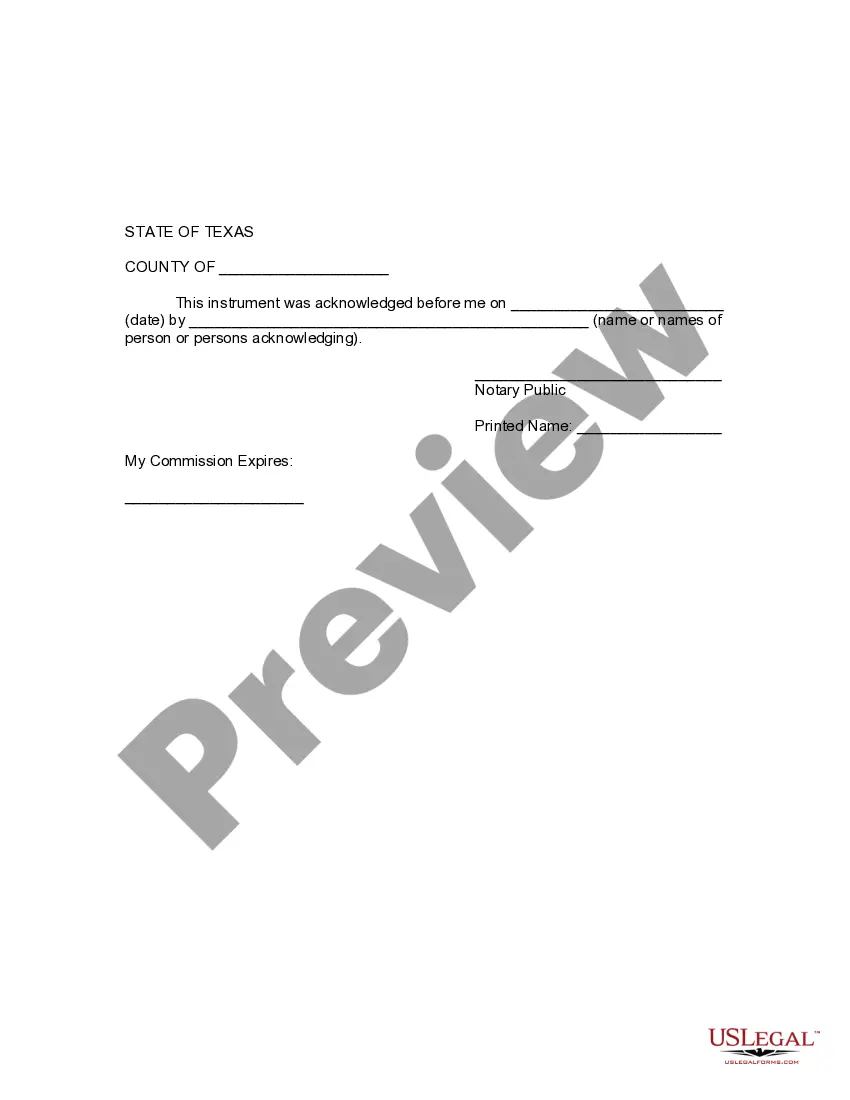

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Harris Texas Revocation of Living Trust: Detailed Overview and Types A "Harris Texas Revocation of Living Trust" refers to the legal process followed to cancel or nullify a previously established living trust in Harris County, Texas. A living trust is a popular estate planning tool that allows individuals to transfer ownership of their assets and properties to a trust during their lifetime, ensuring distribution and management according to their wishes upon incapacitation or death. However, situations may arise where the trust creator, also known as the granter or settler, decides to revoke the trust due to changing circumstances, altered estate planning goals, or other personal reasons. To officially revoke a living trust in Harris County, Texas, specific steps must be taken in compliance with state laws. Firstly, it is crucial to draft a formal revocation document, often referred to as a "Harris Texas Revocation of Living Trust" or "Revocation Agreement." This legal document explicitly states the settler's intent to dissolve the trust and renders it void. The revocation agreement should include essential details such as the name and identification of the trust, the date of the original trust's creation, and the settler's complete name and contact information. When generating content for a Harris Texas Revocation of Living Trust, relevant keywords to include might be: 1. Revocation of Living Trust: Explaining the concept and process involved in revoking a living trust in Harris, Texas. Emphasize the importance of proper legal documentation for ensuring the trust's cancellation. 2. Harris County Trust Dissolution: Shining a light on the revocation process specifically in Harris County, Texas, highlighting any county-specific requirements or procedures that may need to be followed. 3. Texas Living Trust Laws: Discussing the relevant state laws and regulations in Texas governing the revocation of living trusts, including any prerequisites or legal formalities to follow. 4. Harris Texas Revocation Agreement: Exploring the key elements and information that should be included in a revocation agreement, emphasizing its role in making the revocation legally valid. Types of Harris Texas Revocation of Living Trust: While the fundamental process of revoking a living trust remains consistent, there are a few different types of revocation methods that can be employed in Harris County, Texas. These methods include: 1. Express Revocation of Living Trust: This type of revocation occurs when the settler explicitly states their intent to revoke the trust in a written document, such as a revocation agreement or an amendment to the trust instrument. 2. Implied Revocation of Living Trust: Implied revocation happens when the settler takes actions inconsistent with the continued existence of the living trust, such as transferring trust assets to their individual name or creating a new incompatible trust. 3. Operation of Law Revocation: This type of revocation arises when changes in the legal landscape or circumstances render the living trust void automatically, without the necessity for explicit action taken by the settler. These changes may include marriage, divorce, death, or changes in tax laws affecting the trust. Understanding the different revocation methods can help ensure that individuals seeking to dissolve their living trust in Harris County, Texas, choose the most suitable approach aligned with their circumstances and legal requirements. Consulting with a qualified attorney specializing in trusts and estates is advisable to navigate the intricacies of the revocation process and guarantee compliance with relevant laws.Harris Texas Revocation of Living Trust: Detailed Overview and Types A "Harris Texas Revocation of Living Trust" refers to the legal process followed to cancel or nullify a previously established living trust in Harris County, Texas. A living trust is a popular estate planning tool that allows individuals to transfer ownership of their assets and properties to a trust during their lifetime, ensuring distribution and management according to their wishes upon incapacitation or death. However, situations may arise where the trust creator, also known as the granter or settler, decides to revoke the trust due to changing circumstances, altered estate planning goals, or other personal reasons. To officially revoke a living trust in Harris County, Texas, specific steps must be taken in compliance with state laws. Firstly, it is crucial to draft a formal revocation document, often referred to as a "Harris Texas Revocation of Living Trust" or "Revocation Agreement." This legal document explicitly states the settler's intent to dissolve the trust and renders it void. The revocation agreement should include essential details such as the name and identification of the trust, the date of the original trust's creation, and the settler's complete name and contact information. When generating content for a Harris Texas Revocation of Living Trust, relevant keywords to include might be: 1. Revocation of Living Trust: Explaining the concept and process involved in revoking a living trust in Harris, Texas. Emphasize the importance of proper legal documentation for ensuring the trust's cancellation. 2. Harris County Trust Dissolution: Shining a light on the revocation process specifically in Harris County, Texas, highlighting any county-specific requirements or procedures that may need to be followed. 3. Texas Living Trust Laws: Discussing the relevant state laws and regulations in Texas governing the revocation of living trusts, including any prerequisites or legal formalities to follow. 4. Harris Texas Revocation Agreement: Exploring the key elements and information that should be included in a revocation agreement, emphasizing its role in making the revocation legally valid. Types of Harris Texas Revocation of Living Trust: While the fundamental process of revoking a living trust remains consistent, there are a few different types of revocation methods that can be employed in Harris County, Texas. These methods include: 1. Express Revocation of Living Trust: This type of revocation occurs when the settler explicitly states their intent to revoke the trust in a written document, such as a revocation agreement or an amendment to the trust instrument. 2. Implied Revocation of Living Trust: Implied revocation happens when the settler takes actions inconsistent with the continued existence of the living trust, such as transferring trust assets to their individual name or creating a new incompatible trust. 3. Operation of Law Revocation: This type of revocation arises when changes in the legal landscape or circumstances render the living trust void automatically, without the necessity for explicit action taken by the settler. These changes may include marriage, divorce, death, or changes in tax laws affecting the trust. Understanding the different revocation methods can help ensure that individuals seeking to dissolve their living trust in Harris County, Texas, choose the most suitable approach aligned with their circumstances and legal requirements. Consulting with a qualified attorney specializing in trusts and estates is advisable to navigate the intricacies of the revocation process and guarantee compliance with relevant laws.