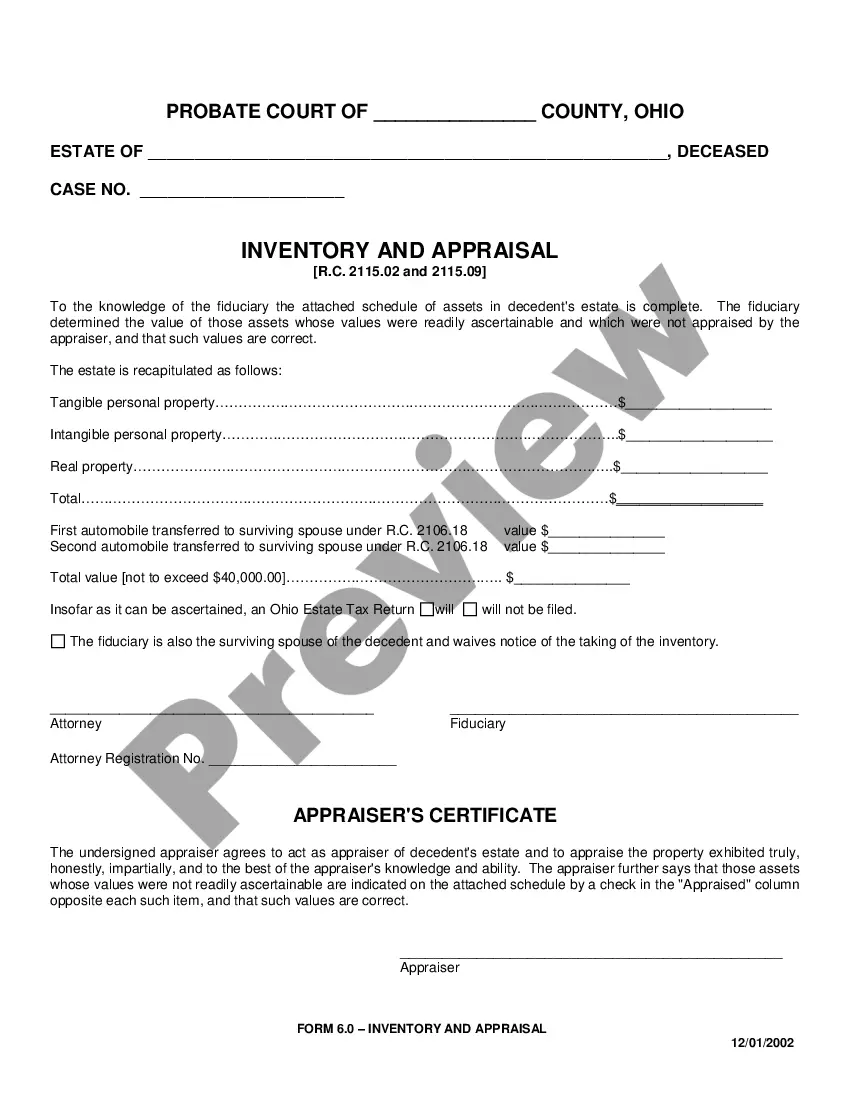

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Title: Understanding the Harris Texas Living Trust for Individuals Who are Single, Divorced, or Widow/Widowers with Children Introduction: In Harris County, Texas, individuals who are single, divorced, or widowed with children have the option to establish a living trust as a vital part of their estate planning. A living trust offers several advantages, including privacy, probate avoidance, and flexibility in managing assets during one's lifetime. Let's delve into the details of Harris Texas Living Trusts designed specifically for this specific group of individuals. Types of Harris Texas Living Trusts: 1. Individual Living Trust: An Individual Living Trust is ideal for a person who is single, divorced, or widowed with children and wishes to maintain control over their assets throughout their lifetime. By establishing an Individual Living Trust, the granter (single individual) can manage their assets, name beneficiaries, and designate a successor trustee to administer the trust upon their death or incapacity. 2. Marital Living Trust: A Marital Living Trust is designed for individuals who have gone through a divorce but have children with their ex-spouse. This trust helps ensure that the assets are held for the benefit of their children, even if the ex-spouse remarries. The granter can outline specific instructions within the trust to ensure the children's interests are protected. 3. Widow/Widower Living Trust: A Widow/Widower Living Trust caters to individuals who have lost their spouse but have children. This trust provides a means to manage and distribute assets while offering potential tax benefits. The surviving spouse, as granter, can decide how assets are to be distributed upon their death and ensure that their children are taken care of. Key Elements of a Harris Texas Living Trust: 1. Granter: The granter, being the single, divorced, or widow/widower individual, establishes the trust, transfers assets into it, and has control over the trust's terms and provisions. 2. Trustee: The granter appoints a trustee, who can be themselves initially, to manage and administer the trust assets. In the event of incapacity or death, a successor trustee takes over the responsibility. 3. Beneficiaries: The granter designates the beneficiaries — typically their childre— – who will inherit the trust assets upon the granter's incapacitation or death. Specific instructions regarding the distribution of assets can be outlined. 4. Distribution: The granter can outline conditions for asset distribution, such as reaching a certain age, attaining specific milestones, or the need for educational or medical support for the children. 5. Asset Management: The granter has full control over managing and using the trust assets during their lifetime and can modify the trust's provisions as circumstances change. Conclusion: Establishing a Harris Texas Living Trust tailored to an individual's circumstances can be a wise choice for those who are single, divorced, or widow/widowers with children. By doing so, they can ensure their assets are properly managed, their children are provided for, and their wishes are honored. It is advisable to consult an experienced estate planning attorney to navigate the complexities of creating a living trust that aligns with your unique needs.