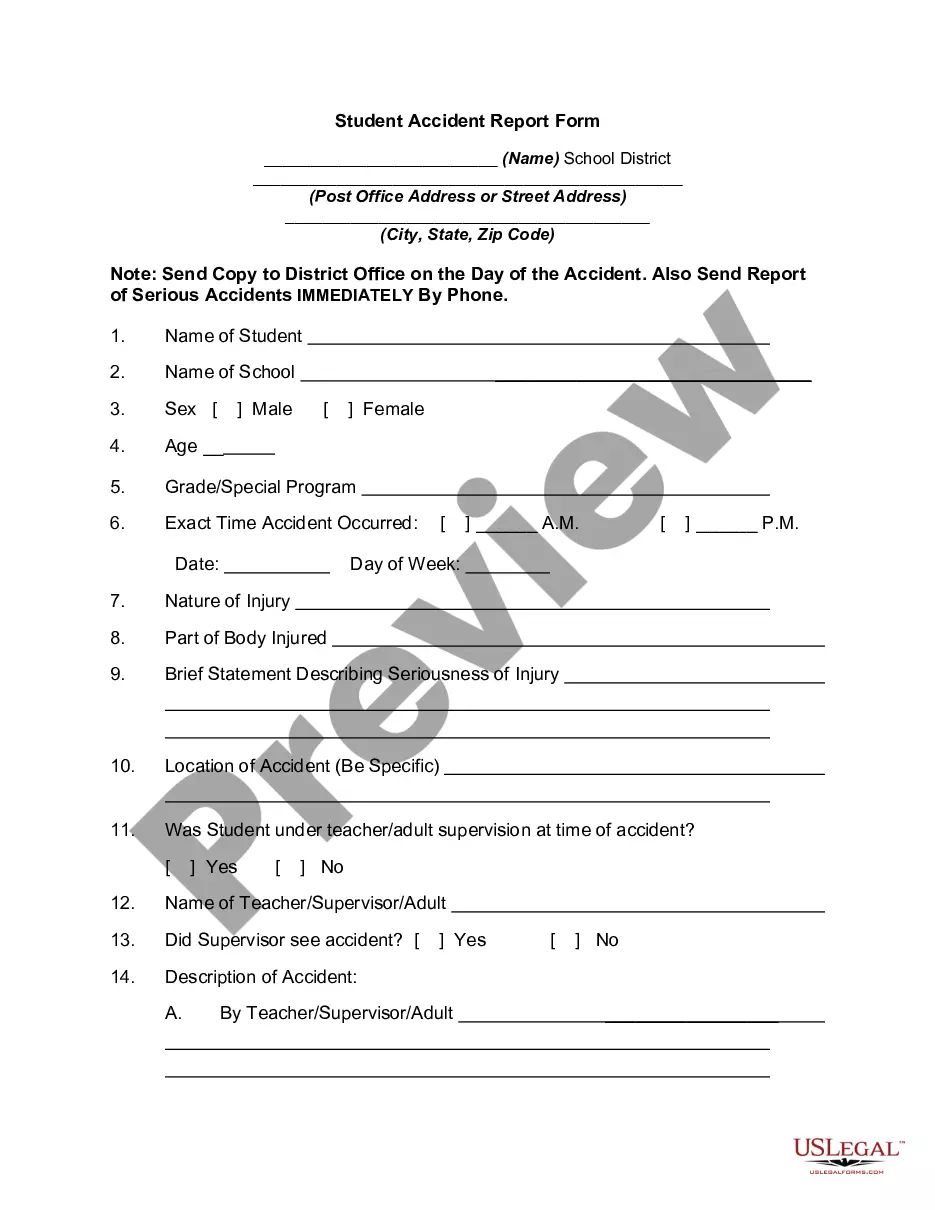

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Pearland Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Texas Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children?

We consistently endeavor to minimize or evade legal repercussions when engaging with intricate legal or financial situations.

To achieve this, we enroll in attorney services that are typically quite costly.

However, not every legal matter is equally complicated.

Many of them can be managed independently.

Make the most of US Legal Forms whenever you need to locate and download the Pearland Texas Living Trust for Individuals who are Single, Divorced, or Widowed with Children, or any other form conveniently and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to take control of your legal affairs without the necessity of consulting a lawyer.

- We provide access to legal form templates that are not always publicly accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Filing a living trust in Texas typically involves ensuring the trust document is finalized rather than submitting it to a government office. For a Pearland Texas Living Trust for Individuals Who are Single, Divorced, or Widowed with Children, make sure your document is signed, dated, and notarized. While there is no formal filing process, you may want to designate a bank or financial institution to recognize your trust. Keeping copies of your trust documentation accessible is crucial for your beneficiaries and trustees.

While hiring an attorney is not legally required to set up a Pearland Texas Living Trust for Individuals Who are Single, Divorced, or Widowed with Children, it can be beneficial. An attorney can help clarify legal terms and ensure your trust document meets all necessary requirements. However, with platforms like US Legal Forms, individuals can create their own living trust documents efficiently and confidently, with user-friendly templates available for guidance and support.

In Texas, a living trust does not need to be officially recorded, including a Pearland Texas Living Trust for Individuals Who are Single, Divorced, or Widowed with Children. However, it is recommended to keep a copy of the trust document in a safe location, such as a safe deposit box or with your attorney. This approach helps ensure easy access for trustees and beneficiaries when needed. Always consider informing your loved ones of the location of the trust document for their convenience.

To register a Pearland Texas Living Trust for Individuals Who are Single, Divorced, or Widowed with Children, start by preparing the trust document. You should outline the terms and conditions of your trust, including the beneficiaries and the trustee. After drafting this document, it’s essential to have it signed and notarized. While registration is not required with the state, you may want to keep the documentation in a safe place and potentially file it with your bank or a financial institution.

Trusts in Texas must comply with specific rules to be considered valid and effective. This includes clearly defining the trust's purpose, appointing a trustee, and detailing how assets will be distributed. With a Pearland Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, it's essential to follow these guidelines to protect your family's interests. Utilizing platforms like USLegalForms can assist you in navigating these requirements.

While a trust offers many advantages, there are some disadvantages in Texas. First, establishing a Pearland Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children may involve initial costs for setup and legal assistance. Additionally, if not properly managed, a trust can lead to complications and potential disputes among beneficiaries. It is vital to weigh these factors before moving forward with a trust.

In Texas, the laws governing trusts allow individuals to create estates that manage and distribute property according to their wishes. A Pearland Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children is legally recognized and can help streamline the transfer of assets. Texas law supports flexible trust arrangements, which can suit various family situations. It's crucial to follow these laws to ensure your trust operates effectively.

You can write your own living trust in Texas, but it's crucial to ensure it meets all state requirements to be legally enforceable. A well-crafted Pearland Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children can provide peace of mind and ensure your wishes are followed. However, crafting a trust can be complex, and seeking assistance from uslegalforms may streamline this process and offer much-needed clarity.

While a living trust offers many benefits, it also has disadvantages. For those creating a Pearland Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, you may incur upfront costs and need to transfer assets into the trust. Moreover, a living trust does not provide any tax benefits or Medicaid protection, which may be critical for certain individuals. Evaluating these factors is essential, and uslegalforms can provide the insights needed to navigate these decisions.

In Texas, a living trust serves as a legal arrangement where a trustee manages assets on behalf of the beneficiaries. If you set up a Pearland Texas Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, you can simplify asset management and avoid probate after your passing. The trust remains flexible during your lifetime and allows you to dictate how and when your assets are distributed to your children. As a useful resource, uslegalforms can help you create this trust efficiently.