This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Fort Worth Texas Assignment to Living Trust

Description

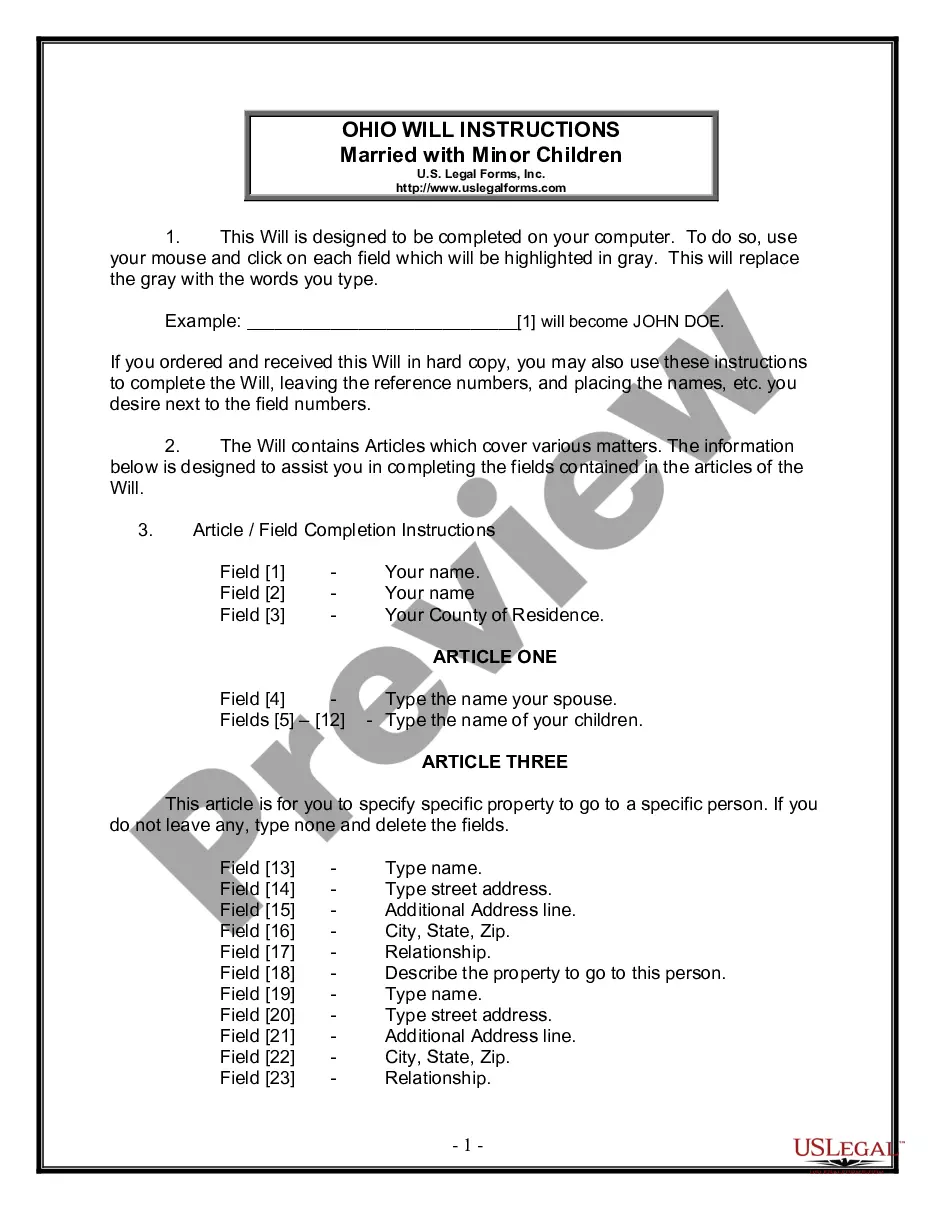

How to fill out Texas Assignment To Living Trust?

We consistently aim to reduce or eliminate legal complications when handling intricate legal or financial situations.

To achieve this, we seek legal assistance which typically incurs high expenses.

However, not all legal issues possess the same level of complexity.

Many of them can be managed independently by us.

Utilize US Legal Forms whenever you need to quickly and safely locate and download the Fort Worth Texas Assignment to Living Trust or any other document. Simply Log In to your account and click the Get button beside it. If you’ve misplaced the form, you can always download it again in the My documents section. The procedure is equally simple if you’re unfamiliar with the website! You can establish your account in just a few minutes. Ensure you verify whether the Fort Worth Texas Assignment to Living Trust aligns with the laws and regulations of your state and area. Additionally, it is crucial that you review the form’s description (if one is provided), and if you discover any inconsistencies with what you initially sought, look for an alternative form. Once you confirm that the Fort Worth Texas Assignment to Living Trust is suitable for your needs, you can select a subscription plan and process your payment. After that, you can download the form in any available file format. For over 24 years, we have assisted millions of individuals by offering customizable and current legal documents. Take full advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is an internet repository of current DIY legal documents that encompass everything from wills and power of attorney to incorporation articles and dissolution petitions.

- Our service enables you to manage your own affairs without relying on a lawyer's assistance.

- We provide access to legal document templates that are not always available to the public.

- Our templates are tailored to specific states and regions, which significantly simplifies the search process.

Form popularity

FAQ

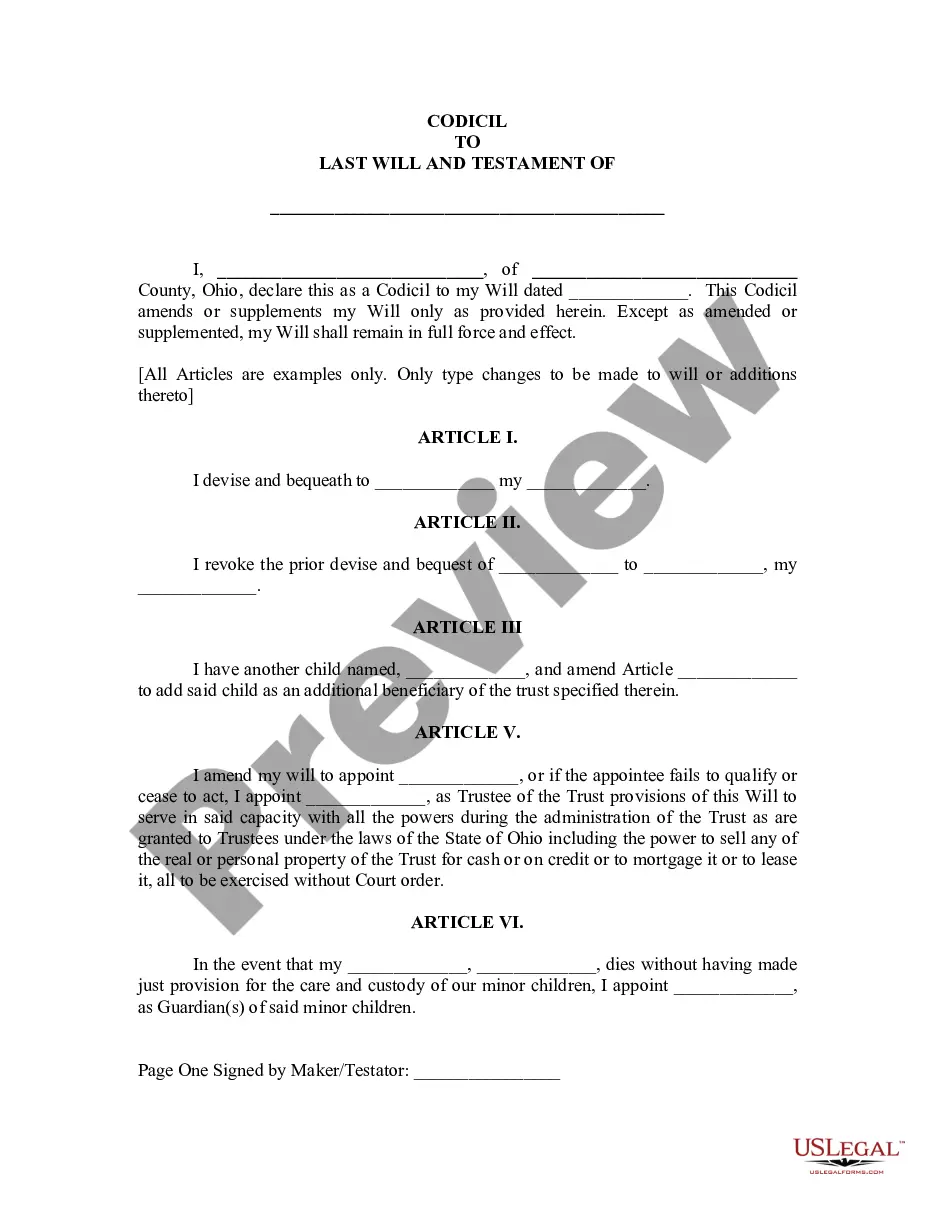

To make a living trust in Texas, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

To make a living trust in Texas, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

The main benefit of putting a house in a trust in Texas is to bypass the probate process. Even if you have a will, all of your assets will go through probate when you die. For married couples, placing a house in trust ensures that the surviving spouse becomes the sole owner when the other spouse dies.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

You could end up paying more than $1,000 to create a living trust. While these costs are a definite downside, you'll dodge the potential dangers of DIY estate planning by getting an expert's input.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

A trust cannot own, manage, or sell real estate or other property. However, the trustee administering the trust may hold legal title to the property on behalf of the individual or individuals that the trust benefits. This means that the trustee may lease, sell, or otherwise manage the property.