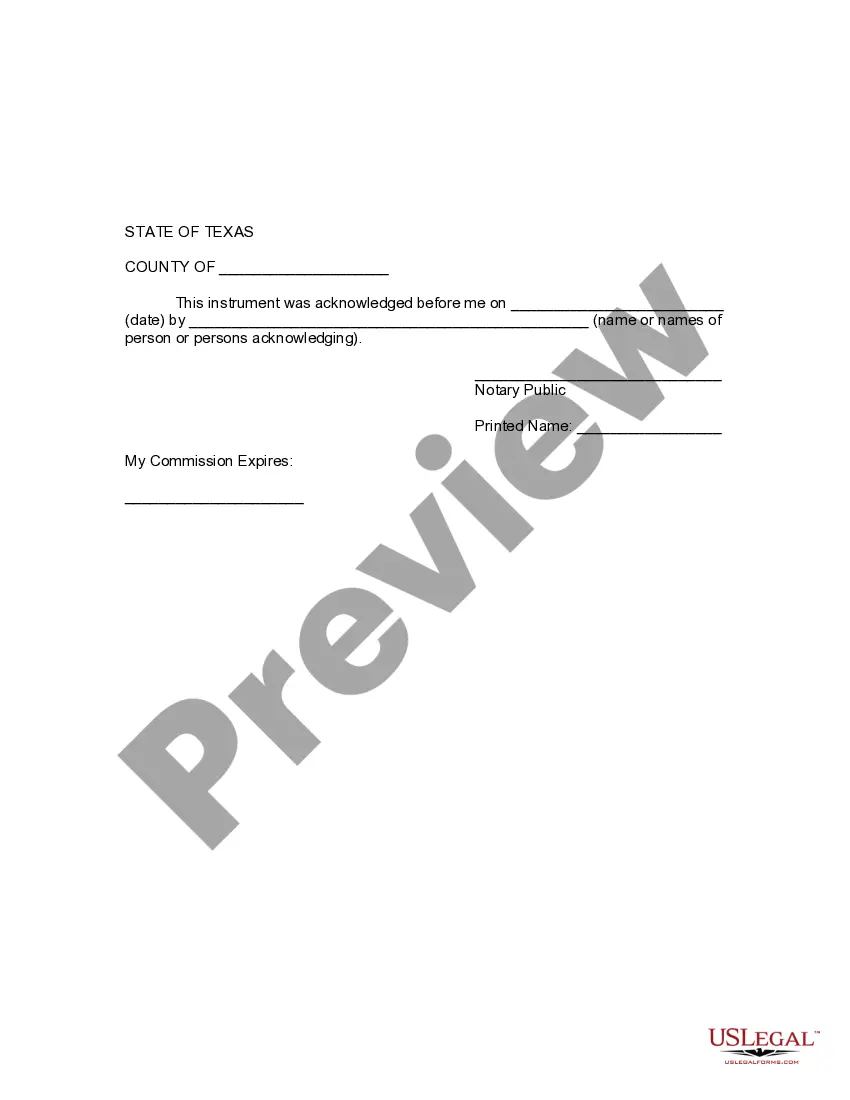

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Frisco Texas Revocation of Living Trust

Description

How to fill out Texas Revocation Of Living Trust?

Locating authenticated templates relevant to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the files are appropriately categorized by usage area and jurisdiction, making the search for the Frisco Texas Revocation of Living Trust as straightforward as pie.

Maintaining orderly documentation that adheres to legal standards is crucial. Take advantage of the US Legal Forms library to consistently have vital document templates available at your fingertips!

- Review the Preview mode and document description.

- Ensure you’ve selected the correct one that fulfills your needs and aligns perfectly with your regional legal specifications.

- Seek another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the accurate one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

One major mistake parents make is failing to communicate their plans clearly with their children, which can result in confusion and conflict. Additionally, parents sometimes do not account for potential changes in their financial situation or family dynamics. If you are considering a Frisco Texas Revocation of Living Trust, learning from these common mistakes can help ensure that your wishes are honored.

A notable negative aspect of a trust is that it can be more expensive to set up and maintain compared to other estate planning tools. Furthermore, if not structured correctly, it may provide limited flexibility in asset control during your lifetime. With considerations like the Frisco Texas Revocation of Living Trust, understanding these negatives can guide you towards making informed choices.

Setting up a trust can have pitfalls such as overlooking crucial details, which may lead to disputes later on. Often, people do not fully understand the tax implications that a trust can have, which can complicate financial planning. In the context of a Frisco Texas Revocation of Living Trust, ensuring proper documentation and understanding can mitigate these issues significantly.

One disadvantage of a family trust is that it can sometimes lead to conflicts among family members, especially if there are unclear terms or expectations. Additionally, managing a trust requires ongoing responsibilities, including record-keeping and legal compliance. If you need to change or revoke the trust, it can involve complexities, particularly under Frisco Texas Revocation of Living Trust laws.

Shutting down a trust typically requires a formal revocation process, following the rules specified in the trust agreement. If you're exploring the Frisco Texas Revocation of Living Trust options, understanding the necessary steps is critical. Consulting knowledgeable legal resources can ease this transition and ensure compliance with all laws.

Ending a trust involves adhering to the conditions set forth when it was created, or through mutual agreement among beneficiaries. In Frisco Texas Revocation of Living Trust, legal guidance ensures that the process meets statutory requirements. To effectively conclude your trust, collaborate with professionals who are skilled in estate law.

To revoke a living trust in Texas, you need to follow the procedures outlined in the trust document, which may involve creating a formal written revocation. When dealing with Frisco Texas Revocation of Living Trust, having a clear understanding of the legal requirements is essential. Utilizing streamlined services like uslegalforms can help you navigate the complexities of revocation.

A nursing home can potentially access assets from a revocable trust to cover care costs if you qualify for Medicaid. However, many factors are at play; thus, in Frisco Texas Revocation of Living Trust scenarios, expert legal advice can help protect your assets. Ensure you understand your options by consulting with professionals who specialize in estate planning.

The 5-year rule often relates to the look-back period for Medicaid eligibility regarding trusts. If you are considering the Frisco Texas Revocation of Living Trust, it's crucial to understand how this rule affects your assets. Consulting with an elder law attorney can provide insight on how to manage your trust in accordance with this regulation.

To deactivate a trust, you typically need to revoke it formally, following the terms stated in the trust document. In the context of Frisco Texas Revocation of Living Trust, proper procedures are essential for legal clarity. Using resources like uslegalforms can simplify this process, providing you with the necessary forms and guidance.