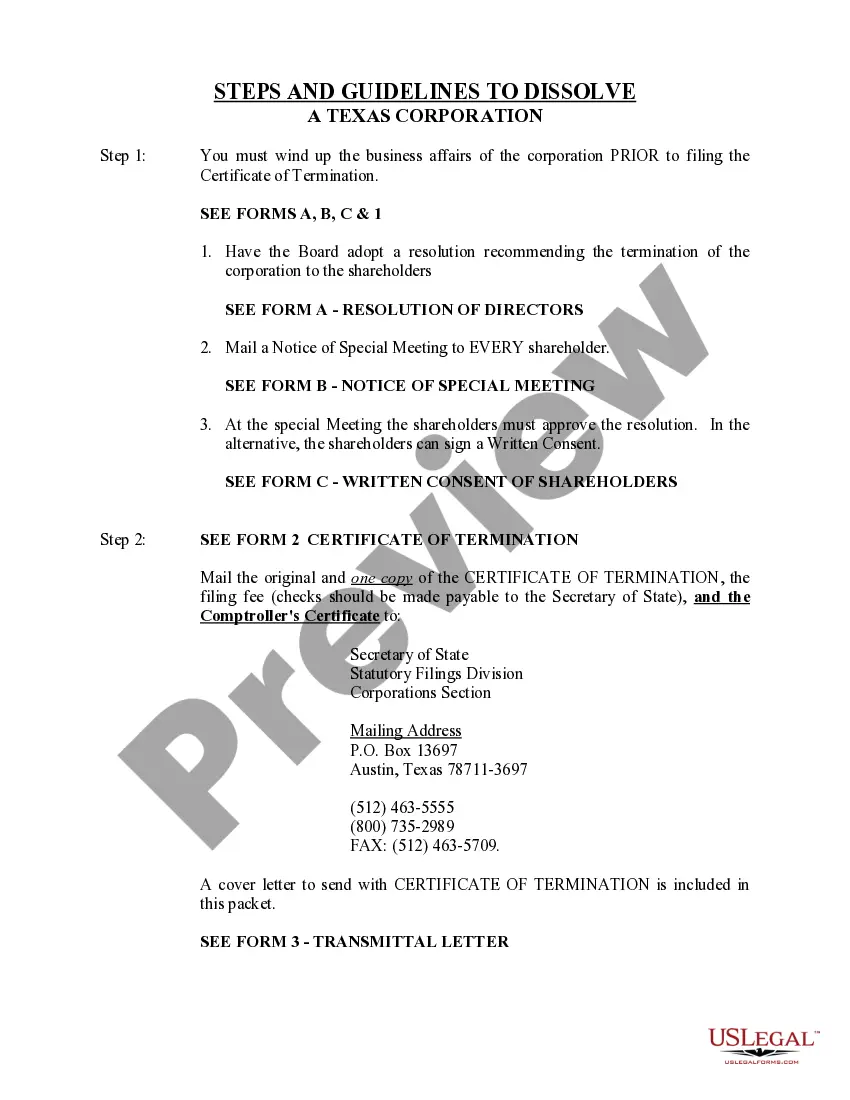

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

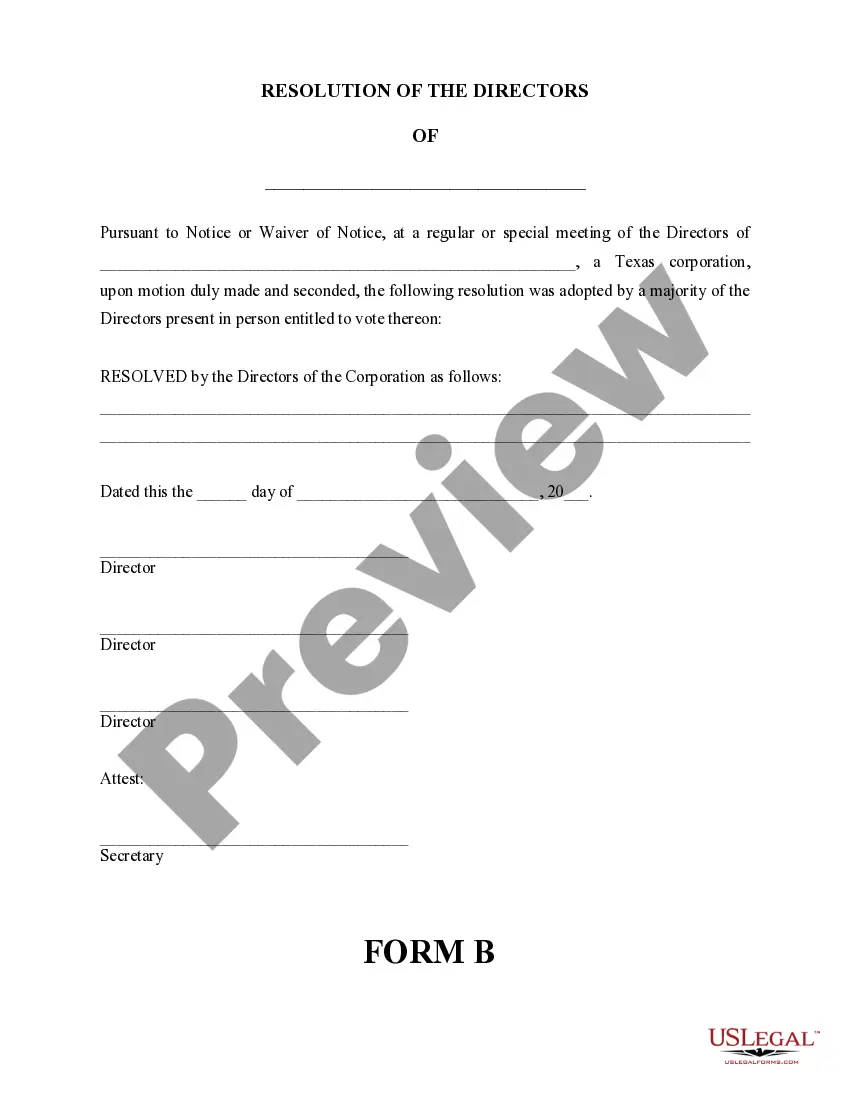

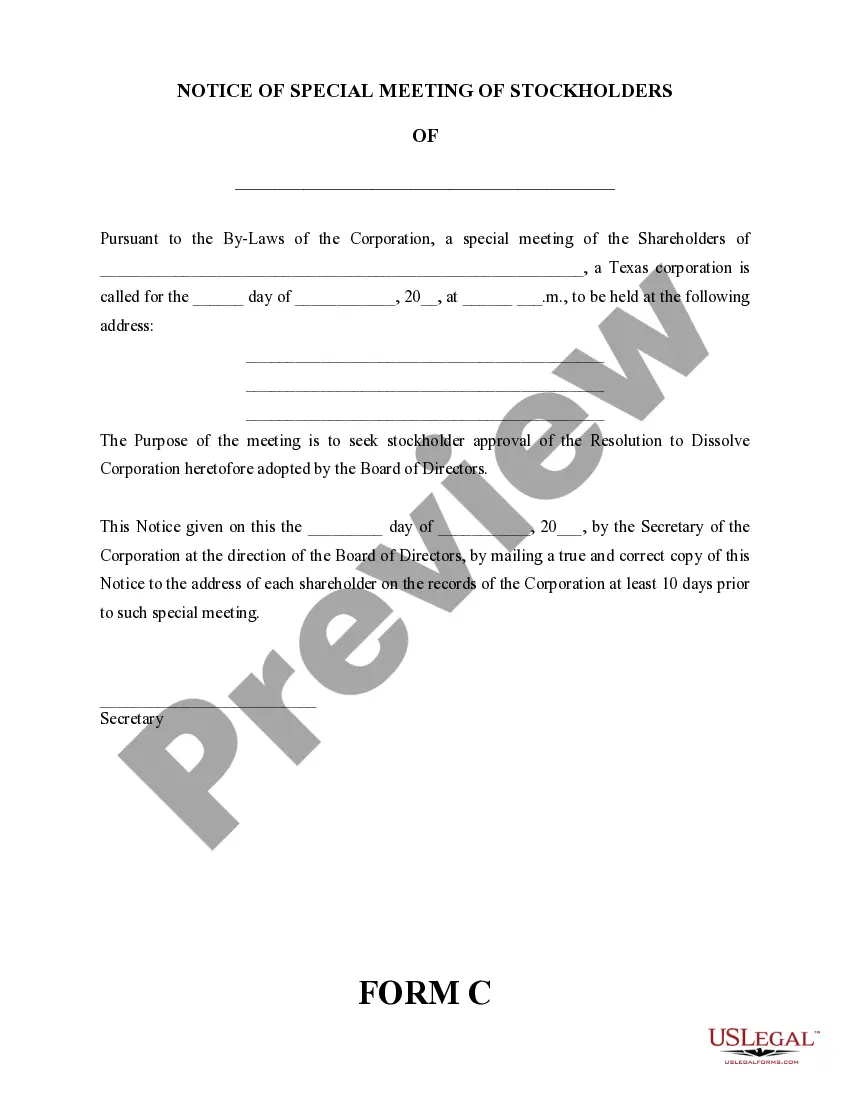

The Houston Texas Dissolution Package is a comprehensive set of legal documents and services specifically designed for the dissolution of a corporation in Houston, Texas. This package includes all the necessary paperwork and guidance required to effectively terminate and close down a corporation, ensuring compliance with relevant state laws and regulations. The dissolution process involves the formal and legal termination of a corporation's existence, including the cessation of business activities, the settlement of liabilities, and the distribution of remaining assets to shareholders. This package provides the necessary tools to efficiently navigate through this complex process and protect the interests of the corporation and its owners. The Houston Texas Dissolution Package typically includes a variety of essential legal documents tailored to meet the specific requirements of dissolving a corporation in Houston, Texas. These documents often include: 1. Certificate of Dissolution: This document formally notifies state authorities of the corporation's intention to dissolve and provides details about the company and its shareholders. 2. Articles of Dissolution: A legal document that outlines the reasons for dissolving the corporation and confirms that all required formalities have been completed. 3. Notice to Creditors: A formal notice that informs the corporation's creditors of its intention to dissolve, providing a designated time period for creditors to submit any outstanding claims. 4. Tax Forms: Various tax-related forms required by the Texas Comptroller of Public Accounts and the Internal Revenue Service (IRS) to report the termination of the corporation's operations and address any tax liabilities. 5. Resolution of Dissolution: A board resolution that formally approves the dissolution of the corporation, demonstrating the decision-making processes and authority behind the dissolution. 6. Shareholder Agreements: Customized agreements that outline the process for distributing remaining assets to shareholders and settling any outstanding debts or obligations. 7. Waiver of Notice: A legal document signed by the corporation's owners, waiving any notification requirements for meetings, resolutions, or actions related to the dissolution process. Additionally, depending on the specific circumstances of the corporation, the Houston Texas Dissolution Package may offer supplementary services such as legal consultations, assistance with the preparation and filing of required documents, and guidance throughout the dissolution process to ensure compliance and mitigate potential legal risks. Overall, the Houston Texas Dissolution Package provides a comprehensive solution for corporations seeking to terminate their operations and formally dissolve in Houston, Texas. The package streamlines the dissolution process, helps protect the interests of shareholders, and ensures compliance with all necessary legal requirements.