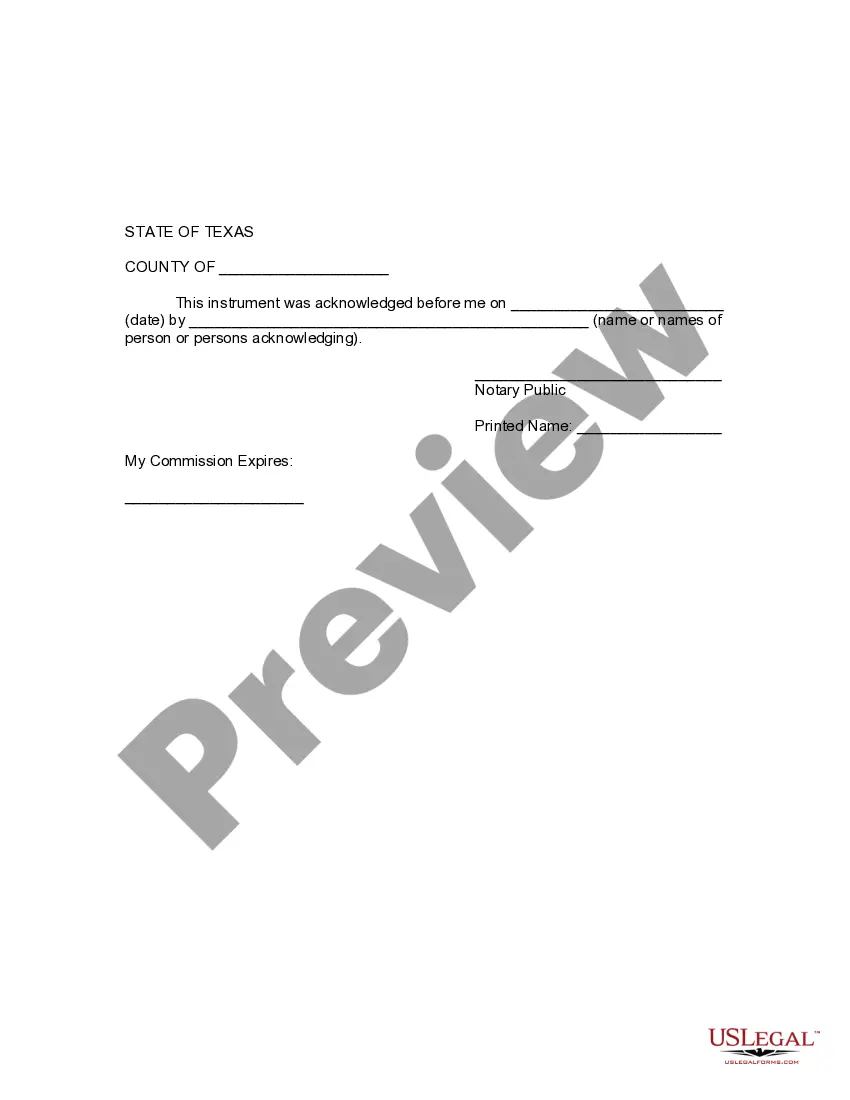

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

McAllen Texas Revocation of Living Trust is a legal process that allows individuals to terminate or cancel their existing living trust in McAllen, Texas. A living trust is created by an individual during their lifetime to manage and distribute their assets. However, circumstances may change, and individuals may decide to revoke their living trust for various reasons such as changes in their financial situation, changes in family dynamics, or change of beneficiaries. The McAllen Texas Revocation of Living Trust process involves several important steps. It is crucial for individuals to understand the procedures and requirements involved in revoking a living trust to ensure it is done correctly and in accordance with Texas state laws. There are various types of McAllen Texas Revocation of Living Trust, including: 1. Voluntary Revocation: This type of revocation occurs when the creator of the living trust willingly decides to terminate it. It can be done at any time and does not require specific reasons. 2. Partial Revocation: In some cases, individuals may only want to revoke a specific portion of their living trust while keeping the rest intact. This type of revocation allows the trust or to make changes to certain provisions without completely revoking the entire trust. 3. Automatic Revocation: Certain events or conditions specified in the living trust can trigger automatic revocation. For example, the trust may be automatically revoked upon the death of the trust or, divorce, or when a specific time frame outlined in the trust passes. 4. Court-Ordered Revocation: In some situations, a court may order the revocation of a living trust. This typically occurs when there are disputes, fraud, or conflicts of interest among the beneficiaries or trustees. To initiate the revocation process, individuals must follow specific guidelines outlined by Texas state law. Generally, these steps include preparing a written statement declaring the revocation, signing and notarizing the document, and providing copies of the revocation statement to all interested parties, such as trustees, beneficiaries, or financial institutions. It is highly recommended consulting with an experienced attorney specializing in estate planning and living trusts to ensure a proper McAllen Texas Revocation of Living Trust process. They can provide personalized guidance, review the legal documents, and ensure compliance with state laws and regulations.McAllen Texas Revocation of Living Trust is a legal process that allows individuals to terminate or cancel their existing living trust in McAllen, Texas. A living trust is created by an individual during their lifetime to manage and distribute their assets. However, circumstances may change, and individuals may decide to revoke their living trust for various reasons such as changes in their financial situation, changes in family dynamics, or change of beneficiaries. The McAllen Texas Revocation of Living Trust process involves several important steps. It is crucial for individuals to understand the procedures and requirements involved in revoking a living trust to ensure it is done correctly and in accordance with Texas state laws. There are various types of McAllen Texas Revocation of Living Trust, including: 1. Voluntary Revocation: This type of revocation occurs when the creator of the living trust willingly decides to terminate it. It can be done at any time and does not require specific reasons. 2. Partial Revocation: In some cases, individuals may only want to revoke a specific portion of their living trust while keeping the rest intact. This type of revocation allows the trust or to make changes to certain provisions without completely revoking the entire trust. 3. Automatic Revocation: Certain events or conditions specified in the living trust can trigger automatic revocation. For example, the trust may be automatically revoked upon the death of the trust or, divorce, or when a specific time frame outlined in the trust passes. 4. Court-Ordered Revocation: In some situations, a court may order the revocation of a living trust. This typically occurs when there are disputes, fraud, or conflicts of interest among the beneficiaries or trustees. To initiate the revocation process, individuals must follow specific guidelines outlined by Texas state law. Generally, these steps include preparing a written statement declaring the revocation, signing and notarizing the document, and providing copies of the revocation statement to all interested parties, such as trustees, beneficiaries, or financial institutions. It is highly recommended consulting with an experienced attorney specializing in estate planning and living trusts to ensure a proper McAllen Texas Revocation of Living Trust process. They can provide personalized guidance, review the legal documents, and ensure compliance with state laws and regulations.