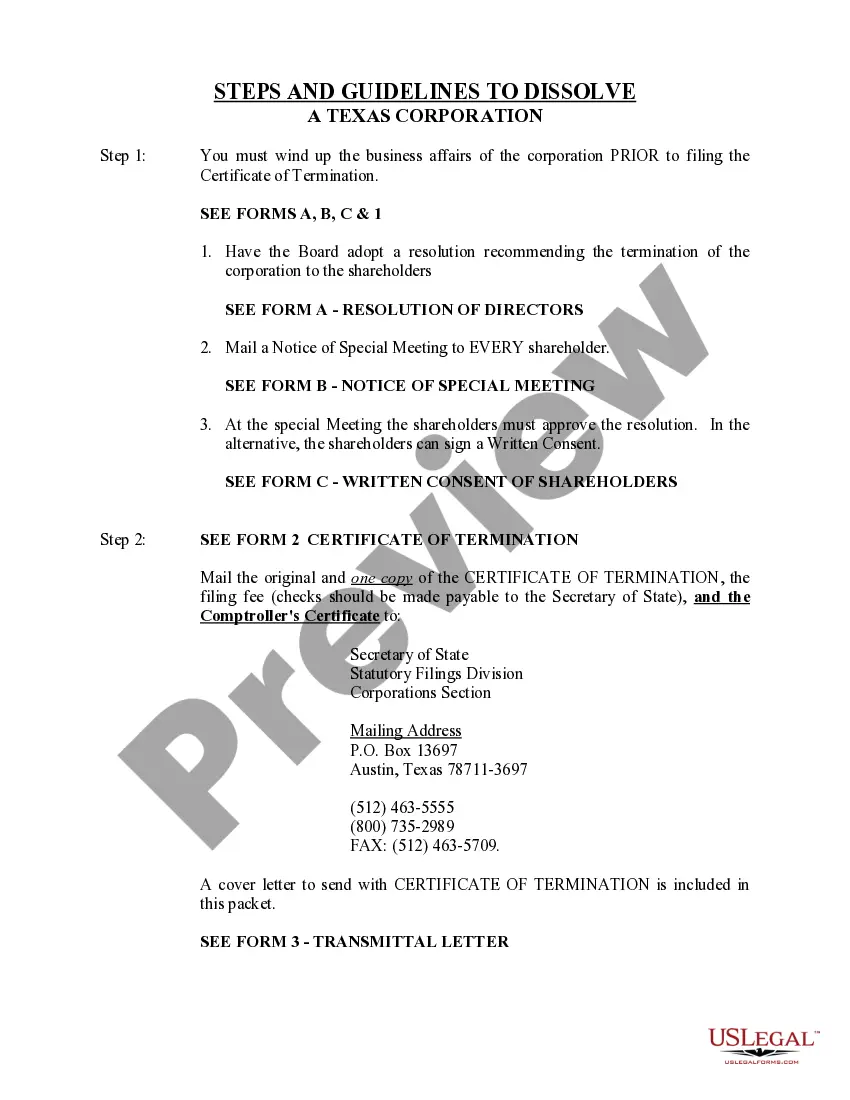

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

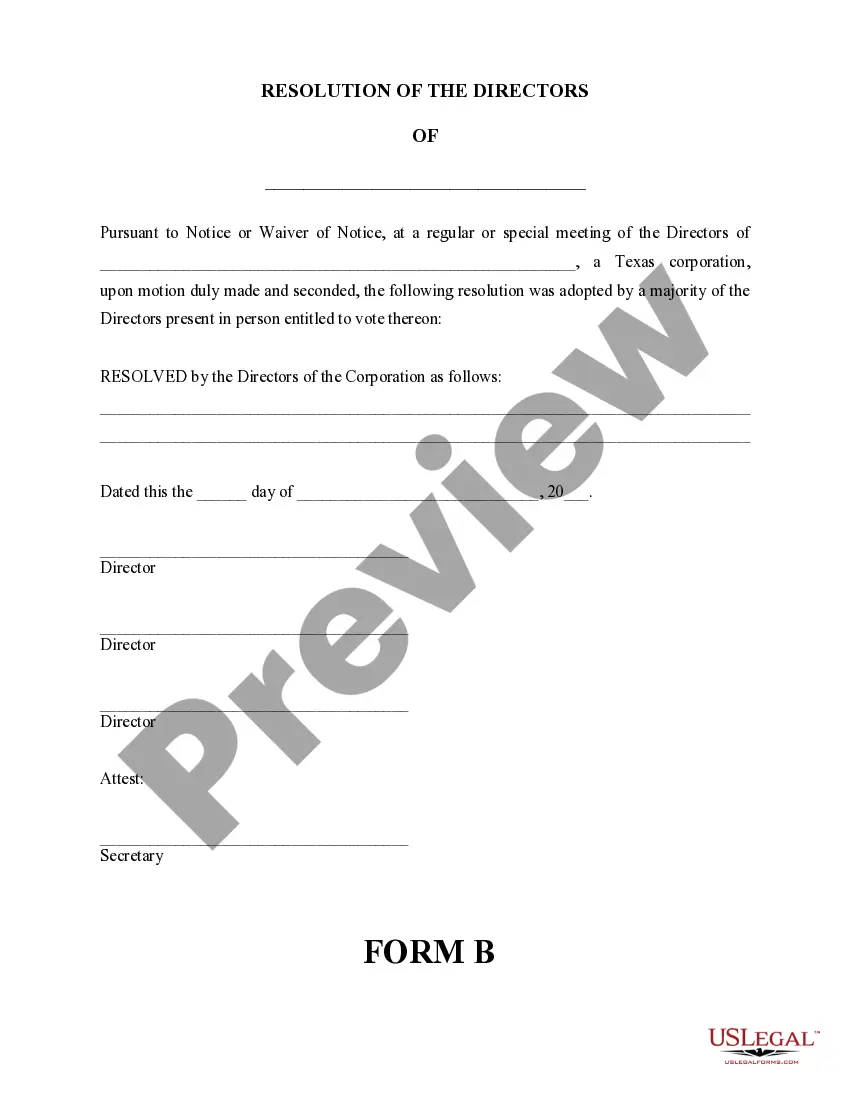

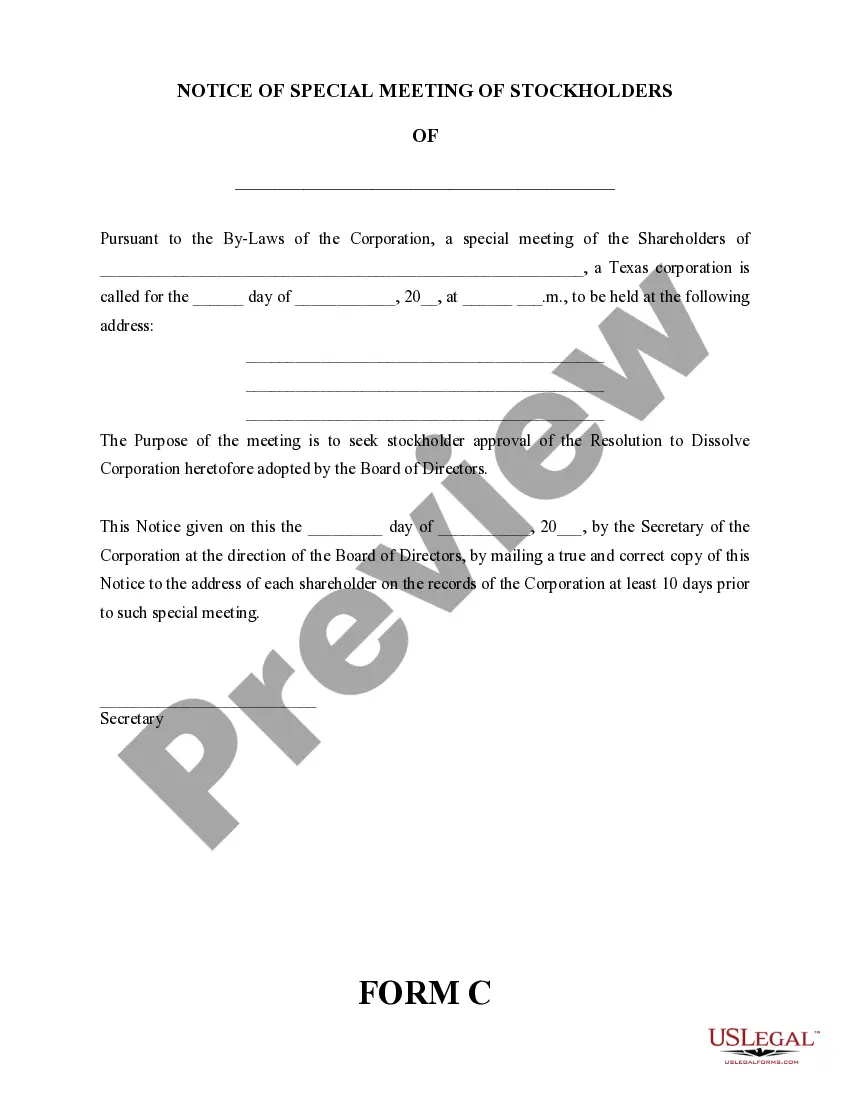

The Round Rock Texas Dissolution Package is a comprehensive set of legal documents and forms required to dissolve a corporation in the city of Round Rock, Texas. This package simplifies the process of winding up a corporation's affairs and terminating its existence. It includes all the necessary paperwork and instructions to ensure a smooth and lawful dissolution. The Round Rock Texas Dissolution Package provides a convenient solution for businesses looking to dissolve their corporation in compliance with local laws and regulations. By availing this package, corporations can eliminate the need for expensive attorney fees and lengthy legal procedures. It enables business owners to dissolve their corporation efficiently and effectively. The contents of the Round Rock Texas Dissolution Package may vary depending on the specific needs and circumstances of the corporation. However, the following key documents are typically included: 1. Certificate of Dissolution: This document formally notifies the Texas Secretary of State and other relevant authorities that the corporation is in the process of dissolution. It includes details such as the corporation's name, date of dissolution, and the reason for dissolution. 2. Articles of Dissolution: The Articles of Dissolution provide a more detailed explanation of the dissolution, including the resolution passed by the corporation's board of directors and shareholders approving the dissolution. It may also include provisions for the distribution of the corporation's assets and liabilities. 3. Resolutions: The package may include sample resolutions for the corporation's board of directors and shareholders, which outline the decision to dissolve the corporation and authorize the necessary actions to wind up its affairs. 4. IRS Forms: If the corporation was previously recognized as a tax-paying entity, the dissolution package would include IRS forms such as Form 966 (Corporate Dissolution or Liquidation) and Form 941 (Employer's Quarterly Federal Tax Return). Other documents that may be included are clear instructions, checklists, and guidance on additional filings or notifications required by local or state authorities. Overall, the Round Rock Texas Dissolution Package provides an all-encompassing solution for corporations in Round Rock, Texas, seeking to dissolve their entity. It streamlines the dissolution process, minimizes the legal complexities, and ensures compliance with relevant laws and regulations. Additionally, it offers convenience and cost-efficiency to business owners aiming to dissolve their corporation in Round Rock, Texas.