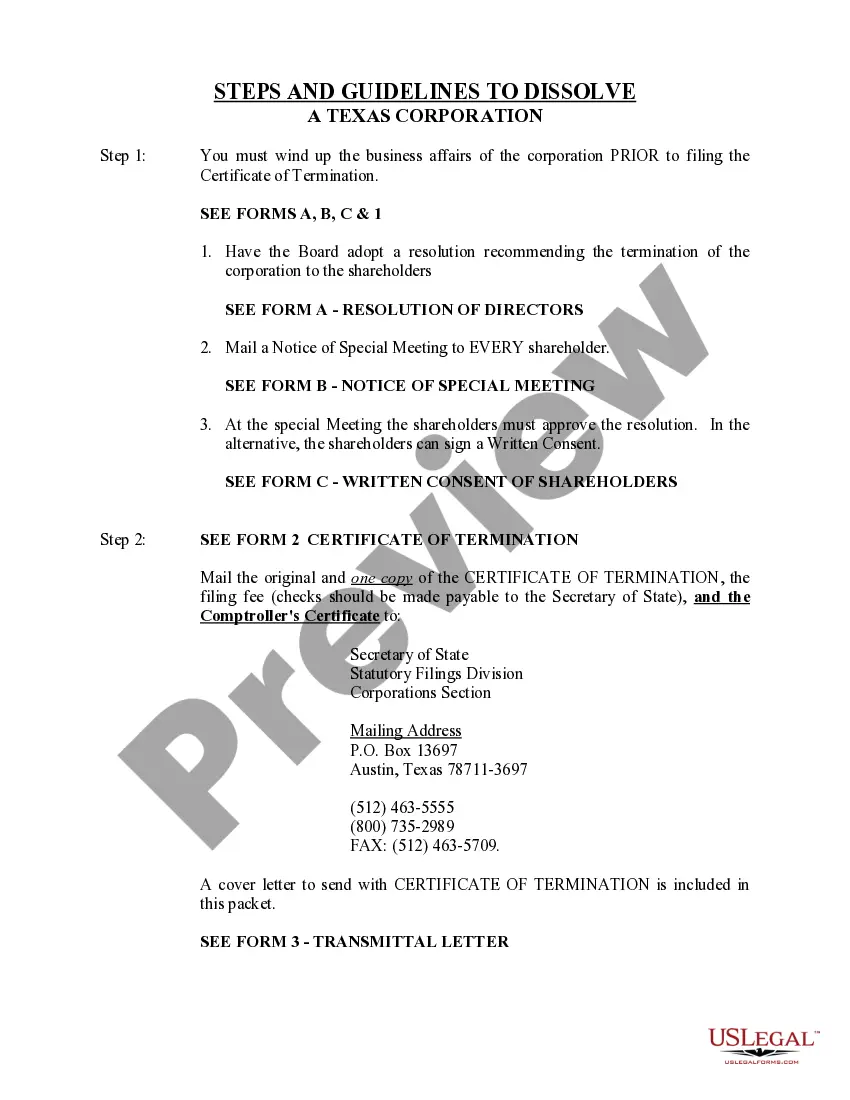

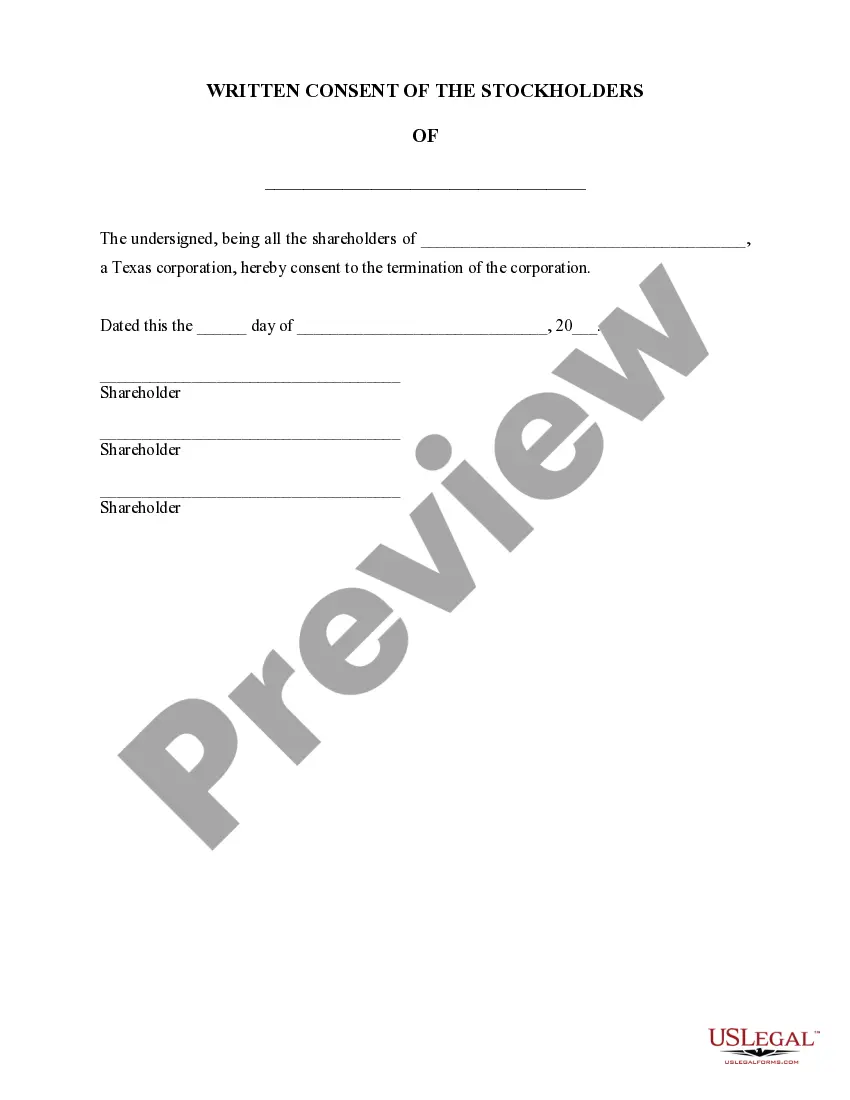

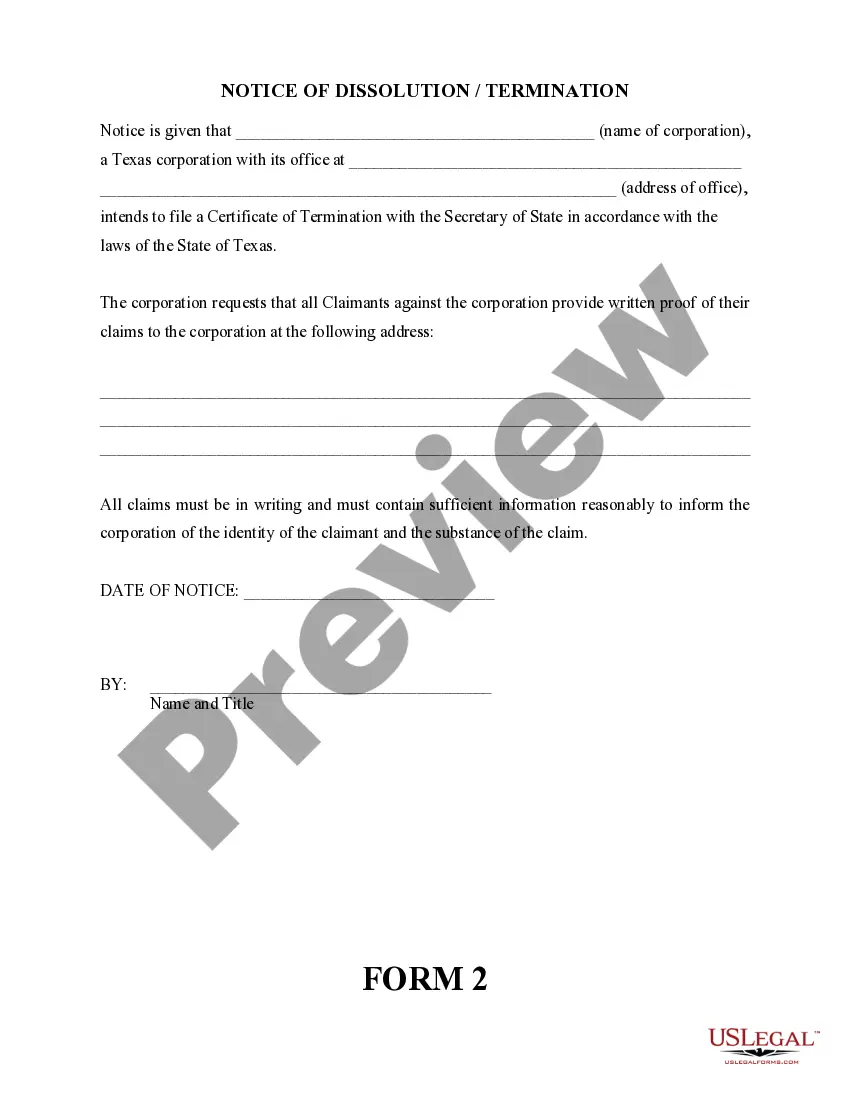

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

San Antonio Texas Dissolution Package to Dissolve Corporation

Description

How to fill out Texas Dissolution Package To Dissolve Corporation?

Regardless of the social or occupational hierarchy, completing legal documents is a regrettable requirement in the contemporary professional landscape.

Often, it’s nearly unfeasible for an individual without formal legal education to draft such documentation from scratch, chiefly due to the intricate terminology and legal subtleties they involve.

This is where US Legal Forms can be a lifesaver.

Ensure the document you have selected is appropriate for your area since regulations differ between states or counties.

Review the document and read a brief description (if available) of situations for which the form can be utilized.

- Our service offers a vast collection of over 85,000 state-specific templates that are applicable for nearly any legal situation.

- US Legal Forms is also a superb asset for associates or legal advisors who aim to conserve time with our DIY paperwork.

- Whether you need the San Antonio Texas Dissolution Package to Terminate Corporation or any other document that will be recognized in your jurisdiction, with US Legal Forms, all resources are available.

- Here’s how to obtain the San Antonio Texas Dissolution Package to Terminate Corporation in minutes using our reliable service.

- If you are currently a subscriber, you can proceed to Log In to your account to retrieve the necessary document.

- However, if you are new to our platform, make sure to follow these steps before downloading the San Antonio Texas Dissolution Package to Terminate Corporation.

Form popularity

FAQ

In exchange for getting back their investment (in full or part), the shareholders return their shares to the company, which are then canceled. If a company returns any money to its shareholders while still having a debt outstanding, the creditor can sue, and the shareholders may have to return the received amounts.

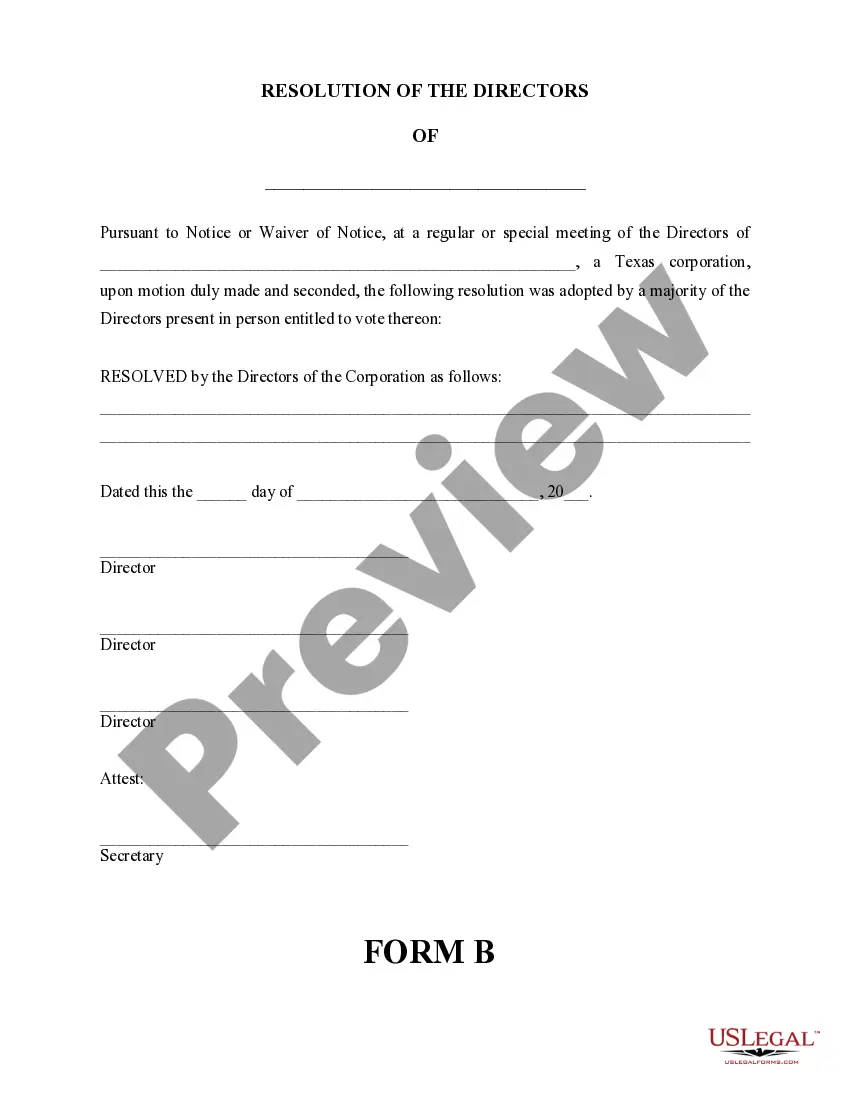

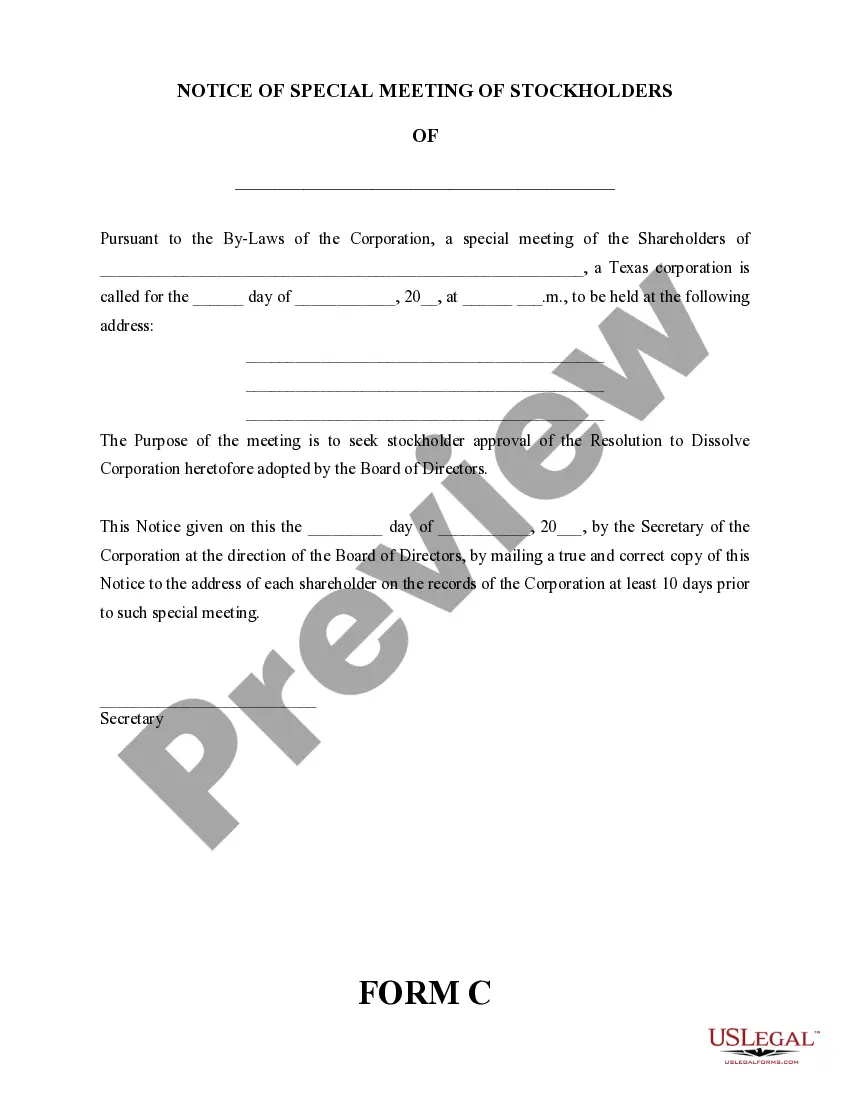

How to dissolve a business in 7 steps Step 1: Get approval of the owners of the corporation or LLC.Step 2: File the Certificate of Dissolution with the state.Step 3: File federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notify creditors your business is closing.Step 6: Settle creditors' claims.

The entity must: Take the necessary internal steps to wind up its affairs.Submit two signed copies of the certificate of termination.Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller.Pay the appropriate filing fee.

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).

The entity must: Take the necessary internal steps to wind up its affairs.Submit two signed copies of the certificate of termination.Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller.Pay the appropriate filing fee.

The Secretary of State charges a $40 filing fee for dissolving an LLC. If submitting via the website, you can pay online when you submit the forms. Checks should be payable to the secretary of state, and if you're paying by credit card via fax, make sure you also attach Form 807.

You can notify the Comptroller's office that you are closing your account by entering the information on the Close Business Location webpage and selecting ?Close all outlets for this taxpayer number.?

Dissolution of a Corporation is the termination of a corporation, either a) voluntarily by resolution, paying debts, distributing assets, and filing dissolution documents with the Secretary of State; or b) by state suspension for not paying corporate taxes or some other action of the government.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

It will take 4-6 weeks for the CPA to process your request. Once you receive your certificate of account status, you will need to attach it to your certificate of termination.