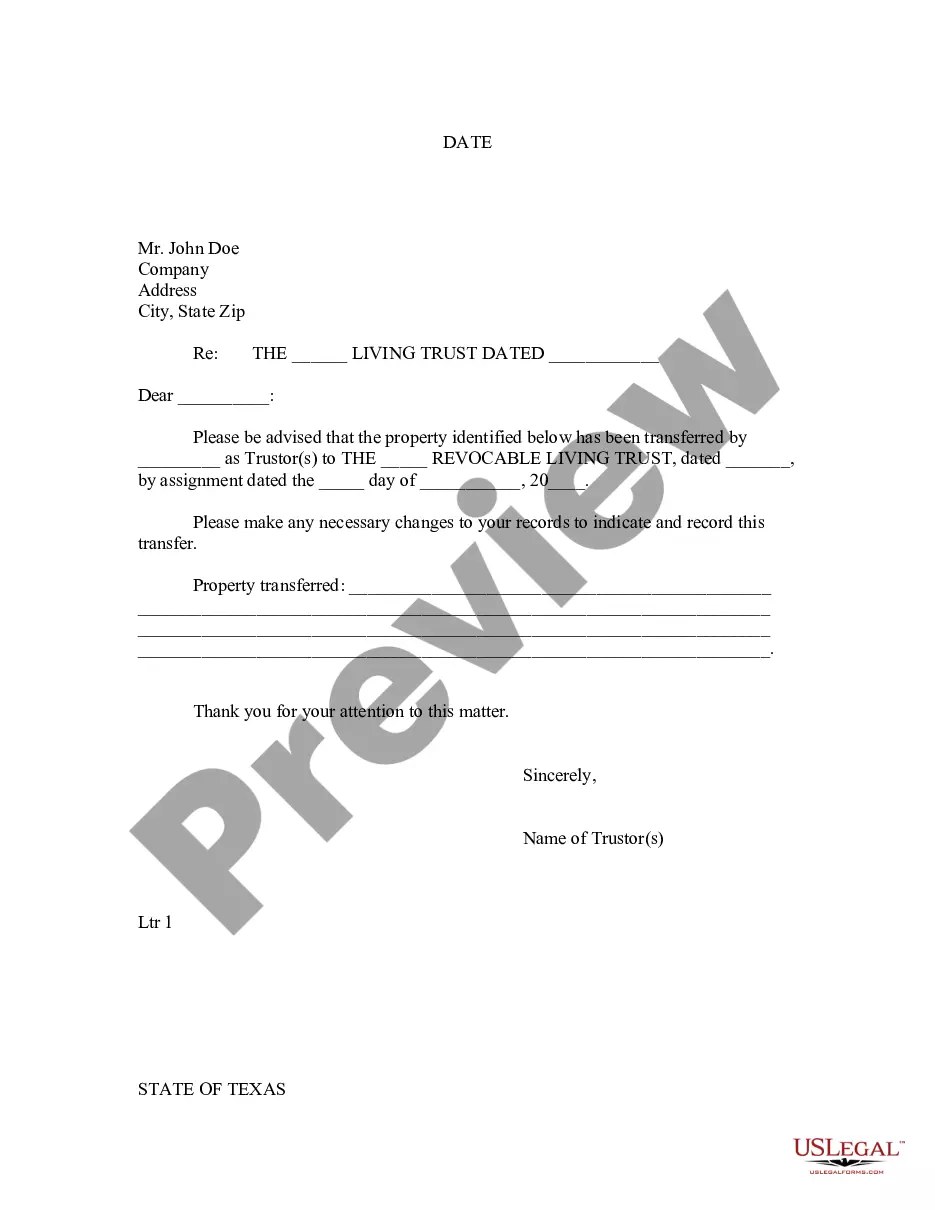

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Title: Collin Texas Letter to Lien holder to Notify of Trust — A Comprehensive Guide Keywords: Collin Texas, letter, lien holder, notify, trust, legal document, beneficiary, property ownership, real estate, mortgage, financial agreement Introduction: A Collin Texas Letter to Lien holder to Notify of Trust is an important legal document used to inform a lien holder about the establishment of a trust on a property. It ensures that all parties involved are aware of the revised ownership structure and the trust's beneficiaries. This article will discuss the purpose, key elements, and different types of Collin Texas Letters to Lien holder to Notify of Trust. Purpose of the Letter: The primary purpose of a Collin Texas Letter to Lien holder to Notify of Trust is to officially communicate the change in property ownership resulting from the establishment of a trust. This letter ensures that the lien holder is aware of the trust's existence and the beneficiary's interest in the property. It also serves as a legal acknowledgment to avoid any potential disputes or confusion in the future. Key Elements of the Letter: 1. Lien holder Information: Include the name, address, and contact details of the lien holder. 2. Trust Information: Clearly mention the name and details of the trust, including the date of establishment. 3. Property Information: Provide the specific details of the property subject to the lien, such as the address, legal description, and any associated mortgage or loan. 4. Trustee Information: Include the name, address, and contact details of the trustee(s) responsible for managing the trust. 5. Beneficiary Information: Clearly state the name(s) and relevant details of the beneficiaries entitled to the property's trust. 6. Lien holder's Responsiveness: Request that the lien holder acknowledges the receipt of the letter and any necessary actions they need to take, if applicable. Different Types of Collin Texas Letters to Lien holder to Notify of Trust: 1. Revocable Trust: This type of trust can be modified or revoked by the property owner during their lifetime. The letter informs the lien holder about the specific terms governing the revocable trust, ensuring they are aware of any changes in property ownership while the trust is in effect. 2. Irrevocable Trust: An irrevocable trust is unalterable once established, meaning the property owner has permanently transferred ownership to the trust. The letter notifies the lien holder about the change in the property's legal ownership status and the beneficiaries' entitlements. 3. Special Needs Trust: This type of trust is designed to manage assets for the benefit of a person with special needs. The letter informs the lien holder about the establishment of the trust and the specific provisions made to support the individual's unique requirements. Conclusion: A Collin Texas Letter to Lien holder to Notify of Trust is a critical document that ensures proper communication between all parties involved in property ownership and trust establishment. By providing accurate information and clearly conveying the change in ownership, this letter helps maintain transparency and prevents potential conflicts or misunderstandings. It is crucial to consult with legal professionals to ensure the letter's compliance with local regulations and to meet specific trust requirements.Title: Collin Texas Letter to Lien holder to Notify of Trust — A Comprehensive Guide Keywords: Collin Texas, letter, lien holder, notify, trust, legal document, beneficiary, property ownership, real estate, mortgage, financial agreement Introduction: A Collin Texas Letter to Lien holder to Notify of Trust is an important legal document used to inform a lien holder about the establishment of a trust on a property. It ensures that all parties involved are aware of the revised ownership structure and the trust's beneficiaries. This article will discuss the purpose, key elements, and different types of Collin Texas Letters to Lien holder to Notify of Trust. Purpose of the Letter: The primary purpose of a Collin Texas Letter to Lien holder to Notify of Trust is to officially communicate the change in property ownership resulting from the establishment of a trust. This letter ensures that the lien holder is aware of the trust's existence and the beneficiary's interest in the property. It also serves as a legal acknowledgment to avoid any potential disputes or confusion in the future. Key Elements of the Letter: 1. Lien holder Information: Include the name, address, and contact details of the lien holder. 2. Trust Information: Clearly mention the name and details of the trust, including the date of establishment. 3. Property Information: Provide the specific details of the property subject to the lien, such as the address, legal description, and any associated mortgage or loan. 4. Trustee Information: Include the name, address, and contact details of the trustee(s) responsible for managing the trust. 5. Beneficiary Information: Clearly state the name(s) and relevant details of the beneficiaries entitled to the property's trust. 6. Lien holder's Responsiveness: Request that the lien holder acknowledges the receipt of the letter and any necessary actions they need to take, if applicable. Different Types of Collin Texas Letters to Lien holder to Notify of Trust: 1. Revocable Trust: This type of trust can be modified or revoked by the property owner during their lifetime. The letter informs the lien holder about the specific terms governing the revocable trust, ensuring they are aware of any changes in property ownership while the trust is in effect. 2. Irrevocable Trust: An irrevocable trust is unalterable once established, meaning the property owner has permanently transferred ownership to the trust. The letter notifies the lien holder about the change in the property's legal ownership status and the beneficiaries' entitlements. 3. Special Needs Trust: This type of trust is designed to manage assets for the benefit of a person with special needs. The letter informs the lien holder about the establishment of the trust and the specific provisions made to support the individual's unique requirements. Conclusion: A Collin Texas Letter to Lien holder to Notify of Trust is a critical document that ensures proper communication between all parties involved in property ownership and trust establishment. By providing accurate information and clearly conveying the change in ownership, this letter helps maintain transparency and prevents potential conflicts or misunderstandings. It is crucial to consult with legal professionals to ensure the letter's compliance with local regulations and to meet specific trust requirements.