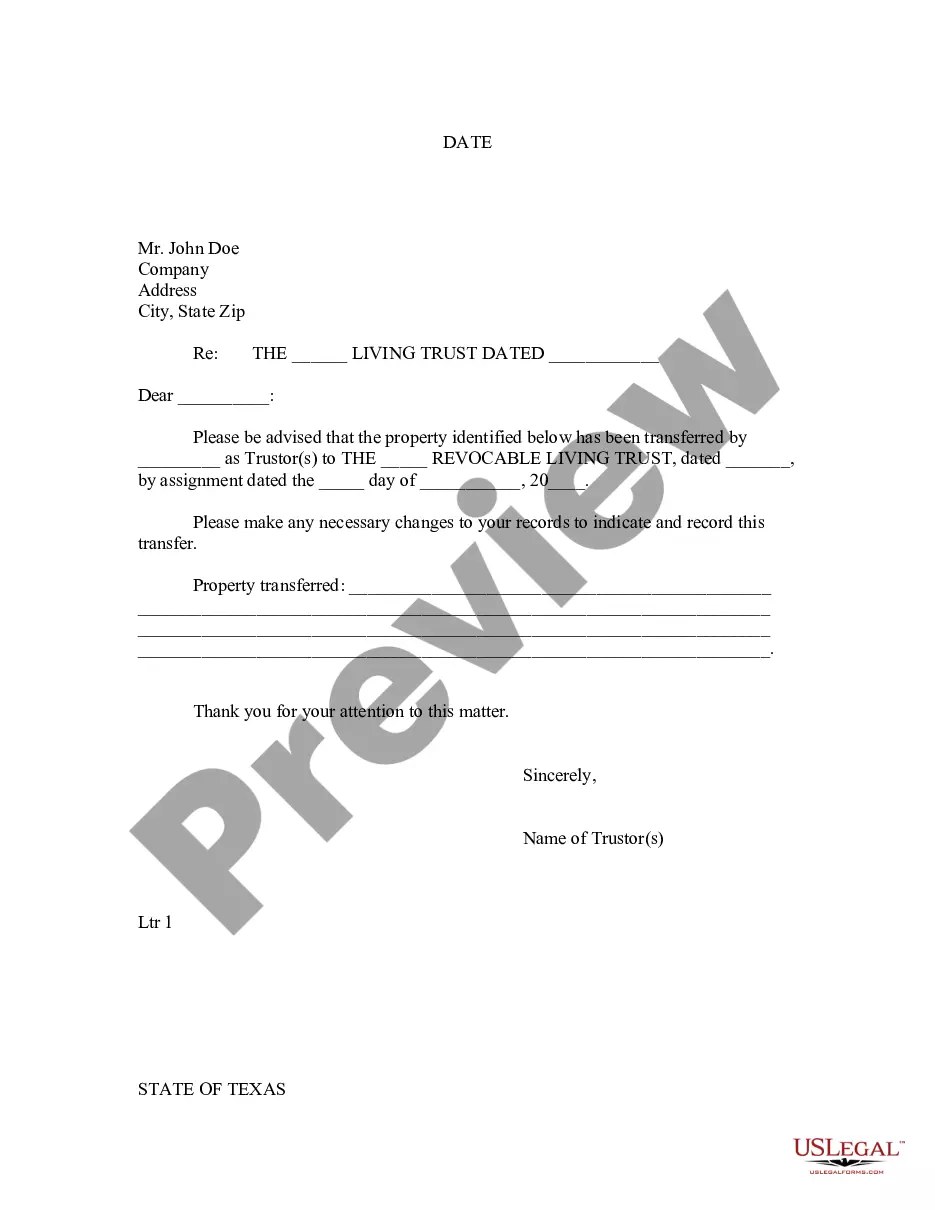

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Title: Frisco Texas Letter to Lien holder to Notify of Trust: Detailed Guide and Variations Introduction: If you're residing in Frisco, Texas, and are in the process of establishing a trust, it is crucial to inform your lien holder about this legal arrangement. By sending a Frisco Texas Letter to Lien holder to Notify of Trust, you ensure that your lien holder is aware of the trust's existence and can update their records accordingly. This comprehensive guide will outline the key components of such a letter and shed light on any potential variations based on different trust scenarios. I. What is a Frisco Texas Letter to Lien holder to Notify of Trust? A Frisco Texas Letter to Lien holder to Notify of Trust serves as a formal communication to inform the lien holder (usually a financial institution or creditor) about a trust established by the property owner. This letter ensures that the lien holder is aware of the new trust arrangement, protecting the interests and rights of all parties involved. II. Key Components of the Letter: 1. Sender and Recipient Information: Clearly state your full name, address, and contact information at the beginning of the letter. Include similar details of the lien holder, such as their name, address, and any relevant account or loan numbers. 2. Title and Introduction: The letter should clearly state its purpose and be addressed to the appropriate lien holder personnel. Begin with a salutation and introduce yourself as the property owner. 3. Trust Description: Include a detailed description or name of the trust, highlighting its purpose and the relevant property involved. This section should specify the trust type (revocable, irrevocable, etc.) and the date of its creation. 4. Notifying of Trust: Express your intent to inform the lien holder of the existence of the trust and its impact on the related property. Clearly mention that the trust is established for managing or protecting the property and that it may affect any associated financial agreements or obligations. 5. Request for Record Update: Kindly request the lien holder to update their records to reflect the trust's existence and designate the appropriate trustee as the primary contact for future communications regarding the property or any ongoing financial agreements. 6. Supporting Documentation: Attach any necessary and legally required documents, such as a copy of the trust agreement, a notarized affidavit of trust, or any other relevant paperwork that substantiates the trust's legitimacy. 7. Contact Information: Provide your contact details and encourage the lien holder to reach out if they require further information or have any queries related to the trust. III. Variations of Frisco Texas Letter to Lien holder to Notify of Trust: 1. Frisco Texas Revocable Living Trust Letter to Lien holder: Used when establishing a revocable living trust for estate planning or asset management purposes. 2. Frisco Texas Testamentary Trust Letter to Lien holder: Appropriate when informing the lien holder about a testamentary trust created through a will, to be effective upon the property owner's passing. 3. Frisco Texas Special Needs Trust Letter to Lien holder: Required for notifying the lien holder about a special needs trust created to benefit individuals with disabilities while preserving their eligibility for government assistance programs. Conclusion: When establishing a trust in Frisco, Texas, sending a detailed and accurate letter to your lien holder is essential. By doing so, you ensure that the lien holder is properly informed about the trust's existence, protecting the interests of all parties involved. Remember to choose the relevant type of Frisco Texas Letter to Lien holder to Notify of Trust, based on the specific trust arrangement.Title: Frisco Texas Letter to Lien holder to Notify of Trust: Detailed Guide and Variations Introduction: If you're residing in Frisco, Texas, and are in the process of establishing a trust, it is crucial to inform your lien holder about this legal arrangement. By sending a Frisco Texas Letter to Lien holder to Notify of Trust, you ensure that your lien holder is aware of the trust's existence and can update their records accordingly. This comprehensive guide will outline the key components of such a letter and shed light on any potential variations based on different trust scenarios. I. What is a Frisco Texas Letter to Lien holder to Notify of Trust? A Frisco Texas Letter to Lien holder to Notify of Trust serves as a formal communication to inform the lien holder (usually a financial institution or creditor) about a trust established by the property owner. This letter ensures that the lien holder is aware of the new trust arrangement, protecting the interests and rights of all parties involved. II. Key Components of the Letter: 1. Sender and Recipient Information: Clearly state your full name, address, and contact information at the beginning of the letter. Include similar details of the lien holder, such as their name, address, and any relevant account or loan numbers. 2. Title and Introduction: The letter should clearly state its purpose and be addressed to the appropriate lien holder personnel. Begin with a salutation and introduce yourself as the property owner. 3. Trust Description: Include a detailed description or name of the trust, highlighting its purpose and the relevant property involved. This section should specify the trust type (revocable, irrevocable, etc.) and the date of its creation. 4. Notifying of Trust: Express your intent to inform the lien holder of the existence of the trust and its impact on the related property. Clearly mention that the trust is established for managing or protecting the property and that it may affect any associated financial agreements or obligations. 5. Request for Record Update: Kindly request the lien holder to update their records to reflect the trust's existence and designate the appropriate trustee as the primary contact for future communications regarding the property or any ongoing financial agreements. 6. Supporting Documentation: Attach any necessary and legally required documents, such as a copy of the trust agreement, a notarized affidavit of trust, or any other relevant paperwork that substantiates the trust's legitimacy. 7. Contact Information: Provide your contact details and encourage the lien holder to reach out if they require further information or have any queries related to the trust. III. Variations of Frisco Texas Letter to Lien holder to Notify of Trust: 1. Frisco Texas Revocable Living Trust Letter to Lien holder: Used when establishing a revocable living trust for estate planning or asset management purposes. 2. Frisco Texas Testamentary Trust Letter to Lien holder: Appropriate when informing the lien holder about a testamentary trust created through a will, to be effective upon the property owner's passing. 3. Frisco Texas Special Needs Trust Letter to Lien holder: Required for notifying the lien holder about a special needs trust created to benefit individuals with disabilities while preserving their eligibility for government assistance programs. Conclusion: When establishing a trust in Frisco, Texas, sending a detailed and accurate letter to your lien holder is essential. By doing so, you ensure that the lien holder is properly informed about the trust's existence, protecting the interests of all parties involved. Remember to choose the relevant type of Frisco Texas Letter to Lien holder to Notify of Trust, based on the specific trust arrangement.