A Houston Texas Complex Will With Credit Shelter Marital Trust for Large Estates is a specialized legal estate planning tool that combines various components to effectively manage and distribute large estates while minimizing estate taxes and protecting the interests of beneficiaries. This type of will is designed to address the complexities associated with wealthier estates, focusing on preserving assets, optimizing tax benefits, and ensuring an efficient transfer of wealth. The key elements of a Houston Texas Complex Will With Credit Shelter Marital Trust for Large Estates include a credit shelter trust and a marital trust. These two trust structures work in tandem to maximize estate tax savings and provide for the surviving spouse and other beneficiaries. 1. Credit Shelter Trust: Also known as a bypass trust or a family trust, a credit shelter trust allows the granter to allocate a portion of their estate tax exemption amount to the trust. This means that upon the granter's death, the assets placed within the trust will be sheltered from estate taxes. The surviving spouse can then access income generated from the trust while its principal remains protected. Using the credit shelter trust helps to diminish estate tax liability and ensures that the chosen beneficiaries ultimately receive a greater share of the estate. 2. Marital Trust: The marital trust, also referred to as a TIP trust (Qualified Terminable Interest Property), provides for the surviving spouse by granting them an income interest in the trust assets. This allows the spouse to receive income generated by the trust during their lifetime. The principal of the trust can also be accessed by the surviving spouse under certain circumstances, such as for healthcare or necessary expenses. However, the principal of the marital trust is not included in the surviving spouse's estate for estate tax purposes. Instead, it is subject to estate taxes only upon the spouse's death. Houston Texas Complex Will With Credit Shelter Marital Trusts for Large Estates can further include additional provisions to address unique circumstances and tailor the estate plan to the specific needs and goals of the granter. Some possible variations are: 1. Qualified Personnel Residence Trust (PRT): This type of trust allows the granter to transfer a primary residence or vacation home to a trust while retaining the right to reside in it for a predetermined period. This can help reduce the taxable estate while still allowing the granter to enjoy the property during their lifetime. 2. Generation-Skipping Trust (GST): A GST is designed to provide for multiple generations of beneficiaries while minimizing estate and generation-skipping transfer taxes. This trust can be used to skip one or more levels of beneficiaries, such as children, and pass the assets directly to grandchildren or other more remote descendants. It is particularly beneficial for estates with substantial wealth and long-term preservation goals. 3. Charitable Remainder Trust (CRT): For those wishing to support charitable causes while still providing for their loved ones, a CRT can be established. This trust allows the granter to donate assets to a charitable organization while retaining an income stream from the trust for a set period. This not only provides an income for the granter but also reduces estate taxes while benefiting the chosen charitable organization. In conclusion, a Houston Texas Complex Will With Credit Shelter Marital Trust for Large Estates is a comprehensive estate planning tool that combines various trust structures to optimize tax benefits, protect assets, and provide for the surviving spouse and beneficiaries. The specific type of trust utilized within this framework may vary depending on the granter's goals and unique circumstances, with options such as credit shelter trusts, marital trusts, Parts, GSTs, and CRTs offering further customization.

Houston Texas Complex Will With Credit Shelter Marital Trust For Large Estates

Description

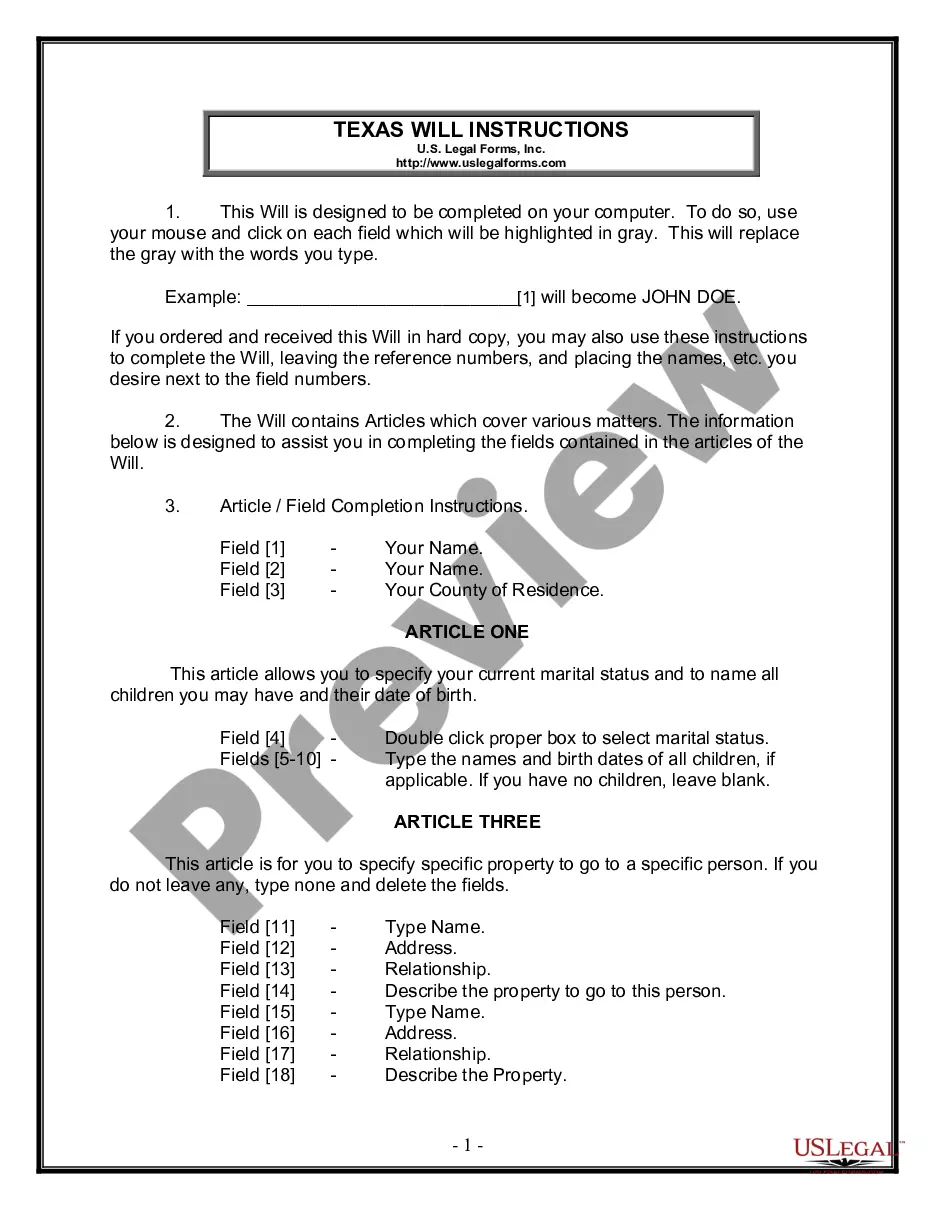

How to fill out Houston Texas Complex Will With Credit Shelter Marital Trust For Large Estates?

If you are looking for a valid form template, it’s extremely hard to choose a more convenient place than the US Legal Forms site – one of the most comprehensive libraries on the web. With this library, you can get thousands of templates for company and individual purposes by categories and states, or keywords. Using our high-quality search function, getting the newest Houston Texas Complex Will With Credit Shelter Marital Trust For Large Estates is as elementary as 1-2-3. Moreover, the relevance of each and every document is proved by a group of professional lawyers that regularly check the templates on our platform and revise them according to the newest state and county requirements.

If you already know about our system and have a registered account, all you need to get the Houston Texas Complex Will With Credit Shelter Marital Trust For Large Estates is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have opened the sample you need. Read its explanation and utilize the Preview feature (if available) to check its content. If it doesn’t meet your needs, use the Search option near the top of the screen to discover the needed document.

- Confirm your choice. Choose the Buy now option. After that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the template. Select the file format and save it on your device.

- Make adjustments. Fill out, modify, print, and sign the acquired Houston Texas Complex Will With Credit Shelter Marital Trust For Large Estates.

Every single template you add to your user profile does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to receive an additional copy for editing or printing, feel free to return and save it once again at any time.

Make use of the US Legal Forms professional library to get access to the Houston Texas Complex Will With Credit Shelter Marital Trust For Large Estates you were looking for and thousands of other professional and state-specific templates in a single place!