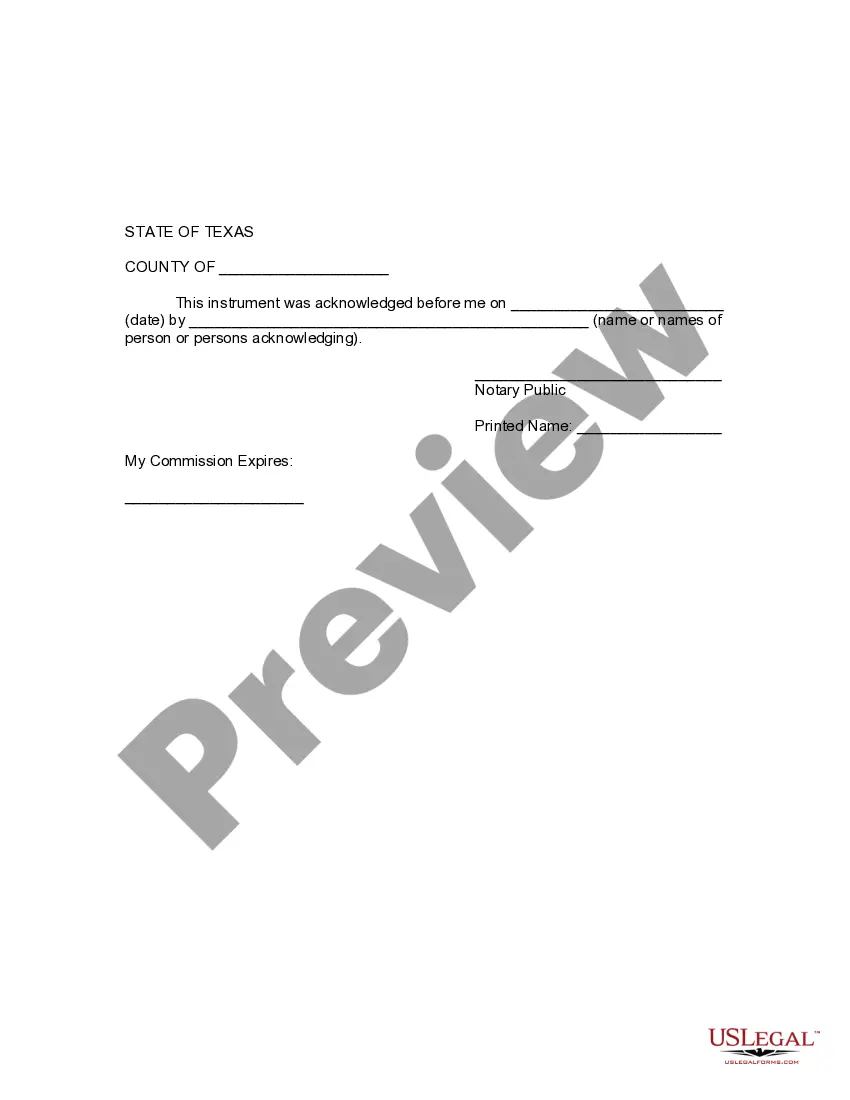

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Harris Texas Revocation of Living Trust

Description

How to fill out Texas Revocation Of Living Trust?

If you are searching for an authentic form template, it’s challenging to discover a superior service than the US Legal Forms website – likely the most comprehensive collections on the web.

With this collection, you can locate a substantial number of form examples for commercial and personal purposes categorized by types and states, or keywords.

With our premium search function, obtaining the latest Harris Texas Revocation of Living Trust is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Choose the file format and download it onto your device. Modify it. Fill out, edit, print, and sign the obtained Harris Texas Revocation of Living Trust. Every template you store in your account has no expiration date and is yours indefinitely. You can always access them through the My documents menu, so if you wish to obtain an additional copy for enhancement or to create a hard copy, you can return and download it again at any moment. Utilize the extensive catalog of US Legal Forms to access the Harris Texas Revocation of Living Trust you were seeking along with numerous other professional and state-specific samples in one place!

- Furthermore, the accuracy of each document is confirmed by a team of skilled attorneys who regularly review the templates on our platform and update them in line with the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Harris Texas Revocation of Living Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions provided below.

- Ensure you have accessed the sample you desire. Examine its details and utilize the Preview feature (if available) to review its content. If it doesn’t fulfill your requirements, employ the Search option located at the top of the screen to find the necessary record.

- Confirm your choice. Click the Buy now button. Then, select your preferred pricing option and provide information to create an account.

Form popularity

FAQ

A trust may become void for various reasons, such as lack of legal capacity, improper creation, or failure to meet statutory requirements. Additionally, if the terms are against public policy or law, the trust might be deemed invalid. Understanding the potential pitfalls is essential, and utilizing the resources offered by the uslegalforms platform can help ensure your Harris Texas Revocation of Living Trust is set up correctly.

The 5 year rule for trusts typically refers to the taxation and distribution requirements set by the IRS, particularly for irrevocable trusts. However, under Harris Texas Revocation of Living Trust, this context may differ; it mainly focuses on the ability to revoke the trust without complications within five years. Understanding these nuances will benefit you in managing your trust effectively.

Trusts can be terminated through several methods, including fulfillment of the trust's purpose, mutual agreement among the beneficiaries, or by a court order. For the Harris Texas Revocation of Living Trust, you will need to gather the necessary documents and, if required, provide a notice of termination. Consulting a legal professional can help navigate this process effectively.

You can bring a trust to an end by following the terms outlined in the trust document. Generally, this involves a formal process where the trustee satisfies all obligations and distributes the trust's assets according to the beneficiaries' wishes. Additionally, under the Harris Texas Revocation of Living Trust, the grantor can revoke the trust entirely, terminating it with proper documentation and procedures.

To revoke a living trust means to nullify the trust while you are still alive, allowing you to take control back over your assets. With the Harris Texas Revocation of Living Trust, this action can help you change your estate plans or correct any issues with the original trust setup. After you revoke the trust, you can redistribute your assets as you see fit. For assistance in managing this process, consider uslegalforms, which offers easy-to-use resources for a smooth revocation experience.

The revocation of trust refers to the process of officially canceling a trust agreement. In the case of the Harris Texas Revocation of Living Trust, this means that you are terminating the legal arrangement that manages your assets and property. It is essential to undertake this process correctly to ensure that all legal obligations are met. Using platforms like uslegalforms can guide you through the necessary steps to revoke your trust efficiently.

Revoking a trust can be straightforward if you follow the established procedures and legal requirements. It involves drafting a document and ensuring all parties are informed. However, complexities may arise based on the trust's structure and state laws, particularly in Texas. For a clear path through the process, consulting resources about Harris Texas Revocation of Living Trust can be valuable.

The revocation of a living trust refers to the legal process of canceling the trust and returning control of the trust assets to the grantor. This process often involves creating a revocation document and notifying pertinent parties. Understanding this process is essential for individuals exploring their options regarding Harris Texas Revocation of Living Trust.

A trust can be terminated through revocation, reaching its designated end date, or by court order. Revocation allows the grantor to dissolve the trust voluntarily, while reaching an end date means the trust was created for a specific purpose that has been fulfilled. Knowing these termination methods is crucial when considering the Harris Texas Revocation of Living Trust process.

A trust may become null and void if it lacks essential elements such as a valid purpose, or if it was created under invalid circumstances. Conditions like incapacity of the trustor or fraudulent activity during its creation can lead to nullification. For those looking into Harris Texas Revocation of Living Trust, understanding these conditions can provide clarity in your situation.