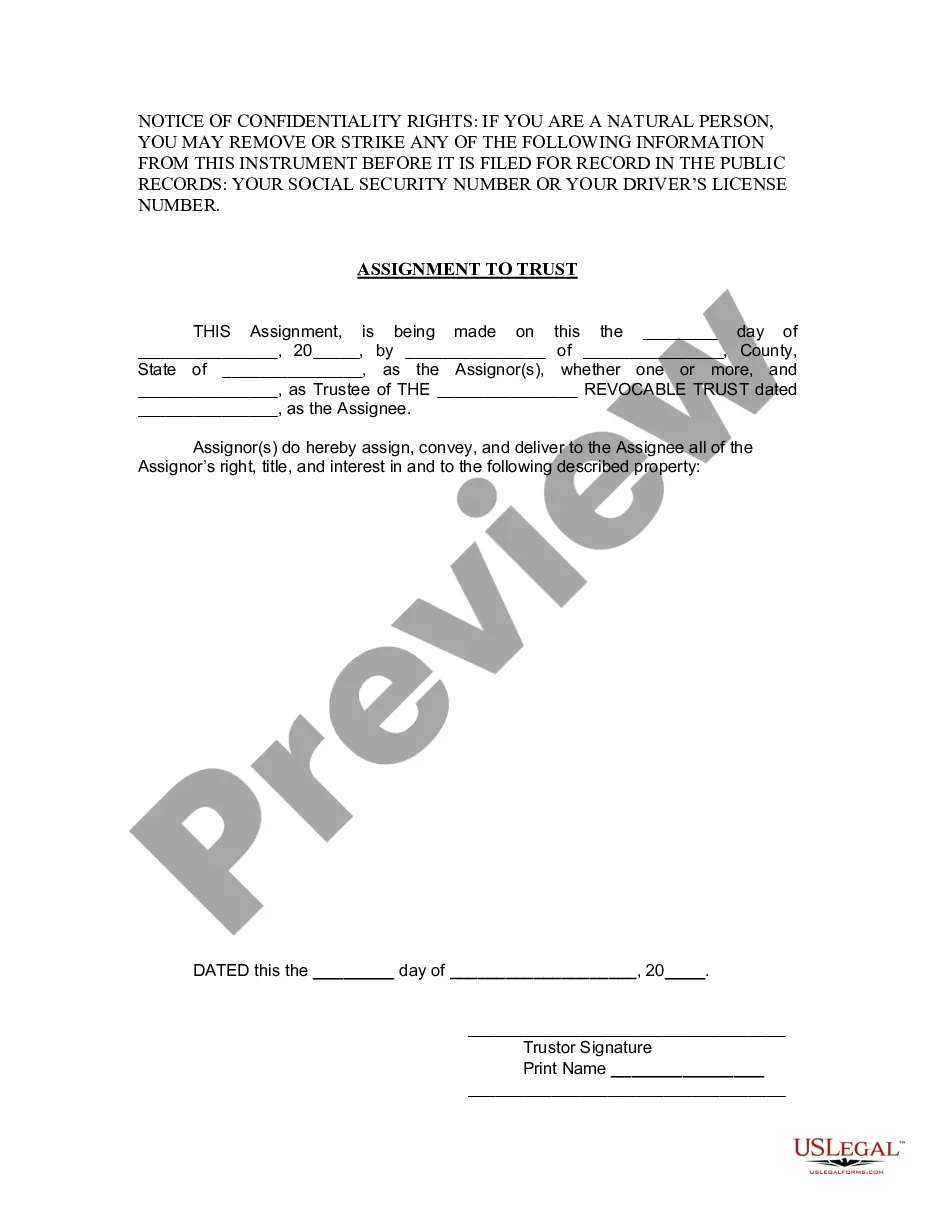

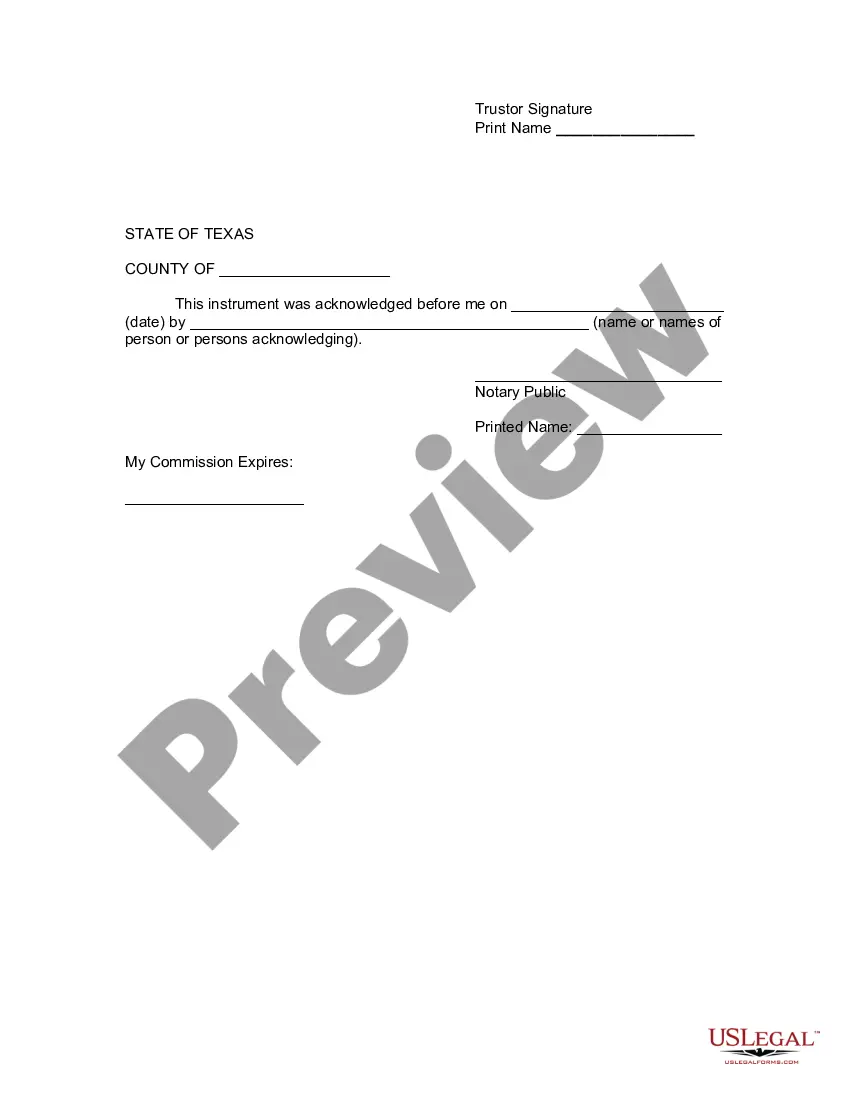

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Laredo, Texas Assignment to Living Trust: A Comprehensive Guide to Securing Your Assets In Laredo, Texas, residents have the opportunity to protect their assets and ensure the smooth transfer of their estate through a legal arrangement called the Assignment to Living Trust. This powerful tool allows individuals to assign their assets, such as properties, bank accounts, and investments, into a trust while still maintaining control and benefitting from them during their lifetime. Let's explore this topic in detail and shed light on the different types of Laredo, Texas Assignment to Living Trust available. What is an Assignment to Living Trust? An Assignment to Living Trust, commonly known as a living trust or revocable trust, is a legal document that enables individuals to transfer their assets into a trust, managed by a trustee, for the purpose of estate planning and avoiding probate. Unlike a will, which takes effect only after death, a living trust becomes effective from the moment it is created, providing a seamless transition of assets while granting greater control over distribution. Key Benefits of Laredo, Texas Assignment to Living Trust: 1. Probate Avoidance: One of the primary advantages of establishing a living trust in Laredo, Texas, is avoiding probate. Through this process, assets held in a trust can bypass the lengthy and potentially expensive probate proceedings, offering privacy and efficiency to your loved ones during the estate distribution process. 2. Flexibility and Control: The Assignment to Living Trust allows the settler (the person creating the trust) to retain control over their assets during their lifetime. They can manage, modify, or even revoke the trust as long as they are mentally competent. This feature makes it a versatile tool for financial planning and adaptation to life circumstances. 3. Incapacity Planning: In case of mental or physical incapacitation, the living trust provides a mechanism for the seamless management of assets by a successor trustee designated by the settler. This ensures the continuity of financial affairs without the need for court intervention, conservatorship, or guardianship proceedings. 4. Privacy Protection: Unlike a will, which becomes a public document upon probate, the living trust maintains utmost privacy. This way, the details of your estate and distribution are kept confidential, shielding your family from potential public scrutiny or external interference. Types of Laredo, Texas Assignment to Living Trust: 1. Individual Living Trust: This is the most common type of living trust, where a single person creates a trust for the management and distribution of their assets upon death or incapacitation. 2. Joint Living Trust: A joint living trust is designed for married or committed couples who wish to combine their assets into one trust. This type of trust provides seamless asset management and distribution for both partners during their lifetimes and after. 3. Testamentary Trust: Although technically not a living trust, it's worth mentioning that Laredo, Texas residents can also create a testamentary trust within their will. This trust only takes effect after the settler's death and allows for the continued management and distribution of assets following their wishes. Creating an Assignment to Living Trust in Laredo, Texas is an astute decision to protect your assets, streamline probate, and ensure a hassle-free transfer of wealth to your loved ones. Consider consulting with an experienced estate planning attorney who can guide you through the process, tailor the trust to your unique circumstances, and secure your financial future.Laredo, Texas Assignment to Living Trust: A Comprehensive Guide to Securing Your Assets In Laredo, Texas, residents have the opportunity to protect their assets and ensure the smooth transfer of their estate through a legal arrangement called the Assignment to Living Trust. This powerful tool allows individuals to assign their assets, such as properties, bank accounts, and investments, into a trust while still maintaining control and benefitting from them during their lifetime. Let's explore this topic in detail and shed light on the different types of Laredo, Texas Assignment to Living Trust available. What is an Assignment to Living Trust? An Assignment to Living Trust, commonly known as a living trust or revocable trust, is a legal document that enables individuals to transfer their assets into a trust, managed by a trustee, for the purpose of estate planning and avoiding probate. Unlike a will, which takes effect only after death, a living trust becomes effective from the moment it is created, providing a seamless transition of assets while granting greater control over distribution. Key Benefits of Laredo, Texas Assignment to Living Trust: 1. Probate Avoidance: One of the primary advantages of establishing a living trust in Laredo, Texas, is avoiding probate. Through this process, assets held in a trust can bypass the lengthy and potentially expensive probate proceedings, offering privacy and efficiency to your loved ones during the estate distribution process. 2. Flexibility and Control: The Assignment to Living Trust allows the settler (the person creating the trust) to retain control over their assets during their lifetime. They can manage, modify, or even revoke the trust as long as they are mentally competent. This feature makes it a versatile tool for financial planning and adaptation to life circumstances. 3. Incapacity Planning: In case of mental or physical incapacitation, the living trust provides a mechanism for the seamless management of assets by a successor trustee designated by the settler. This ensures the continuity of financial affairs without the need for court intervention, conservatorship, or guardianship proceedings. 4. Privacy Protection: Unlike a will, which becomes a public document upon probate, the living trust maintains utmost privacy. This way, the details of your estate and distribution are kept confidential, shielding your family from potential public scrutiny or external interference. Types of Laredo, Texas Assignment to Living Trust: 1. Individual Living Trust: This is the most common type of living trust, where a single person creates a trust for the management and distribution of their assets upon death or incapacitation. 2. Joint Living Trust: A joint living trust is designed for married or committed couples who wish to combine their assets into one trust. This type of trust provides seamless asset management and distribution for both partners during their lifetimes and after. 3. Testamentary Trust: Although technically not a living trust, it's worth mentioning that Laredo, Texas residents can also create a testamentary trust within their will. This trust only takes effect after the settler's death and allows for the continued management and distribution of assets following their wishes. Creating an Assignment to Living Trust in Laredo, Texas is an astute decision to protect your assets, streamline probate, and ensure a hassle-free transfer of wealth to your loved ones. Consider consulting with an experienced estate planning attorney who can guide you through the process, tailor the trust to your unique circumstances, and secure your financial future.