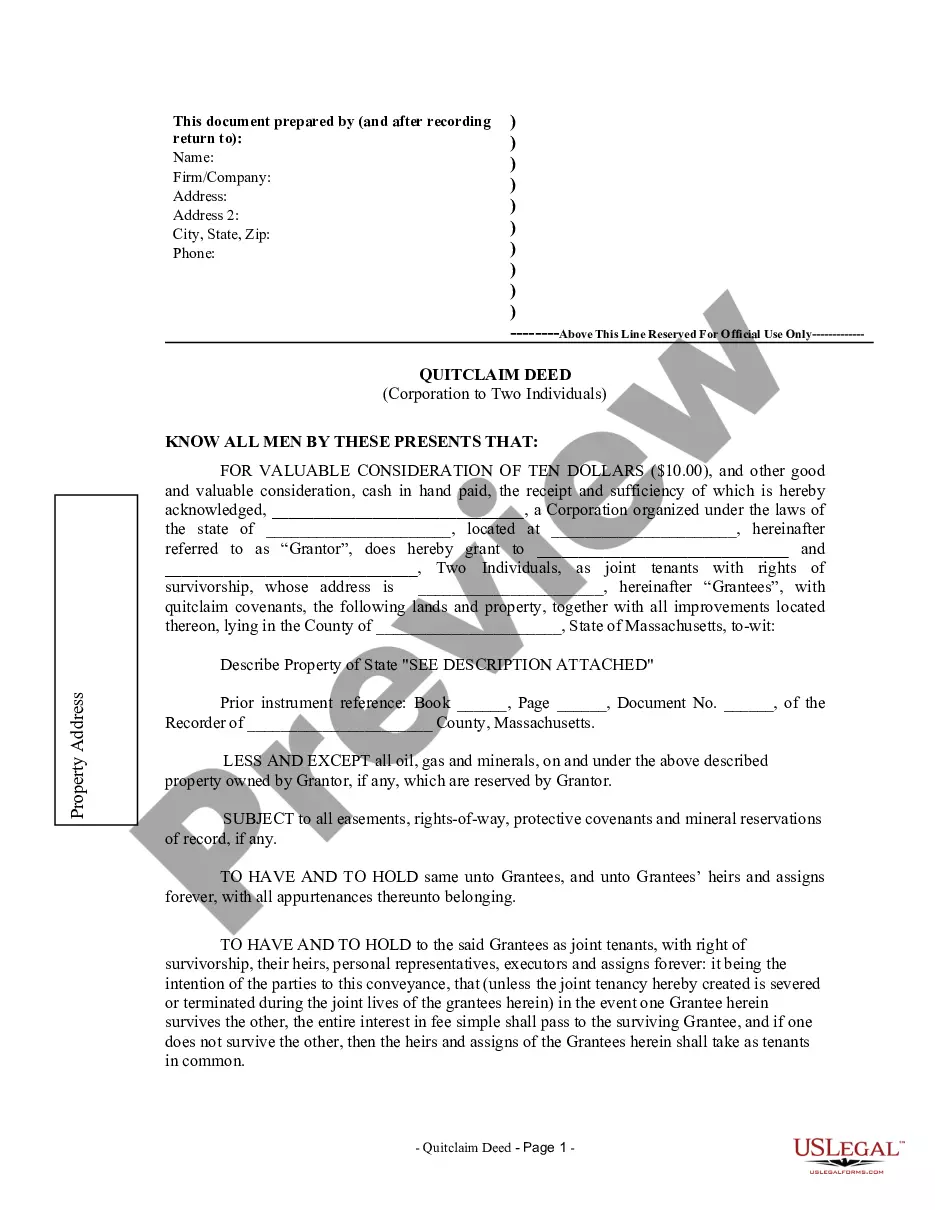

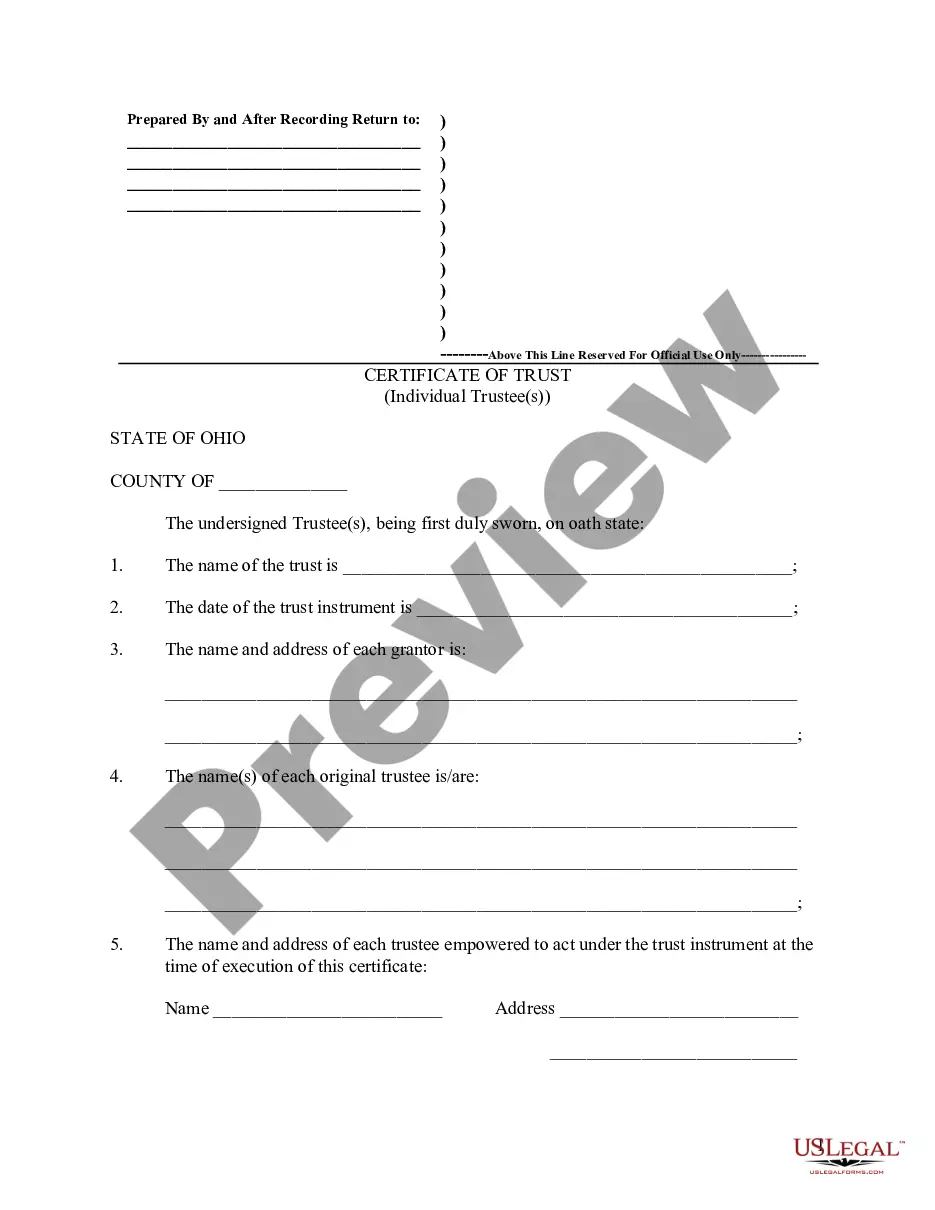

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Corpus Christi Texas Notice of Assignment to Living Trust

Description

How to fill out Corpus Christi Texas Notice Of Assignment To Living Trust?

If you've previously utilized our service, sign in to your account and retrieve the Corpus Christi Texas Notice of Assignment to Living Trust on your device by clicking the Download button. Verify that your subscription is active. If it is not, renew it per your payment plan.

If this is your initial engagement with our service, follow these straightforward steps to acquire your document.

You have lifelong access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to conveniently find and save any template for your personal or professional requirements!

- Confirm that you’ve found a suitable document. Browse through the description and utilize the Preview option, if available, to see if it suits your needs. If it's unsuitable, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and complete the payment. Enter your credit card information or choose the PayPal option to finalize the transaction.

- Receive your Corpus Christi Texas Notice of Assignment to Living Trust. Select the file format for your document and download it to your device.

- Fill out your document. Print it or use online editing tools to complete it and sign it electronically.

Form popularity

FAQ

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

To make a living trust in Texas, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Duty to keep accounts: Texas trust law requires a trustee to keep accurate accounts of trust property. Duty to supply information: ?First tier? beneficiaries 25 and over have the right to examine trust property and accounts along with certain documentation related to trust property.

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

A trust cannot own, manage, or sell real estate or other property. However, the trustee administering the trust may hold legal title to the property on behalf of the individual or individuals that the trust benefits. This means that the trustee may lease, sell, or otherwise manage the property.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

Under Texas trust laws, the following are required for a valid trust to be formed: The Settlor must have a present intent to create a trust. The Settlor must have capacity to convey assets to the trust. The trust must comply with the Statute of Frauds.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

You could end up paying more than $1,000 to create a living trust. While these costs are a definite downside, you'll dodge the potential dangers of DIY estate planning by getting an expert's input.

More info

You can help me with that. In this example, because the foreign judgment is a “foreign judgment,” it is subject to some state rules, especially with respect to service of process. The Texas statute requires it to be served by mail—apparently a common misconception. It is only as a foreign judgment that Texas requires service by mailing; in a domestic judgment, the foreign judgment itself may suffice as a means of service. The statute specifies that a summons and other process must be issued before the foreign judgment is “appealed” (Tex. Administrative Code Ann. § 20.003). A certificate must be issued by a Justice of the Peace requesting the Court to issue and serve the foreign judgment on the judgment debtor. Tex. Administrative Code Ann. § 20.024. The certificate may be delivered to the judgment debtor. Tex. Administrative Code Ann. § 20.025. A judgment debtor must be notified in writing of the foreign judgment within five days of its being recorded by the clerk.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.