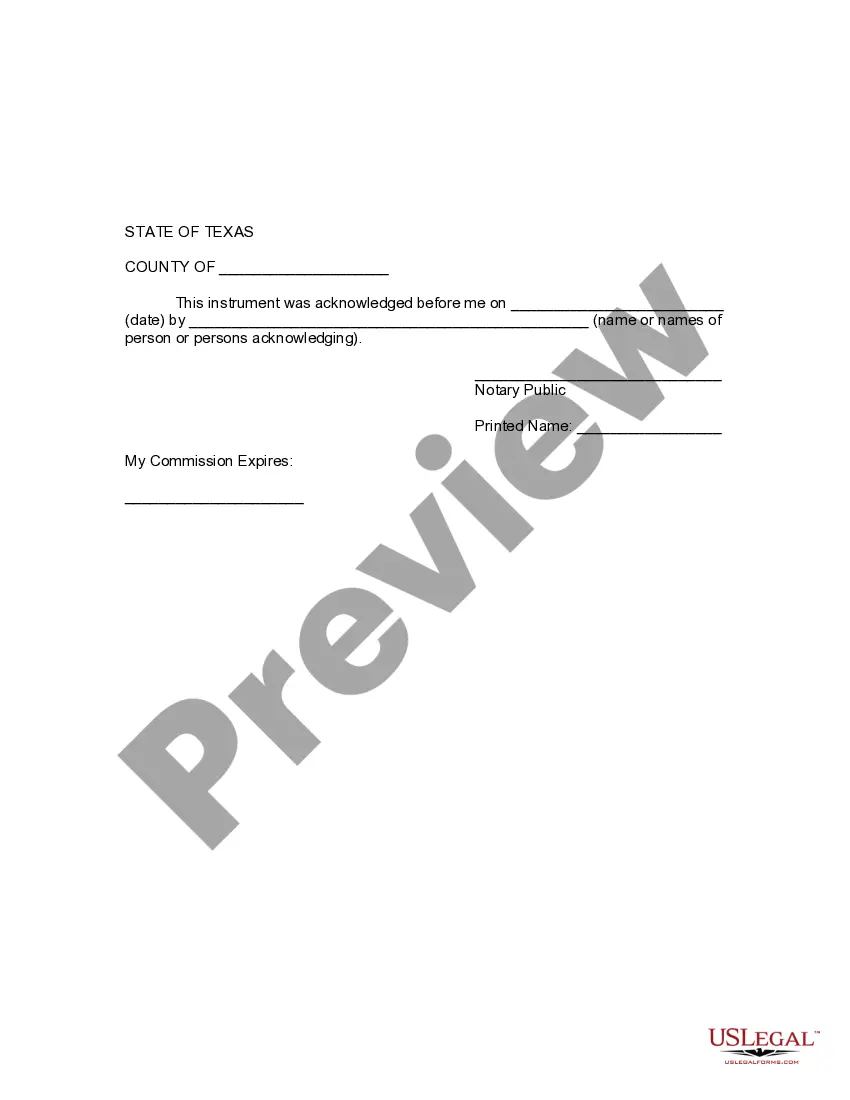

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Travis Texas Revocation of Living Trust

Description

How to fill out Texas Revocation Of Living Trust?

If you have previously utilized our program, Log In to your account and retrieve the Travis Texas Revocation of Living Trust on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment schedule.

If this is your inaugural experience with our service, adhere to these straightforward steps to acquire your file.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to use it again. Leverage the US Legal Forms service to effortlessly find and store any template for your personal or professional needs!

- Ensure you’ve located an appropriate document. Review the details and employ the Preview feature, if accessible, to verify if it fulfills your specifications. If it’s not suitable, utilize the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and proceed with payment. Input your credit card information or select the PayPal option to finalize the transaction.

- Obtain your Travis Texas Revocation of Living Trust. Choose the file format for your document and save it to your device.

- Finalize your document. Print it out or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

A trust can be categorized as null and void if it violates public policy, lacks the necessary legal formalities, or has unlawful provisions. In a Travis Texas Revocation of Living Trust, all requirements must be met to ensure the trust stands valid. Engaging with a legal professional can help you navigate trust creation and maintain its legitimacy.

A trust may be considered void if it lacks essential elements, such as a clear intent from the grantor, identifiable beneficiaries, or proper legal execution. In the context of a Travis Texas Revocation of Living Trust, any errors in the documentation or failure to adhere to state laws could invalidate the trust. To avoid complications, ensure you follow legal guidance when establishing your trust.

Yes, an irrevocable trust can be subject to the 5-year rule, which may impact your eligibility for certain government benefits. The Travis Texas Revocation of Living Trust allows you to assess how assets are handled, but once you place assets in an irrevocable trust, you generally cannot remove them. It’s wise to consult a professional to understand your specific implications.

You can avoid inheritance tax by establishing a living trust, particularly a Travis Texas Revocation of Living Trust. This type of trust allows you to transfer assets outside of your estate, which can reduce or eliminate taxes on those assets upon your passing. Additionally, consulting with a legal expert can provide specific strategies relevant to your situation.

When you revoke a living trust, all assets held in the trust return to you, the grantor. This process means that the Travis Texas Revocation of Living Trust ceases to have any legal standing or authority over those assets. Consequently, the assets are now part of your estate and subject to your direct control. Understanding the implications of revocation is essential, and uslegalforms can guide you through this transition effectively.

Yes, you can modify a revocable trust in Texas at any time before its revocation. This flexibility allows you to adjust terms, change beneficiaries, or even update asset allocations within the Travis Texas Revocation of Living Trust. However, it's crucial to draft any modifications clearly and keep records of these changes. Uslegalforms can help you create the appropriate documents to accurately reflect your modifications.

To revoke a living trust in Texas, you must follow a straightforward process. Typically, you will need to create a written declaration stating your intention to revoke the Travis Texas Revocation of Living Trust. It's wise to destroy all copies of the original trust document after making the revocation. For guidance, uslegalforms can provide you with the necessary templates and tools to ensure the process is smooth and legally sound.

The 5 year rule for trusts refers to the period in which certain assets transferred into a trust may be subject to challenges regarding their ownership. With the Travis Texas Revocation of Living Trust, this rule becomes particularly significant for revocable trusts. If you revoke the trust within five years of establishing it, assets may still be seen as part of your estate. This could affect tax implications and creditor claims in Texas.

To invalidate a trust, you generally need to follow specific legal procedures. In Travis, Texas, a revocation of a living trust involves clear written documentation indicating your intention to revoke. You may also need to notify beneficiaries and relevant parties about the revocation. For assistance with the Travis Texas Revocation of Living Trust process, consider using US Legal Forms to access the necessary documents and streamline your efforts.

When filling out a revocable living trust, you begin by identifying yourself as the grantor and detailing the assets you wish to include. Specify the trustees and beneficiaries, making sure to outline the terms and conditions of the trust. This process can be straightforward, but using a platform like US Legal Forms can provide valuable templates and guidance, simplifying the Travis Texas Revocation of Living Trust if needed.