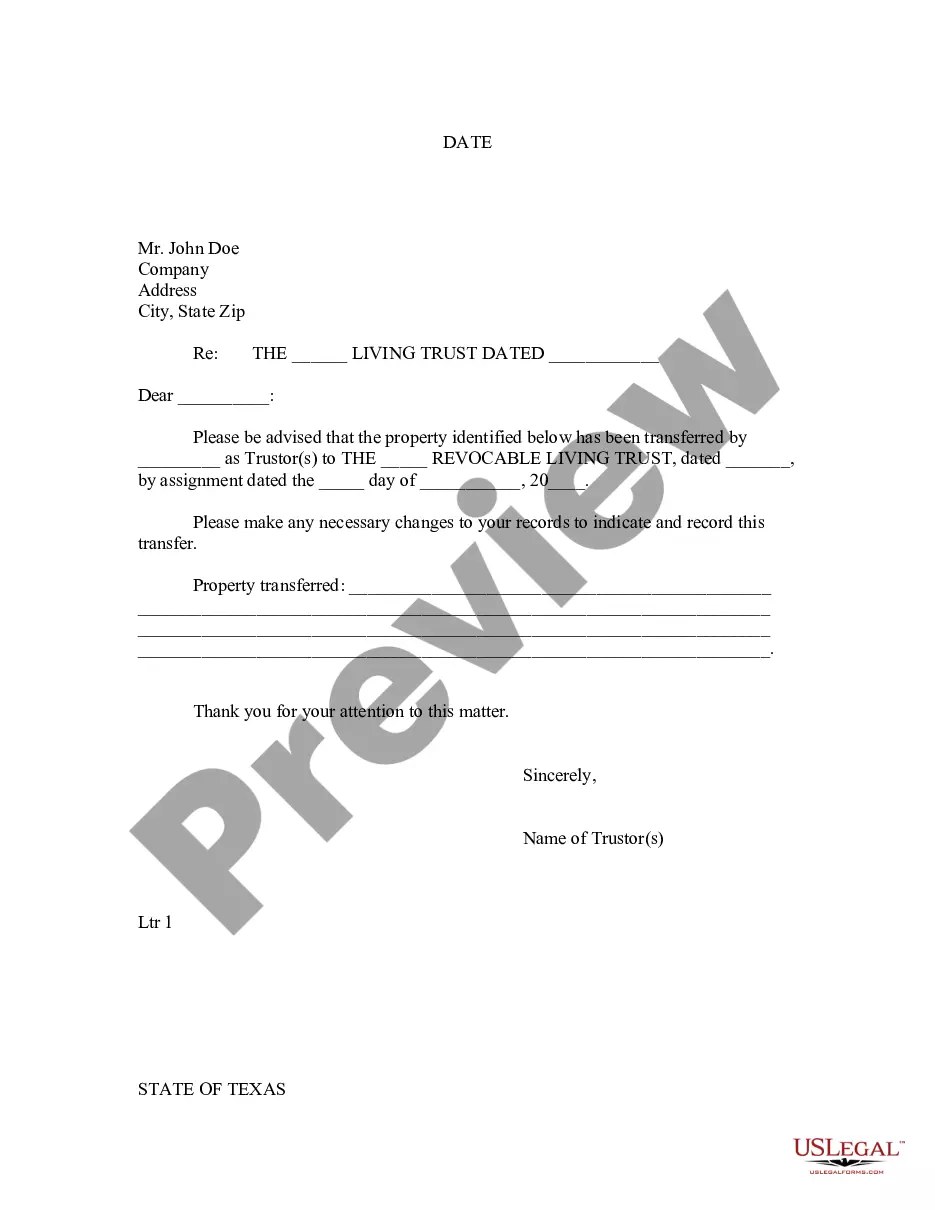

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

The Houston Texas Letter to Lien holder to Notify of Trust is a legal document used to inform the lien holder about the establishment of a trust in Houston, Texas. This letter is crucial as it notifies the lien holder of the ownership transfer of the property in question into a trust, allowing the trust to hold legal ownership and title rights. The letter includes essential information to facilitate the smooth transition of ownership. Firstly, it should clearly state the names of the parties involved, including the lien holder, the trust or (the owner of the property), and the trustee(s) (the individual(s) responsible for managing the trust). It is important to provide accurate details to avoid any confusion or potential legal disputes. Moreover, the letter should provide a comprehensive description of the property being placed into the trust, including its address, legal description, and any additional pertinent information. This ensures that the lien holder has a clear understanding of the property in question and can update their records accurately. Additionally, the letter should state the effective date of the trust, which signifies when the ownership was transferred to the trust. This date is crucial for the lien holder to update their records accordingly and accurately reflect the change in ownership. There may be different types of Houston Texas Letters to Lien holder to Notify of Trust, namely: 1. Revocable Living Trust Notification: This letter is used when the trust or establishes a revocable living trust, allowing them to maintain control over the property during their lifetime. The letter notifies the lien holder of the trust's existence and transfer of ownership but also emphasizes the trust or's ability to revoke or modify the trust at any time. 2. Irrevocable Trust Notification: This type of letter is used when the trust or establishes an irrevocable trust, relinquishing all control and ownership rights over the property. The letter notifies the lien holder that the trust or has no power to revoke or modify the trust, providing information on the new trustee(s) responsible for managing the property's affairs. 3. Testamentary Trust Notification: This letter is used when the trust or establishes a testamentary trust, typically created within a will and taking effect after their death. The letter notifies the lien holder that the property will be transferred into the trust upon the trust or's passing, and it provides relevant details about the executor or trustee responsible for managing the property until then. In conclusion, the Houston Texas Letter to Lien holder to Notify of Trust is a vital legal document used to inform lien holders about the establishment of trusts, allowing for accurate record-keeping and transitions of property ownership. The various types of letters, such as the revocable living trust notification, irrevocable trust notification, and testamentary trust notification, cater to different scenarios and legal arrangements, ensuring clear communication between the parties involved.