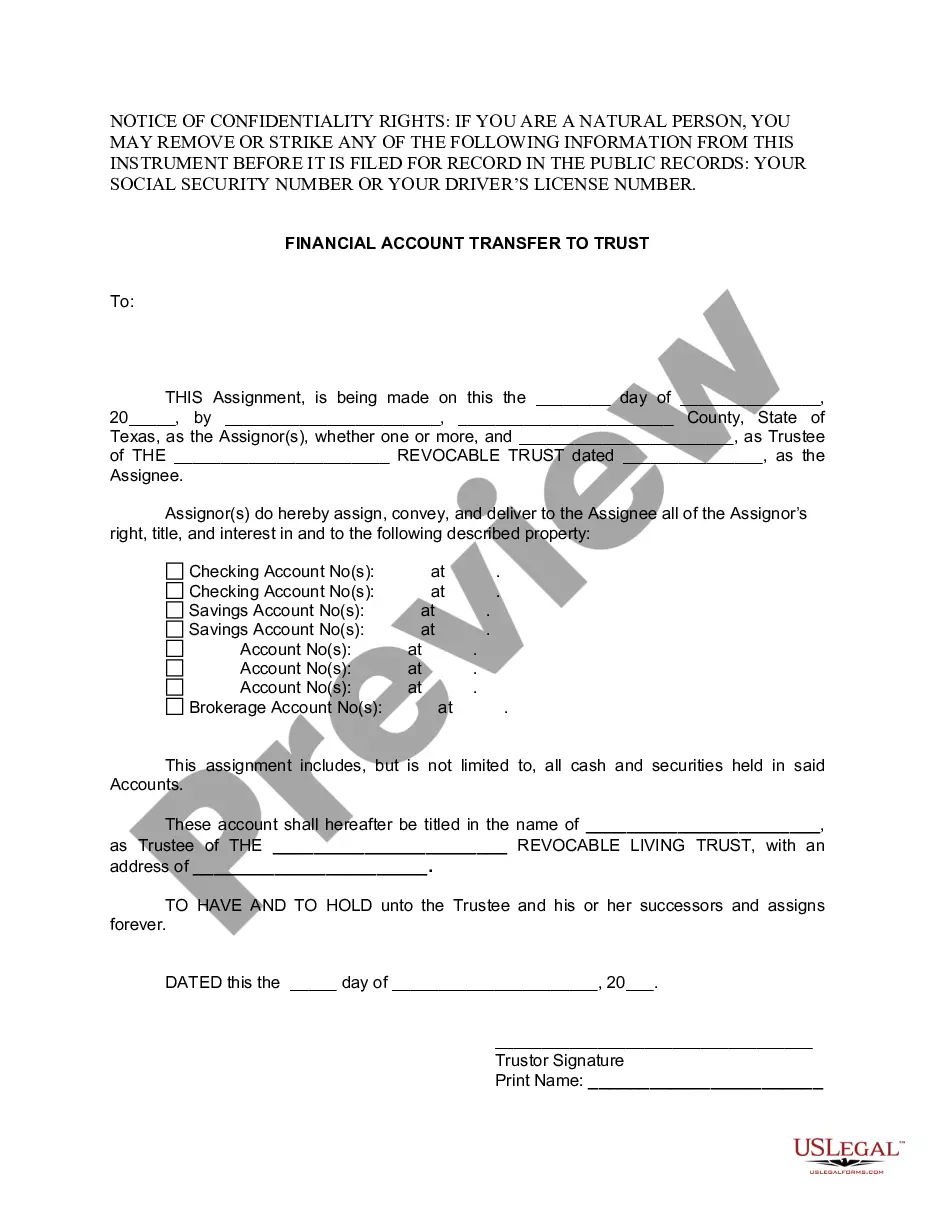

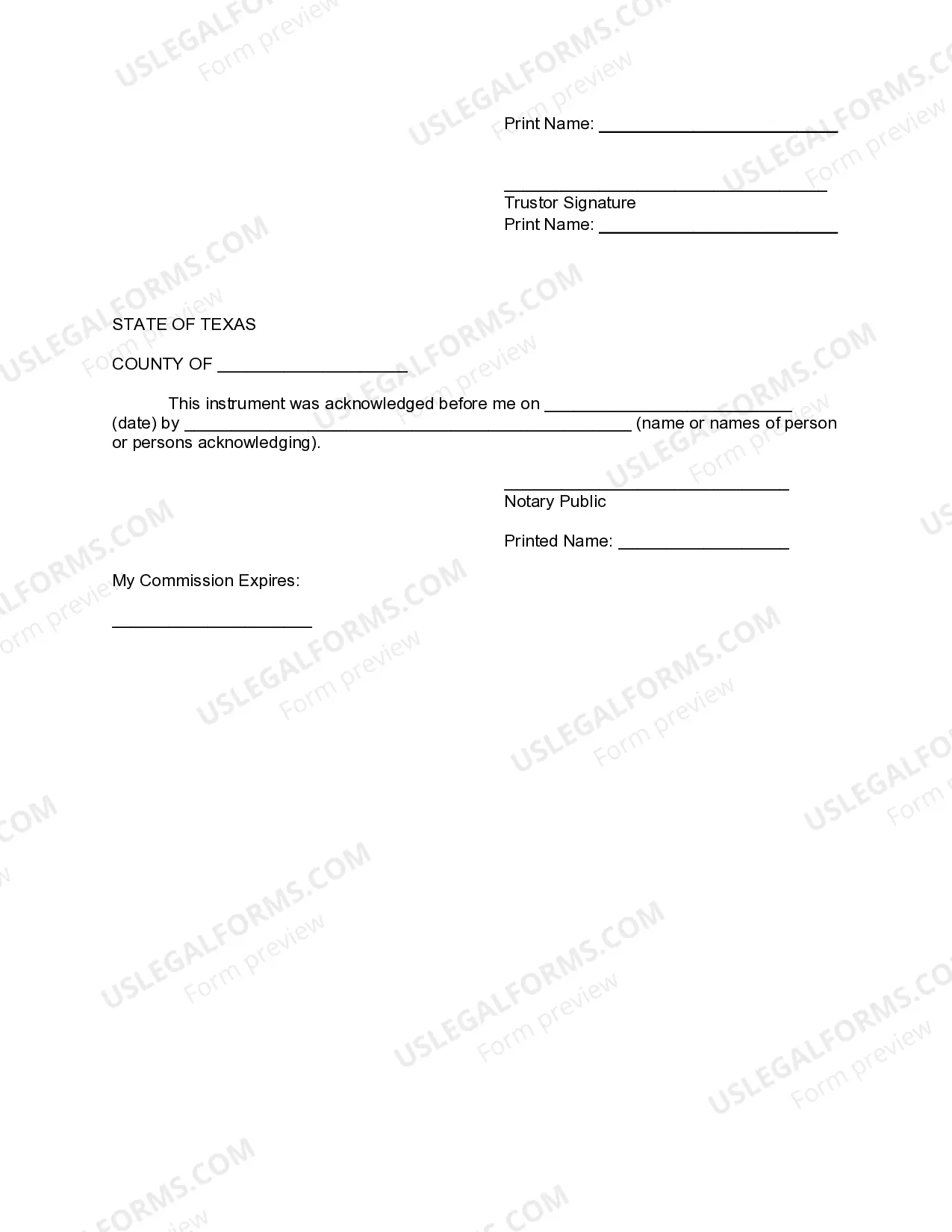

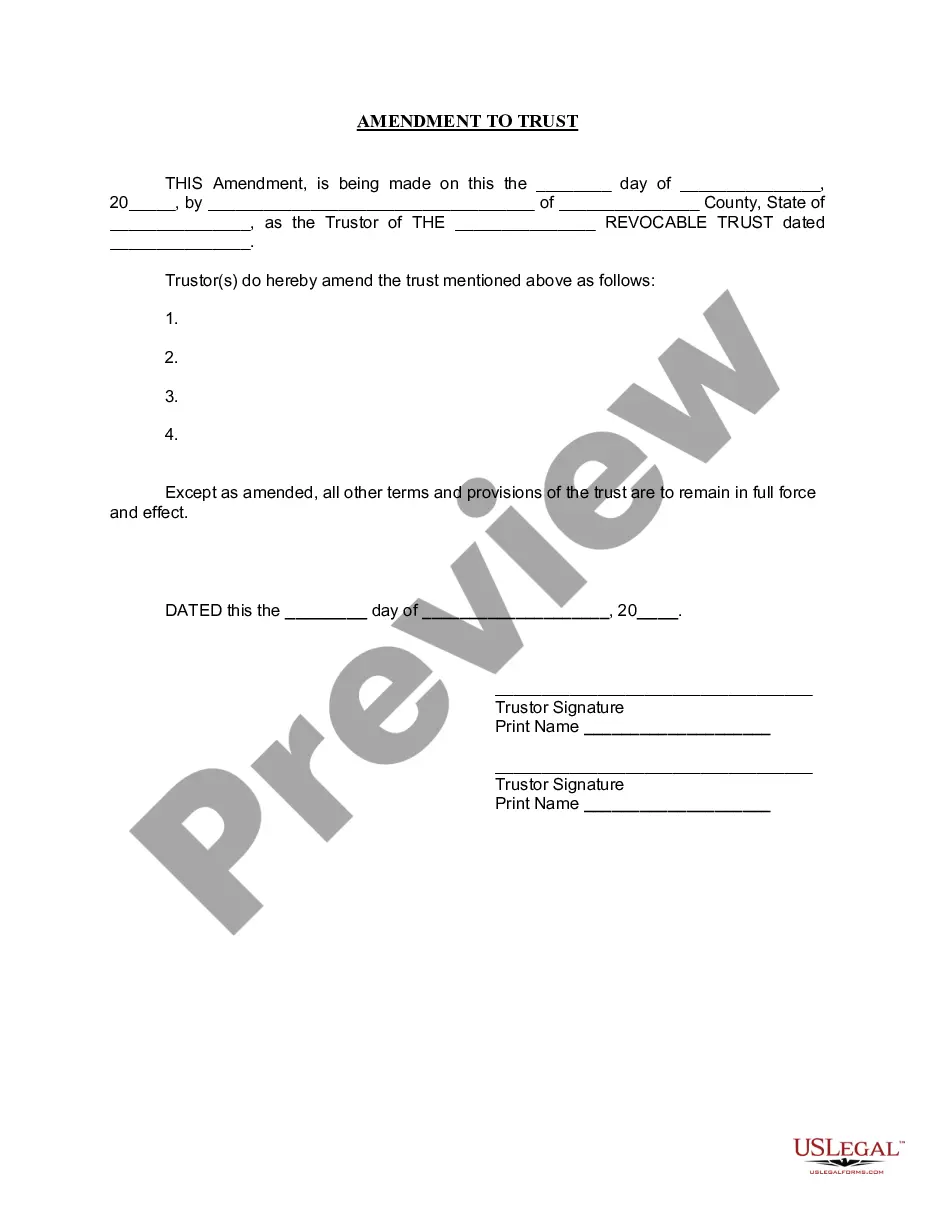

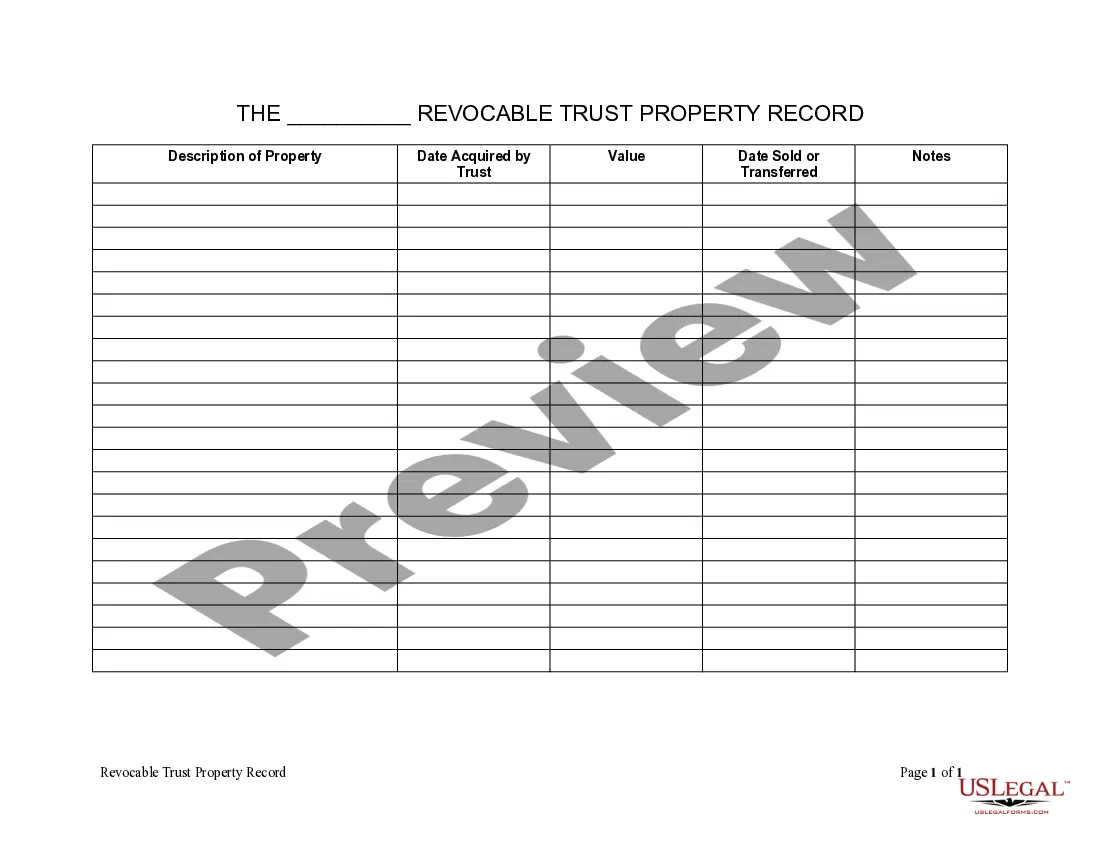

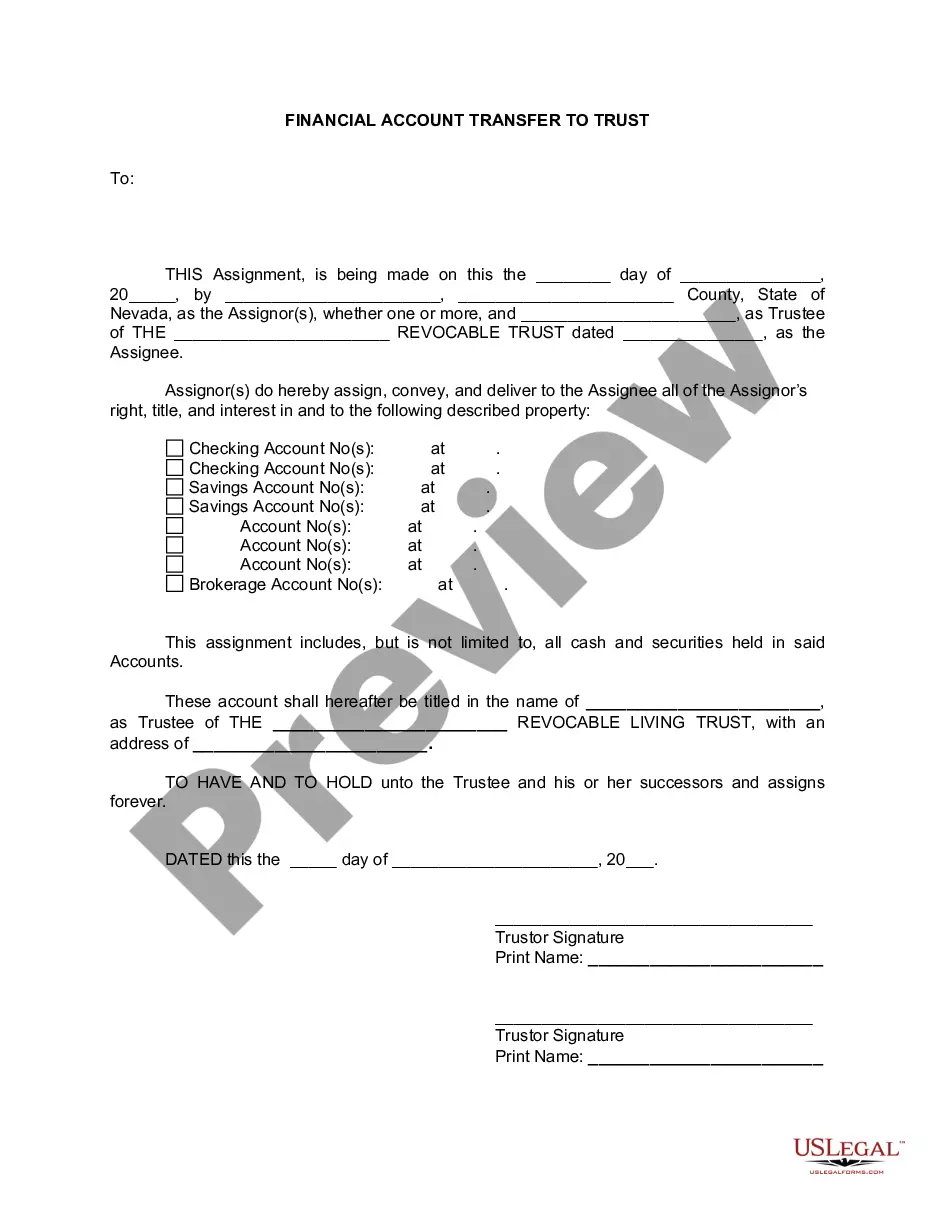

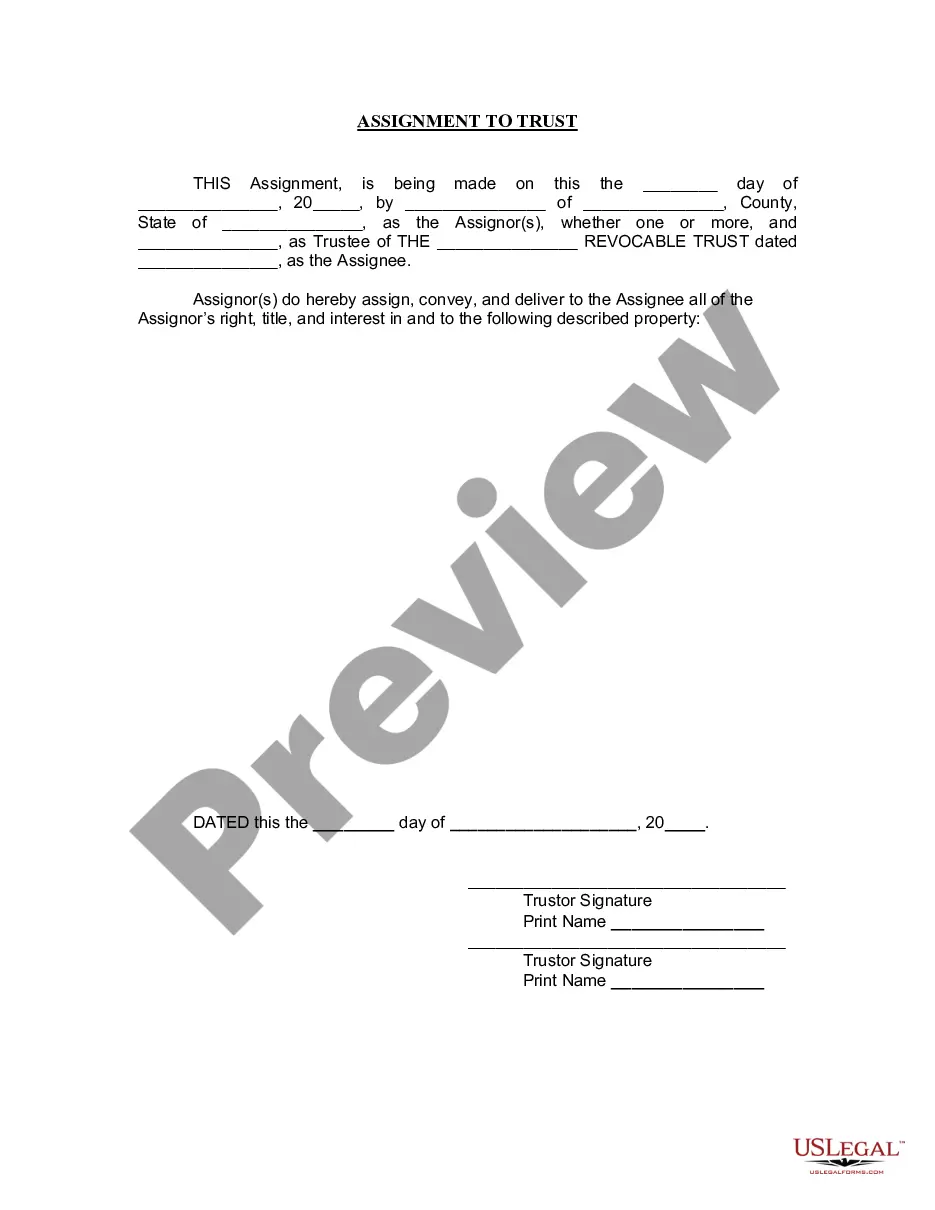

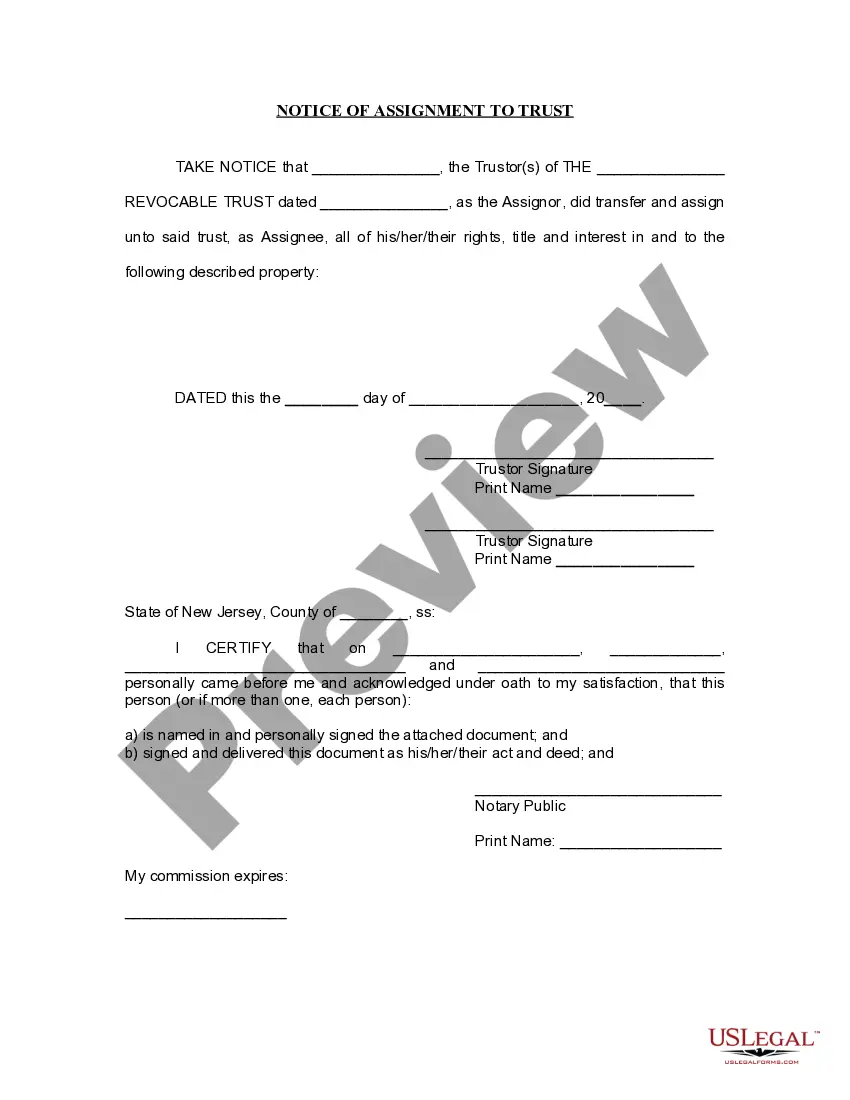

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Wichita Falls Texas Financial Account Transfer to Living Trust

Description

How to fill out Texas Financial Account Transfer To Living Trust?

Do you require a reliable and affordable provider of legal documents to obtain the Wichita Falls Texas Financial Account Transfer to Living Trust? US Legal Forms is your ideal choice.

Whether you seek a straightforward contract to establish guidelines for living with your partner or a collection of paperwork to progress your divorce through the legal system, we have you covered.

Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are tailored specifically to the laws of different states and counties.

To access the form, you need to Log In, locate the desired form, and click the Download button adjacent to it. Remember, you can access your previously acquired document templates anytime via the My documents tab.

You can now create your account. Choose the subscription plan and go ahead with the payment. Once the payment is finalized, download the Wichita Falls Texas Financial Account Transfer to Living Trust in any accessible format. You can revisit the site whenever needed and re-download the form without incurring any additional charges.

Finding current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time researching legal documents online.

- Are you unfamiliar with our site? No concerns.

- You can swiftly set up an account, but prior to that, ensure to do the following.

- Verify if the Wichita Falls Texas Financial Account Transfer to Living Trust aligns with the laws of your region.

- Review the form’s information (if available) to determine who and what the form is suitable for.

- Reinitiate the search if the form doesn't fit your unique needs.

Form popularity

FAQ

To put your finances into a trust, you first need to establish a living trust. This involves creating a legal document that outlines how your assets will be managed. Once your trust is set up, you will then transfer your financial accounts into the trust. Using a platform like USLegalForms can simplify the Wichita Falls Texas Financial Account Transfer to Living Trust process by providing the necessary forms and guidance to ensure everything is done correctly.

Transferring your checking account to a trust involves visiting your bank and requesting the appropriate forms. After submitting your trust documents, the bank will process the transfer, establishing the trust as the account owner. This step is vital for anyone looking to simplify their Wichita Falls Texas Financial Account Transfer to Living Trust, ensuring a clear path for managing your finances.

To transfer assets to a trust in Texas, first, identify the assets you want to include, such as bank accounts, real estate, or investments. You will then need to execute a transfer deed or titles to formally place these assets in the trust. This process is essential for those seeking a Wichita Falls Texas Financial Account Transfer to Living Trust, as it clearly designates how your assets will be distributed.

Changing a bank account to a living trust involves several steps, beginning with contacting your bank. You will need to present your trust documents and fill out any necessary forms to add the trust as an account owner. This action is crucial for facilitating a smooth Wichita Falls Texas Financial Account Transfer to Living Trust, ensuring your assets are managed according to your intentions.

To transfer your checking account to a living trust, first, contact your bank for their specific process. Typically, you will need to provide the trust documents to establish the trust as an account holder. This step ensures that your checking account aligns with your Wichita Falls Texas Financial Account Transfer to Living Trust plans, making it easier for your beneficiaries to access.

Placing your checking account in a trust can help protect your assets from probate. This process can simplify the transfer to beneficiaries upon your passing, ensuring your wishes are honored. Additionally, using a trust may provide some financial privacy compared to a will, making it a smart move for those considering Wichita Falls Texas Financial Account Transfer to Living Trust.

To transfer property to a living trust in Texas, you will first need to create the trust document. Once established, you should prepare a deed to transfer the property into the trust's name. Ensure that you properly execute and record this deed with the county clerk's office. For ease and compliance, consider using the uslegalforms platform, which provides templates and guidance for a Wichita Falls Texas Financial Account Transfer to Living Trust.

Transferring property into a living trust in Texas involves several key steps. First, you need to retitle the property in the name of the trust, ensuring that the trust document includes accurate information. It's also essential to prepare any necessary legal paperwork and consider consulting with a professional to streamline the process. Engaging with uslegalforms can help you navigate the Wichita Falls Texas financial account transfer to living trust efficiently.

Many parents overlook the importance of clear communication when establishing a trust fund. This often leads to confusion and misunderstandings among family members about the intent and distribution of assets. To avoid this, discuss your wishes openly and create a detailed plan that aligns with your family's needs. For those in Wichita Falls, Texas, utilizing resources like uslegalforms can ensure a smooth financial account transfer to a living trust.