 acres (family).

According to this law, a debtor must file an affidavit with the county to secure the release of a judgment lien against a primary residence. The debtor must first provide a 30-day notice letter to the creator of the judgment, containing a copy of the affidavit the debtor intends to file.

Texas has a homestead exemption, which means creditors can still place liens on a debtor's primary real estate, but they cannot seize the property. However, having a lien on your homestead still clouds the title.

Three of the most common are: 1) immediately dispute the lien (whether through statutorily provided preliminary means, a demand to/against the claimant, or a full-blown lawsuit) 2) force the claimant to file suit to enforce the lien in a shorter period (if available in your state) 3) just wait it out.

Interesting Questions

More info

For a second-hand vehicle, a sale is required in the same manner. If the title company is retained, title insurance is required. The vehicle may be resold prior to expiration. The title company is responsible for paying the taxes incurred from the sale on the sold vehicle. All Texas laws apply. However, the courts may set different rates for different license plates. License plates that have been issued may not be used on cars that are sold unless they are in stock at the dealership. If not in stock, their expiration date must be over 30 days after the plate issuance. If not in stock, they must be sold with the purchaser's full payment. Texas Vehicle License Plates The Texas Department of Motor Vehicles (DMV×) publishes Texas Vehicle License Plates.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.