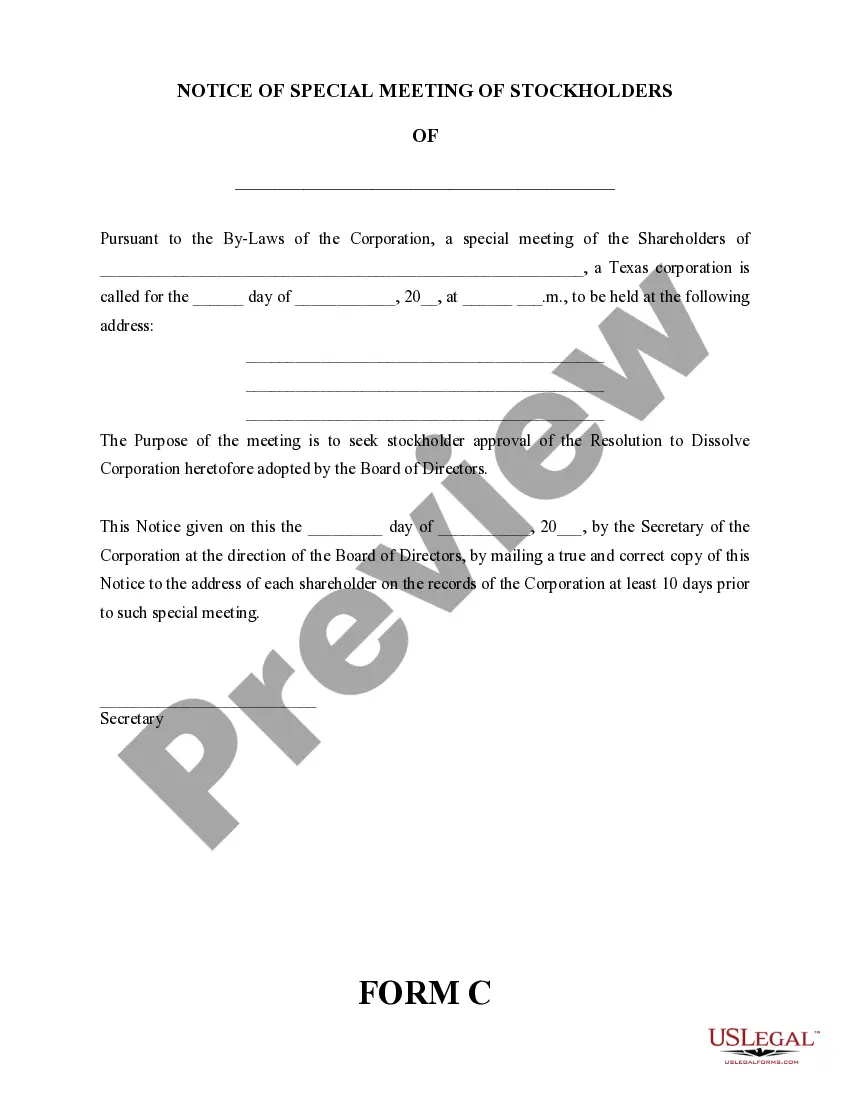

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Austin Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

If you are in search of a legitimate form, it’s impossible to discover a more user-friendly platform than the US Legal Forms website – one of the largest online repositories.

With this repository, you can locate numerous templates for organizational and personal uses by categories and regions, or keywords. Utilizing our high-quality search feature, finding the latest Austin Texas Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Moreover, the accuracy of every document is validated by a team of professional attorneys who consistently review the templates on our platform and refresh them according to the latest state and county laws.

Obtain the document. Indicate the file format and download it to your device.

Edit as needed. Complete, modify, print, and sign the acquired Austin Texas Dissolution Package to Dissolve Corporation.

- If you are already familiar with our platform and have a registered account, all you need to obtain the Austin Texas Dissolution Package to Dissolve Corporation is to Log In to your user profile and click the Download button.

- If this is your first time using US Legal Forms, simply follow the instructions below.

- Ensure you have found the template you require. Review its description and use the Preview feature (if available) to examine its contents. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to locate the necessary document.

- Verify your choice. Click the Buy now button. Next, select your preferred pricing plan and provide the necessary details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).

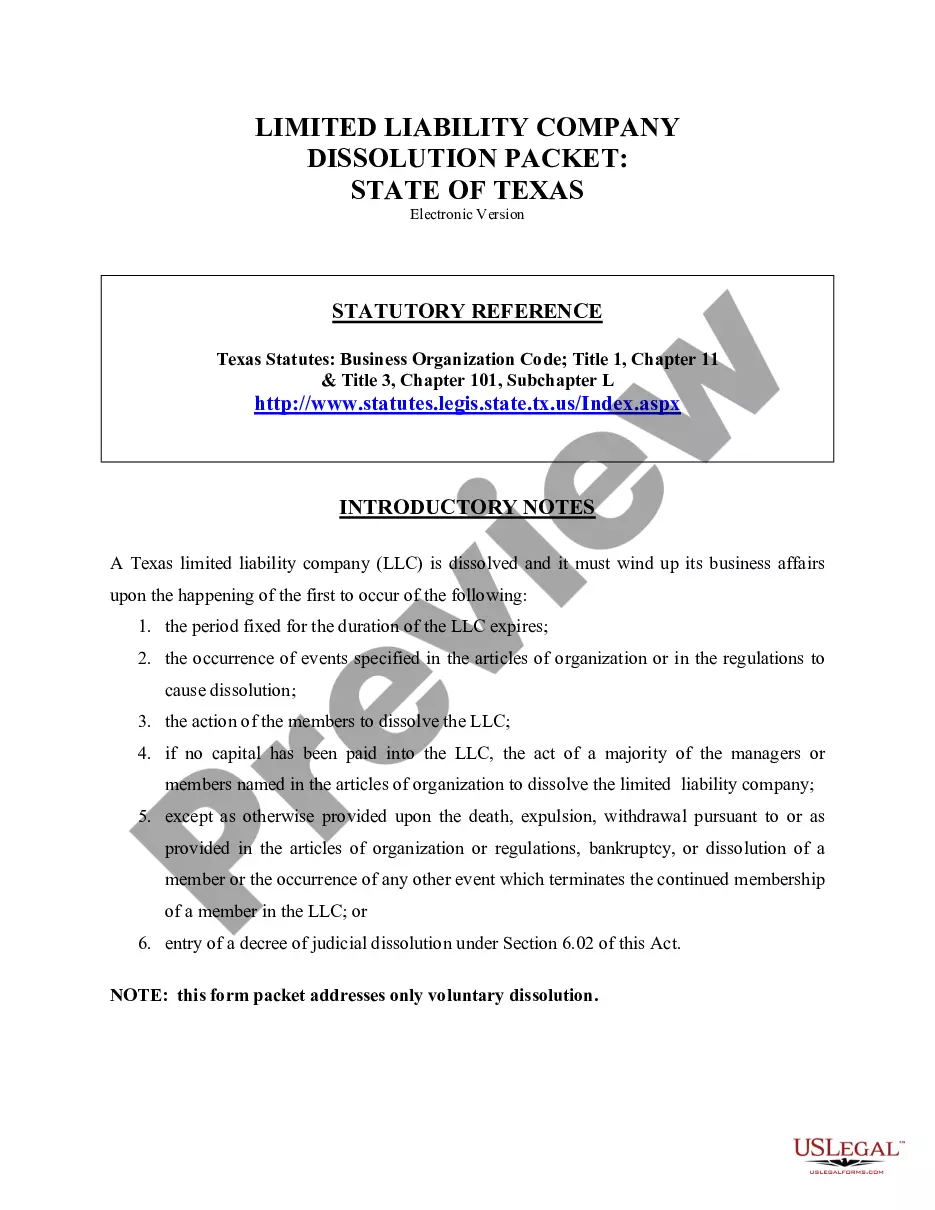

Dissolution: The beginning of the end, not the end itself. What it is and what it isn't. Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence.

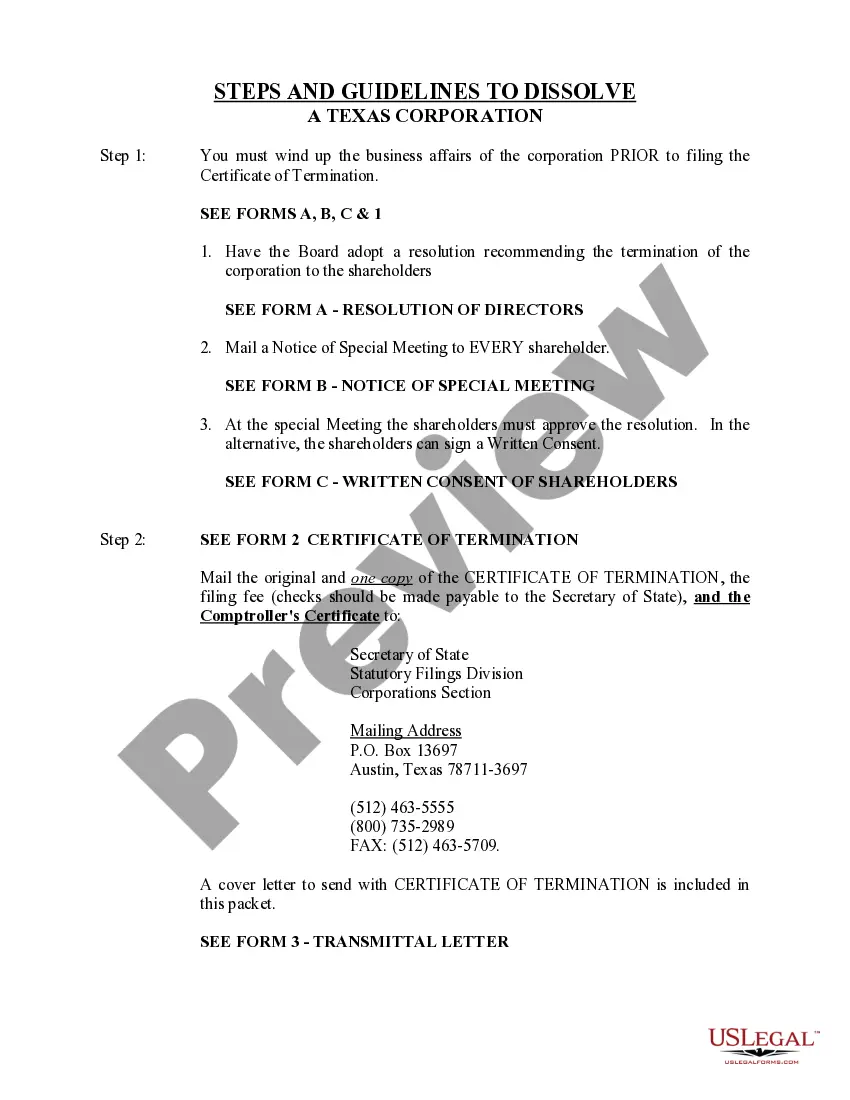

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee.

How do you dissolve a Texas corporation? To dissolve your Texas corporation, you file Form 651 Certificate of Termination of Domestic Entity and accompany that with a tax clearance certificate from the Texas Comptroller of Public Accounts indicating that all taxes have been paid by the entity.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

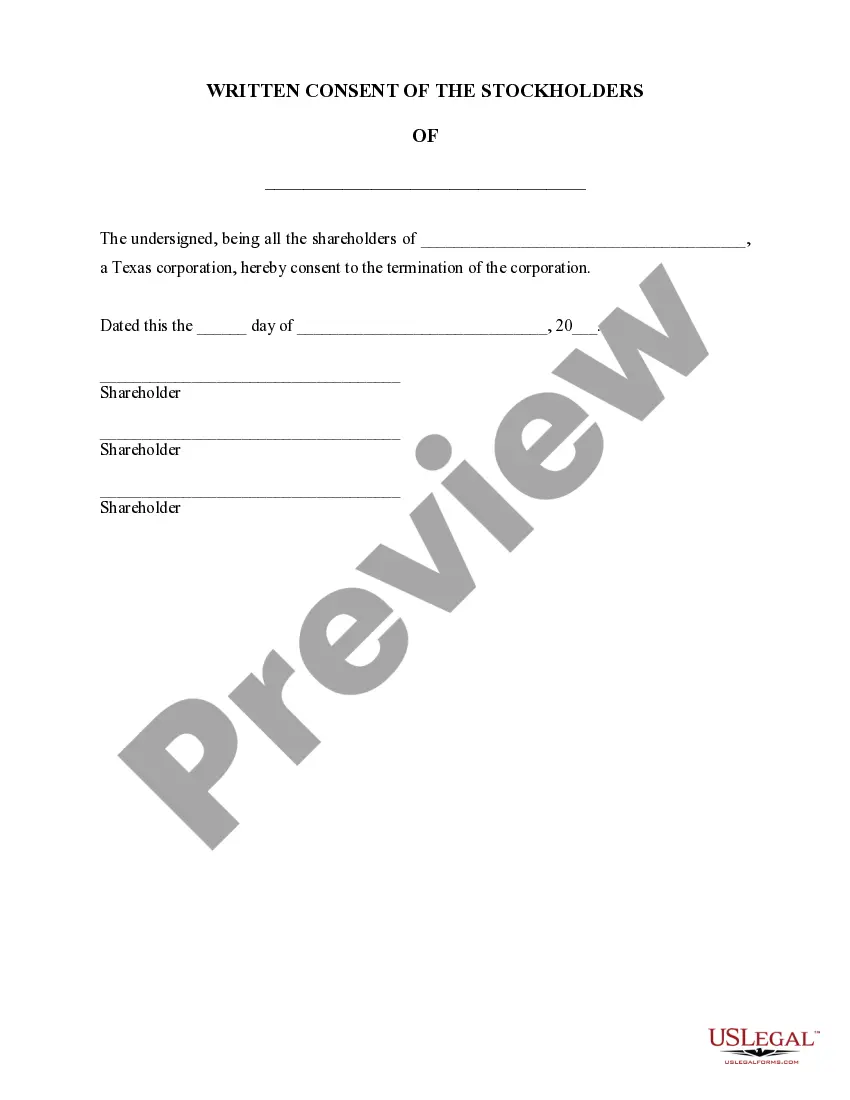

In exchange for getting back their investment (in full or part), the shareholders return their shares to the company, which are then canceled. If a company returns any money to its shareholders while still having a debt outstanding, the creditor can sue, and the shareholders may have to return the received amounts.

Summary chart for terminating a Texas entity. Texas Domestic Entity TypeGoverned by BOCFeeFor-profit or professional corporation that neither commenced business nor issued sharesForm 651 Word, PDF$40For-profit or professional corporation that commenced business and/or issued sharesForm 651 Word, PDF$405 more rows

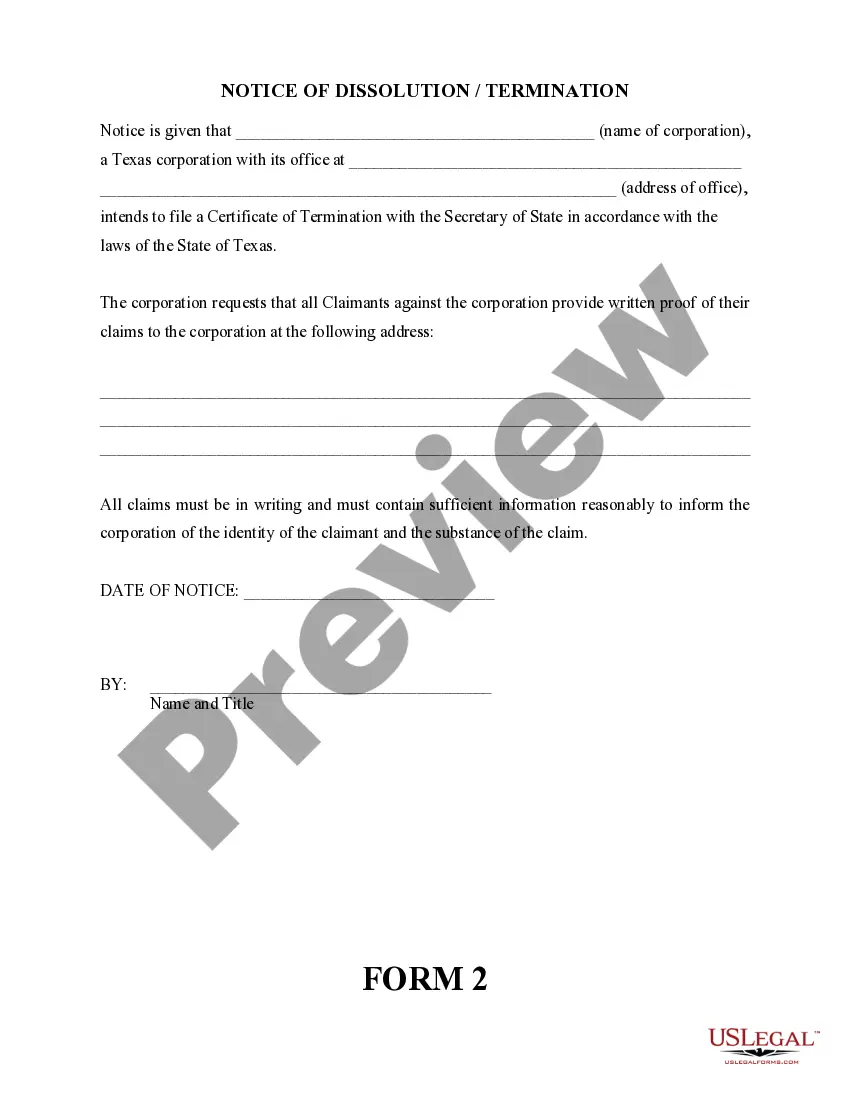

Dissolution of a Corporation is the termination of a corporation, either a) voluntarily by resolution, paying debts, distributing assets, and filing dissolution documents with the Secretary of State; or b) by state suspension for not paying corporate taxes or some other action of the government.

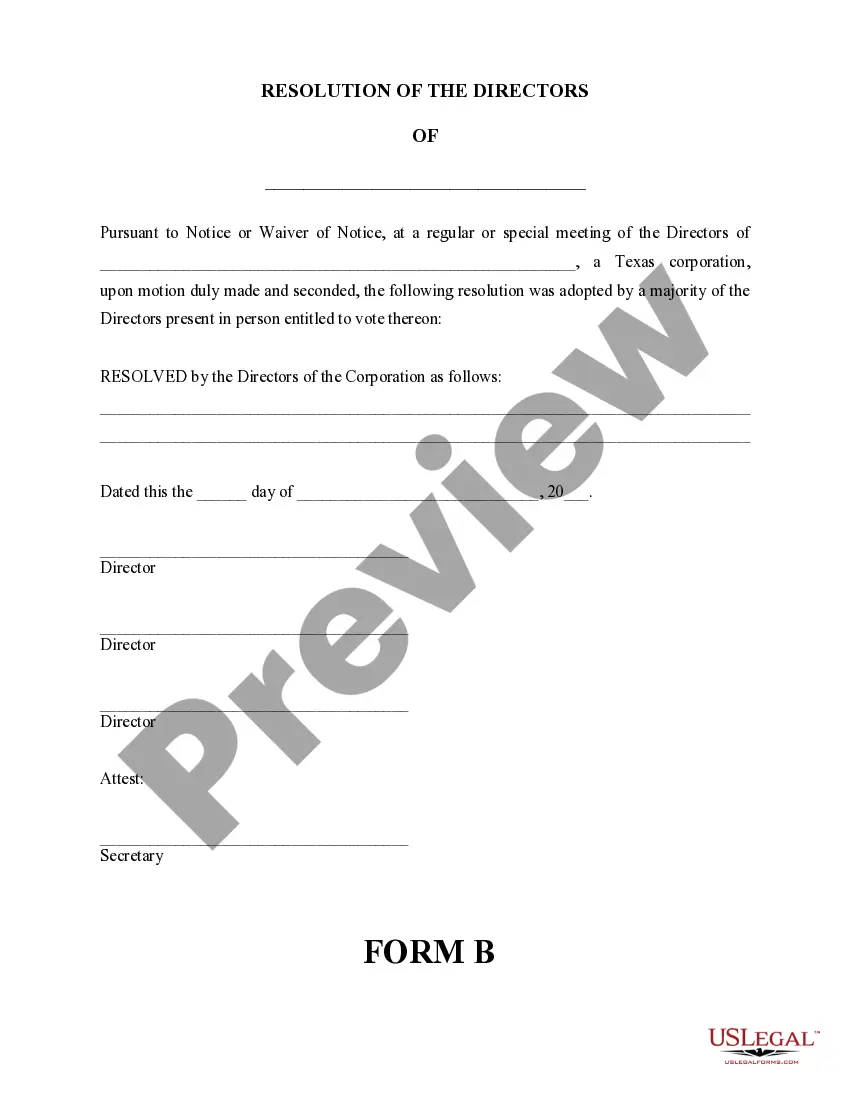

Steps to Dissolve a Corporation in Texas Step 1: Initiate the Process of Termination.Step 2: The ?Wind Up? Process.Step 3: Obtain a Certificate of Account Status.Step 4: File a Certificate of Termination.Step 5: Inform the IRS.Step 6: Close Your Accounts.Step 7: Cancel Any Licenses.

How much does it cost to dissolve a California business? There is no fee to file the California dissolution forms.