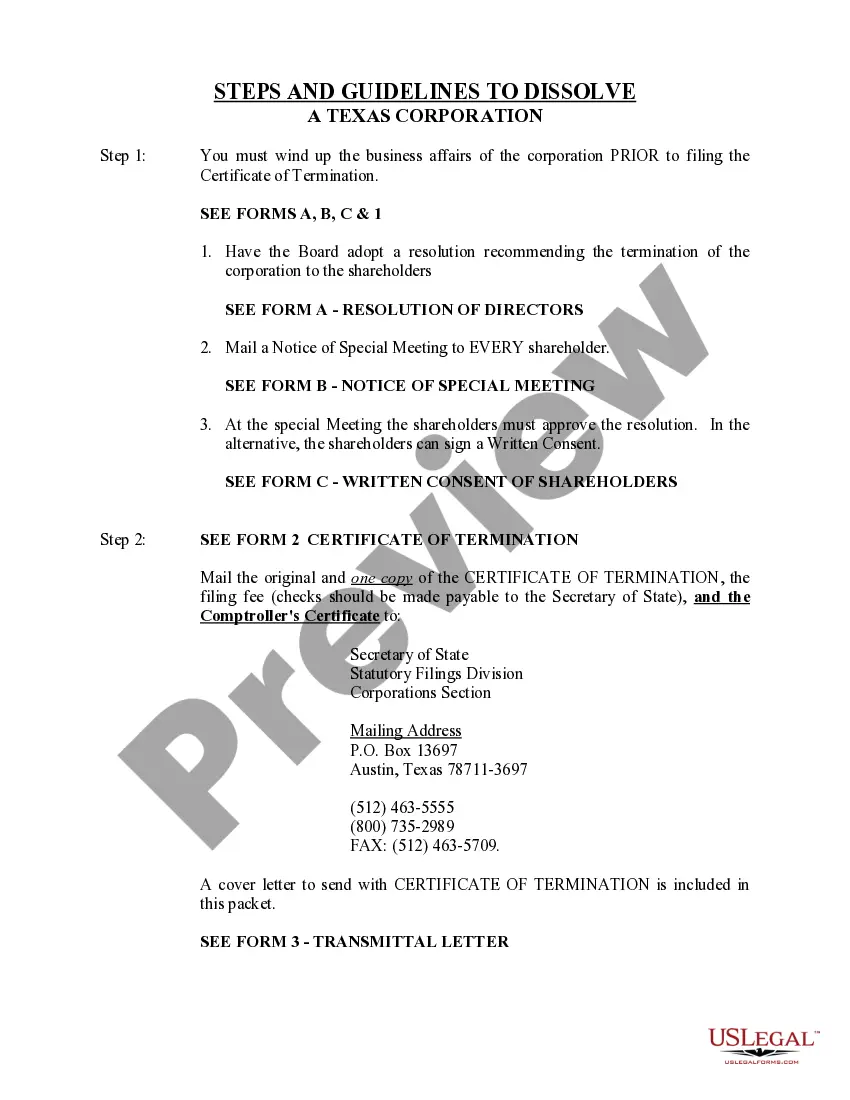

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

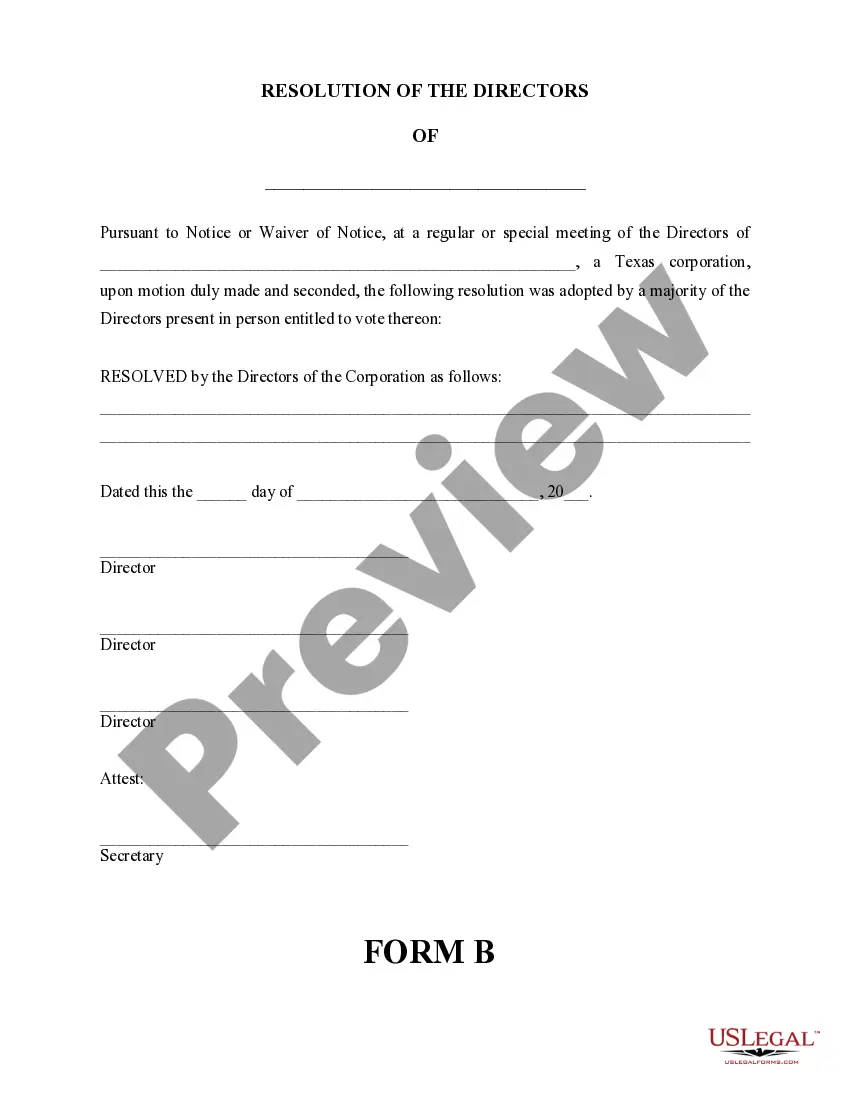

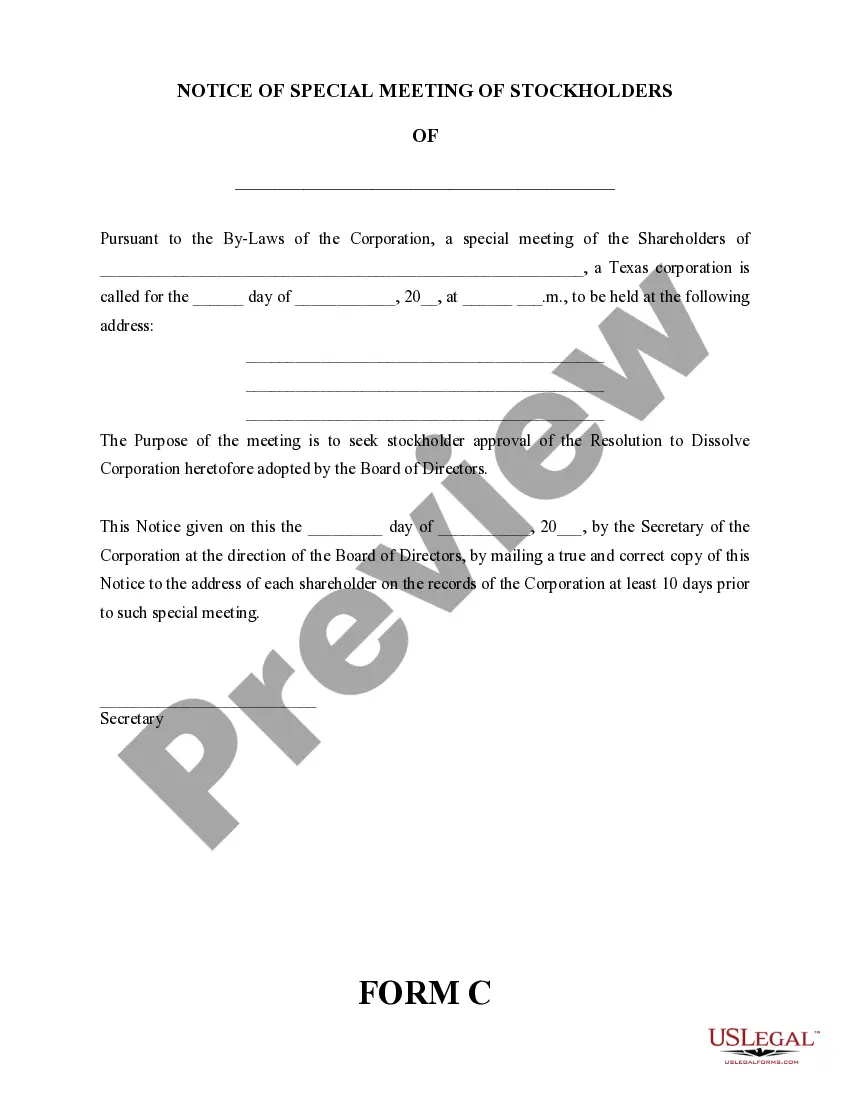

Bexar Texas Dissolution Package to Dissolve Corporation is a comprehensive set of legal documents and services designed to guide business owners through the process of dissolving their corporation in Bexar County, Texas. This package provides all the necessary paperwork and guidance to ensure a smooth and proper dissolution in compliance with the applicable laws and regulations. The Bexar Texas Dissolution Package to Dissolve Corporation includes various essential documents that are crucial for terminating the corporation's existence legally. These documents typically consist of: 1. Certificate of Dissolution: This document serves as official proof that the corporation is being dissolved and is no longer operating. 2. Articles of Dissolution: These papers provide detailed information about the corporation, such as its name, date of incorporation, and the reason for dissolution. 3. Board Resolution: A formal resolution passed by the corporation's board of directors, indicating their unanimous decision to dissolve and liquidate the corporation's assets. 4. Notice of Dissolution: This document is used to notify creditors, shareholders, and other interested parties about the corporation's dissolution. 5. Tax Clearance: To ensure the corporation has met all its tax obligations, it is necessary to obtain a tax clearance from the appropriate tax authorities. 6. Asset Distribution Agreement: If the corporation has assets to distribute, this agreement outlines how they will be allocated among the shareholders or stakeholders. 7. Final Tax Returns: The package may also include guidance on filing final tax returns and dissolving any tax permits and licenses held by the corporation. It's worth noting that Bexar County, Texas, does not have different types of dissolution packages specifically tailored to certain types of corporations. The dissolution package mentioned above applies to all types of corporations, including C Corporations, S Corporations, and Limited Liability Companies (LCS). To take advantage of the Bexar Texas Dissolution Package to Dissolve Corporation, business owners can consult an attorney or utilize online legal service providers specializing in business formations and dissolution. These services typically offer customizable templates and step-by-step instructions, making the dissolution process more accessible and cost-effective for corporation owners in Bexar County, Texas.Bexar Texas Dissolution Package to Dissolve Corporation is a comprehensive set of legal documents and services designed to guide business owners through the process of dissolving their corporation in Bexar County, Texas. This package provides all the necessary paperwork and guidance to ensure a smooth and proper dissolution in compliance with the applicable laws and regulations. The Bexar Texas Dissolution Package to Dissolve Corporation includes various essential documents that are crucial for terminating the corporation's existence legally. These documents typically consist of: 1. Certificate of Dissolution: This document serves as official proof that the corporation is being dissolved and is no longer operating. 2. Articles of Dissolution: These papers provide detailed information about the corporation, such as its name, date of incorporation, and the reason for dissolution. 3. Board Resolution: A formal resolution passed by the corporation's board of directors, indicating their unanimous decision to dissolve and liquidate the corporation's assets. 4. Notice of Dissolution: This document is used to notify creditors, shareholders, and other interested parties about the corporation's dissolution. 5. Tax Clearance: To ensure the corporation has met all its tax obligations, it is necessary to obtain a tax clearance from the appropriate tax authorities. 6. Asset Distribution Agreement: If the corporation has assets to distribute, this agreement outlines how they will be allocated among the shareholders or stakeholders. 7. Final Tax Returns: The package may also include guidance on filing final tax returns and dissolving any tax permits and licenses held by the corporation. It's worth noting that Bexar County, Texas, does not have different types of dissolution packages specifically tailored to certain types of corporations. The dissolution package mentioned above applies to all types of corporations, including C Corporations, S Corporations, and Limited Liability Companies (LCS). To take advantage of the Bexar Texas Dissolution Package to Dissolve Corporation, business owners can consult an attorney or utilize online legal service providers specializing in business formations and dissolution. These services typically offer customizable templates and step-by-step instructions, making the dissolution process more accessible and cost-effective for corporation owners in Bexar County, Texas.