The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

Plano Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

If you have previously utilized our service, Log In to your account and retrieve the Plano Texas Dissolution Package to Dissolve Corporation on your device by selecting the Download button. Verify that your subscription is active. If not, renew it as per your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have indefinite access to all the documents you have purchased: you can locate them in your profile under the My documents section whenever you need to access them again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or business requirements!

- Confirm you’ve found the correct document. Review the description and use the Preview feature, if accessible, to verify if it aligns with your requirements. If it doesn’t fit, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription option.

- Create an account and proceed with a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Access your Plano Texas Dissolution Package to Dissolve Corporation. Choose the file format for your document and store it on your device.

- Fill out your sample. Print it or utilize online professional editors to complete and electronically sign it.

Form popularity

FAQ

To close an LLC in Texas, you need to follow a structured process. Begin by holding a vote among the members to approve the dissolution. After that, you must file the necessary dissolution documents with the Texas Secretary of State. A Plano Texas Dissolution Package to Dissolve Corporation can help you streamline this procedure, making sure you comply with all state regulations and avoid potential issues.

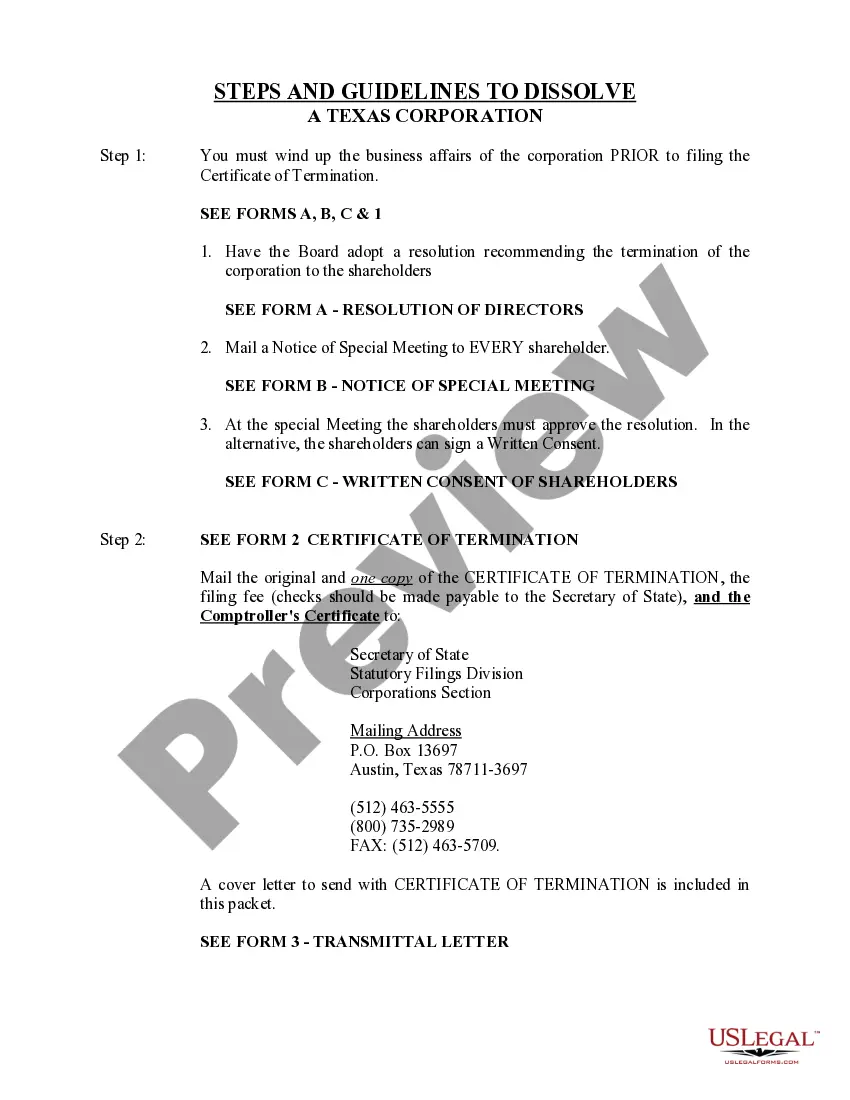

Shutting down a company in Texas involves several steps. First, you must hold a meeting with your board of directors or members to agree on the dissolution. After obtaining approval, you should file a Certificate of Termination with the Texas Secretary of State. Utilizing a Plano Texas Dissolution Package to Dissolve Corporation can guide you through these steps and ensure that you complete all required paperwork correctly.

Dissolving a corporation does not automatically trigger an audit, but it can draw attention if there are inconsistencies in your filings or if your company previously had issues with the IRS. Keeping your records clear and transparent is crucial, especially when you utilize the 'Plano Texas Dissolution Package to Dissolve Corporation' for proper documentation. Maintaining compliance during this phase can help mitigate any unforeseen audits.

The dissolution process typically starts with a formal vote to dissolve the company followed by filing the necessary documents with state authorities. You'll also need to address any outstanding obligations, including debts to creditors. The 'Plano Texas Dissolution Package to Dissolve Corporation' simplifies this process, providing you with everything needed to make dissolution as efficient as possible.

To close AC Corp with the IRS, you need to file your final tax return and check the box indicating it is your last return. Ensure that all tax liabilities are settled, and distribute any remaining assets to shareholders. Following these steps while using the 'Plano Texas Dissolution Package to Dissolve Corporation' streamlines the process of notifying the IRS and completing all necessary documentation.

Filling out form 651 requires accurate information about your corporation, including its name, the reason for dissolution, and the date of the resolution. Ensure that you gather the necessary details before starting and take your time to avoid mistakes. If you're unsure, the 'Plano Texas Dissolution Package to Dissolve Corporation' can guide you through the specifics of filling out form 651 accurately.

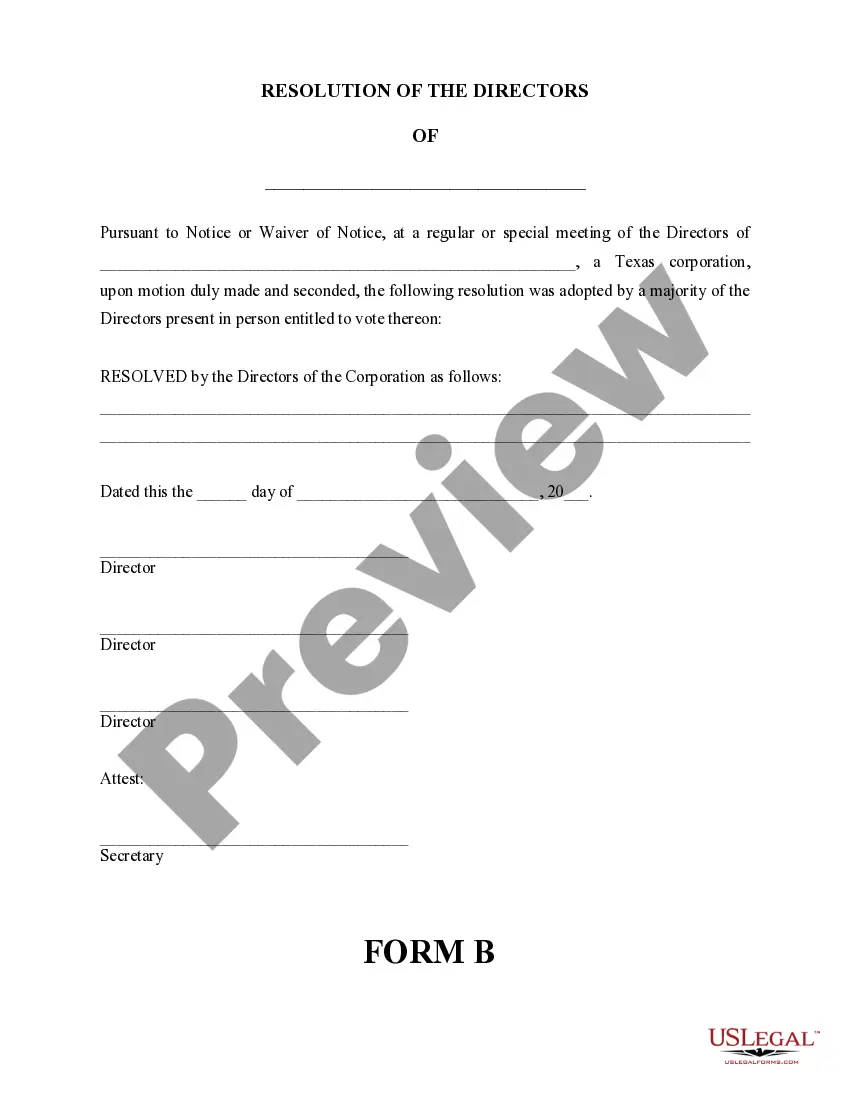

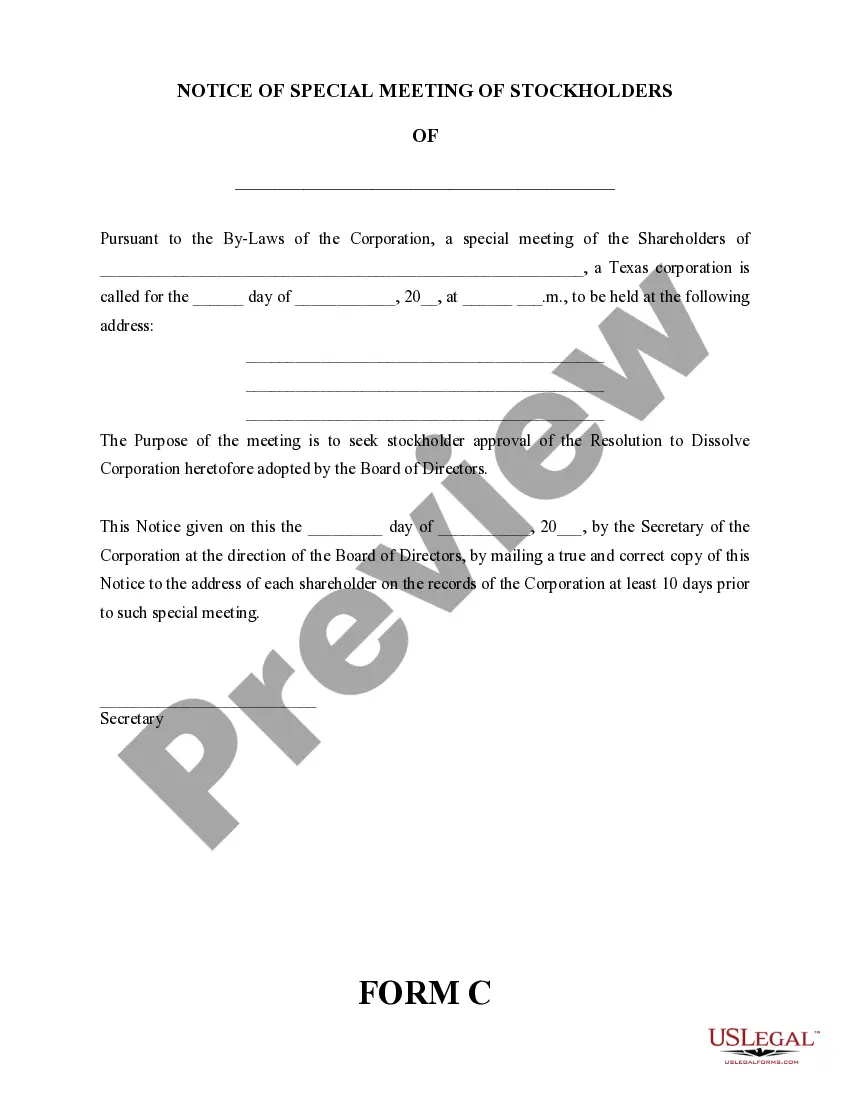

Dissolving a corporation involves several steps to ensure compliance with state laws. First, you will need to hold a meeting with your corporation's board and obtain a resolution to dissolve. After resolving to dissolve, you must file the appropriate paperwork, like the 'Plano Texas Dissolution Package to Dissolve Corporation,' with the Texas Secretary of State. Finally, notify creditors and settle debts before closing the business.

Dissolving a corporation in Texas consists of several key steps. First, gather approval from your board of directors and shareholders regarding the decision to dissolve. Next, file the necessary documents, including a certificate of termination, with the state. Finally, settle any outstanding debts and distribute remaining assets. A Plano Texas Dissolution Package to Dissolve Corporation can make these steps clearer and help ensure a smooth transition.

To shut down a corporation in Texas, you first need to adopt a resolution for dissolution by either the board of directors or the shareholders. Once approved, you must file a certificate of termination with the Secretary of State. Additionally, ensure that all tax obligations are addressed to avoid any future liabilities. Consider using a Plano Texas Dissolution Package to Dissolve Corporation to simplify the process and ensure compliance.