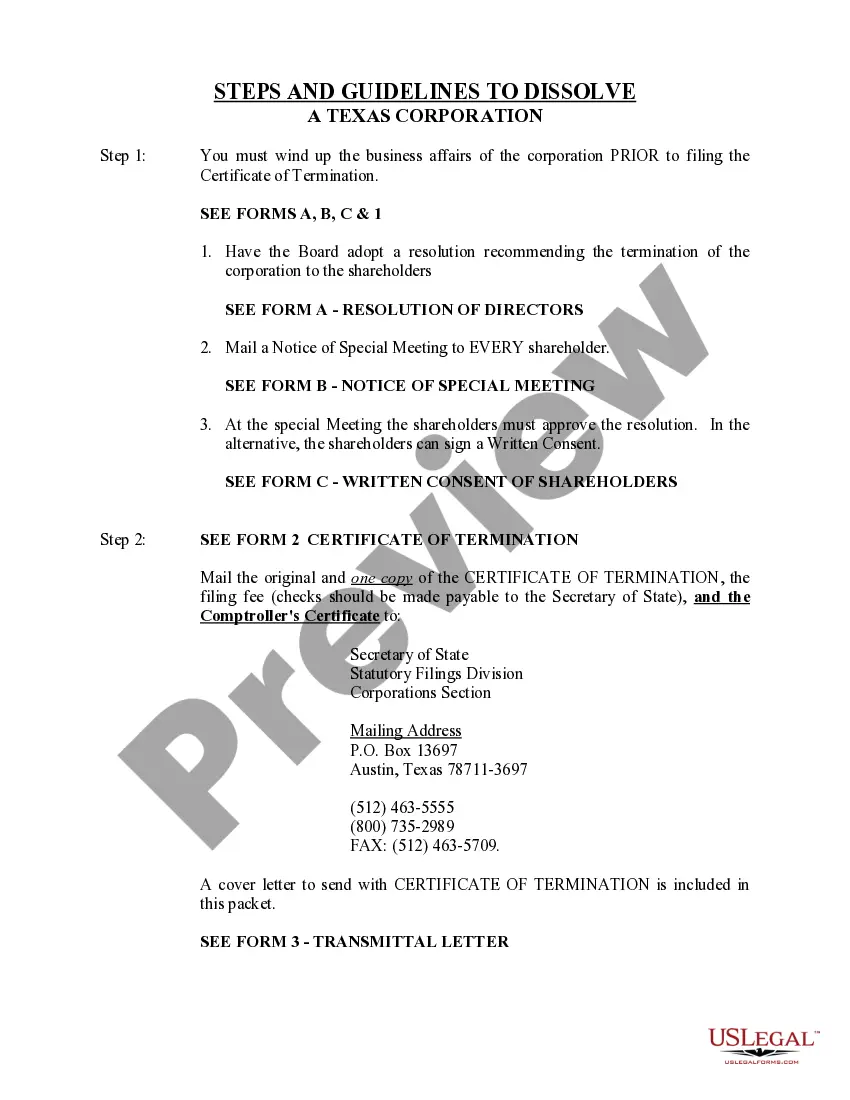

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

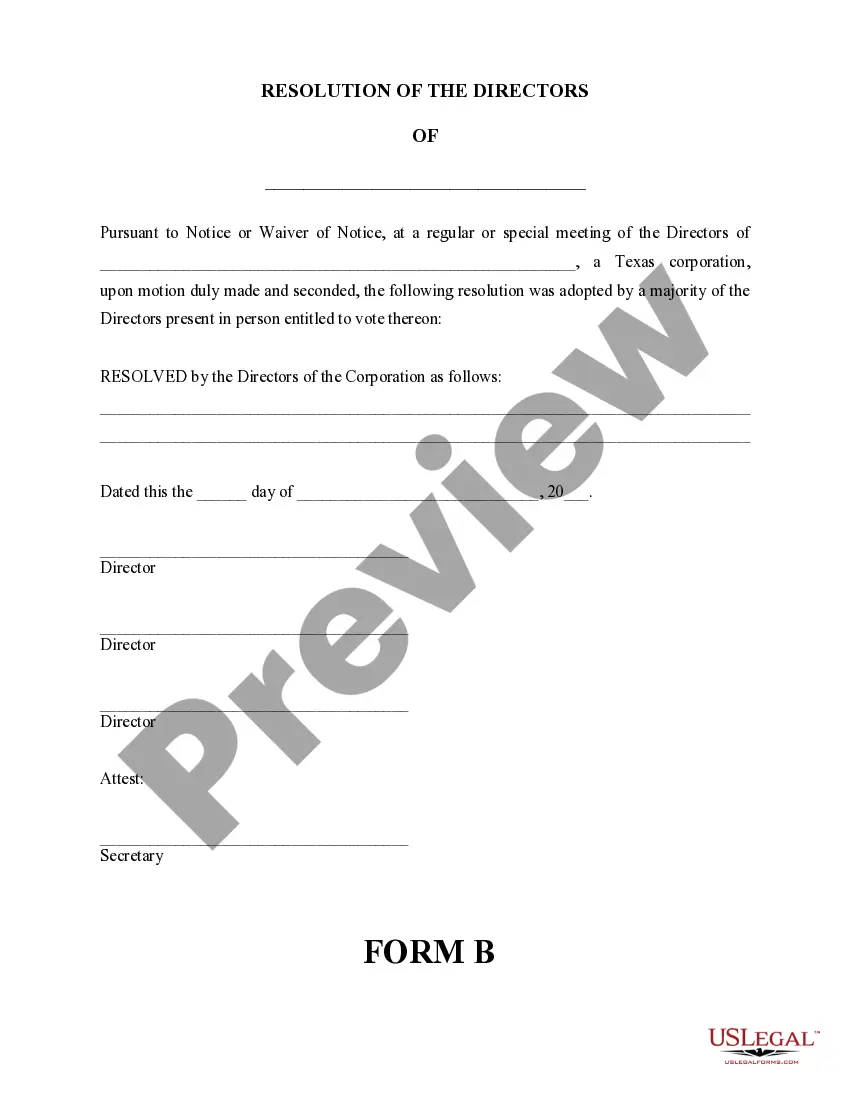

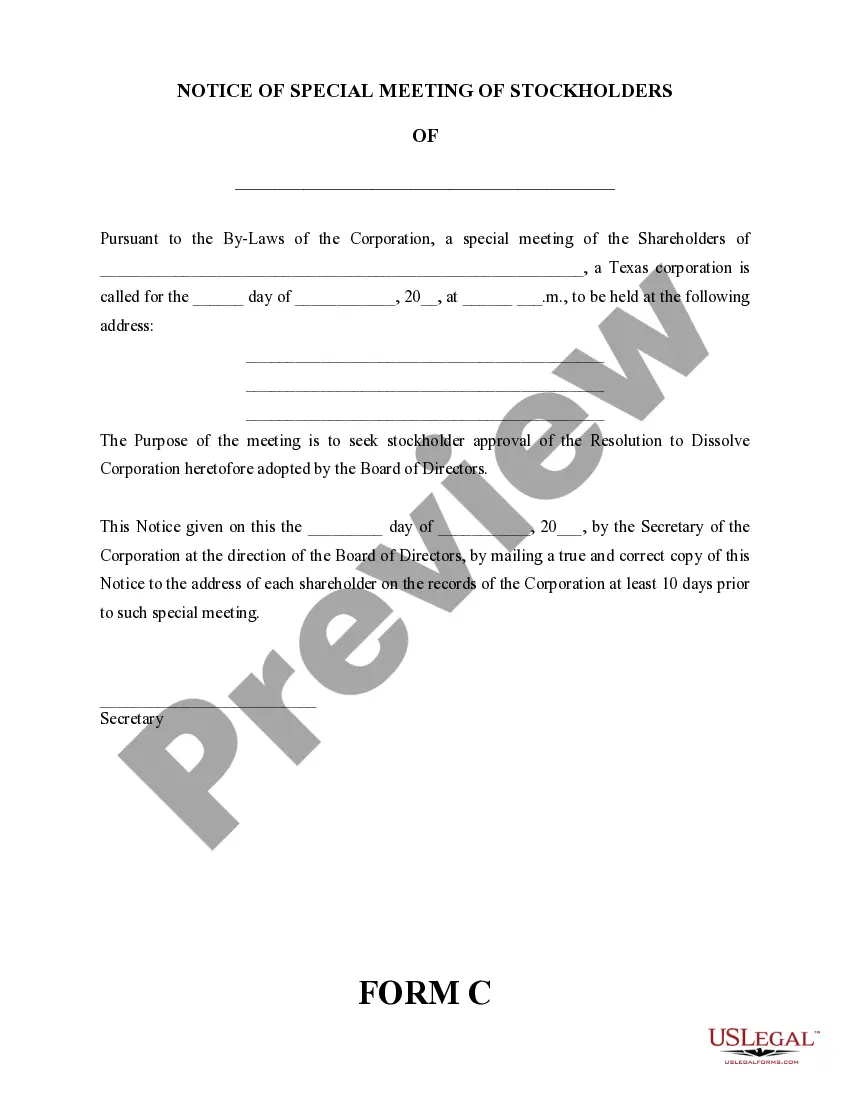

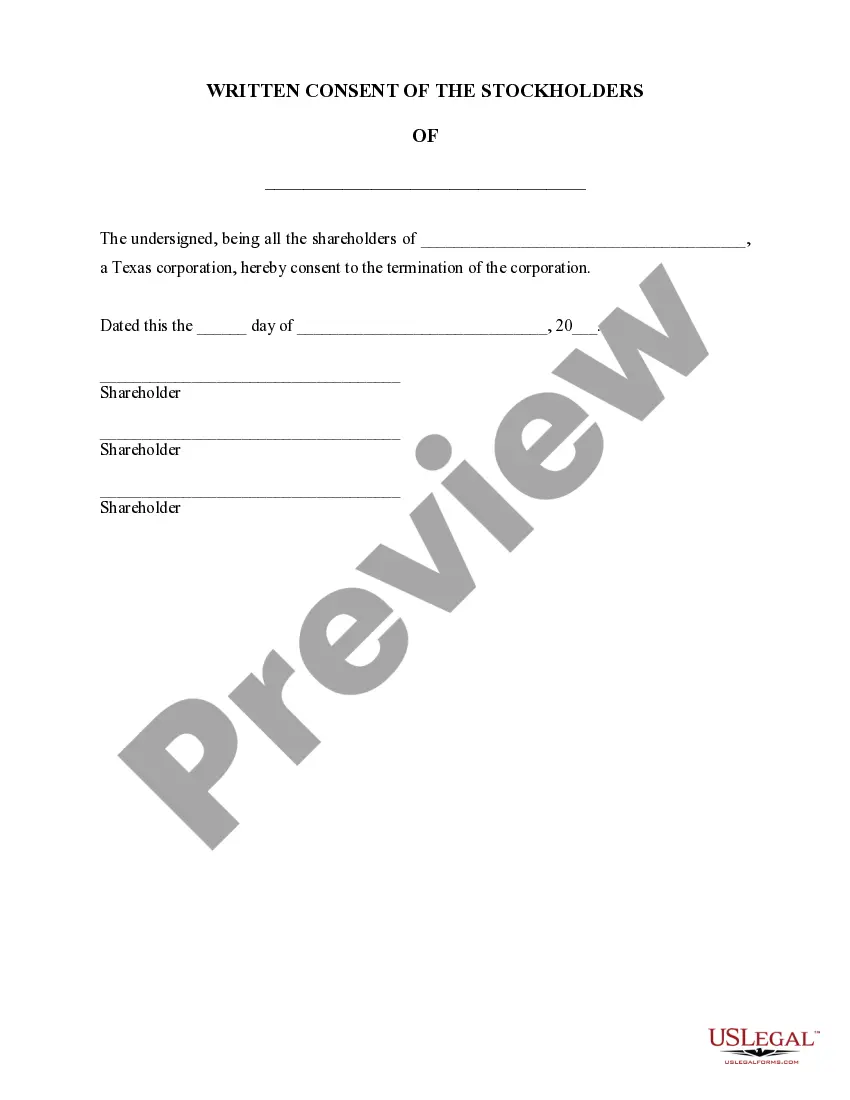

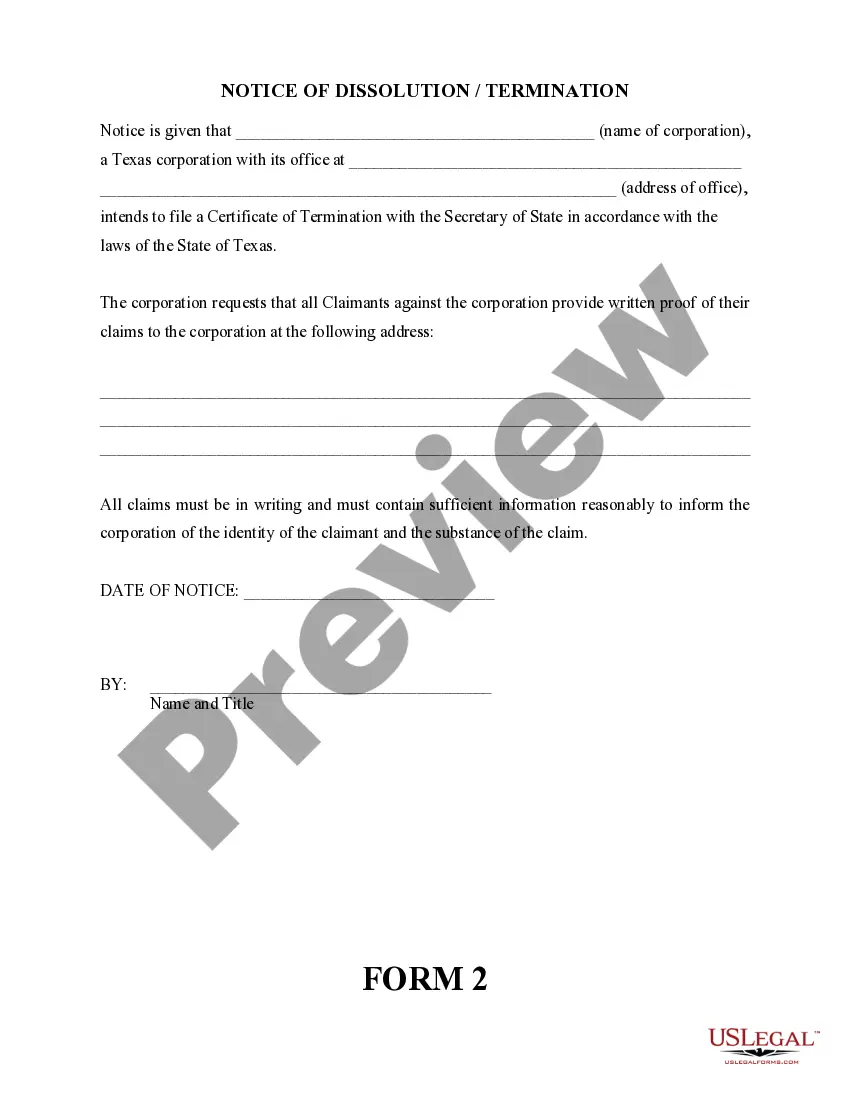

The Lewisville Texas Dissolution Package to Dissolve Corporation is a comprehensive set of legal documents and forms intended to assist corporations in Texas with the dissolution process. When a corporation decides to cease its operations and officially dissolve, it is crucial to follow the correct legal procedures in order to avoid any potential liabilities or legal issues. This dissolution package includes all the necessary documentation required by the State of Texas to properly dissolve a corporation. It offers a convenient and straightforward solution for corporations based in Lewisville, Texas, seeking a hassle-free dissolution process. Some essential components typically included in the Lewisville Texas Dissolution Package to Dissolve Corporation are: 1. Certificate of Dissolution: This document is the foremost requirement for dissolving a corporation and officially terminates its existence. It contains vital details such as the corporation's name, address, date of dissolution, and a statement affirming that all debts and obligations have been settled. 2. Articles of Dissolution: These are legal documents that provide a more detailed account of the corporation's dissolution, explaining the reason and method of dissolution. It is usually filed with the Texas Secretary of State and requires specific information about the corporation's structure and shareholders. 3. Notice of Dissolution: This notice serves as an announcement to interested parties, including creditors, suppliers, and other stakeholders, informing them about the corporation's impending dissolution. It may be published in local newspapers or sent directly to known parties associated with the business. 4. Tax Clearance: Before dissolving, corporations in Texas must obtain tax clearance from various state agencies, such as the State Comptroller's office, to ensure all tax obligations have been met. The dissolution package may also include necessary forms and instructions for obtaining tax clearance. 5. Wind-Up Completion: This includes the necessary steps to finalize any remaining business activities, distribute remaining assets to shareholders, settle remaining liabilities, and close bank accounts, licenses, or permits associated with the corporation. While the specific contents of the Lewisville Texas Dissolution Package may vary, it is designed to provide corporations with everything required to smoothly navigate the dissolution process. It is crucial to choose a dissolution package tailored to the state of Texas and, if applicable, the city of Lewisville, as different states may have different requirements and procedures for dissolution. By utilizing a comprehensive Lewisville Texas Dissolution Package, corporations can ensure a legally compliant dissolution process, protecting their directors, officers, and shareholders from potential liabilities that may arise after dissolution.The Lewisville Texas Dissolution Package to Dissolve Corporation is a comprehensive set of legal documents and forms intended to assist corporations in Texas with the dissolution process. When a corporation decides to cease its operations and officially dissolve, it is crucial to follow the correct legal procedures in order to avoid any potential liabilities or legal issues. This dissolution package includes all the necessary documentation required by the State of Texas to properly dissolve a corporation. It offers a convenient and straightforward solution for corporations based in Lewisville, Texas, seeking a hassle-free dissolution process. Some essential components typically included in the Lewisville Texas Dissolution Package to Dissolve Corporation are: 1. Certificate of Dissolution: This document is the foremost requirement for dissolving a corporation and officially terminates its existence. It contains vital details such as the corporation's name, address, date of dissolution, and a statement affirming that all debts and obligations have been settled. 2. Articles of Dissolution: These are legal documents that provide a more detailed account of the corporation's dissolution, explaining the reason and method of dissolution. It is usually filed with the Texas Secretary of State and requires specific information about the corporation's structure and shareholders. 3. Notice of Dissolution: This notice serves as an announcement to interested parties, including creditors, suppliers, and other stakeholders, informing them about the corporation's impending dissolution. It may be published in local newspapers or sent directly to known parties associated with the business. 4. Tax Clearance: Before dissolving, corporations in Texas must obtain tax clearance from various state agencies, such as the State Comptroller's office, to ensure all tax obligations have been met. The dissolution package may also include necessary forms and instructions for obtaining tax clearance. 5. Wind-Up Completion: This includes the necessary steps to finalize any remaining business activities, distribute remaining assets to shareholders, settle remaining liabilities, and close bank accounts, licenses, or permits associated with the corporation. While the specific contents of the Lewisville Texas Dissolution Package may vary, it is designed to provide corporations with everything required to smoothly navigate the dissolution process. It is crucial to choose a dissolution package tailored to the state of Texas and, if applicable, the city of Lewisville, as different states may have different requirements and procedures for dissolution. By utilizing a comprehensive Lewisville Texas Dissolution Package, corporations can ensure a legally compliant dissolution process, protecting their directors, officers, and shareholders from potential liabilities that may arise after dissolution.