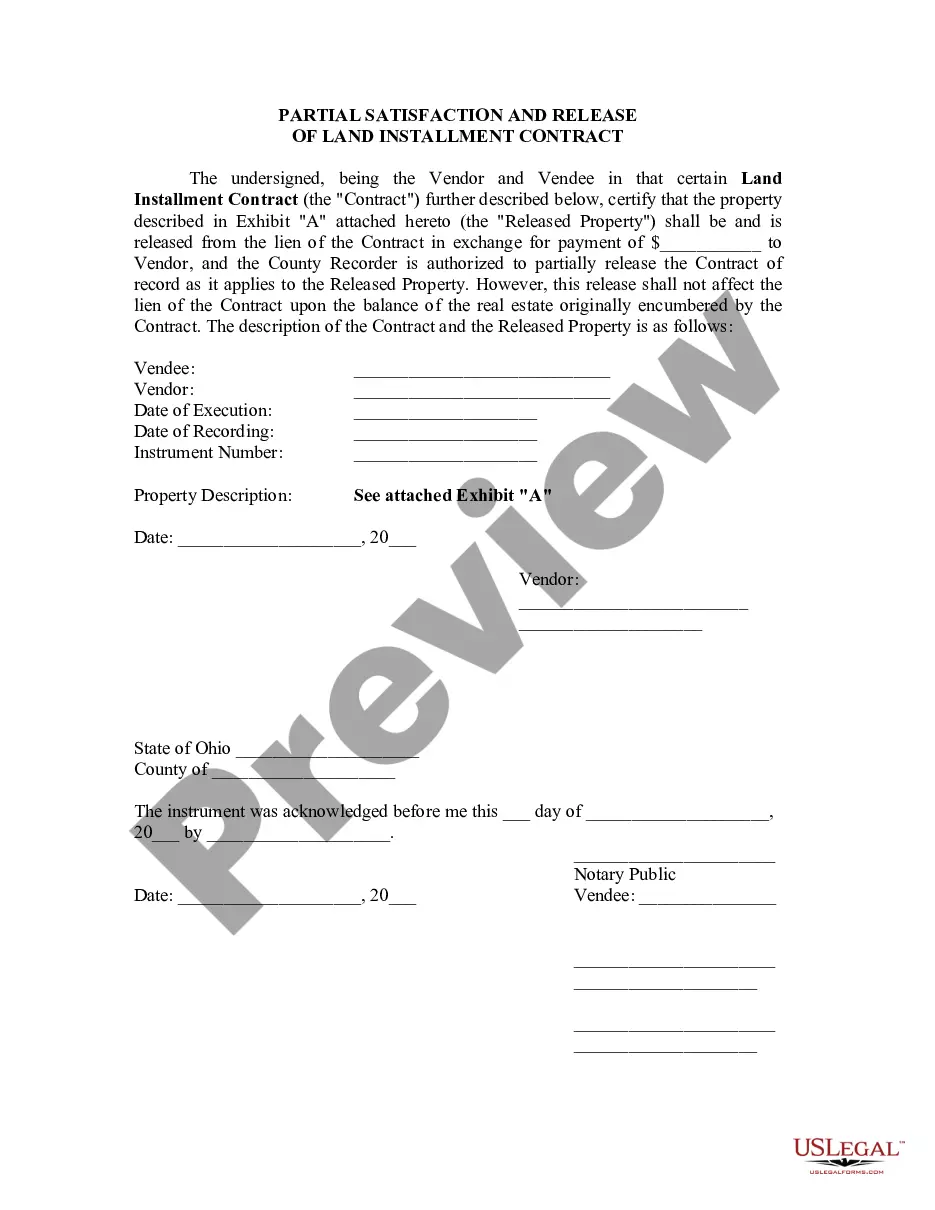

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Dallas Texas Amendment to Living Trust

Description

How to fill out Texas Amendment To Living Trust?

We consistently aim to minimize or avert legal complications when managing intricate legal or financial matters.

To achieve this, we pursue legal assistance that is typically quite expensive.

However, not every legal issue is of the same degree of complexity. Many can be handled independently.

US Legal Forms is an online repository of current do-it-yourself legal documents covering a wide range from wills and power of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and select the Get button next to it. If you misplace the document, you can always re-download it in the My documents section. The process is equally simple if you are new to the website! You can register within minutes. Ensure that the Dallas Texas Amendment to Living Trust complies with the laws and regulations of your state and region. Additionally, it’s essential to review the form’s description (if available), and if you notice any inconsistencies with what you initially needed, look for an alternative form. Once you confirm that the Dallas Texas Amendment to Living Trust is suitable for you, you can select a subscription option and proceed with the payment. Afterwards, you can download the document in your desired file format. With over 24 years in the market, we’ve aided millions by providing ready-to-modify and current legal forms. Take full advantage of US Legal Forms now to conserve time and resources!

- Our library enables you to manage your affairs independently without the need for a lawyer's services.

- We provide access to legal form templates that aren't always readily accessible.

- Our templates are specific to states and regions, which significantly eases the search process.

- Make use of US Legal Forms whenever you need to locate and download the Dallas Texas Amendment to Living Trust or any other form efficiently and securely.

Form popularity

FAQ

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

A beneficiary can renounce their interest from the trust and, upon the consent of other beneficiaries, be allowed to exit. A trustee cannot remove a beneficiary from an irrevocable trust. A grantor can remove a beneficiary from a revocable trust by going back to the trust deed codes that allow for the same.

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

Generally, no. Most living or revocable trusts become irrevocable upon the death of the trust's maker or makers. This means that the trust cannot be altered in any way once the successor trustee takes over management of it.

An amendment is a formal document making a change to one or multiple parts of a Revocable Living Trust. A codicil is a formal document making a change to one or multiple parts of a Last Will and Testament. If your Living Trust has been lost or destroyed, we can Restate your original Trust.

Overview. A change to a trust will only be valid where that change is effected in accordance with the trust deed's requirements. When effecting a change to a trust, the parties must review those requirements carefully.

To make a living trust in Texas, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

You can also amend a trust if you decide to add or remove property from the trust. Common situations that lead to a trust amendment are divorce or marriage, birth of a child or grandchild, a move to a state with different laws, a change in tax laws, a change in your financial situation, or the death of a beneficiary.

A court will allow a trust to be modified if you can show that the trust's main purpose is being inhibited in some way. A third way to change an irrevocable trust is by what is called ?decanting?. This means the trustee modifies the trust by moving assets from one trust to a new trust with different terms.