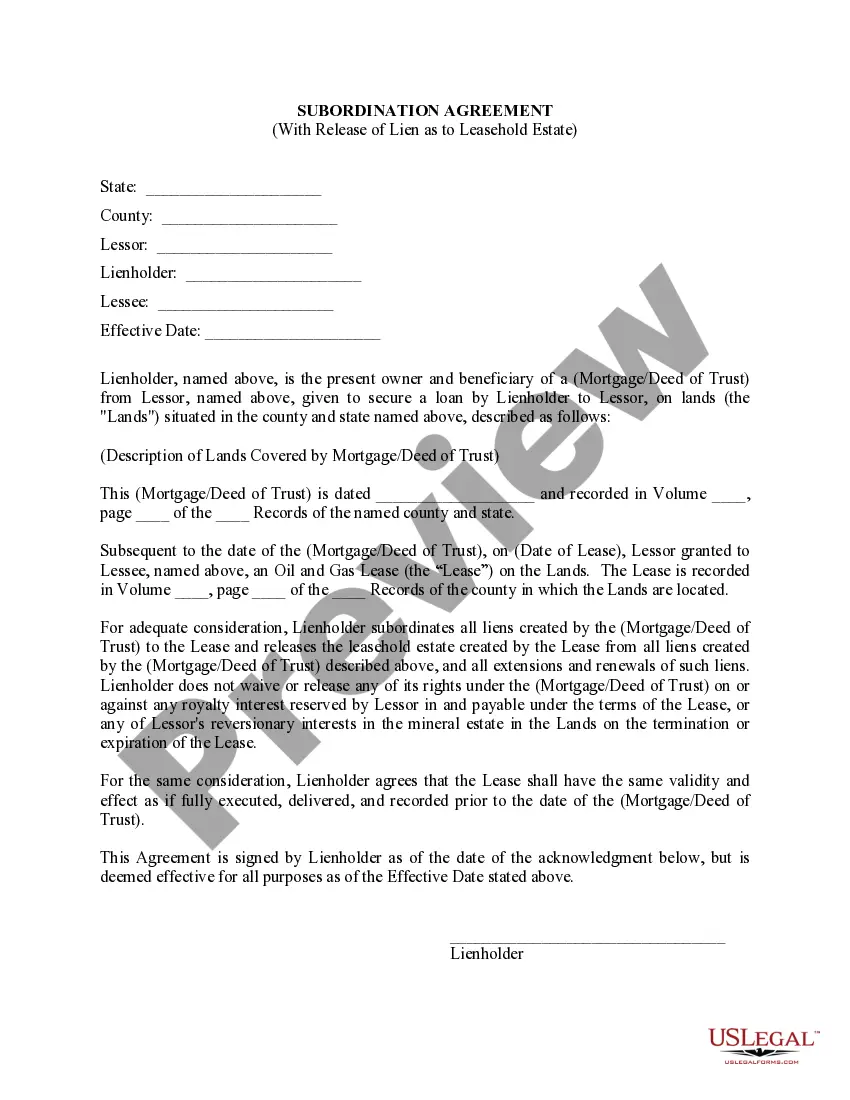

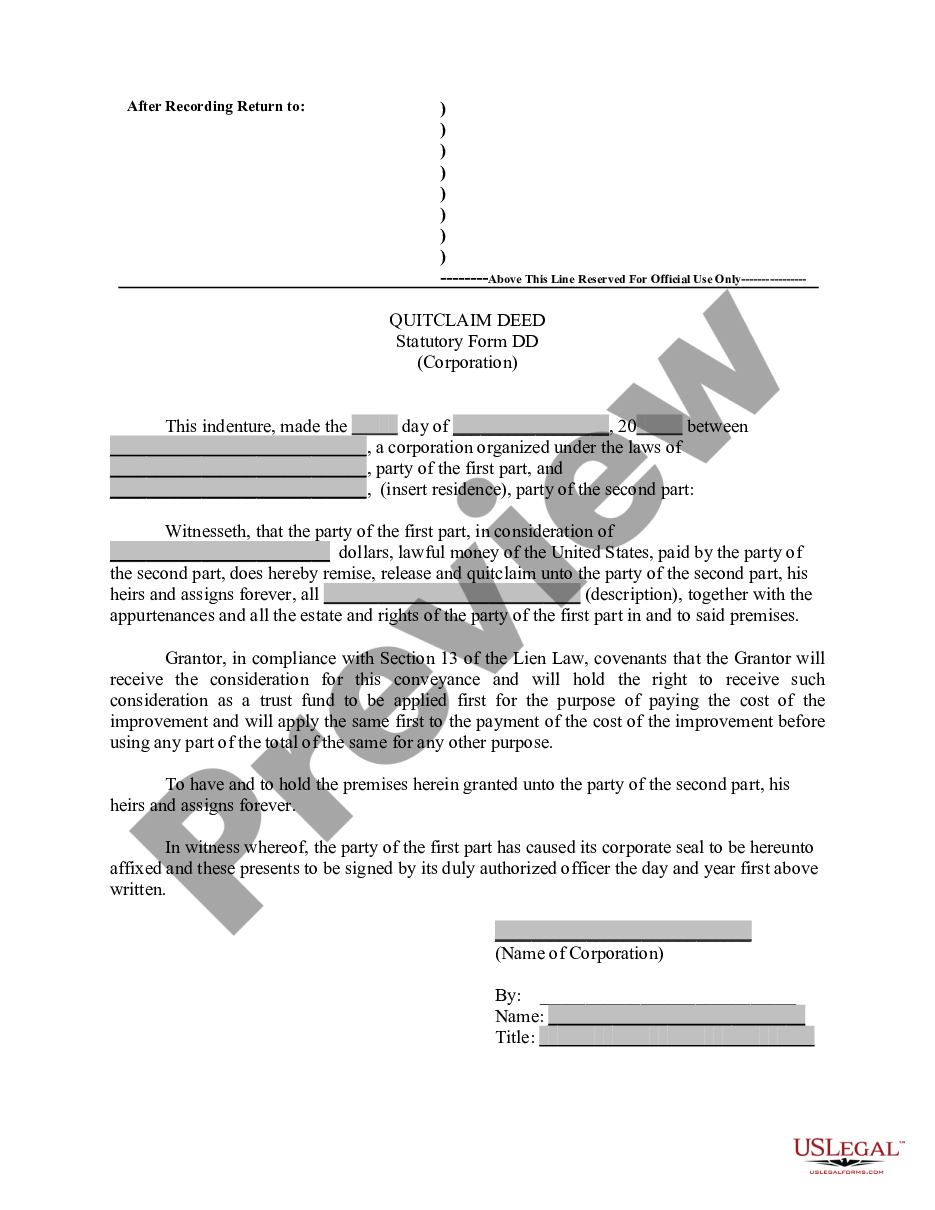

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Travis Texas Financial Account Transfer to Living Trust

Description

How to fill out Texas Financial Account Transfer To Living Trust?

If you’ve previously utilized our service, Log In to your account and store the Travis Texas Financial Account Transfer to Living Trust on your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your billing plan.

If this is your initial encounter with our service, follow these straightforward instructions to obtain your document.

You have continual access to all documents you have acquired: you can find them in your profile under the My documents section whenever you wish to use them again. Leverage the US Legal Forms service to quickly locate and save any template for your personal or business requirements!

- Ensure you’ve found a suitable document. Review the details and use the Preview feature, if available, to confirm it fulfills your needs. If it does not suit you, employ the Search tab above to discover the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Receive your Travis Texas Financial Account Transfer to Living Trust. Choose the file format for your document and store it on your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

To transfer property to a living trust in Texas, you must first create the trust document that outlines your wishes. Next, you will need to change the title of the property to reflect the trust as the new owner. This process often involves completing a deed that must be filed with the county clerk. For seamless execution of your Travis Texas Financial Account Transfer to Living Trust, consider using USLegalForms, where you can find the necessary documents and guidance tailored to your needs.

Yes, you can place a brokerage account in a living trust. Doing so allows you to control how your assets are handled and distributed according to your wishes, avoiding probate. This move offers peace of mind, ensuring your loved ones receive their inheritance without unnecessary delays. To ensure a smooth Travis Texas Financial Account Transfer to Living Trust, consider seeking assistance from trusted resources.

Transferring your brokerage account to a living trust involves notifying your brokerage firm of your intent. You will need to fill out specific forms that identify the living trust as the new account holder. This transition allows the trust to manage the account, ensuring that your assets are distributed according to your wishes after your passing. Utilizing platforms like USLegalForms can simplify the Travis Texas Financial Account Transfer to Living Trust journey.

To transfer property into a living trust in Texas, begin by drafting the trust document, which outlines how you want your assets managed. Next, execute a deed to transfer the property title from your name to the living trust. This process ensures the property is under the trust's control while you retain the right to manage it during your lifetime. Resources like USLegalForms can assist you in smoothly navigating the Travis Texas Financial Account Transfer to Living Trust process.

Transferring stock to a revocable trust typically does not trigger immediate tax consequences. The IRS treats the transfer as complete control remains with the grantor, allowing you to manage your assets as you wish. However, it is essential to understand that any future gains from the stock may still be subject to taxes when realized. Consulting with an expert on Travis Texas Financial Account Transfer to Living Trust can provide personalized guidance.

Transferring your checking account to your living trust is a straightforward process that requires a few essential steps. First, confirm that your living trust is established and funded. Then, go to your bank with the necessary documentation, including your trust agreement, to officially transfer the account. This process is vital for a seamless Travis Texas Financial Account Transfer to Living Trust.

To transfer your bank account to your living trust, you'll need to establish the trust first, followed by a visit to your bank. Be prepared to complete forms and provide the trust agreement as proof of your established trust. Successfully completing a Travis Texas Financial Account Transfer to Living Trust ensures that your financial assets are managed according to your wishes.

One significant mistake parents often make when setting up a trust fund is failing to fund the trust properly. If the intended assets, such as bank accounts or properties, are not transferred into the trust, the trust will not serve its purpose. Understanding how to execute a Travis Texas Financial Account Transfer to Living Trust can prevent this common pitfall and secure your family's legacy.

To put your checking account in a trust, you'll first need to set up a living trust with the appropriate legal documentation. After establishing the trust, visit your bank and provide the required documents, such as the trust agreement and identification. Completing a Travis Texas Financial Account Transfer to Living Trust can help ensure your assets are managed according to your wishes.

When considering a bank account for your trust, it is crucial to choose a bank that offers trust accounts with low fees and good customer service. A checking or savings account specifically designed for trusts can provide the flexibility and accessibility needed for effective management. Ensure that the institution understands the requirements for a Travis Texas Financial Account Transfer to Living Trust.