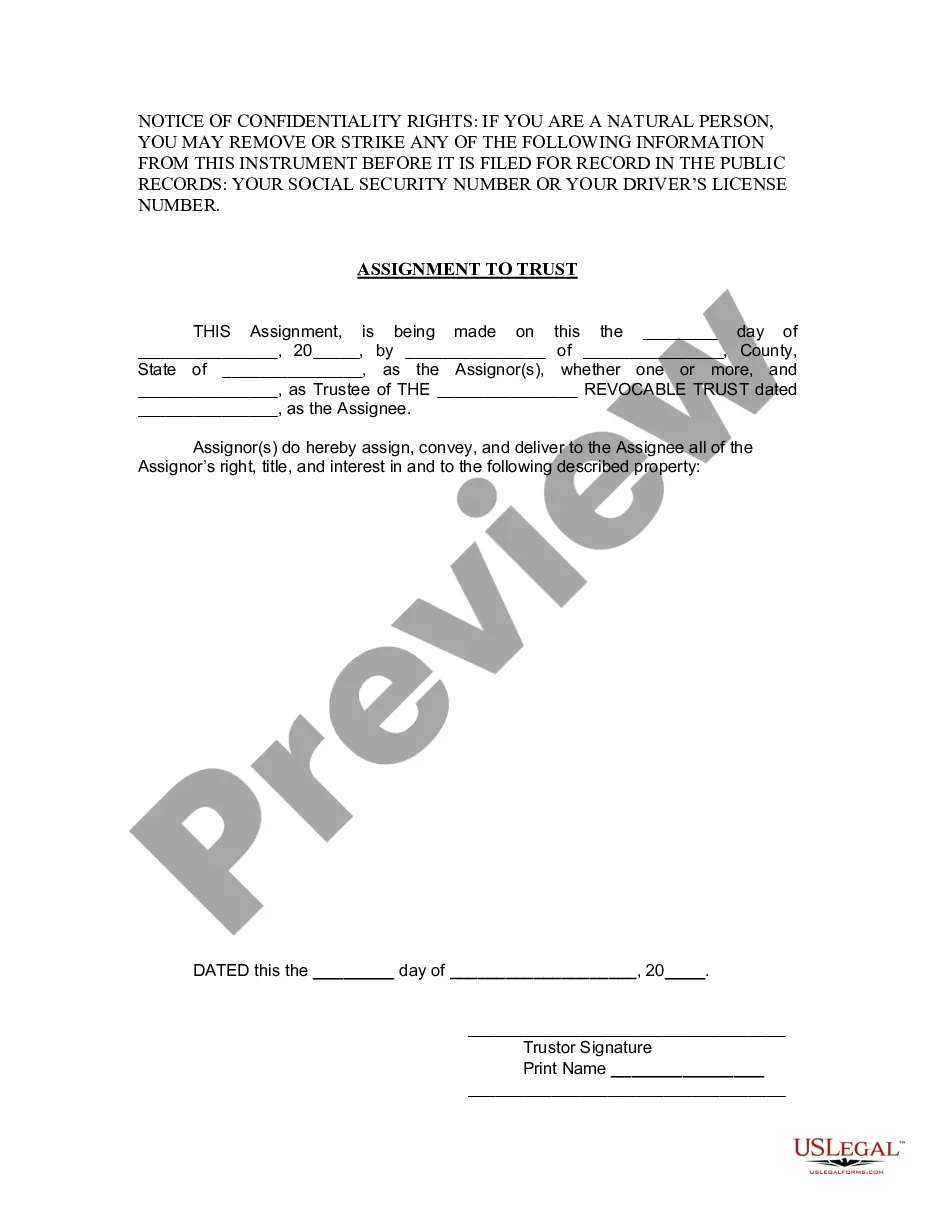

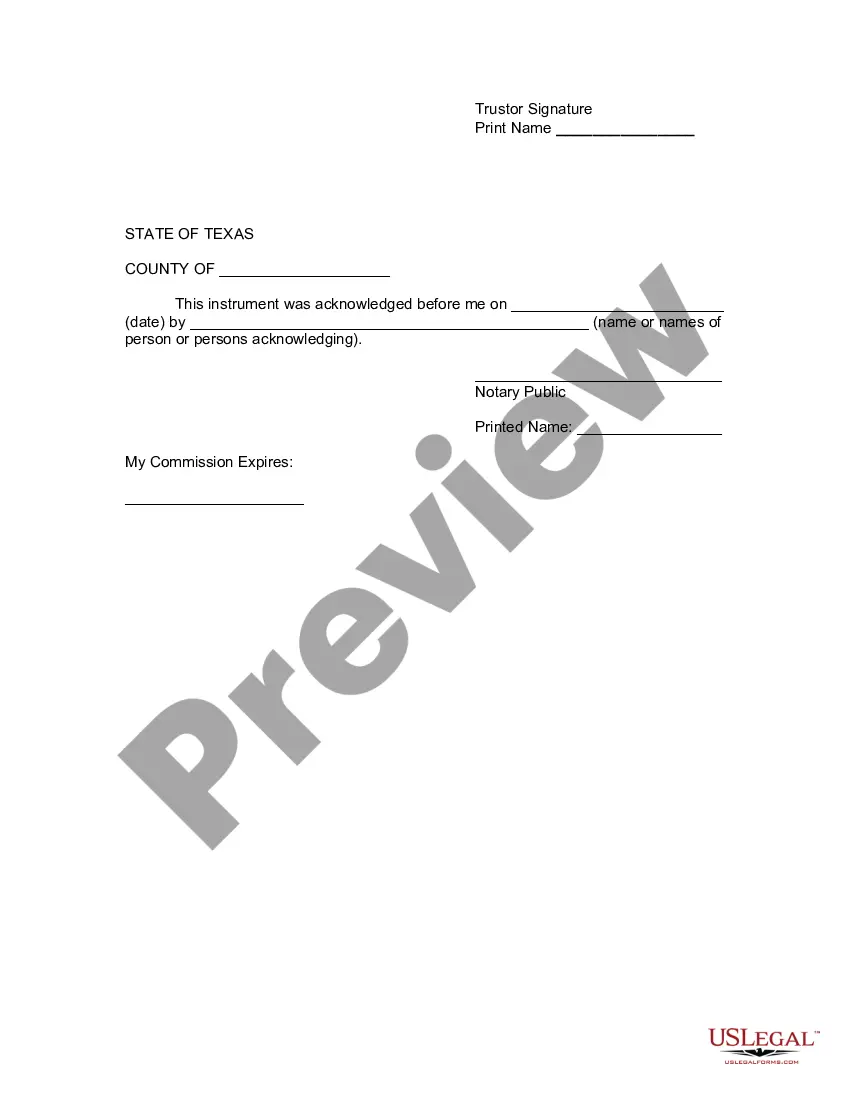

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

San Antonio Texas Assignment to Living Trust

Description

How to fill out Texas Assignment To Living Trust?

Utilize the US Legal Forms and gain immediate access to any document template you require.

Our advantageous platform featuring numerous templates allows you to easily locate and obtain nearly any document sample you desire.

You can save, complete, and authenticate the San Antonio Texas Assignment to Living Trust in mere minutes instead of spending hours online searching for an appropriate template.

Using our catalog is an excellent method to enhance the security of your document submissions.

Access the page with the form you require. Ensure that it is the form you were looking for: check its title and description, and use the Preview option when available. Otherwise, utilize the Search field to locate the necessary one.

Initiate the download process. Click Buy Now and choose the pricing plan you prefer. Then, register for an account and pay for your order using a credit card or PayPal.

- Our skilled attorneys routinely examine all documents to ensure the templates are applicable for a specific state and adhere to current laws and regulations.

- How can you obtain the San Antonio Texas Assignment to Living Trust? If you have an existing subscription, simply Log In to your account.

- The Download button will be visible on all the samples you browse.

- Additionally, you can access all previously saved documents in the My documents section.

- If you haven't created a profile yet, follow the steps below.

Form popularity

FAQ

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

You could end up paying more than $1,000 to create a living trust. While these costs are a definite downside, you'll dodge the potential dangers of DIY estate planning by getting an expert's input.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Protecting your assets A family trust holds property on behalf of the beneficiaries and protects it from creditors. The trust assets cannot be seized following a lawsuit or personal bankruptcy. It's important to remember, however, that the trust must be created when everything is going well.

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

A trust cannot own, manage, or sell real estate or other property. However, the trustee administering the trust may hold legal title to the property on behalf of the individual or individuals that the trust benefits. This means that the trustee may lease, sell, or otherwise manage the property.