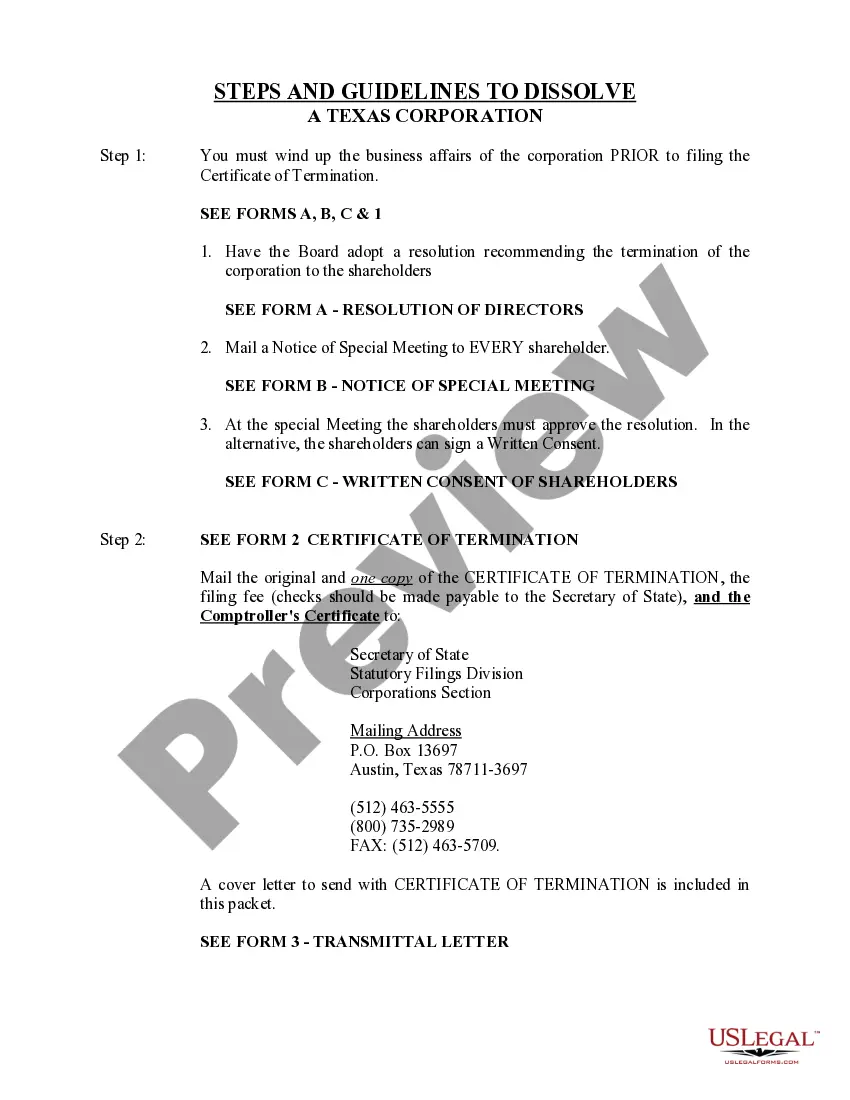

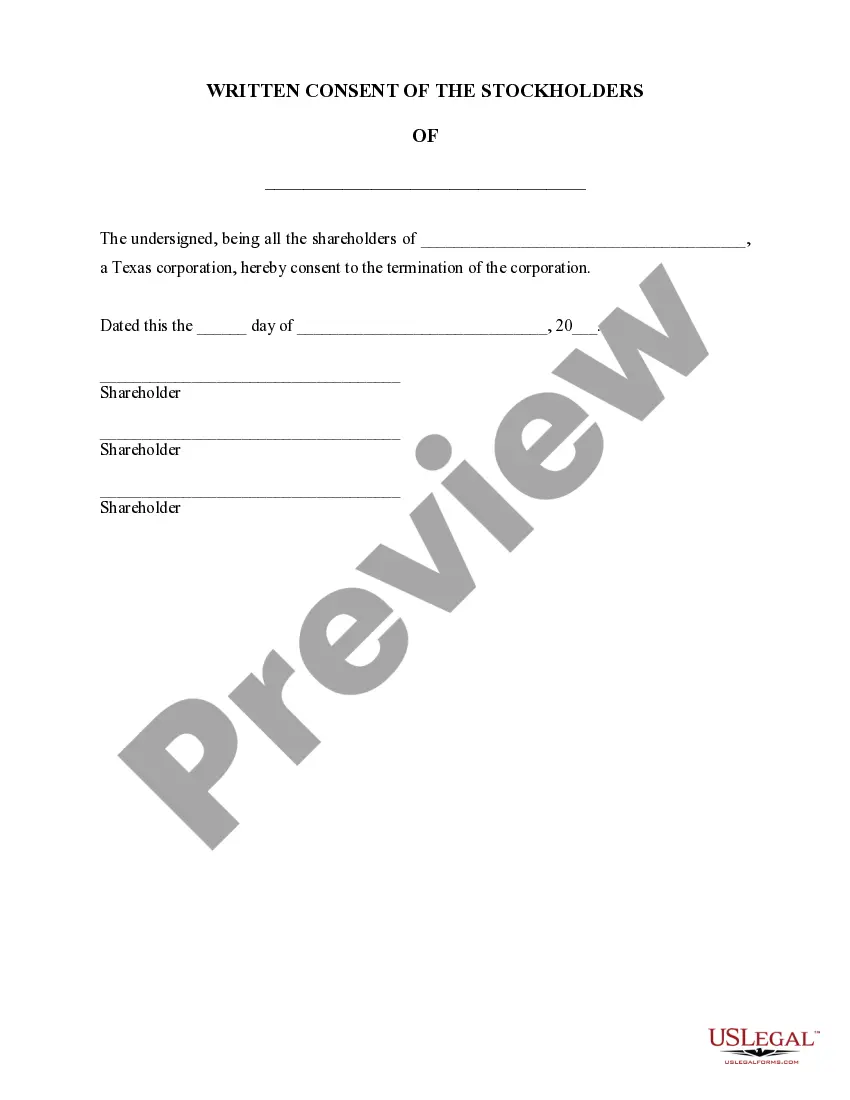

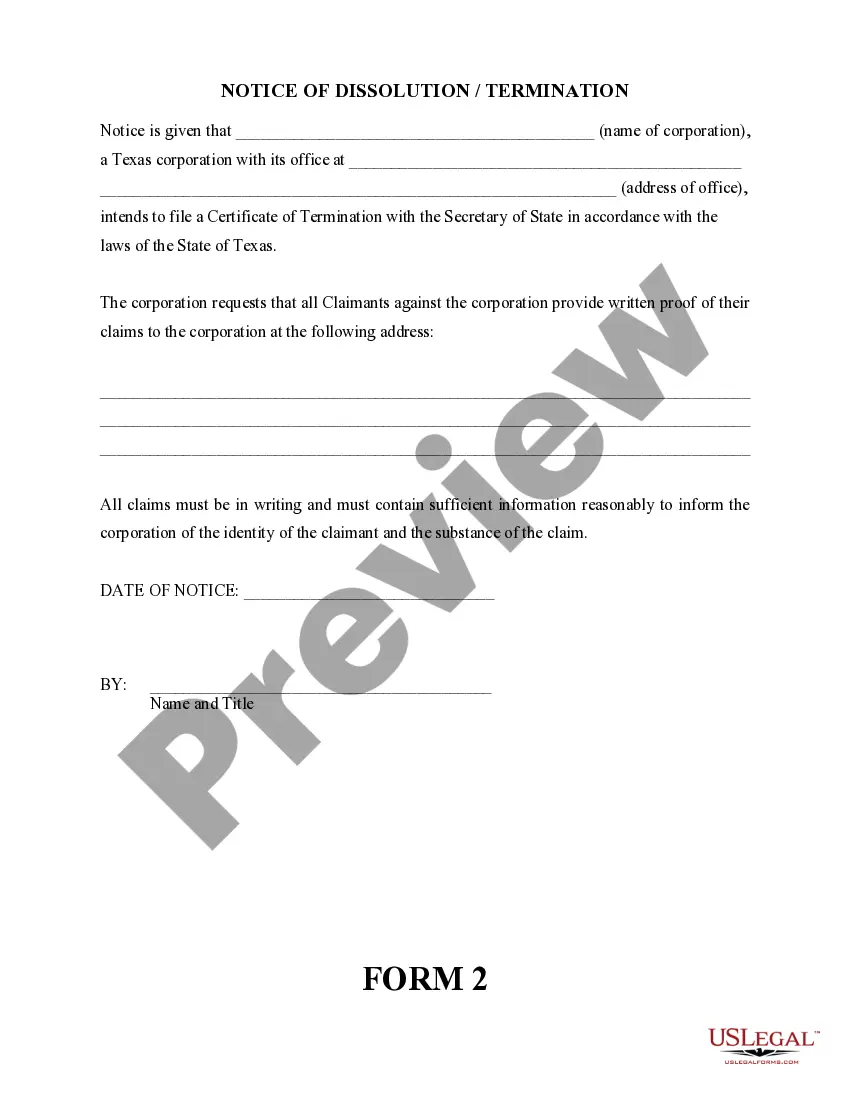

The dissolution of a corporation package contains all forms to dissolve a corporation in Texas, step by step instructions, addresses, transmittal letters, and other information.

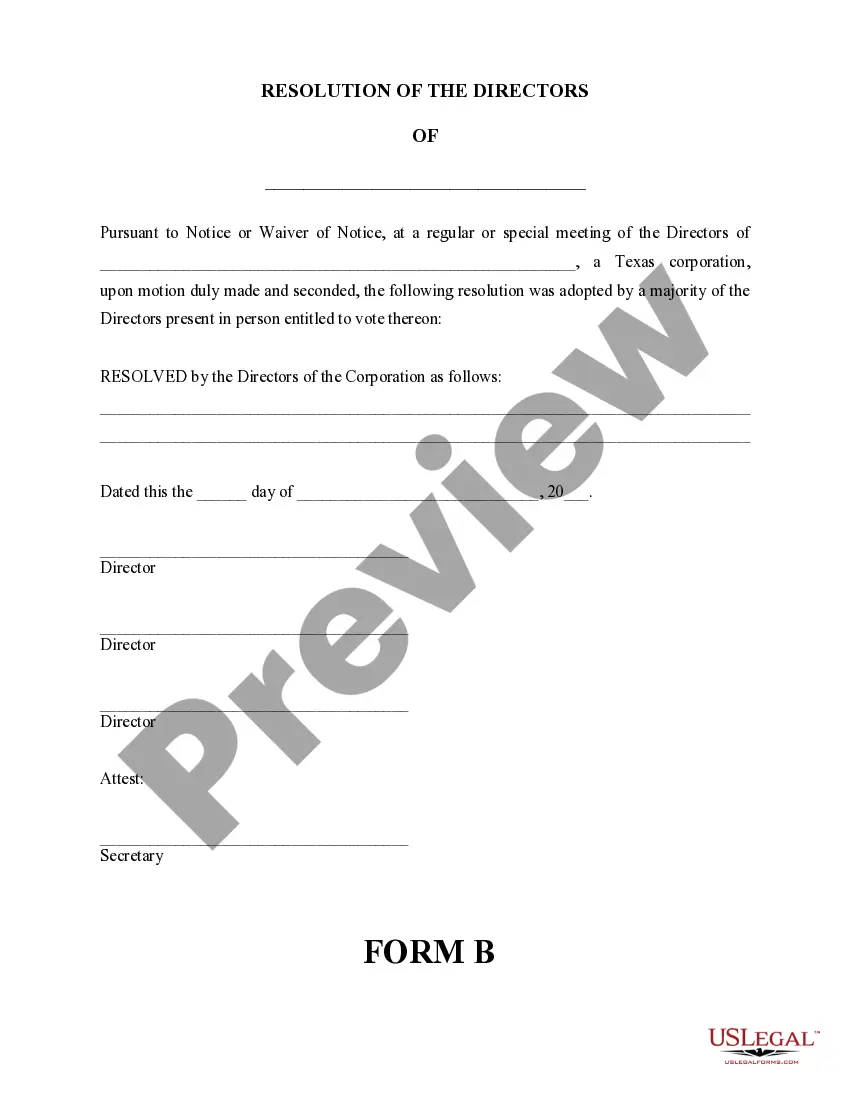

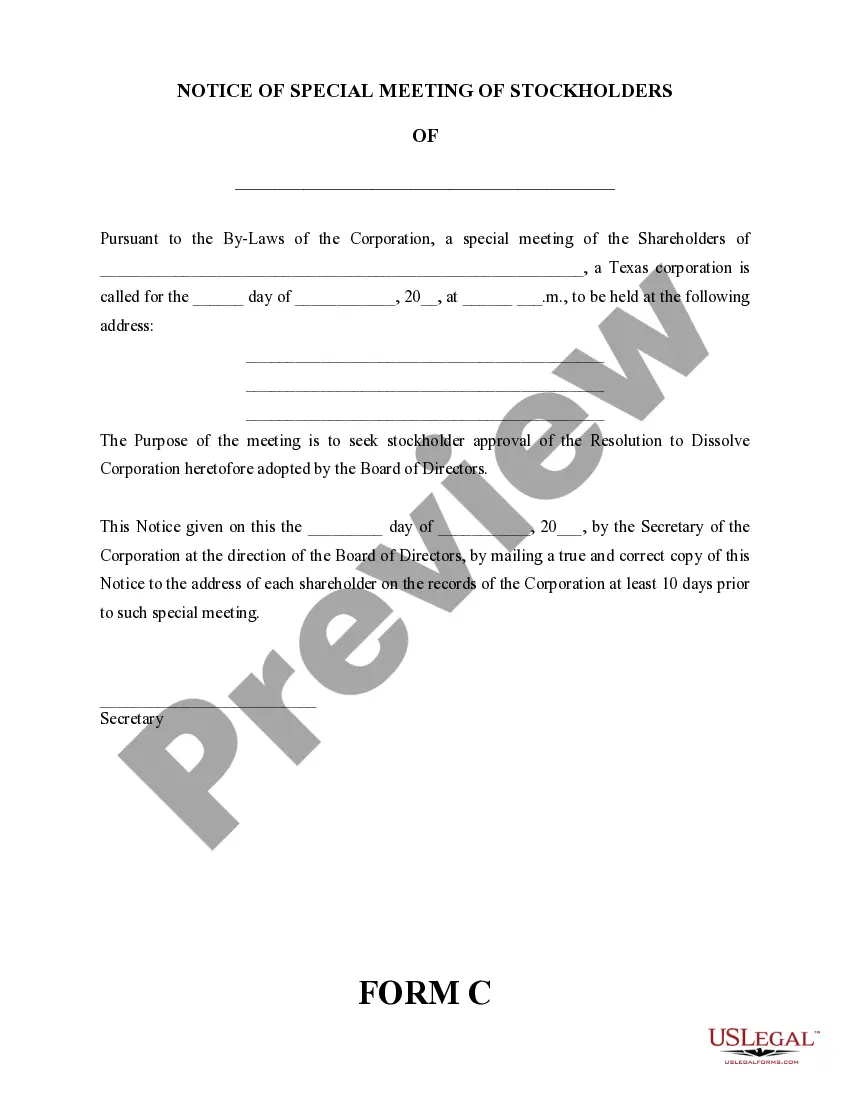

If you're looking for information on how to dissolve a corporation in Tarrant, Texas, you may come across the term "Tarrant Texas Dissolution Package." This package refers to a set of legal documents and procedures required to officially dissolve a corporation in Tarrant County, Texas. The Tarrant Texas Dissolution Package includes various forms, filings, and notifications that must be completed to legally terminate a corporation within the jurisdiction. Winding up a corporation's affairs and dissolving it properly is crucial to avoid any future legal or financial liabilities. The specific documents and procedures included in the Tarrant Texas Dissolution Package may vary based on the specific circumstances of the corporation and its type of business structure. Some common types of Tarrant Texas Dissolution Packages include: 1. Tarrant Texas Dissolution Package for a C Corporation: A C Corporation is a standard business structure where the corporation is considered a separate legal entity. The dissolution package for a C Corporation may include forms such as the Certificate of Dissolution, documents related to the distribution of assets, and forms for notifying creditors, shareholders, and the Texas Secretary of State's office about the dissolution. 2. Tarrant Texas Dissolution Package for an S Corporation: An S Corporation is a special type of corporation that provides its owners with certain tax benefits. The dissolution package for an S Corporation might have similar forms to a C Corporation, but there may be additional forms specifically tailored to S Corporations, such as the Form 966 (Corporate Dissolution or Liquidation). 3. Tarrant Texas Dissolution Package for a Nonprofit Corporation: Nonprofit corporations are charitable or educational organizations that operate for the benefit of the public. Dissolving a nonprofit corporation requires specific documents, such as a Plan of Distribution for its remaining assets, and additional filings or notifications to the Texas Attorney General's office or other relevant regulatory bodies. It's important to consult with a business attorney or seek professional advice to ensure that you are utilizing the correct Tarrant Texas Dissolution Package that is appropriate for your corporation's structure and that complies with all legal requirements. Filling out and submitting the necessary forms accurately and in a timely manner is vital to a successful dissolution process and avoiding any potential penalties or liability.If you're looking for information on how to dissolve a corporation in Tarrant, Texas, you may come across the term "Tarrant Texas Dissolution Package." This package refers to a set of legal documents and procedures required to officially dissolve a corporation in Tarrant County, Texas. The Tarrant Texas Dissolution Package includes various forms, filings, and notifications that must be completed to legally terminate a corporation within the jurisdiction. Winding up a corporation's affairs and dissolving it properly is crucial to avoid any future legal or financial liabilities. The specific documents and procedures included in the Tarrant Texas Dissolution Package may vary based on the specific circumstances of the corporation and its type of business structure. Some common types of Tarrant Texas Dissolution Packages include: 1. Tarrant Texas Dissolution Package for a C Corporation: A C Corporation is a standard business structure where the corporation is considered a separate legal entity. The dissolution package for a C Corporation may include forms such as the Certificate of Dissolution, documents related to the distribution of assets, and forms for notifying creditors, shareholders, and the Texas Secretary of State's office about the dissolution. 2. Tarrant Texas Dissolution Package for an S Corporation: An S Corporation is a special type of corporation that provides its owners with certain tax benefits. The dissolution package for an S Corporation might have similar forms to a C Corporation, but there may be additional forms specifically tailored to S Corporations, such as the Form 966 (Corporate Dissolution or Liquidation). 3. Tarrant Texas Dissolution Package for a Nonprofit Corporation: Nonprofit corporations are charitable or educational organizations that operate for the benefit of the public. Dissolving a nonprofit corporation requires specific documents, such as a Plan of Distribution for its remaining assets, and additional filings or notifications to the Texas Attorney General's office or other relevant regulatory bodies. It's important to consult with a business attorney or seek professional advice to ensure that you are utilizing the correct Tarrant Texas Dissolution Package that is appropriate for your corporation's structure and that complies with all legal requirements. Filling out and submitting the necessary forms accurately and in a timely manner is vital to a successful dissolution process and avoiding any potential penalties or liability.